We have to admit the reality, the Meme cycle is gone forever

Reprinted from panewslab

02/27/2025·2MAuthor: Loopify

Compiled by: Deep Tide TechFlow

I am not the first person to put forward this point of view, nor the person who waits until the matter is settled before expressing his opinions. That will only be considered "hindsight". But I still want to make a bold judgment: I think the Memecoins craze is over.

This Memecoins craze has basically come to an end. There may be a chance for existing currencies to return to their all-time highs, but it is unlikely that new currencies can reach billions of dollars in market cap and continue. For currencies with medium and low market capitalization, the probability of recovery is almost 0.1%.

You can mark the critical moments that caused the Meme market to collapse from the chart: $TRUMP is the first currency to trigger the transformation, followed by $MELANIA, followed by a series of other rug pulls, and the last straw that crushes the market is $LIBRA.

Large-scale fraud and runaway emergence is inevitable, just as platforms like pump.fun will appear in some form anyway.

The market has been volatile, from extreme rises (PvE memecoin climbs to billions of market capitalization) to extreme scams (national gang rug operations). Most people either make money or suffer losses in the process.

There is no real coin holder

One thing that’s very important about Solana’s trenches: it’s entirely driven by the momentum of the market. The vast majority of people who buy these tokens simply to make money, as the "narrative" appeal in traditional crypto projects has disappeared. This also means that the prices of these coins fall faster than other currencies.

Albert Murad Einstein Promote Memecoins

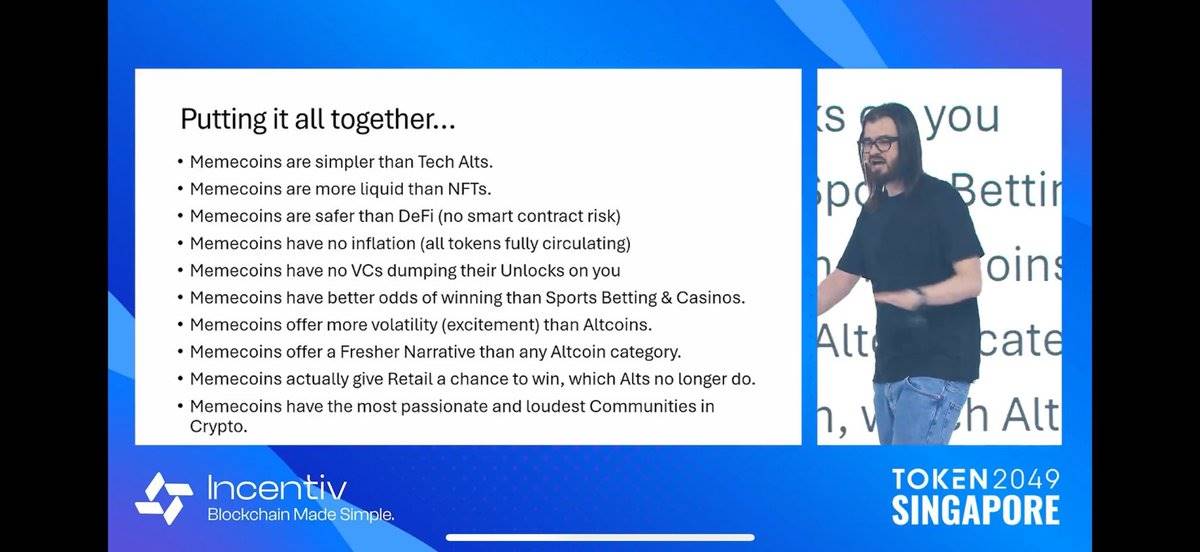

The Memecoin craze is touted as the purest form of transactions because it has no restrictions. This is also an important reason why they can run so crazy. However, this "purity" also brings huge drawbacks.

Once the excitement of making money fades, the coin holders will quickly leave the market, and the same group of people will completely give up on the market. This is different from other cryptocurrencies, where holders of other currencies usually also have faith in the project itself, because these projects have at least some real value support, while Memecoins relies entirely on market sentiment and has almost no substance.

This also applies to NFT to some extent, but NFT is still different from Memecoins. Memecoins completely abandons the concept of "practicality", only a few break through the barriers of attention, and are to some extent considered by the market as "classic" or "eternal", such as $PEPE.

This round of Memecoin craze has also spawned some relatively new phenomena, such as order follow-up. In the past, people always tracked the behavior of wallets on the chain, but this time the influx of currency reached an unprecedented level. The trading user experience (UX) on Solana and the improvement of liquidity issues have also made this phenomenon more popular.

However, some people have now earned hundreds of thousands of dollars through this model. They make profits by attracting followers (this is not specifically referring to someone, but a common phenomenon - those who become famous for "making a lot of money" on public wallets tend to attract a large number of followers, and some even take advantage of this on purpose).

DEX has long been able to follow orders, but in the past you couldn't buy a small currency with a market capitalization (MCAP) of only $10,000 at 5 SOL as you do now, and sell it at 10 SOL after 15 seconds.

This phenomenon has led to more people following the so-called KOLs into the “incinerator” (i.e., loss), but unlike in the past, this time it has received little widespread criticism from social media, as these traders do not explicitly promote or promote certain tokens.

Comparison with NFTs

Do you still remember the glory of NFTs? I use this comparison because it was a hot spot in the previous cycle, just like ICO was a trend in 2017.

Almost everyone has heard of NFTs. This trend has not only been widely circulated on the Internet, but has also attracted countless A-level celebrities to launch their own projects (although most of them end up running away). The NFT market has traded tens of billions of dollars, and the lowest prices of multiple series have reached six figures.

In that wave, OpenSea became the biggest winner, with fees alone exceeding $1 billion – by comparison, pumpfun’s total transaction volume was only about $500 million.

However, this memecoin boom is significantly different from NFTs: there are many protocols that benefit from large-scale.

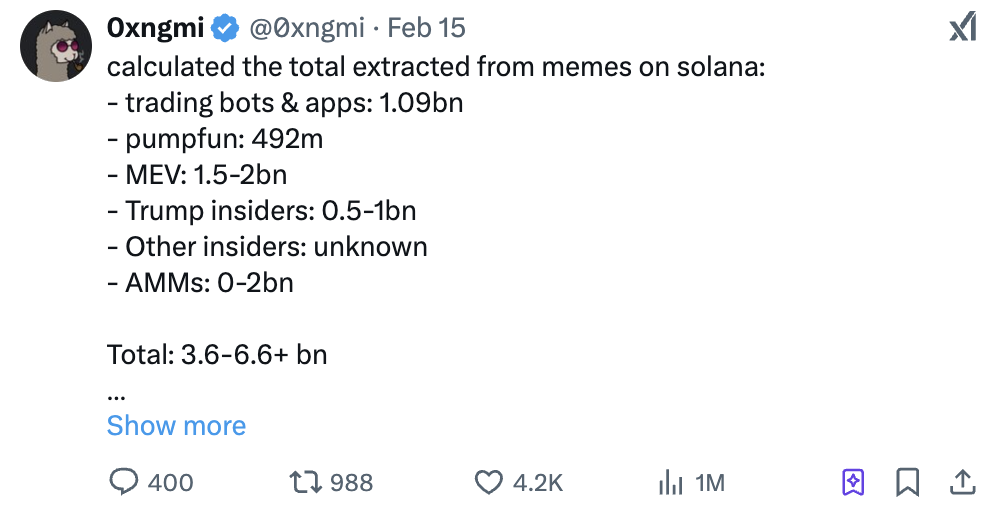

@0xngmi: The total "extraction" gains from the memecoin craze on Solana are as follows:

- Trading Robots and Applications: $1.09 billion

- Pumpfun: $492 million

- Maximum Extractable Value (MEV): USD 1.5 billion to USD 2 billion

- Trump Insider: $500 million to $1 billion

- Other insiders: Unknown

- Automatic Market Makers (AMMs): $0 to $2 billion

- Total: 3.6 billion to 6.6 billion US dollars

Even at the lowest estimate, about $4 billion was "extracted" from this craze, which is definitely not a small amount. (After all, one of the most powerful people in the world has launched a coin that has reached a market value of $70 billion in two days, which is no longer "early".)

In contrast, I roughly estimate that if market transactions, royalties and coin revenue are included, the total size of NFT is slightly lower than this number.

This shows that the memecoin craze has surpassed the trend of the previous cycle, and the strong liquidity has made the market adjust faster.

Many members of the Solana community are sensitive to the word “extract” (so I put quotes on purpose) and compare it to traditional business models. But I don't think this comparison is appropriate.

In traditional business, for example, if I buy a game, I get entertainment value from it, and the company gets revenue, which is a positive game.

You can say that many behaviors in the cryptocurrency market are zero-sum games, but many projects are originally intended to provide some practical value.

However, pumpfun is a negative sum game that operates through a value extraction mechanism, similar to a casino, whose main function is to create tokens with no actual value, and the core purpose of these tokens is simply to speculate or gambling more benefits (of course, this does not include projects that are not specifically targeted at Memecoins, such as Jup or Phantom, although these projects benefit the most from Memecoins).

What will happen next?

No one really knows when this cycle will end, and this will determine the direction of the market in the short term.

There will be a new hot spot in each cycle, but it may also be an evolutionary version of the previous trend, or a recovery (or a complete death) because people always want to find the next opportunity to rise 100 times.

Going back to the point I mentioned earlier, I think Memecoin is less likely to rise again than other trends because it has no real holders and no believers.

Basically, the largest currency will survive, while the others will die. If the market returns, the new currency will likely outperform everything existing.

You need to be prepared for this situation: survive, survive, continue to survive.

If you exit the market before the next trend comes, or you don’t have capital, it will be difficult for you to adapt. And in such a market, adaptability is crucial. Everyone can make money in a bull market, but making money in a bear market is the real ability, and then adapting to the next bull market is another ability. (Each cycle requires a different mindset.)

Finally, I recommend an article that explores in-depth why "becoming rich" is only half of the process, while the other half is "keeping wealth". There are also some actionable suggestions in the article:

( Tweet link )

*Note: If you think an asset has fallen by 90%, so these suggestions are useless, remember that it may fall by 90%.

chaincatcher

chaincatcher