When the blood loss plummeted, Hyperliquid NFT actually rose against the trend?

Reprinted from panewslab

02/26/2025·2MAuthor: Cookie

Since mid-last year, NFTs have gradually deviated from the "classical value standards". The value elements used to judge traditional PFP-type NFTs such as picture content, community, and traditional brand building narratives have basically failed. This trend reached its peak until the end of last year and early this year. There are Kaito's rise to 10+ ETH, several projects with sharp rise in Cosmos ecosystems on Stargaze, and MegaETH, which have caused huge market controversy.

Many players call this type of "FT covered in NFT" "equity NFTs". The most direct reflection is that these NFTs mostly come from project parties that are about to issue coins, using NFTs as a starting point to warm up the ecosystem and build them. The community may directly sell the token quota.

So when I found that the NFT on Hyperliquid had a bit of market and it was a bit "classical"...

Growing wildly without an NFT trading market

The most anticipated Hyperliquid NFT trading market at present should be Drip.Trade(@drip__trade), which will be launched on February 27. Although the product has not been launched yet, the platform currency $JPEG has been issued a few days ago. At its peak, the market value was close to $20 million, and the current market value is approximately $7.5 million.

The airdrops are currently the two most popular NFT projects on Hyperliquid, Wealthy Hypio Babies and K-16 aka KARU. Both are currently on the Base network and have not been bridged to HyperEVM.

So how do you trade projects that are already on HyperEVM? Now it is on Net Protocol, a tool made by OpenSea protocol engineer aspyn, which has supported some native Hyperliquid NFT transactions.

This wild growth situation made me dream about the inscription era in early 2023, when using Excel to do over-the-counter trading in order book...

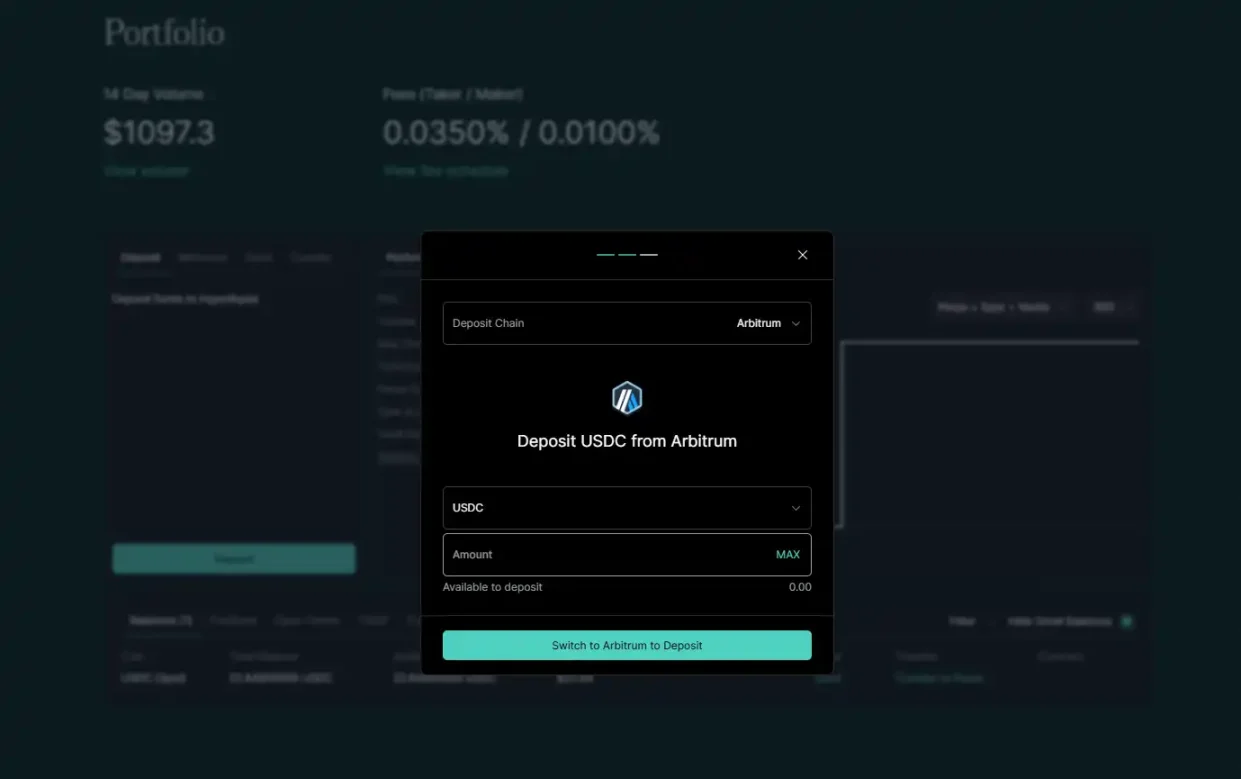

In addition, NFT casting on Hyperliquid is also quite cumbersome, just like the early Ordinals. To roughly describe the entire process, you must first mention USDC to the Arbitrum network:

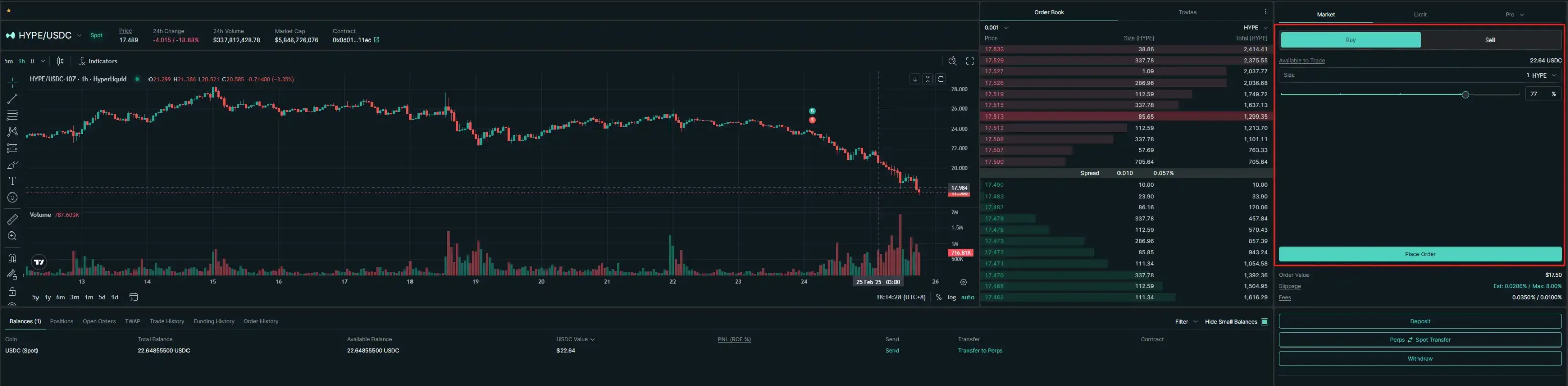

After the deposit is confirmed, purchase $HYPE in the HYPE/USDC trading pair:

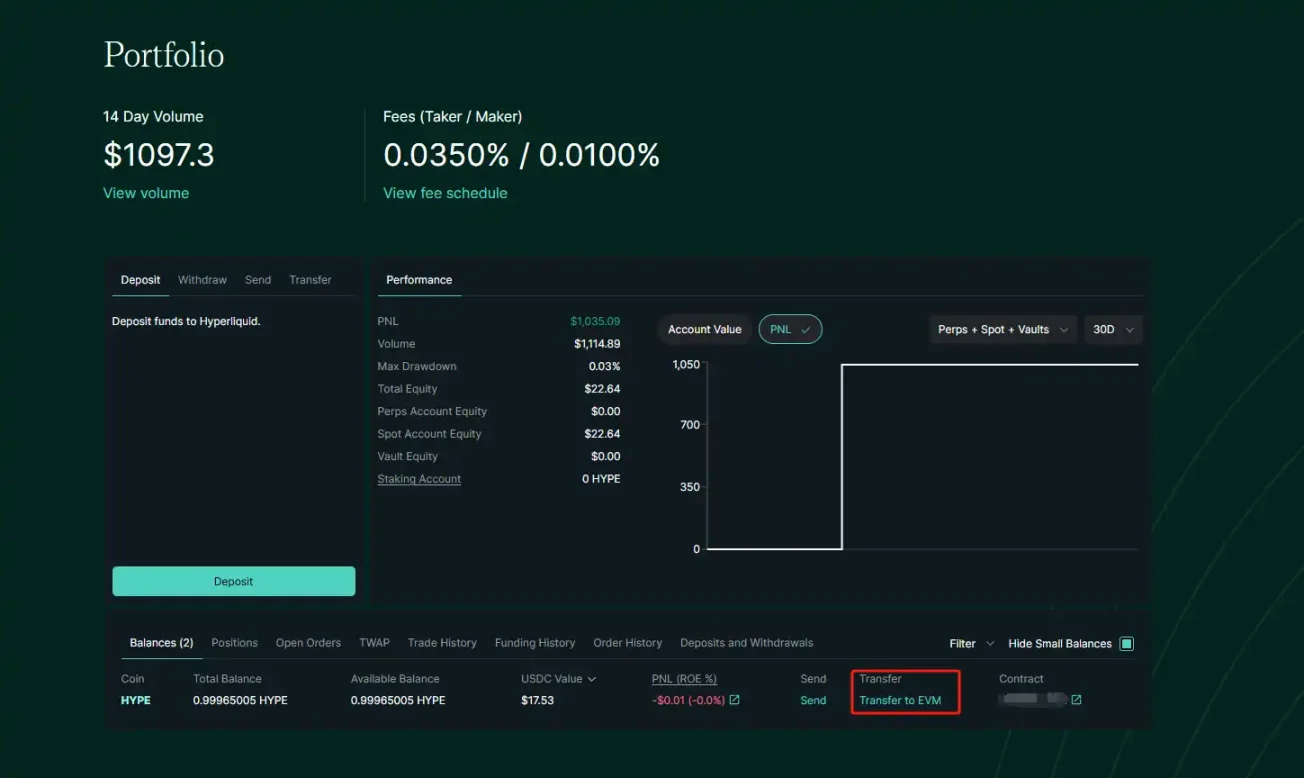

After the purchase is successful, return to the Portfolio page and click Transfer to EVM in the position to mention $HYPE to HyperEVM.

After you have $HYPE on HyperEVM, you can use $HYPE to cast new projects.

Which NFT projects are currently in the first echelon?

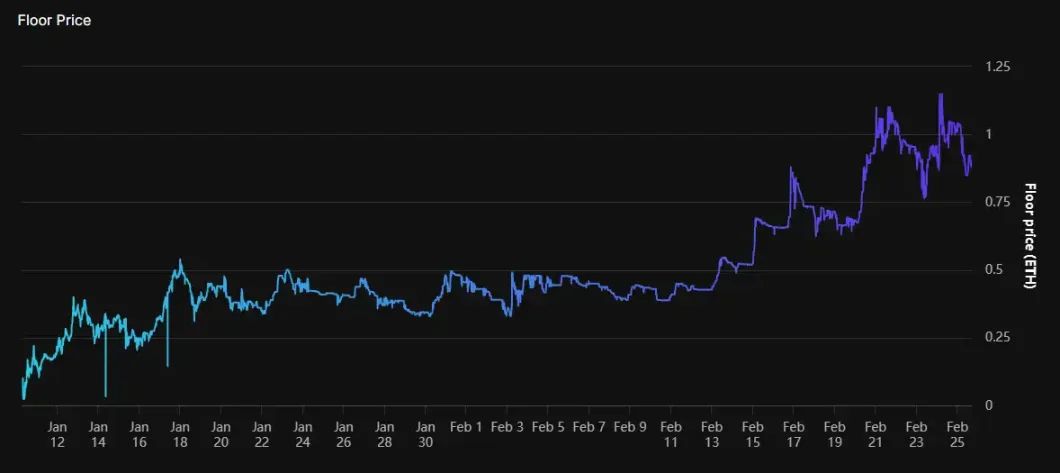

The first is Wealthy Hypio Babies (@HypioHL), the current floor price is about 0.9 ETH, which has dropped from 1+ ETH of ATH. However, the market is falling now, and it is reasonable to pull back.

If you look at this floor price trend, you will find that although the overall trend of Hypio has risen steadily, it has also gone through about one month of dormant in the middle of the month, and finally started a second wave of new highs in the middle of this month.

Hypio's community is indeed the best in the current Hyperliquid NFT project, which is also reflected in price and transaction volume. In addition, holding Hypio has also gained a lot of airdrops, including the aforementioned $JPEG from the upcoming Hyperliquid NFT trading market Drip.Trade, the infectious native meme $BUDDY on Hyperliquid, and the AI Agent on Hyperliquid $SENT of platform Sentiment. On the way are DeFAI Swarm $Neko on Hyperliquid and $SPR on the short-term option platform Supurr (former Buffer Finance) on Hyperliquid.

The second project under Hypio is K-16 aka KARU (@karu__16), which has a similar value logic to Hypio.

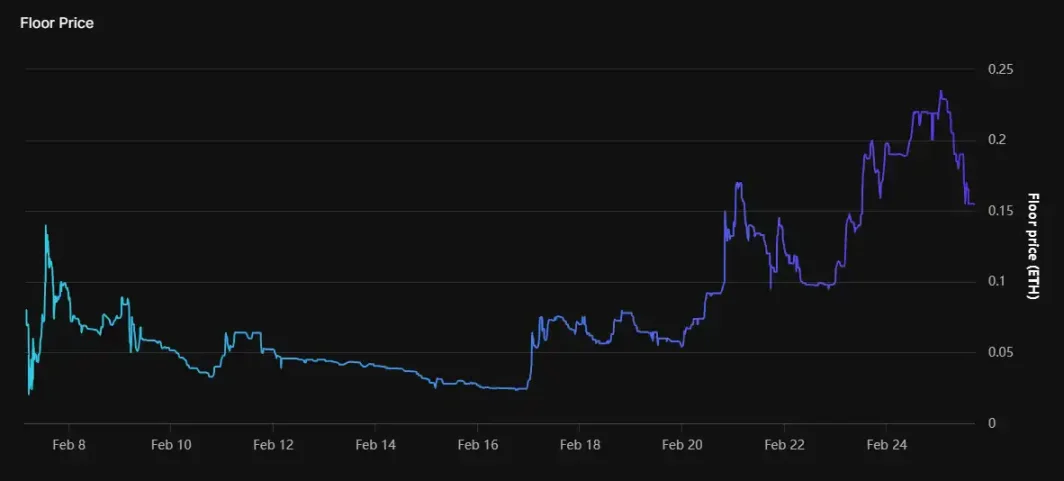

But KARU's price trend has not been as smooth as Hypio. After quickly breaking through 0.1 ETH at the beginning, it fell sharply in a week, and then rebounded from the bottom to hit a new high, which can be said to have withstood the test.

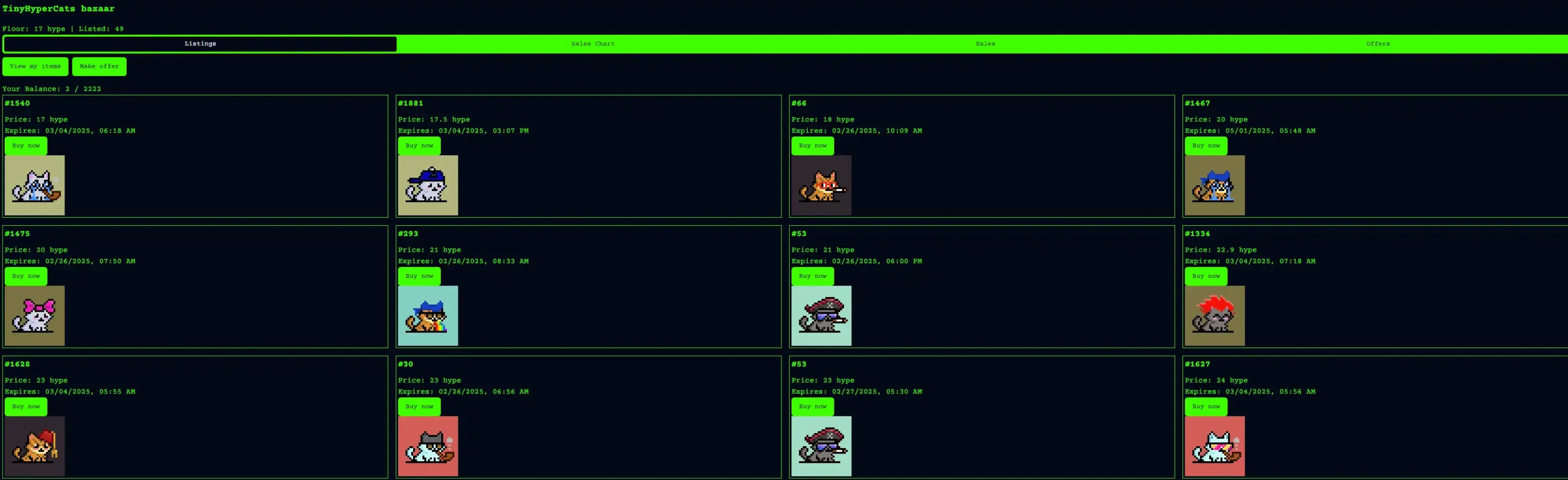

The last one is TinyHyperCats(@tinyhypercats), the first native NFT project on HyperEVM. Because it is native, it currently needs to be traded on the aforementioned Net Protocol. The current floor price is 17$HYPE.

What new projects are worth paying attention to?

Hypers(@HypersOnHL)

This project was mentioned in an article introducing the new NFT project at the end of last year. It was already very popular at that time and is finally about to be released. The casting will be opened on Drip.Trade when it goes online on February 27. Total volume 8888, casting price 2 - 2.5 $HYPE.

PiP(@PiPonHL)

Although the number of fans is not very large, the actual response is greater than that of fans. There is no more information at the moment, just keep updating the content.

Catbal(@CatCabal_hl)

It's similar to PiP, but it will be more closely connected with other projects in the ecosystem, such as they will also receive $BUDDY airdrops.

Rekt Gang(@rekt_gang)

This project has had some community cooperation with Hyperliquid 2-3 years ago, such as lottery and Space, and they are also running a Hyperliquid verification node. However, their purpose is a community that focuses on exploring multi-chain ecosystems, which means that there are already some NFT assets in other chains, so this needs to be paid attention to.

Conclusion

The reason why NFTs on Hyperliquid can have a small market depends mainly on the entry of foreign NFT players. As for why foreign NFT players choose to hype this chain, I think it may be because the trend of $HYPE has evoked good memories of their past NFT diamond players who can get rich returns, Wealthy Hypio Babies, K-16 aka KARU And TinyHyperCats are all like this. The recent pre-sale meme coins on AVAX also has a similar flavor.

If the market for Hyperliquid's small picture continues, there will inevitably be more new projects "suddenly like a spring breeze coming", but now the overall market situation is very uncertain. When creating new projects, we still need to do the community and cooperative relationships. When evaluating the thickness carefully, you should still cherish the $HYPE in your hand.

jinse

jinse

chaincatcher

chaincatcher