BTC breaks through $106,000 equity capital market "opens door" to encryption

Reprinted from jinse

05/21/2025·26DSource: Blockworks; Translated by: Wuzhu, Golden Finance

May brought more cryptocurrency mergers and acquisitions, long-awaited U.S. public listing, landmark S&P 500 selection and a surge in Bitcoin prices. And only two-thirds have passed this month.

In this environment, cryptocurrency equity diversification is the key.

This is the view of Matthew Sigel, manager of VanEck's newly launched on-chain economic ETF (NODE).

“The equity capital markets are currently open to any cryptocurrency-related projects thanks to the rising Bitcoin price and the favorable benefits of the Trump administration and the SEC’s deregulation of financial regulations,” Sigel told me. “This includes special purpose acquisition companies (SPACs), IPOs and mergers. If Bitcoin prices remain firm, capital formation in the sector is expected to increase significantly next month.”

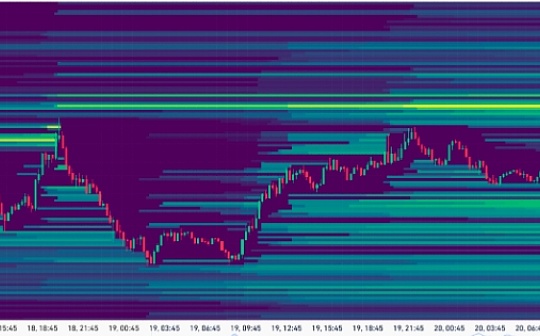

Although BTC has not yet reached its peak of about $109,000 in January, its breakout above $106,000 is already the asset's highest weekly closing price. At 2:30 p.m. ET, BTC hovers around $105,800.

Overall, BTC is currently performing well. Coinbase's shares are equally strong (up 2% in the past five days), which is in stark contrast to the positive news of its upcoming acquisition of Deribit and being included in the S&P 500 despite security breaches and news from the Securities and Exchange Commission investigation.

Several Wall Street analysts believe COIN 's initial decline due to security breach news is a bit exaggerated , with Oppenheimer and Cantor Fitzgerald reiterating the buy rating. An IMD report that measures how well a business is ready for long-term trends puts Coinbase in fifth place in financial services, behind JPMorgan Chase and ahead of insurance giant Progressive.

The report pointed out that the reason why the cryptocurrency exchange can surpass financial institutions such as HSBC and UBS is "because tokenized asset custody can affect both growth expectations and innovation returns, and many all-round banks are lagging behind in both aspects."

In terms of diversified investment, Sigel is fulfilling investors' commitments with practical actions. NODE invested in about 70 securities from the beginning, above its guide price of 30-60, and held about 1% of its position.

Following VanEck's spot Bitcoin ETF, its top ranks include COIN, Robinhood (just acquired Canadian WonderFi), Galaxy Digital (listed on Nasdaq last week), Mercado Libre and Strategy.

Speaking of MSTR, the Michael Saylor-led company bought another 7,390 bitcoins last week (currently a total holding of 576,230 bitcoins). Other companies followed suit.

Metaplanet accelerated the purchase of Bitcoin and released its latest purchase record on Monday, with a total of 1,004 bitcoins purchased. The company's Bitcoin holdings have nearly doubled over the past seven weeks (from 4,046 on March 31 to 7,800).

Nasdaq-listed DigiAsia said in a press release on Monday that its board of directors has approved a plan to create a treasury reserve for Bitcoin. The company is seeking to raise $100 million in funding to build a BTC position and execute a “cryptocurrency-based earnings strategy to optimize funding performance.”

Sigel said many newly established "Bitcoin Balance Sheet companies" are too small to be suitable for institutional stock investors and require subsequent transactions to grow.

He added: "It would be interesting to see how many such transactions can be completed for any reason. This is a very volatile market area."

As for Bitcoin’s outlook, YouHodler Marketing Head Ruslan Lienkha noted that BTC’s latest price trend—which remained above $100,000 for 11 consecutive days—“seems to be in a consolidation phase, marked by accumulation, which could lay the foundation for the next round of gains, ultimately setting an all-time high.”

The inflow of funds from Bitcoin ETFs remains strong, with $667 million flowing into U.S. products yesterday. Lienkha believes that $90,000 to $110,000 is “a psychologically and technically important price range” where it will still gain support even as BTC falls back from a possible new peak.

chaincatcher

chaincatcher