Web3 Payment Research Report: In 2025, stablecoins will be in Africa

Reprinted from chaincatcher

05/21/2025·17DAuthor: Will Awang

The world is flat

Our world has transformed from an isolated local economy through the global links of the Internet to a closely connected global system, and Thomas L. Friedman said that "the world is flat." Although the Internet makes the flow of information free and global, the infrastructure that supports the flow of funds still mainly depends on the framework before the Internet era, the flow of funds/value is still so difficult and expensive.

Although some regional financial innovations can accelerate the flow of funds, the financial tracks supporting Africa have not been synchronized. The failure of traditional financial systems to provide stability, accessibility and efficiency has led to people facing the risks of inflation and financial uncertainty, limited control over savings, and difficulty in entering the global market. But just as the region crosses the desktop computer era and goes directly into the mobile field, now the continent is ready to move beyond the outdated banking infrastructure to actively embrace stablecoins.

We can no longer limit our vision to the transaction use cases of stablecoins in the native crypto market. We should look at the actual use cases of stablecoins in non-crypto-native scenarios from a completely new perspective. Stablecoins have become an important part of the crypto narrative in sub-Saharan Africa and are a popular hedge tool to resist long-term inflation and currency depreciation.

"Stablecoins based on blockchain networks are an answer. Stablecoins are the first time we have a real chance to make changes to currency like emails to communication: make them open, instant and boundless. This is a currency/value Whatsapp moment, a global network built through blockchain and stablecoins that can benefit everyone." — Chris Dixon, a16z

1. Africa 's stablecoin revolution is quiet

Africa’s mobile currency penetration ranks first in the world and is well-known, demonstrating the need for alternative financial solutions. As a result, the emergence of stablecoins is naturally a way to seamlessly access financial services with just one mobile phone. Stablecoins can be further developed on this basis, expand financial inclusion, and achieve more efficient borderless transactions.

According to Chainalysis, Africa is the fastest growing region with cryptocurrency applications , with a year-on-year growth rate of 45% from 2022 to 2023-2024, surpassing the 42.5% in other emerging markets such as Latin America. This rapid growth highlights the huge potential of stablecoin applications, especially in Africa where bank penetration remains at the lowest level in the world.

"Stablecoins have become a reality in Africa's cross-border payments...the rest of the world is just catching up." - Zekarias Amsalu, Co-Founder of Africa Fintech Summit

One of the main drivers of the adoption of stablecoins in Africa is the Forex (FX) crisis faced by many countries. About 70% of African countries face foreign exchange shortages, making it difficult for companies to get the USD they need to operate. In countries such as Nigeria, the local currency Naira (NGN) has depreciated significantly, and stablecoins provide much-needed alternatives. " The bank has no dollar, the government has no dollar, and even if there is, they won't give it to you." — Chris Maurice, CEO & Co-founder of Yellow Card

Stablecoins have become an integral part of the African financial system over the past three years, providing a reliable store of value, cross-border remittances and trade without relying on severely volatile and unstable local currencies. USDT and USDC-backed stablecoins are filling gaps in traditional finance, allowing people in a scarce dollar economy to obtain a stable store of value.

From remittances, retail savings to B2B trade and cross-border payments, stablecoins are addressing problems such as Dollar Access, Instant Settlement and FX Infficiencies on the continent , which are particularly prominent in markets with insufficient traditional payment channels.

Africa is the world's most dynamic growth market, with the fastest population growth, the youngest median age, and has nine of the twenty fastest growing economies. Africa has 400 million mobile payment users, and the popularity of digital finance is already very large. Stablecoins are the next leap to transform smartphones into globally connected dollar accounts. Looking ahead, in ten years, more people in Africa will have crypto wallets and use stablecoins for daily transactions rather than traditional bank accounts.

" You don 't have to educate users, life will force them to use it. " -- Sky, Co-founder of ROZO

2. Projects to promote future stablecoin adoption

Chuk from Paxos has drawn an ecosystem map for us covering payment channels, use cases and companies to show the depth of the change already impacted. While many market maps showcase the global stablecoin ecosystem, few focus on Africa’s role in shaping its financial future. So we made this map to showcase builders and use cases that are redefining the financial infrastructure on the continent.

(Mobile Money to Global Money: Africa's Stablecoin Revolution, Chuk @ Paxos)

In the past three years of investment in the African market, we have seen more and more companies building around stablecoins, each playing a key role in promoting the adoption and innovation of stablecoins. Here are some of the most noteworthy players, along with key growth and financing data that highlight the industry’s rapid expansion.

-

Yellow Card: One of Africa's leading crypto asset exchanges, operating in 20 countries on the African continent. Africa's largest and first licensed stablecoin entry and exit platform. Yellow Card allows users to seamlessly exchange fiat currency into cryptocurrencies and vice versa. In 2024, the platform's annual transaction volume doubled from $1.5 billion in 2023 to $3 billion.

-

Conduit: Provides stablecoin payment services for import and export companies in Africa and Latin America. Annualized TPV will soar from $5 billion in 2023 to $10 billion in 2024.

-

Juicyway: A Lagos-based startup that uses stablecoins to facilitate cross-border payments. Since 2021, Juicyway has processed a total of $1.3 billion in payments.

-

Bridge : Bridge was founded in 2022 and was acquired by Stripe for $1.1 billion just two years later. Bridge enhances global stablecoin payment infrastructure. It serves most African payment companies and promotes stablecoin payments in Europe, the United States and Asia.

-

Jia: A blockchain-based fintech company that provides loans to small and medium-sized enterprises in emerging markets. In 2024, Jia's cumulative loan issuance exceeded US$10 million, up from US$2 million in the previous year, with an internal rate of return (IRR) of 24%, and a default rate of 0.14%.

-

Onboard: A global P2P transaction protocol that allows anyone to access on-chain finance anywhere. Nestcoin raised $1.9 million in its last round of funding to drive growth in its products.

-

KotaniPay: Provides stablecoin settlement solutions for enterprises and users. KotaniPay is developing an API product that connects blockchain and local payment channels. In 2023, KotaniPay received a $2 million seed round.

-

Accrue: Build a US dollar stablecoin proxy network and expand cross-border payment infrastructure. It has received a seed round of $1.58 million to expand its operations.

-

Convexity: Developed Nigeria's first regulated stablecoin cNGN. The company has partnered with the Central Bank of Nigeria since 2021 and obtained a temporary license issued by the Securities and Exchange Commission of Nigeria (SEC) in 2024.

-

Honeycoin: A platform for cross-border remittances, bill payments, purchase call time and online consumption. GTV soared from $40 million in the previous quarter to $500 million in the fourth quarter of 2024.

-

Paycrest: Paycrest is a decentralized liquidity protocol that supports instant, low-cost payments powered by stablecoins. In addition, they have developed Zap, a DApp for seamless payments between cryptocurrencies and fiat currencies, and won the Base 2024 Global Onchain Summer Buildathon Competition. Today, Zap is ready to go into production as Noblocks, the first interface supported by a distributed network of liquidity nodes that can perform instant decentralized payments with any bank or mobile wallet.

-

Haraka: A stablecoin-powered microfinance agreement for underserved entrepreneurs in emerging markets. Haraka leverages a reputation-based credit scoring system and demonstrates early business verification through partnerships with Grameen Bank and Mercy Corps.

Many of these companies have experienced significant growth over the past two years and are at the forefront of African stablecoin innovation.

For the global fintech community, the question is not whether stablecoins will go mainstream. The question is, what can we learn from where stablecoins have become popular—Africa.

3. Stablecoins are solving daily problems in Africa

“In Africa, this is not a choice between stablecoins and other financial instruments. It is a stablecoin, or nothing.” — Samora Kariuki, Frontier Fintech

Across Africa, stablecoins are solving practical problems. From preserving assets to promoting trade, stablecoins adoption is out of necessity, not out of trading and speculation. Here are the most critical use cases based on real needs and the companies that are building support for them.

3.1 Daily tools: savings, consumption and credit

In many African countries, inflation, currency depreciation and limited access to banking services make it extremely difficult to establish financial security. Stablecoins provide a more reliable path to become a dollar-denominated savings, trading and credit instrument.

A. Asset value preservation

Stablecoins are increasingly gaining popularity in areas where US dollar banking services are difficult to obtain, high inflation rates, and excessive or unreliable statutory payment networks. The situation in Africa reflects these situations, making stablecoins a key tool to protect savings and maintain purchasing power, especially in economies where the local currency continues to depreciate.

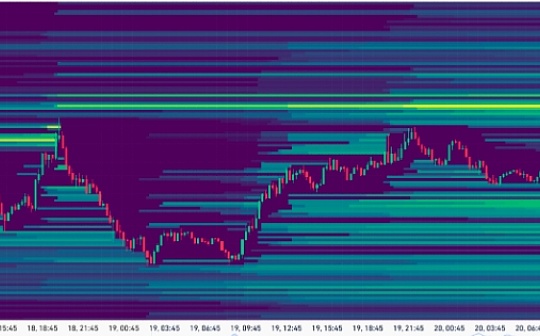

Currency devaluation is one of the biggest financial challenges facing African markets. Take the Kenyan shilling as an example. Although Kenya's GDP tripled between 2008 and 2024, its exchange rate against the US dollar has depreciated by 50% since 2021. The contradiction is obvious: economic growth is rising, but people's confidence in local currencies has not increased. Similarly, in Nigeria, inflation and depreciation of naira have been key drivers of stablecoin adoption over the past 18 months. Naira fell to an all-time low in February 2024 and has been struggling since then, highlighting the need for stable alternatives.

(Stablecoins: Leapfrogging Africa's Financial System, Ayush Ghiya and Uchenna Edeoga)

As local currencies continue to depreciate, stablecoins are becoming the preferred hedge tool, providing more reliable ways to trade and store wealth. Unlike cash or gold, stablecoins provide a fully digital, widely available payment channel without relying on banks, payment networks or central banks. Not only can they hedge currency volatility, they also provide higher yields than traditional savings accounts, which is an attractive option for Africans who want to maintain and increase their value. Traditional banks have lower interest rates, while stablecoin savings platforms use decentralized finance (DeFi) and cryptocurrency lending models to create higher returns for users.

Currently, stablecoins based on the US dollar are the first choice for users in emerging markets. In most parts of Africa, USDT (based on trough) has become the de facto digital dollar. Most users acquire stablecoins through centrally escrowed applications like Binance, with speed and liquidity prioritizing over Western concerns about reserves or transparency.

The most important thing for those facing foreign exchange rationing and 30% inflation is that it can work. Stablecoins help users maintain their assets in marginal areas and save in stable currency. According to the World Bank, as of 2021, only 49% of people in Africa have bank accounts, but 400 million people use mobile payments, and stablecoins can meet user needs in places that banks cannot cover.

Platforms like Fonbnk can realize instant recharge to USDT on basic mobile phones, while Accrue provides a local community proxy network for cash deposits and withdrawals of stablecoins. Nigerian cryptocurrency platform Busha Earn allows users to save stablecoins at an annual rate of return of up to 7.5% (much higher than the yields of most Nigerian banks). Sub-Saharan Africa leads the world in DeFi applications, which may be due to the growing demand for convenient financial services in the region. This shows that stablecoins are not just an alternative, they are crucial to financial stability in areas where traditional systems fail.

This makes stablecoin savings an attractive option—not only because of higher interest rates, but also because users can also gain in addition to the value they gain by hedging the depreciation of the currency. These factors work together to make stablecoins a powerful tool for preserving and increasing wealth.

“By converting daily prepaid payments – mobile data, bank transfers and mobile payments – into USDT, Fonbnk acts as a stablecoin settlement layer, providing 400 million unbanked and underserved Africans with a means to hedge against currency devaluation and open up new avenues for savings and credit beyond traditional banks.” – Chris Duffus, Founder & CEO, Fonbnk

B. Expand credit access

Small and medium-sized enterprises (MSMEs) in Africa have a credit gap of US$330 billion. The lack of banking services has led to an underdeveloped credit system for small and micro enterprises, and millions of individuals and small businesses are rejected by banks. In these markets, small businesses are often overlooked by traditional financial institutions due to their high collateral requirements, lengthy documentation processes and lack of credit history. Difficult to obtain affordable upfront capital, many small and medium-sized enterprises (MSMEs) turn to informal lenders for financing, and the lack of affordable credit limits their ability to maintain daily operations and promote economic growth.

In the Web3 space, stablecoin-based lending protocols have shown great potential to solve this problem over the past three years. However, most such solutions still require a too high mortgage rate, requiring about 150% of crypto assets as collateral, which effectively excludes small and medium-sized enterprises in emerging markets. While low-collateral lending agreements like Goldfinch have emerged, they primarily act as alternative debt providers for fintech lenders rather than directly serving brick-and-mortar small businesses.

Recently, two companies Jia (using decentralized finance to provide factoring, supply chain financing and other loans) and Haraka (using an innovative social credit system) have actively worked to disrupt this area and seize market opportunities in Africa. These companies provide blockchain-based loans to small businesses and give responsible borrowers ownership, allowing them to accumulate wealth and drive the economic development of their communities.

Introducing this real-world economic activity into the chain is beneficial to both investors and borrowers. Investors can democratically obtain real gains, while borrowers can obtain blockchain liquidity and use ownership as a way to create long-term wealth for themselves and their communities. The use of blockchain also reduces the high transaction costs commonly found in the private credit market (usually passed on to the final borrower) and allows borrowers to create on-chain credit records, thus building a reputation over time.

These tools give users more control over their funds and unlock financial options that were previously unattainable.

3.2 Cross-border flows: trade, fund management and remittances

As Stripe CEO Patrick Collison said, stablecoins are “a room temperature superconductor for financial services.” They will enable businesses to seek new opportunities that could not otherwise bear the burden of existing payment channels or the friction of traditional gatekeepers. This is particularly obvious in the field of cross-border payments, where traditional systems are slow, costly, and rely on multiple intermediaries. High fees and long delays complicate transactions – especially in Africa, where the average remittance rate is about 8%, and financial infrastructure is usually limited or missing.

Cross-border payments are the basis of Africa’s daily economy, from importing goods, sending remittances to returning profits and paying freelancers. However, payment channels that support these capital flows remain vulnerable: 3-5-day delays, 5-10% fees, and are subject to foreign exchange rationing. Stablecoins have changed this situation and provide a solution to these problems, which supports real-time, low-cost transfers without the need for large capital reserves or bank intermediaries.

(Stablecoins: Leapfrogging Africa's Financial System, Ayush Ghiya and Uchenna Edeoga)

For a scenario where a Ugandan user wants to transfer funds to a Nigerian user in the picture above. If the remittance is based on the SWIFT network, since the two countries do not have a direct bank network, the user may have to go around the middle bank in the United States to transfer money. However, once a stablecoin payment network is adopted, users do not need to make payments through multiple intermediaries, but can convert local currency into stablecoins and send them directly to Nigerian users, who then exchange them into Nigerian naira and obtain funds locally.

This process eliminates the inefficiencies of SWIFT and the net-based settlement model, as transfers are performed directly through an exchange or blockchain wallet connected to a monetary acceptance deposit and withdrawal service provider. These service providers integrate with local payment systems to enable seamless conversion between stablecoins and local currencies.

Recently, Stripe acquired Bridge, a stablecoin API provider for $1.1 billion, just two years after Bridge was founded in 2022 to enhance its global stablecoin payment network. Africa is Bridge’s main market, providing stablecoin payment services to most African payment companies operating in Europe, the United States and Asia. This highlights the growing demand for stablecoin infrastructure in the market and the expansion of major players in the field.

While Bridge has laid the foundation for the orchestration and issuance of stablecoins, there is still a lot of work to be done in this sub-field. Cross-border payments are still a huge opportunity, but there are also some key issues to be solved.

A. Trade and B2B Payment

China is Africa's largest trading partner. In 2023, Africa's imports from China reached US$176 billion, with a trade deficit of US$66.6 billion. This creates a sustained demand for USD payments, which stablecoins meet with high efficiency and high liquidity. Due to its deep liquidity and extensive exchange support, USDT (Tron-based) has become the preferred channel for many commercial payments.

“Stablecoins are the new cornerstone of cross-border payments in Africa. Companies use Conduit to settle payments almost instantly, reducing working capital, maintaining liquidity, and avoiding currency fluctuations.”—Eric Wainaina, General Manager, Africa at Conduit

“Stablecoins have completely changed the situation of importers who cannot obtain US dollars through banks – their businesses are now thriving.” – Suleiman Murunga, Director, MUDA

Internal trade payments on the African continent: Internal trade on the African continent accounts for only 15% of the total import and export volume of the African continent, far lower than 54% in North America, 60% in Asia and 70% in the EU. The main reason for this imbalance is the lack of direct currency exchange infrastructure – most transactions require local currency to be converted into USD, GBP or Euro and then to other African currencies. This inefficiency adds $5 billion in unnecessary costs to intra-continent transactions per year. Solving this problem is crucial to achieving smooth trade across the continent.

Fund remittance: Some large multinational corporations selling goods and services in Africa can use stablecoins to remit funds back to their home countries. With the help of stablecoin infrastructure, funds settlement time is less than 30 minutes, while traditional payment methods take 2-3 days.

B. Remittance and global payments

Just as stablecoins can enable external payments, they can also bring funds to the African continent. This includes remittances, wage payments and income from freelancers.

Remittance is one of the most common cross-border payment needs, but traditional remittance methods make it expensive. In 2023, global remittance flows reached US$883 billion, with fees particularly affecting low-income users. Today, sending $200 from the United States to Nigeria through stablecoins costs less than $0.01, while using the traditional method costs $7.60. Massive reduction of these costs remains an urgent task.

“Sub-Saharan Africa remains the highest remittance cost in the world, with an average remittance cost of 8.37% in 2024. However, many Africans overseas don’t know that they can now use stablecoins to send money home, faster and less expensive.” — Xino Zee, Lead at Send Africa

Payment: For freelancers in the gig economy, cross-border micropayments are still costly and inefficient. In places like Kenya, some people even choose to “rental” PayPal accounts because it’s too difficult to open an account on their own – highlighting how access barriers have exacerbated the already high costs of small-scale international payments. The emergence of stablecoins can simplify payment processes, thus significantly benefiting these workers. In addition, businesses operating across countries can efficiently manage cash flow using stablecoins and seamlessly make payments to employees, customers or suppliers around the world.

Global Aid: Currently, only about 40 cents of each dollar donation received by Global Aid will eventually reach the hands of the recipients, while the rest will go to multiple middlemen. We obviously need a more efficient, low-cost system that provides global assistance in a transparent and seamless way.

A new group of companies are rebuilding Africa's cross-border payment infrastructure around stablecoins. As exchanges, Yellow Card, Busha, VALR and Luno provide liquidity for local inbound and outbound currency acceptances. Conduit, Honeycoin, Shiga Digital and Juicyway support commercial trade, collections and payments, while Sling and Send drive consumer P2P payments.

These builders silently transferred the total billions of dollars. Many companies do not directly sell "stable coins" but instead sell cheaper remittances, working capital efficiency and currency stability.

4. Opportunities for African builders

“In Africa, if you kick a tree, three fintech companies using stablecoins fall off… The strongest team we support now has a single channel or industry liquidity – stablecoins are only hidden behind the scenes of fintech companies.” – Brenton Naicker, Principal & Head of Growth (Africa) at CV VC

4.1 Four levers for creating value

The first wave of stablecoin growth is concentrated on infrastructure: deposits and withdrawals, channel liquidity, and basic wallet functions. This level is rapidly becoming crowded. The next stage is differentiation: who owns users, who defines standards, and earns profits in real-world use cases. Here are four levers that shape value creation across the continent:

A. Distribution: Win users

Control of the user interface and customer relationships determines the flow of transaction volume. The strongest companies do not lead the stablecoin infrastructure, but solve payment, lending or fund management issues, hiding stablecoins behind the scenes.

B. Liquidity: Control both ends of the channel

Local foreign exchange liquidity is uneven and difficult to replicate. Teams capable of managing start and end flows can provide better pricing, internal net transactions, and lower fees. Mobility accumulates, forming a defensive moat.

C. Regulation: Shaping rules when they have not yet been formed

Perfect execution is crucial in competitive markets such as Nigeria and Kenya. But in underdeveloped markets like Malawi or Cape Verde, pioneers face less competition and can work with regulators to define the rules of the game. Builders of early-stage investment trust may win long-term policy consistency.

“Dollar liquidity has been on-chained through stablecoins in most parts of Africa. Policy makers should prioritize the large-scale on-chain local currencies to accelerate economic sovereignty and trade.” —Wale Ayeni, Managing Partner of Helios Digital Ventures

D. Vertical Field: Customized for a specific workflow

Whether it is agriculture (such as Agridex), logistics, education, or global aid, each industry has its own workflow, user expectations, compliance requirements and payment pace. Professional builders are able to use jargon, access existing tools, and solve problems that generalists cannot solve. Once trust is gained, they can add additional financial services such as credit, fund management or insurance. Focus on bringing user stickiness and profit.

4.2 Major crypto economies in Africa

(State of Crypto Report 2024: New data on swing states, stablecoins, AI, builder energy, and more)

A. Nigeria – the center of crypto activities in Africa

Nigeria, the most populous country in Africa, is leading the way in adopting stablecoin, driven by a booming fintech industry and severe economic challenges. In recent years, Nigeria's economy has faced a series of shocks. The sluggish oil prices, a key driver of its export economy, coupled with the impact of the COVID-19 pandemic and supply chain disruptions, has led to long-term financial uncertainty. Nigeria ranks among the highest inflation rate in Africa, even higher than the entire French-speaking region. As the Naira continues to depreciate, stablecoins have become an important tool for Nigerians to seek wealth preservation and global transactions.

The country ranks second overall in the Chainalysis team’s global adoption index for crypto. Between July 2023 and June 2024, the country received approximately US$59 billion worth of cryptocurrencies. Nigeria is also one of the main markets for mobile crypto wallet adoption, second only to the United States. The country is actively committed to regulatory clarity, including through incubation programs, and the use of stablecoins in daily transactions such as bill payments and retail purchases has increased significantly.

(Sub-Saharan Africa: Nigeria Takes #2 Spot in Global Adoption, South Africa Grows Crypto-TradFi Nexus, Chainalysis)

Like Ethiopia, Ghana and South Africa, stablecoins are also an important part of Nigeria's crypto economy, accounting for about 40% of all stablecoin inflows in the region - the highest in sub-Saharan Africa. Nigerian users report that they trade more frequently and have the deepest understanding that stablecoins are a financial instrument, not just an asset class.

Crypto activity in Nigeria is driven primarily by small retail and professional-scale transactions, with approximately 85% of the transfers worth less than USD 1 million. Due to the inefficient and costly traditional remittance channels, many Nigerians rely on stablecoins for cross-border remittances. " Cross-border remittances are the main purpose of Nigerian stablecoins. It is faster and more affordable. "

“Daily activities such as bill payments, mobile phone top-ups and retail shopping are increasingly powered by cryptocurrencies. People are beginning to see the practicality of cryptocurrencies in the real world, especially in daily transactions, which is different from the previous view that cryptocurrencies are regarded as a means of getting rich quickly.” — Moyo Sodipo, CEO & Co-founder of Busha, Nigeria cryptocurrency exchange

In addition to the traditional financial system, the DeFi platform also provides Nigerians with new opportunities to earn interest, loans and participate in decentralized transactions. “DeFi is a key area of growth as users are exploring ways to maximize returns and access to financial services that they may not be able to access,” Sodipo said.

(GPR 2025: the past, present and future of payments, WorldPay)

We can see in the figure above that cryptocurrencies are already 1% of the online E-com and offline point-of-sale POS in Nigeria and are classified as Digital Payments. In WorldPay's report, similar countries include: Argentina, Brazil, India, Nigeria, Philippines, Singapore, Turkey.

Against the backdrop of inflation, remittance and financial channels driving the application of stablecoins, it is believed that the adoption of stablecoins will be reflected in various scenarios. Nigeria has become an ideal test site for African stablecoins. The country's role in the construction of stablecoin infrastructure will determine the direction of the technology on the African continent.

In December 2023, the Central Bank of Nigeria lifted a ban on banks that provide services to cryptocurrency companies, which also played a key role in the popularity of cryptocurrencies. “Since the bank ban was lifted, it opened up many possibilities for collaboration and smoother transactions,” Sodipo explained. On this basis, in June 2024, the Securities and Exchange Commission of Nigeria (SEC) launched the Accelerated Regulatory Incubation Program (ARIP), requiring all virtual asset service providers (VASPs) to register and undergo evaluation before they are fully approved. “The industry is optimistic about ARIP; it is a shift away from uncertainty and a positive step towards regulatory clarity,” Sodipo said.

These policy initiatives will enable companies from all walks of life to consider moving from traditional payment channels to stablecoin infrastructure. Although compliance solutions are not perfect, every company that adopts stablecoins can prove to existing companies that stablecoins are a reliable, secure, compliant and more complete solution to traditional payment problems.

B. South Africa – TradFi agency adoption drives market development

As Africa’s largest economy, South Africa has positioned itself as one of Africa’s most advanced Web3 markets, with an advanced regulatory framework and strong institutional investor interest. The country has become one of the largest cryptocurrency markets on the continent, with transactions reaching US$26 billion in the past year. Unlike many African countries that are primarily driven by retail investors, institutional investor participation in South Africa is increasing, with licensed companies and traditional financial institutions entering the field.

Starting from the end of 2023, stablecoins have continued to grow on local exchanges in South Africa - up more than 50% month-on-month in October 2023. Stablecoins have replaced Bitcoin as the most popular cryptocurrency in recent months.

(Sub-Saharan Africa: Nigeria Takes #2 Spot in Global Adoption, South Africa Grows Crypto-TradFi Nexus, Chainalysis)

The key driver of South Africa's cryptocurrency growth lies in its clear regulatory stance. The country has classified cryptocurrencies as financial products, thus building a structured legal environment that provides a clear regulatory framework for businesses and investors. In March 2024, South Africa approved 59 cryptocurrency operating licenses, paving the way for wider adoption of stablecoins. By setting up regulatory guardrails, the government aims to attract investment, protect users from cybercrime, and expand access to low-cost digital asset transactions.

The South African Intergovernmental FinTech Working Group is actively refining its stablecoin regulatory approach and plans to formally classify stablecoins as a unique subset of crypto assets. The move is in line with the country's broader financial modernization and digital payments initiatives, aiming to ensure stablecoins are properly integrated into the financial ecosystem. The 2024 budget review further highlights the government’s commitment to structural reforms, improving public fiscal management, and developing new policies focused on stablecoins and blockchain-based digital payments.

The growing interest of institutional investors has also sparked discussions about banks issuing stablecoins. As traditional financial institutions explore the stablecoin model, regulated, bank-backed digital assets may soon emerge in South Africa, which will further promote the mainstream application of stablecoins. Led by startups such as VALR, Luno and Altify, South Africans have begun using stablecoins to diversify their investments, make payments and access financial services more efficiently.

With a developed financial industry, clear regulation and an increasingly integrated cryptocurrency with traditional finance, South Africa is becoming a leader in the application of stablecoins on the African continent. As the government improves its policy framework and in-depth institutional participation, South Africa is laying the foundation for stablecoins to play a central role in its growing digital economy.

C. Kenya – becoming a stablecoin hub in East Africa

Kenya has long been at the forefront of African financial innovation. From being the first to launch mobile currencies to embracing Web3 in the early days, the country has been moving beyond the traditional banking system toward more efficient digital solutions. Today, Kenya is positioning itself as a key player in the stablecoin revolution with its strong fintech infrastructure, an open regulatory environment and growing demand for alternative financial services.

One of Kenya’s biggest strengths is its deeply rooted mobile currency culture. Launched by Safaricom in 2007, M-Pesa has become a pillar of Kenya's financial system, handling about 60% of the country's GDP and covering more than 90% of the adult population. Its success is that it provides banking services without the need for a physical bank, allowing millions of Kenyans to deposit, withdraw, transfer money, and even get credit through mobile devices. Stablecoins complement this ecosystem, allowing users to hold value in a stable currency and conduct frictionless transactions around the world.

In addition to mobile currencies, Kenya's regulatory environment has been an important driving force for the development of fintech and Web3. Unlike many countries that take restrictive stances on digital assets, the Kenya Capital Markets Authority (CMA) actively promotes innovation through regulatory sandboxes, allowing blockchain-based companies to test and refine their products.

Kenya's demand for stablecoins stems from its lack of formal financial services. Small and medium-sized enterprises (SMEs) face significant credit hurdles, with Kenyan businesses seeking loans of approximately US$1.1 billion in 2021 alone.稳定币驱动的贷款解决方案可以填补这一缺口,为企业和个人提供更便宜、更快捷、更便捷的信贷选择。

肯尼亚也已成为代币化私人信贷领域的全球领导者。 根据RWA.xyz 的数据,肯尼亚在代币化现实世界资产借贷领域位居全球第一,贷款额达7380 万美元,超过了印度和巴西等规模更大的经济体。这不仅反映了肯尼亚对替代融资解决方案的旺盛需求,也体现了该国将基于区块链的信贷模式融入其金融生态系统的能力。

凭借成熟的移动货币格局、先进的监管机构以及日益普及的稳定币应用,肯尼亚正迅速成为东非地区重要的稳定币中心。随着越来越多的金融科技公司构建基于稳定币的解决方案,肯尼亚在塑造该地区金融未来方面的作用将不断增强。

(Nika, 拍摄于肯尼亚市中心, 2025 年5 月)

五、需要克服的采用障碍

尽管我们能够看到众多建设者在非洲的理想实验田中取得了强劲的进展,但是稳定币基础设施仍然面临结构性挑战。要进一步扩展,建设者必须应对艰难的障碍,其中一些是技术性的,另一些是政治性的。

5.1 政策风险和监管模糊

尽管最大的国家在监管方面取得了进展,但大多数其他国家仍然处于监管灰色地带。稳定币既未被禁止,也未被完全合法化,这减缓了企业采用的速度,并阻碍了机构资本的进入。

随着交易量的增长,执法力度可能会在资本管制、税收、反洗钱和报告方面增加。这一领域的进展将来自与监管机构的积极互动。创始人、行业协会和区域沙盒可以帮助塑造规则。

“Busha 很自豪成为这个市场上的第一家获得许可的交易所,我们正在引领这场变革,提供所需的流动性、信任和基础设施,以推动稳定币驱动的经济。这不是未来,它已经到来。”——Michael Adeyeri, Co-Founder & CEO of Busha

5.2 货币主权

各国政府越来越担心稳定币钱包正在创造一个“影子美元经济”。一些国家正在探索本地替代方案,例如ZARP(津巴布韦数字资产储备平台)和cNGN(奈拉支持的稳定币),或者试点央行数字货币(CBDC),以维持货币控制权。

“美元稳定币的主导地位反映出一种信任危机……如果没有果断的政策创新和对像cNGN 这样的受监管的、有竞争力的奈拉支持稳定币的鼓励,非洲国家可能会将其金融控制权拱手让给离岸稳定币发行方。”——Adedeji Owonibi, Founder & COO of Convexity (cNGN Issuer)

5.3 流动性缺口

快速跨境支付需要资本在正确的时间、地点和货币中可用。像Wise 和Thunes 这样的提供商通过预存资金账户来解决这一问题,但随着稳定币的流动,这一责任转移到了做市商、场外交易柜台和其他流动性提供者身上。随着交易量的增长,资本在每个通道中仍然是一个限制因素。

像MANSA 和Arf 这样的支付金融(PayFi)公司正在填补这一空白。通过将稳定币作为传输层,它们为金融科技公司、协调者和中小企业提供了实时流动性。

“实时、低成本的流动性不仅让支付更快,还解锁了全新的模式,比如及时供应商融资。对于那些一直围绕结算风险构建业务的创始人来说,这是一个游戏规则的改变者。

下一步是将这种美元流动性直接嵌入新兴市场企业已经使用的应用程序和工具中,以便价值能够像WhatsApp 消息一样轻松地流动。”——Mouloukou Sanoh, CEO & Co-Founder, MANSA

5.4 欺诈、诈骗和消费者信任

加密货币的采用带来了新的风险,从网络钓鱼诈骗、假冒钱包到安全性差的应用程序。这些漏洞削弱了用户的信任,尤其是首次使用者的信任。保障安全的责任落在了消费者应用程序上。可信的设计、风险工具和教育必须成为核心产品的一部分。

“用户是恶意行为的最大受害者。用户只会继续使用并推荐他们认为安全的平台。”——Zach Bijesse, CEO & Co-Founder at Archer

5.5 意识和教育

在加密货币原生圈子之外,许多商家和代理仍然觉得稳定币难以理解。持续的“最后一公里”采用取决于易用性、培训和展示实际价值。

“在许多农村地区甚至城市社区,对加密货币的认知度仍然很低,因为加密货币看起来太技术化了。”——Xino Zee, Lead at Send Africa

这些障碍是真实存在的,但每天都在逐渐被克服。成功的团队不会等待条件完美,而是会增强韧性、赢得信任,并随着监管的完善而适应各个通道和社区。

六、稳定币正在重新定义非洲金融

稳定币通过提供便捷、高效、可靠的传统银行系统替代方案,正在从根本上改变新兴市场的金融格局。 与西方经济体受机构驱动的采用不同,非洲并没有等待对于稳定币的全球共识,而是已经着手建设。 撒哈拉以南非洲等新兴市场正在经历由散户用户参与的小额转账、汇款、点对点支付和价值存储的草根式增长。同时,也在金融科技公司的推动下,在汇款、贸易、信贷和储蓄等领域,实际开展应用。

过去几年的经验证明,稳定币不仅仅是一种替代方案,更是非洲货币未来的必然趋势。它们能够绕过断裂的金融轨道,提供稳定的价值,并实现即时、低成本的交易,使其成为个人、企业乃至机构的重要工具。随着更多基础设施的建设和监管透明度的提高,稳定币必将更加深入地融入非洲的金融体系。

这里就是可编程货币的未来原型。这是一个值得学习、建设并投资的地区。

我们正在制作一系列纪录片来讲述这些故事——人类在最后一英里使用稳定币的故事——因为为了充分实现稳定币的机会,我们需要更好地了解推动稳定币发展的条件,并将继续推动稳定币在该技术已找到产品市场契合点的市场中的采用。——Justin Norman, Founder of The Flip

他指出, 要理解非洲的稳定币采用,需要看到“最后一公里”的人,而不仅仅是技术。

非洲的人口结构已经到位,需求显而易见,随着全球监管的逐步完善,这一势头只会加速。稳定币已经不再是一个在Crypto 市场的炒作名词,而是 一场从传统金融中解耦、在链上重构的系统级变革 。

每个人看到的切面不同,但都指向同一个未来—— 一个不需要银行,但人人都能“有银行”的世界。

jinse

jinse