Bitcoin open contract hit record highs longs flock to new BTC highs

Reprinted from jinse

05/21/2025·17DAuthor: Marcel Pechman, CoinTelegraph; Compilation: Baishui, Golden Finance

summary

-

Bitcoin futures open contracts hit a new high of $72 billion, indicating that institutional investors' leverage usage is rising.

-

Short positions worth $1.2 billion (the position price ranges from $107,000 to $108,000) are facing liquidation risks, which increases the likelihood of a BTC breakthrough.

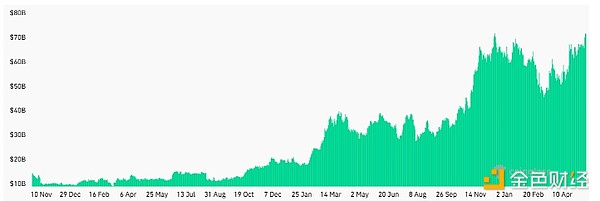

Total open contracts for Bitcoin

On May 20, the total open contract for Bitcoin futures soared to an all-time high, raising questions about whether short positions are at risk. Although Bitcoin prices have repeatedly failed to break through the $107,000 mark since May 18, the huge scale of leveraged positions may push Bitcoin prices to record highs.

Total open contract for Bitcoin futures (USD). Source: CoinGlass

On May 20, the total open contracts for BTC futures climbed to $72 billion, an increase of 8% from $66.6 billion a week ago. Institutional demand continues to be the main driver of leverage, with the Chicago Mercantile Exchange (CME) leading the total open contract size of BTC futures at $16.9 billion; followed by Binance, with holdings of $12 billion.

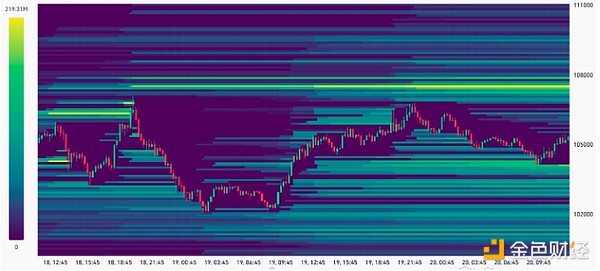

$1.2 billion bearish BTC liquidation is concentrated between $107,000 and

$108,000

According to CoinGlass, the maximum data for bearish BTC futures clearing is concentrated between $107,000 and $108,000, with a total of about $1.2 billion.

Bitcoin futures leverage hot map, unit: million US dollars. Source: CoinGlass

While it is impossible to predict what factors could trigger gold prices to break through $108,000, forcing leveraged short positions to close, concerns over growing U.S. fiscal debt have led to rising market optimism. There remains uncertainty about how the government plans to achieve economic growth while cutting spending, especially as there are ongoing differences between Democrats and Republican lawmakers.

More importantly, the 20-year Treasury yield is still close to 5%, up from 4.82% two weeks ago. Long-term weak demand for government bonds could force the Fed to step in as the last buyer to maintain market stability, thus reversing the 26-month trend. This approach puts downward pressure on the dollar and prompts investors to seek other hedging strategies, including Bitcoin.

Gold dominated, but Bitcoin absorbed funds in the reconfiguration of reserves.

Gold remains a major alternative asset, but its 24% gain so far in 2025 and a $22 trillion market cap make it less attractive to many investors. By comparison, the overall market capitalization of the entire S&P 500 is $53 trillion, while the total market capitalization of U.S. Bank of America and Treasury (M1) is $18.6 trillion. By comparison, Bitcoin currently represents a $2.1 trillion asset class, with a roughly equivalent size to silver.

Meanwhile, some regions, especially the United States, have begun to prepare to convert some of their gold reserves into Bitcoin — a move that could easily push Bitcoin prices to record highs. These countries only need to allocate 5% of their gold reserves into Bitcoin moderately, which will bring in $105 billion inflows, equivalent to buying 1 million Bitcoins for $105,000.

In the long run, Strategy, a US-listed company led by Michael Saylor, currently holds 576,230 bitcoins. There is no doubt that institutional investors remain the main catalyst for Bitcoin to break through the $108,000 mark. The move will trigger liquidation of high-leverage short positions and may accelerate Bitcoin to record all-time highs. However, continued macroeconomic uncertainty continues to drag down overall investor sentiment.

As Bitcoin approaches the $107,000 mark, investors holding short positions face higher risk of forced closing – which could further drive prices.

chaincatcher

chaincatcher