Ethereum price rose 90% last time the indicator turned bullish

Reprinted from jinse

05/21/2025·17DAuthor: Biraajmaan Tamuly, CoinTelegraph; Translated by: Tao Zhu, Golden Finance

summary

-

A bull market flag is forming on the daily chart of Ethereum, which may break through $3,600.

-

If ETH recovers the two-week Gaussian channel midline, a 90% rebound may occur.

The ETH price consolidates between $2,400 and $2,750 on the daily chart, forming a bullish flag pattern, with the target looking towards the resistance area of $3,000 to $3,100. The bullish flag is a continuation pattern, following the price surge from $1,900 (black flagpole) to $2,730, and the current range forms the flag shape.

Ethereum 1-day chart. Source: Cointelegraph/TradingView

After breaking through $2,600, the target price may be $3,600 (which is calculated by adding flagpole height to breakpoints), but the current key focus area is still within the resistance range of $3,100 to $3,000.

The 200-day exponential moving average (EMA) supports the lower range. Relative Strength Index (RSI) has declined significantly over the past few days, although still close to the overbought area.

A breakout of ETH, accompanied by rising RSI and volume, may confirm bullish trends, while a break below $2,400 may invalidate the pattern.

Can Ethereum return to the midline of the Gaussian channel?

On May 20, Ethereum saw a significant trend shift as it tried to return to the two-week Gaussian channel midline. Gaussian channels are technical indicators used to identify price trends. Gaussian channels or normal distribution channels plot price trends in the dynamic range and can adapt to market fluctuations.

Historically, there is usually a big rebound when ETH breaks through this midline. In 2023, ETH soared 93% after a similar crossover to $4,000; while in 2020, ETH soared 1,820%, triggering a massive rebound in altcoins.

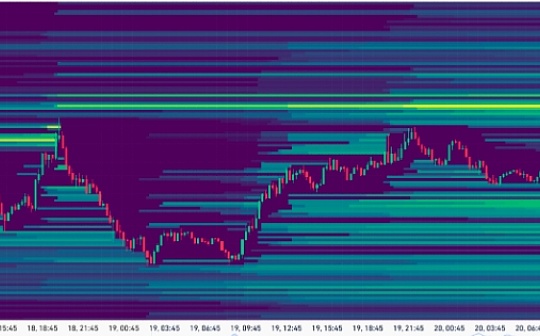

Ethereum Gaussian Channel Analysis. Source: Cointelegraph/TradingView

Instead, a similar setup in August 2022 resulted in the failure of the market adjustment period, highlighting the risk of relying solely on the indicator.

Similarly, cryptocurrency trader Merlijn pointed out that a golden cross between the 50-day moving average (SMA) and the 200-day moving average (SMA), which may further strengthen the momentum of ETH's upcoming breakthrough. It is worth noting that the golden cross appears on the 12-hour chart, which is not as reliable as the single-day chart.

Traders are cautious before possible "range volatility environment"

Popular cryptocurrency trader XO points out that Ethereum is consolidating below the "pretty good" resistance level below the $2,800. The trader expects a pullback if Ethereum fails to break through $2,800 in the next few days. The analyst said:

“I tend to think that the price will form a range volatility for at least a few weeks or more, after which I will be a buyer again.”

Ethereum price fluctuates below the Fibonacci level, which also reflects a bullish view opposite to the bulls. There are reports that Ethereum has recently retested the 0.5 to 0.618 Fibonacci levels, which may trigger a short-term pullback for Ethereum.

In this case, short-term support is still around $2,150 and $1,900, which may slow the bullish momentum over a longer period of time.

Ethereum price analysis for one week. Source: Cointelegraph/TradingView

chaincatcher

chaincatcher