Bankless: Coinbase’s top 10 catalysts in 2025

Reprinted from jinse

05/21/2025·26DSource: Bankless; Translated by: Wuzhu, Golden Finance

Coinbase has been quietly laying the foundation for its publicly listed company’s most transformative year to date.

From the landmark S&P 500 inclusion, to ambitious derivative expansions to cutting-edge privacy initiatives, Coinbase seems determined to gain a foothold at the intersection of traditional finance and decentralized innovation.

Although the company's stock price has not soared and is still coping with the impact of major data breaches, COIN continues to rise, up more than 50% in the past month.

In this article, we will analyze 10 key catalysts that will impact COIN’s development trajectory in 2025.

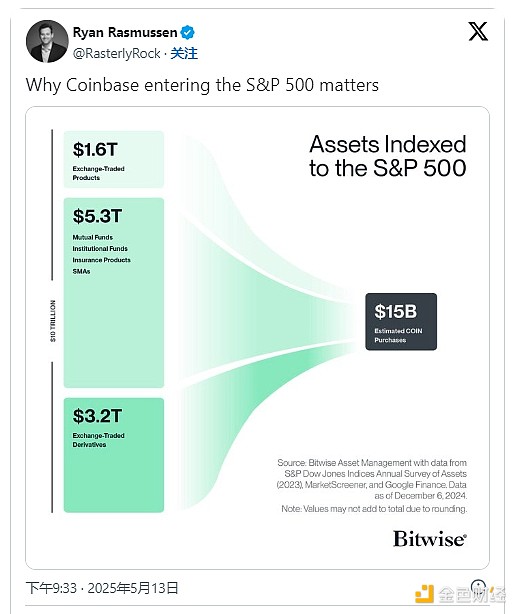

1. S&P 500 index included

The S&P 500 Index is a broad market benchmark that weights the 500 top-valued U.S. companies in a programmatic way. It is the basis of trillions of dollars in passive and active investment strategies.

On May 19, Coinbase became the first cryptocurrency stock to be included in the index; it is estimated that this inclusion brought in $15 billion inflows to the stock, meaning that about 0.11% of every dollar inflow into the S&P 500-linked portfolio is allocated to the cryptocurrency exchange.

While this figure may not seem large, the index’s massive scale converts this portion of the money into a monthly purchase of millions of dollars as investors allocate funds into passive strategies, a valuable support mechanism for Coinbase’s price and liquidity, marking the growing connection between cryptocurrencies and traditional finance.

2. Deribit acquisition

Coinbase recently announced that it will acquire Deribit, the undisputed global leader in crypto options for $2.9 billion ($700 million in cash and 11 million COIN shares). The acquisition is by far the largest deal in the cryptocurrency industry.

The deal will enable Coinbase to provide options products to international and veteran traders, as well as existing spot, futures and perpetual contract products, transforming the exchange into a full-service cryptocurrency giant, providing savvy traders with all the tools they need to express their views on digital assets and commodity markets.

Options rely on their built-in leverage, allowing traders to trade larger nominal dollar trading volumes per dollar capital. The introduction of these tools will not only allow Coinbase to earn more fees, but will also establish synergies, thereby increasing the overall transaction volume of the platform.

3. 24/7 Futures Market

Traditional financial markets may close on weekends, but cryptocurrency markets will never close. To adapt to this reality and to meet traders’ needs in the “never closing” market, Coinbase has recently become the first exchange registered with the CFTC, providing trading services for BTC and ETH futures markets 24/7.

By providing all-weather leveraged futures contract trading services, Coinbase ensures speculators and market makers can respond at any time. Longer trading days mean more trading can be conducted, and exchange trading volume is expected to continue to grow.

4. Riot Games Partnership

Riot Games is a multi-billion dollar studio with popular games like League of Legends and Valorant. Earlier this month, the company announced that it would enter the digital asset space with Coinbase.

As the "exclusive cryptocurrency exchange and official blockchain technology partner" for Valorant and League of Legends eSports global events, Coinbase will provide viewers with real-time analysis of currency trends during the game and provide event audiences with convertible emoticons/icons "drops".

Although the scale of this cooperation is small, it may only be the starting point for the two parties' many years of cooperative relationship. Riot Games will use the help of Coinbase to introduce in-game assets ownership into the blockchain, which may bring huge profits to both parties.

5. Bitcoin Income Fund

Ethena became a blue chip cryptocurrency protocol in this market cycle, as its stablecoin products attracted billions of dollars in deposits. These stablecoin products hold spot crypto assets and short perpetual contract futures to synthesize US dollar exposure and generate returns.

To participate, Coinbase Asset Management launched the Bitcoin Income Fund in late April, aiming to achieve 4-8% Bitcoin earnings by adopting a basis trading strategy similar to Ethena.

There are countless alternatives to Ethena, but few existing customers. The Coinbase Bitcoin Income Fund provides convenient returns to institutional investors in its settlement and provides more favorable prices for buyers in the Coinbase futures/perpetual contract market by matching buyers with programmatic sellers.

6. Verified pool

The Verified Pool, which Coinbase launched on March 18, combines authentication with decentralized exchanges by linking to Uniswap V4.

This pool can be useful (if not required) for real-world asset swaps and highlights the role of Coinbase’s existing KYC database in facilitating on- chain securities trading, especially in the era where the Securities and Exchange Commission (SEC) is committed to providing transparency in digital assets.

7. Custody and on-chain transactions

Coinbase Custody protects 12% of the total cryptocurrency market capitalization and serves as the registered custodian of the vast majority of spot cryptocurrency ETFs on the U.S. exchanges, including mainstream BTC and ETH products provided by Grayscale and BlackRock.

Coinbase Custody supports over 40 blockchains, covering hundreds of assets, seamlessly integrates custodial staking capabilities, and supports DeFi engagement through its Prime Onchain wallet. Given that Bank of America has been approved to offer such services, these two unique features set it apart from more traditional hosting options.

As institutions grow their interest in digital asset ownership, Coinbase is ready to profit by leveraging the growing deposits in its paid custody services.

8. Enhance subscription benefits

Coinbase has been working to expand its lasting “services and subscriptions” revenue segment for years, and one of its main ways to make money in this category is through Coinbase One. This is a retail-focused cryptocurrency subscription service that offers lower transaction fees, higher USDC rewards and more.

In February, Coinbase enhanced One’s services, offering subscription users a range of on-chain benefits, including a $10 monthly Base Gas fee, a free 5-digit Basename claim, and a lower fee/token benefit from partner agreements.

9. The US perpetual contract will be launched soon

Coinbase International has provided a range of crypto-pegged perpetual futures to qualifying non-U.S. users. While the instruments have not yet been approved by the U.S. Commodity Futures Trading Commission (CFTC), the exchange promises that it is the next derivative they hope to offer to U.S. users.

With no expiration date for perpetual futures contracts, Coinbase International's existing traders can get up to 20 times leverage. If these retail users-oriented tools are approved by the U.S. Commodity Futures Trading Commission (CFTC), Coinbase may become the leading platform for leveraged trading of digital assets and commodities.

10. Privacy first

Cryptocurrencies require privacy. On March 6, Coinbase announced that it had hired the team behind Iron Fish, a zero-knowledge privacy layer that provides optional privacy protection for assets on transparent chains, to lead a new privacy team within Base and to accelerate the implementation of its network privacy strategy by developing privacy protection primitives.

While the collaboration is still in its infancy, it shows that Coinbase is committed to building Base as a leader in private blockchain solutions for the benefit of developers, users and the cryptocurrency industry.

If more and more institutions and individuals migrate to the chain, they will need to conduct some sensitive, unpublicly-known financial transactions; Base can attract these users by becoming the leader in private blockchain solutions.

chaincatcher

chaincatcher