Why is Wyoming, the United States creating a multi-chain stablecoin WYST? Why is it questioned by its Republican colleagues?

Reprinted from panewslab

03/31/2025·1M

Author: Weilin, PANews

At the DC Blockchain Summit in March, Anthony Apollo, executive director of the Wyoming Stable Token Commission, hosted a special fireside conversation by Mark Gordon, the state’s governor and chairman of the stablecoin committee. Apollo officially announced that Wyoming stablecoin WYST has entered the testing phase on multiple blockchain networks. Apollo said it is the first stablecoin in the United States issued by a public entity, backed by fiat currencies and fully reserved.

The stablecoin committee plans to launch WYST on publicly visible blockchains, including Avalanche, Solana, Ethereum, Arbitrum, Optimism, Polygon and Base. These preliminary, worthless test tokens have been deployed on the testnet in partnership with token issuing partner LayerZero.

Nevertheless, the plan was subsequently questioned by senior Republican politicians, raising concerns about the establishment of a CBDC (central bank digital currency) in Wyoming.

Wyoming takes the lead in testing the waters, the first public entity

stablecoin in the United States

The Wyoming Stable Coin Commission was established in March 2023 with the legal basis of the Wyoming Stable Coin Act. The mission is to issue stable tokens that are fully backed by state legal and financial responsibilities. Its mission is to enhance financial transparency through blockchain innovation while driving economic growth.

In an official statement, the committee noted that LayerZero's OFT (Omnichain Fungible Token) standard and extensive experience in secure smart contract development provide a powerful, scalable and compliant solution that meets the Commission's legislative requirements for the provision of multi-chain stablecoins.

As part of the preliminary test, a third-party cross-chain bridge Stargate, supported by LayerZero, conducted a demo transaction for WYST between Ethereum and Avalanche testnets. WYST as OFT architecture means it can be bridged through any compatible interface – Stargate is just one example.

During a fireside conversation, Governor Gordon highlighted Wyoming’s commitment to transparency and innovation, noting the potential of blockchain technology in creating a secure and efficient financial ecosystem. “We are excited to share Wyoming’s state leadership vision in the capital,” Gordon noted. “Our forward-looking approach to blockchain and digital asset legislation has made Wyoming a role model not only for other states, but also for the federal government.”

Gordon added that WYST has several advantages: including the need to over-collateralize cash with U.S. Treasury bonds to reduce the risk of “decoupling” and the use of Treasury bond interest on state education funds to achieve fiscal rewards. WYST is expected to be tested until the end of the second quarter of 2025 and is scheduled to be officially launched in July of the same year.

According to the committee’s official website, these two persons in charge have both financial and blockchain experience in the background. Mark Gordon has served as governor of Wyoming since November 2018 and has signed more than 30 legislation involving cryptocurrencies, blockchain and digital assets. He was Wyoming Treasury Secretary (2012–2019). Anthony Apollo was appointed as the first executive director of the Stablecoin Committee in September 2023, with rich experience in traditional finance (KPMG, EY) and blockchain industries (ConsenSys, Rensa).

It is worth mentioning that Cynthia Lummis, who supports Bitcoin’s national strategic reserves, is also a senator from Wyoming.

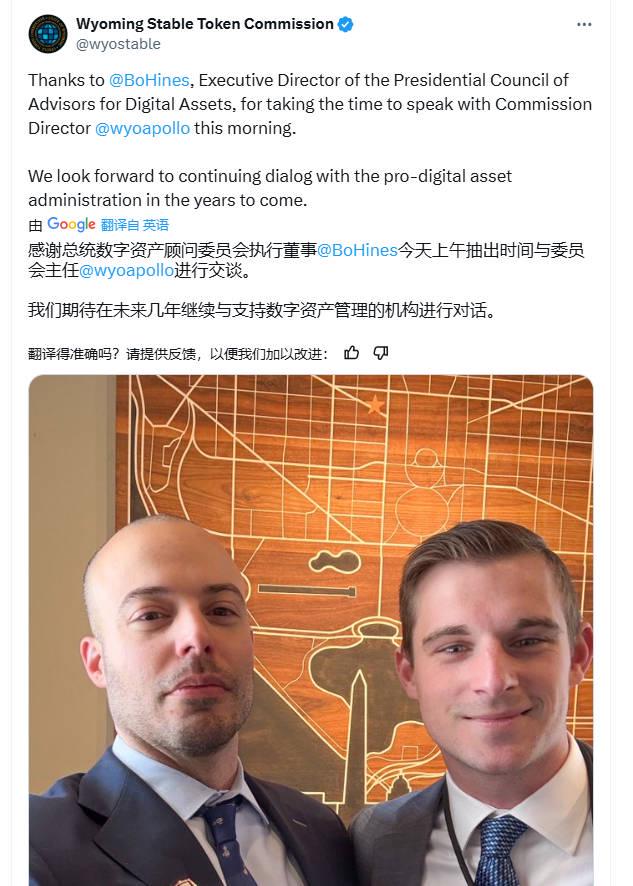

On March 27, the Wyoming Stablecoin Commission's X platform account also posted a photo of Anthony Apollo, executive director of the committee, and Bo Hines, executive director of the President's Digital Assets Advisory Committee, with the caption saying, "We look forward to continuing to talk with the government that supports digital asset management in the next few years."

Stablecoin or CBDC? Committee was criticized by Republican colleagues

Although the committee stressed that WYST was not issued by the central bank and was essentially different from the Central Bank Digital Currency (CBDC), the project was treated with some sensitivity in the Republican circle of the United States.

On March 27, after the WYST program announced the latest progress, the U.S. House Majority Whip and Republican Tom Emmer rarely publicly criticized the actions of his colleagues in the party.

“I respect the votes of the people of Wyoming, however, I personally strongly oppose any government issuing a tokenized version of its currency,” Tom Emmer told the media. “At the federal level, this will be considered a central bank digital currency.”

Central Bank Digital Currency (CBDC), the digital version of the country's legal currency, has become the "monster" that Republican politicians fear the most in recent years. Republican governor and President Trump are both committed to banning the development of CBDCs in the United States because they are considered a threat to user privacy. Unlike decentralized crypto assets, CBDC is issued and managed by central institutions, has the ability to freeze and track funds, is considered to be censorship-resistant, and may be used for government intervention in personal finance.

In this regard, Apollo firmly denied that WYST and CBDC were equated. He said he also opposed the state's support for the concept of CBDC, but WYST is a completely different product. “Wyoming takes privacy very seriously,” Apollo said. “We will create rules that clearly state what we can and cannot collect, how to process this data, and how to act on it.”

“Wyoming is not a central bank,” Apollo added. “We did not issue any cash.”

However, Apollo also admitted that the public and lawmakers frequently raised questions about whether WYST is equivalent to CBDC. This issue has also attracted much attention within Wyoming. Just a few weeks ago, Gov. Gordon just signed a bill banning CBDC development in the state, expressing the state’s opposition to “controlled digital currencies.”

Crypto Legislative Pioneer State: Actively embrace Bitcoin, 4 related

bills have been proposed this year

This is not the first time that Wyoming has attracted attention due to blockchain legislation. Over the past decade, it has continuously promoted friendly legislation in the digital asset field. Since 2019, the state legislature has passed more than 30 relevant bills. This year, MPs supporting cryptocurrencies have proposed four core proposals:

HB 201: State funds invest in Bitcoin

Proposed by Republican Rep. Jacob Wasserburger, a Republican, allows up to 3% of state fiscal funds to invest in Bitcoin, in an attempt to give Wyoming a lead before the federal government may accept Bitcoin. Although the bill ultimately failed to pass, Wasserburger said it will continue to promote relevant education and legislation.

HB 256: Establishment of Blockchain Special Committee (failed)

HB 264: CBDC prohibited

Proposed by Rep. Daniel Singh, the aim is to prohibit state agencies from accepting CBDC payments and not allow the use of taxpayer funds to build CBDC infrastructure, expressing Wyoming's boycott position against the CBDC.

HB 308 Encryption Frontier Act

The last major bill related to cryptocurrencies is another bill proposed by Singh. HB 308 will authorize the state attorney general to “invest specific federal overreach of rights involving blockchain or cryptocurrencies.” The bill is consistent with Singh and Wasserburger’s goal to enhance states’ ability to operate digital currencies without federal intervention. However, the bill has not been considered in the House of Representatives.

At present, although there is some controversy in the testing deployment of WYST, at the state level, the plan has certain significance for testing the waters and also poses a challenge to the path choice of the US federal government in CBDC and stablecoin regulation.

On the one hand, Wyoming proved with actions that stablecoins are not only controlled by private institutions, and local governments can also build digital currency products with compliance and public responsibility. On the other hand, the progress of the project also makes people have to think about: Where is the boundary between public stablecoins and CBDC?

WYST will continue to run on the test network in the coming months and will be gradually undergoing external audits and public assessments. Can it become the first successful example of the state-level “on-chain dollar” in the United States? This will not only affect Wyoming, but also may also affect the overall direction of the development of digital currency in the United States.

chaincatcher

chaincatcher