Analysis: The bull market is still there, and 10 common market top signals have not appeared

Reprinted from panewslab

03/31/2025·1MAuthor: Atlas , Encrypted KOL

Compiled by: Felix, PANews

Recently, voices about the "copying season has ended" have been circulating, and market sentiment is generally pessimistic, but some traders or KOLs still believe that the current situation is not the end of this bull market.

Among them, crypto KOL Atlas published an analysis that due to the cyclical behavior of the market, it has witnessed the repetition of many patterns, and common historical indicators at the top of the Bitcoin bull market have not yet appeared. and pointed out the top signs of 10 bull markets it has observed over the years.

Atlas believes that none of these 10 market top signals have appeared, and the current situation is not the end of this bull market. And when 5 of the signals appear, all positions can be sold.

Suddenly interested in cryptocurrencies

This top signal is not perfect, but one day people around you will start asking questions about cryptocurrencies or randomly asking what tokens to buy.

When you notice this happening, it is likely that it is approaching the final stage of the bull market.

Bullish sentiment is everywhere

At the beginning of the bull market, many people remained suspicious and cautious, but as prices continued to rise, this suspicion gradually disappeared and more and more people became overly optimistic.

When you realize that no one is bearish anymore and everyone believes that the market will continue to rise, the top of the market may be approaching.

Cryptocurrency enters mainstream media

This is also not a perfect top signal, as cryptocurrencies have been frequently seen in mainstream news.

But when you start seeing it on big entertainment shows like Jimmy Fallon, it's usually a sign that you're near the peak of the cycle.

Good news doesn 't boost price increases

Even strong positive news cannot drive the market up. Despite optimism in the market, prices began to fall slowly.

At the same time, any negative news will lead to a sharp decline in prices, which is a clear sign that the upward force is weakened.

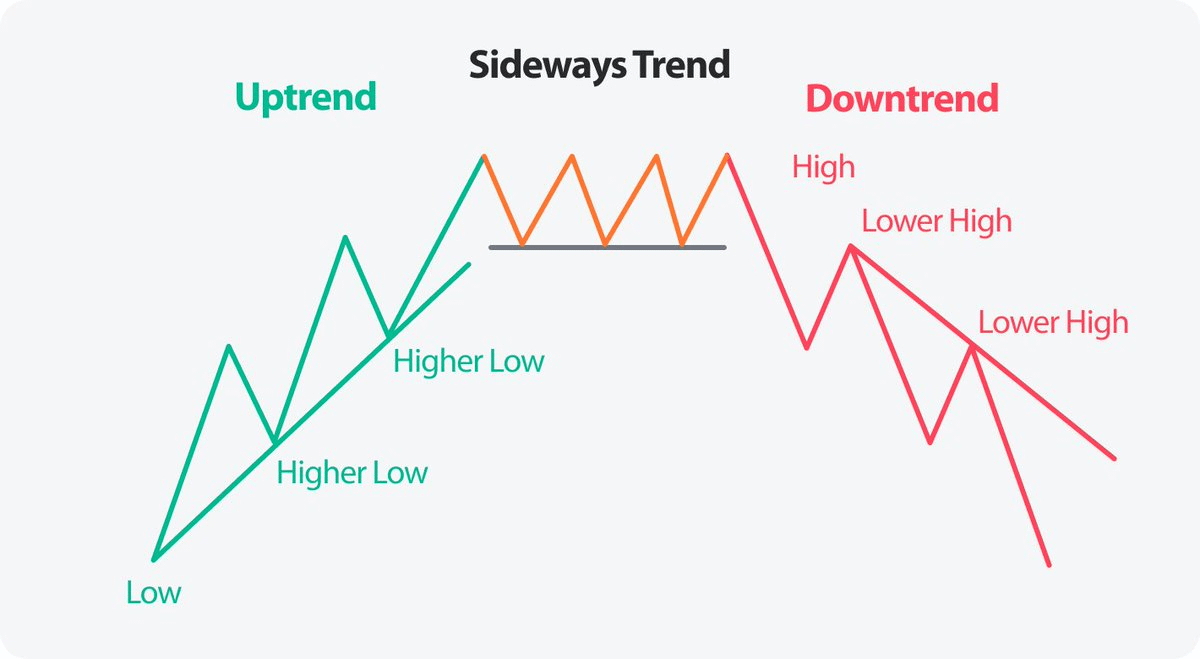

Upward trend collapses

A more obvious signal is that the steady upward trend begins to collapse.

The market quietly shifts from creating higher highs to forming lower lows – usually without much attention at the beginning.

It may look like a simple consolidation, but it usually means that momentum is fading.

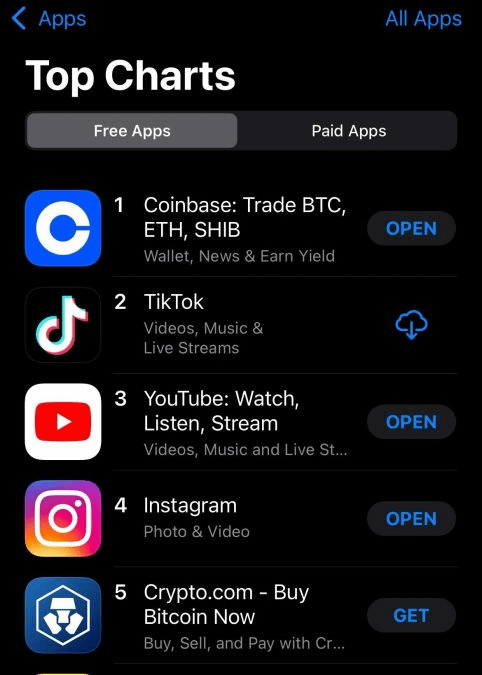

Coinbase ranks number one in the US app store

When applications such as Coinbase climbed to the top of the rankings, it was a clear sign that retail FOMO was in full swing.

By then, the market will definitely be no longer early. The market may still move higher, but it is a strong signal to start locking in some profits.

Show off your gains

Crypto Twitter is filled with people showing off their earnings, luxury cars, watches and carnival parties. Everyone is showing off their gains, making others feel that they are late to enter.

Greed dominates emotions—as they say, “Buy when you are afraid, sell when you are greedy.”

Resigned one after another

Some newbies are lucky in a few deals and start announcing that they are leaving their nine-to-five jobs.

This is usually driven by excessive confidence after a big win in a trade.

You will hear something like, “I’ve quit my job, I’m going to work full-time in the crypto industry”—a typical top atmosphere.

" Abandoned " project begins operation

Even some outdated or abandoned projects have begun to re-operate, driven by strong hype sentiment.

Narrative tokens that have no actual development or long forgotten suddenly attracted attention.

This situation is usually a signal in the late stage of a bull market.

Crazy price predictions are everywhere

Players start advocating crazy price predictions and telling you to keep holding anyway.

But the reality is, no one knows exactly where the top is.

Pay less attention to speculation about future prices and ensure profits as much as possible.

Related Readings: Crypto Investment Frenzy: Why is South Korea one of the hottest markets in the world?