Which giants are hoarding coins in the BTC high month? How institutions view the current market

Reprinted from jinse

05/26/2025·13DDeng Tong, Golden Finance

In May, BTC hit a record high of $110,000 due to factors such as Trump's relaxation of tariff policies, improved regulatory policies for Hong Kong and the United States, and the triple killing of U.S. stocks, bonds and foreign exchanges. Many investors are discouraged in the face of new highs, but many institutions are still enthusiastic about buying.

According to a recent report released by Bitwise, institutions are expected to hold more than 4.2 million bitcoins by 2026. “We expect approximately $120 billion of institutional funds to flow into Bitcoin by the end of 2025 and approximately $300 billion in 2026, with a total of more than 4.2 million Bitcoins being held by a group of diversified investors including public Bitcoin reserve companies, sovereign wealth funds, ETFs and countries.”

In this month when BTC breaks its price record, which institutional investors are hoarding coins? How do institutions view the current crypto market?

Top 10 institutions that hold BTC, source: bitbo

Top1: BlackRock

Latest moves: Increase holdings of 23,600 ETH and over US$3 billion BTC,

which is approximately US$3.09 billion

On May 22, BlackRock increased its holdings of 9,989 ETH from Coinbase Prime hot wallet address through its Ethereum Exchange-traded fund ETHA, worth US$26.47 million. Historical trading data shows that this is the third consecutive day BlackRock has increased its holdings of ETH, and has increased its holdings of 5,449 ETH and 8,162 ETH respectively in the previous two days, worth approximately US$34.34 million.

On May 6, BlackRock purchased 5,613 BTC worth about US$529.5 million, and its total Bitcoin holdings reached 620,252, worth about US$58.51 billion.

From April 28 to May 4, BlackRock increased its holdings of Bitcoin worth US$2.5 billion, equivalent to buying $500 million in Bitcoin every working day.

Eric Balchunas, a senior Bloomberg ETF analyst, posted on the X platform that BlackRock currently second only to Satoshi Nakamoto in terms of Bitcoin holdings, accounting for 57% of the world's second largest Bitcoin holders, and is expected to become the world's largest Bitcoin holder by the end of next summer. If Bitcoin reaches $150,000 in the next few months, it may see financial advisors "crazy snap-ups" that could shorten BlackRock's timeline for top spots.

Top2: Strategy

Latest move: Increase holdings of 9,285 BTC, approximately US$945 million

Strategy is definitely a big coin hoarder. Between May 12 and May 18, Strategy purchased 7390 bitcoins, with an average price of $103,498 (total: $764.9 million). Currently, the BTC held accounts for 2.744% of the total 21 million BTC.

Between April 28 and May 4, Strategy acquired 1,895 BTC for approximately $180.3 million, with each Bitcoin priced at approximately $95,167.

Top3: Twenty One

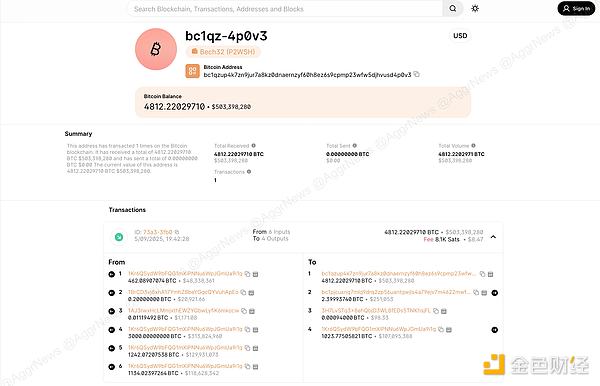

Latest move: Increase holdings of 4812 BTC, approximately US$458.7

million

On May 14, listed company Twenty One announced that it would purchase 4,812 BTC (US$458.7 million) through TETHER, with an average price of US$95,300.

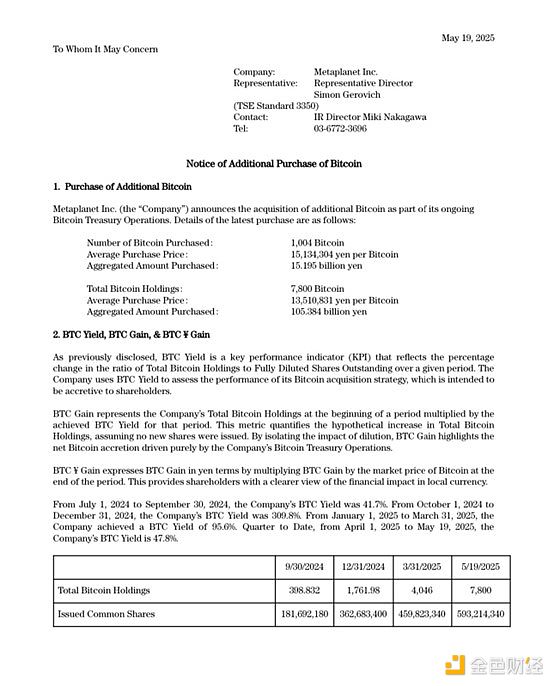

Top4: Metaplanet

Latest move: Increase holdings of 2,245 BTC, approximately US$284 million

On May 7, MetaPlanet purchased 555 new bitcoins at an average price of 13,824,064 yen (about 89,000 US dollars).

On May 12, MetaPlanet increased its holdings of 1,241 bitcoins, with an average purchase price of 14,848,061 yen (about 103,900 US dollars) per bitcoin, and a total cost of 18.426 billion yen (about 129 million US dollars).

On May 19, Metaplanet purchased 1,004 bitcoins again, with a total amount of 15.195 billion yen (about 106 million US dollars), and the average price per coin was about 15.13 million yen. Up to now, the company has held a total of 7,800 Bitcoins, with an average historical purchase price of 13.51 million yen (approximately US$94,600) per coin.

Top5: Abraxas Capital

Latest move: Increase holdings of 107,600 ETH, approximately US$231

million

From May 8 to 9, Abraxas Capital withdraws 61,401 ETH from the exchange, worth approximately US$116.3 million.

On May 20, Abraxas Capital once again increased its holdings of 46,295 Ethereum (approximately US$115.3 million).

Top6: Semler Scientific

Latest move: Increase holdings of 622 BTC, approximately US$66.2 million

On May 5, listed company Semler Scientific announced that it would increase its holdings of 167 Bitcoins for US$16.2 million.

On May 23, Semler Scientific CEO Eric Semler posted on the X platform that the company has increased its holdings of 455 BTC, spending US$50 million, and its yield so far this year has reached 25.8%. So far, the company's Bitcoin holdings have reached 4,264.

Top7: DeFi Development

Latest move: Increase holdings of 193,143 SOL, approximately US$26.57

million

On May 8, DeFi Development increased its holdings of 20,473 Solana (SOL), with a transaction amount of approximately US$2.97 million.

On May 12, DeFi Development increased its holdings of 172,670 SOL tokens, the $23.6 million purchase was the largest increase since its entry into the cryptocurrency sector last month. The Florida-based company currently holds 595,988 SOLs, worth nearly $105 million at current prices.

Top8: The Blockchain Group

Latest move: Increase holdings of 227 BTC, approximately US$25.0331

million

On May 23, The Blockchain Group, the first Bitcoin funding company in Europe, recently spent 21.2 million euros to purchase 227 Bitcoins, bringing its total holdings to 847.

Top9: SOL Strategies

Latest move: Increase holdings of 122,524 SOL, approximately US$18.25

million

SOL Strategies announced the acquisition of 122,524 SOLs for $18.25 million, with an average price of $148.96 per SOL.

Top 10: KULR

Latest move: Increase holdings of 83.3 BTC, approximately US$9 million

On May 20, Michael Mo, CEO of listed company KULR, disclosed on the X platform that the company has increased its holdings of 83.3 BTC, spent $9 million, and the average purchase price is $103,234, and the Bitcoin yield so far this year has reached 220%. As of May 20, 2025, we held 800 BTC.

Top11: Remixpoint

Latest move: Increase holdings of 32.83 BTC, approximately US$3.5012

million

On May 16, Remixpoint, a listed company on the Tokyo Stock Exchange in Japan, announced an additional purchase of 500 million yen (about 32.83 BTC, approximately US$3.5012 million) of Bitcoin, with an average purchase price of 15.23 million yen/BTC.

Top 12: Genius Group

Latest move: Increase holdings of 24.5 BTC, approximately US$2.7 million

On May 22, artificial intelligence company Genius Group announced that it has increased its Bitcoin gold inventory by 40% by purchasing 24.5 new bitcoins. Currently, the company holds a total of 85.5 bitcoins, with a total purchase amount of US$8.5 million, and an average purchase price of US$99,700 per coin.

Top13: Smarter Web

Latest move: Increase holdings of 23.09 BTC, approximately US$2.48

million

On May 23, British listed company Smarter Web increased its holdings of 23.09 bitcoins to its funding pool, with an average purchase price of US$107,424. After this increase in holdings, the company's total Bitcoin holdings reached 58.71.

Top14: DDC Enterprise

Latest move: 21 BTC increase, approximately US$2.28 million

On May 23, DDC Enterprise (also known as DayDayCook), listed in New York, bought 21 bitcoins worth $2.28 million. The company also said it plans to buy another 79 bitcoins in two "next days", bringing its total Bitcoin holdings to 100.

Previously, DDC announced that it plans to purchase 5,000 bitcoins in the next three years and 500 bitcoins by the end of 2025. If DDC bitcoin holdings reach the planned 5,000 pieces, it will be among the top ten listed companies with the largest bitcoin holdings, second only to Japanese investment company Metaplanet (which holds 7,800 pieces).

Top15: Quantum BioPharma

Latest Action: Buy cryptocurrency worth $1 million

On May 19, listed company Quantum BioPharma announced that after obtaining the board of directors, the company has purchased an additional $1 million worth of Bitcoin and other cryptocurrencies as part of its strategic move. This brings the total amount of Bitcoin and other cryptocurrencies purchased by the company to $4.5 million. The company is now ready to accept financing in cryptocurrencies and perform other types of cryptocurrencies transactions.

How do institutional investors view the current crypto market?

-

QCP Capital: The current BTC price trend is closely related to the buying behavior of the two major institutions, Strategy and Metaplanet, and they are still the main buyers at the current price. If these institutions reduce their purchasing power, it may trigger profit-taking among other market participants and may reverse the current upward trend. If BTC breaks through a new high, it may trigger a new round of chasing up and drive off-market funds to enter the market.

-

Bitfinex Alpha: Bitcoin continues to show outstanding elasticity and structural strength, with a steady rise since recovering its $92,000 low in late April. This round of rise is obviously driven by the spot market, and is characterized by impulsive rises after a short and clear consolidation stage. This pattern shows that the market is accumulating healthily, with potential demand strong, rather than over-speculation. The cumulative spot volume increase on major exchanges has remained positive, which strengthens the market's view that real buyers, rather than leveraged traders, are dominated by. Meanwhile, derivative positions have been passive, with open contract volatility highlighting the transition period characterized by short squeeze and clearing-driven resets. The result is that the market foundation is healthier, the speculative bubble is cleaned up, and real capital flows support the market momentum.

-

Matrixport: Bitcoin continues to hit historical highs, but market sentiment remains rational. We observed that the trading volume did not significantly increase and the fluctuations in capital rates were relatively stable. In the context of lack of retail investors' follow-up, it remains to be seen whether Bitcoin's rise is sustainable. We have been firmly bullish since mid-April, and Bitcoin’s performance also confirms our judgment. But if we want to continue the current momentum, we may need a wider range of funds to participate in the market. At this stage, it may be wise to put the bags properly.

-

CoinGlass: The total inflow of Bitcoin spot ETFs continues to grow, and its asset management scale has now exceeded US$104 billion, a record high. This surge shows that institutional capital is beginning to realize that Bitcoin is not only a high-performance asset, but also a politically neutral store of value similar to gold. In an era of increasingly unstable fiat debt economies, Bitcoin is becoming a reliable alternative to providing a monetary system based on predictability and decentralization. Bitcoin is still heavily undervalued as its market cap is well below the $22 trillion of gold.

-

CryptoQuant analyst Axel Adler Jr: Short-term holders who currently hold currency for 1-3 months have unrealized profit margins of 27%. In the past four years, when the indicator exceeds 40%, this group of coin holders will start selling, putting downward pressure on prices. At the current daily growth rate of about 0.818 percentage points, the indicator is expected to reach a critical value of 40% 16 days later (June 11), when Bitcoin price is expected to reach about $162,000.

chaincatcher

chaincatcher