UNODC releases fraud report in Southeast Asia: cryptocurrency becomes a criminal tool, and all parties need to strengthen international cooperation

Reprinted from panewslab

05/08/2025·16DAuthor: Lisa

Editor: Liz

background

In April 2025, the United Nations Office on Drugs and Crime (hereinafter referred to as “UNODC”) released a report titled “The Global Impact of Southeast Asian Fraud Centres, Underground Money Houses and Illegal Internet Markets” [1]. The report systematically analyzes the emerging transnational organized crime forms in Southeast Asia, focusing on a new digital crime ecosystem built with the Internet fraud center as the core, integrating the underground money laundering network and the illegal online market platform.

Shortly after the report was released, the US Treasury Department [2] announced on May 5, 2025 that it imposed sanctions on the Karen National Army (KNA) and its leaders and relatives, identifying it as a major transnational criminal organization, leading and assisting in cyber fraud, human trafficking and cross-border money laundering. The Myanmar-Thailand border area controlled by KNA has become a gathering place for multiple fraud groups. Its collusion with the Myanmar military has enabled it to rent land on a large scale in the armed controlled area, provide power guarantee and security services, and support the daily operation of the fraud park. On May 1, 2025, the U.S. Financial Crime Law Enforcement Network [3] also listed Huione Group as the main target of money laundering, pointing out that it is a key channel for North Korean hacker organizations and Southeast Asian fraud groups to clean up the proceeds of virtual assets, involving various virtual asset investment frauds such as "pig killing".

The report pointed out that as Southeast Asia's synthetic drug market becomes saturated, criminal groups are rapidly transforming, using fraud, money laundering, data transactions, and human trafficking as profit-making methods, and building a cross-border, high-frequency, and low-cost black production system through online gambling, virtual asset service providers, Telegram underground markets and crypto payment networks. This trend initially broke out in the Mekong subregion (Myanmar, Laos, Cambodia), and quickly spread to weak regulatory areas such as South Asia, Africa, and Latin America, forming a clear "gray export".

UNODC warned that this type of crime model has the characteristics of highly systematic, specialized and globalized, and has relied on emerging technologies to evolve, which has become an important blind spot in international security governance. Faced with the continued spread of threats, the report calls on governments to immediately strengthen supervision of virtual assets and illegal financial channels, promote the construction of on-chain intelligence sharing and cross-border collaboration mechanisms between law enforcement agencies, and establish a more efficient anti-money laundering and anti-fraud governance system to curb this rapidly developing global security risk.

This article will analyze from the following four dimensions: Southeast Asia's crime ecosystem, global expansion outside Southeast Asia, emerging illegal network markets and money laundering services, and transnational criminal networks and global law enforcement collaboration.

Southeast Asia is gradually becoming the core of the crime ecosystem

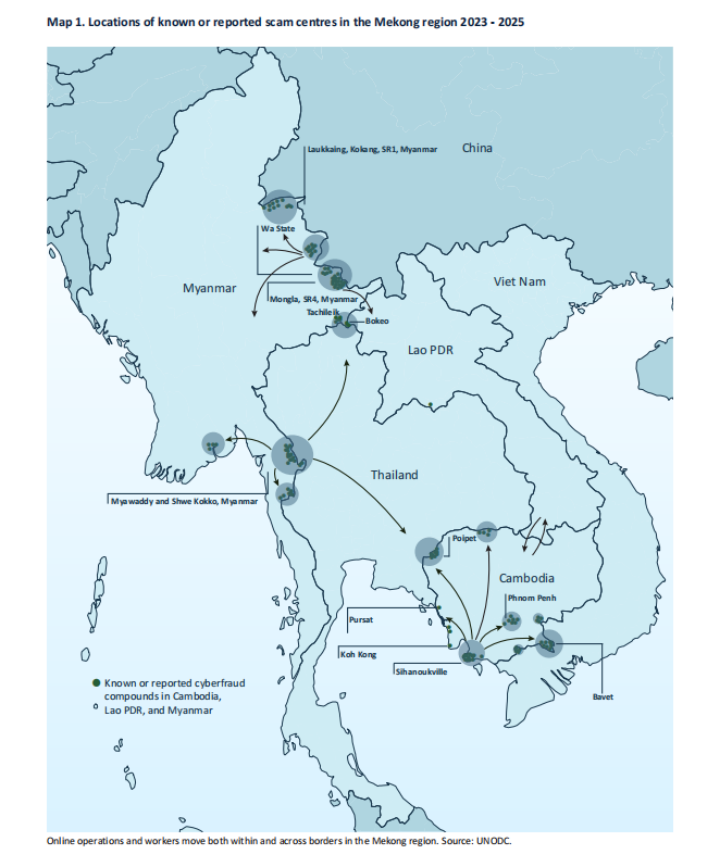

With the rapid expansion of Southeast Asia's cybercrime industry, the region is gradually evolving into a key hub of the global crime ecosystem. Crime groups have used the region's weak governance, convenience of cross-border collaboration and technical loopholes to establish a highly organized and industrialized crime network. From Mywady in Myanmar to Sihanoukville in Cambodia, fraud centers are not only huge in scale, but are constantly evolving, using the latest technologies to evade attacks and obtain cheap labor through human trafficking.

High liquidity and adaptability coexist

Southeast Asian cybercrime groups are highly liquid and adaptable, and can quickly adjust their activity locations according to law enforcement pressures, political situations or geopolitical conditions. For example, after Cambodia banned online gambling, a large number of fraud gangs moved to special economic zones such as Shan State in Myanmar and the Golden Triangle in Laos. Later, due to war in Myanmar and joint regional law enforcement, they moved to the Philippines, Indonesia and other places again, forming a circular trend of "strike-transfer-reflow". These gangs use casinos, border special economic zones, resorts and other physical places to disguise themselves, and at the same time "sink" to more remote and weak rural areas and border areas with weak law enforcement to avoid concentrated crackdowns. In addition, the organizational structure is becoming increasingly "cellular", and fraud points are scattered to residential buildings, homestays and even outsourcing companies, showing strong survival resilience and re-layout capabilities.

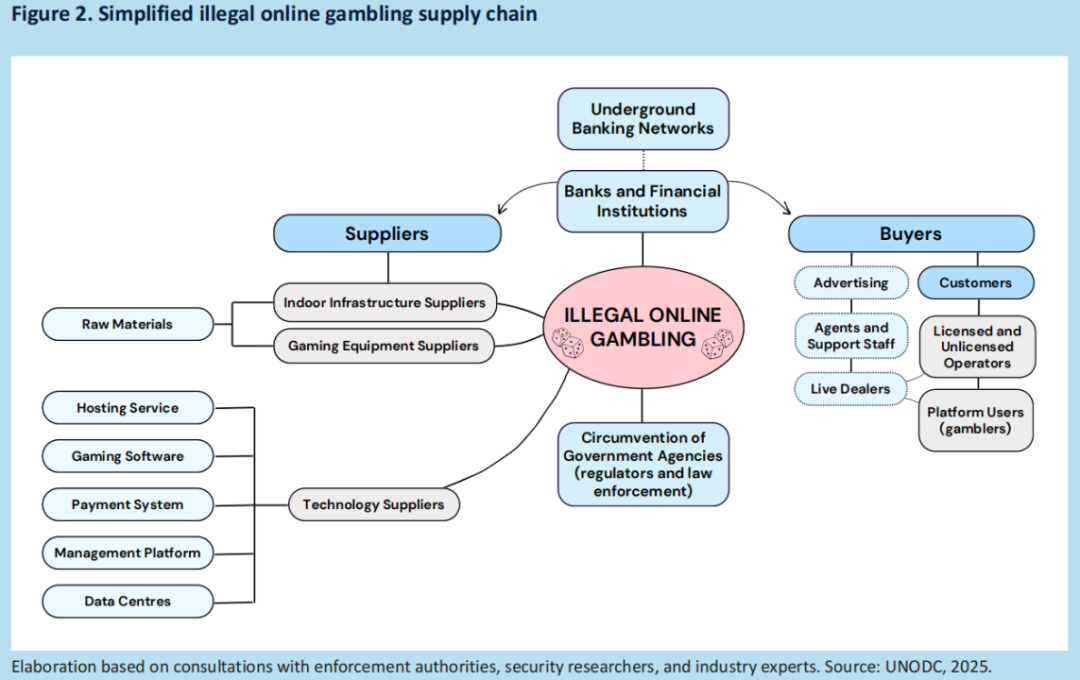

Systematic evolution of the fraud industry chain

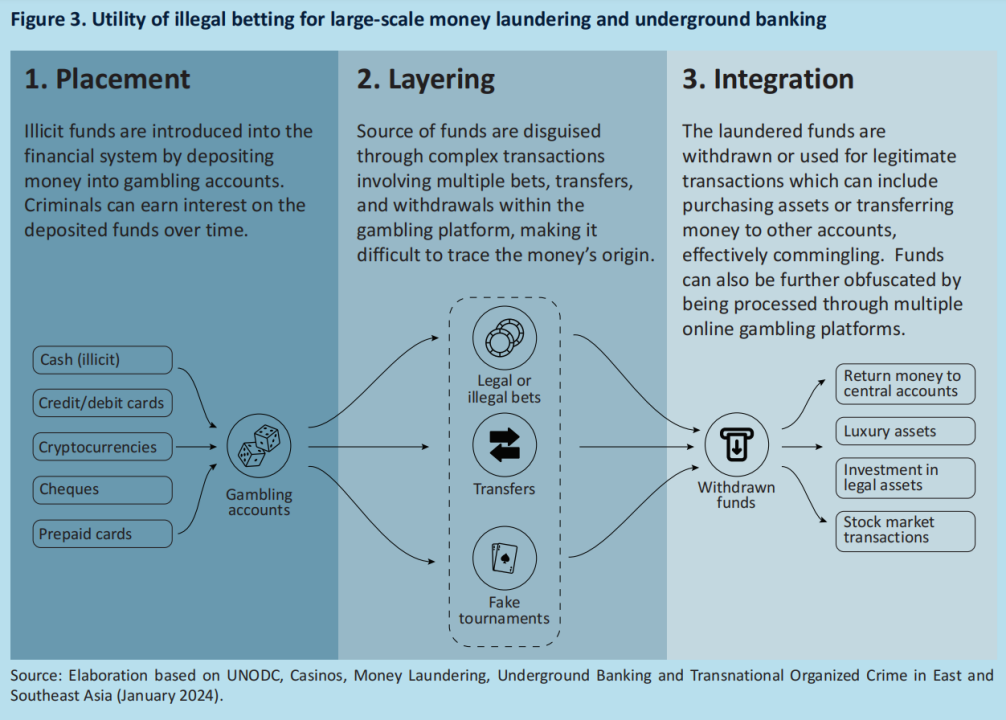

Fraud groups are no longer loose gangs, but have established a "vertical integrated criminal industry chain" from data collection, fraud execution to money laundering and withdrawal. The upstream relies on platforms such as Telegram to obtain global victim data; the midstream commits fraud through "pig killing", "false law enforcement", and "investment induction"; the downstream relies on underground banks, OTC over-the-counter transactions and stablecoin payments (such as USDT) to complete fund cleaning and cross-border transfers. According to UNODC, cryptocurrency scams caused more than $5.6 billion in economic losses in the United States alone in 2023, with an estimated $4.4 billion attributed to the most prevalent so-called "pig killing" scams in Southeast Asia. The scale of fraudulent income has reached the "industrial level", forming a stable profit closed loop, attracting more and more transnational criminal forces to participate.

Human Trafficking and Labor Black Market

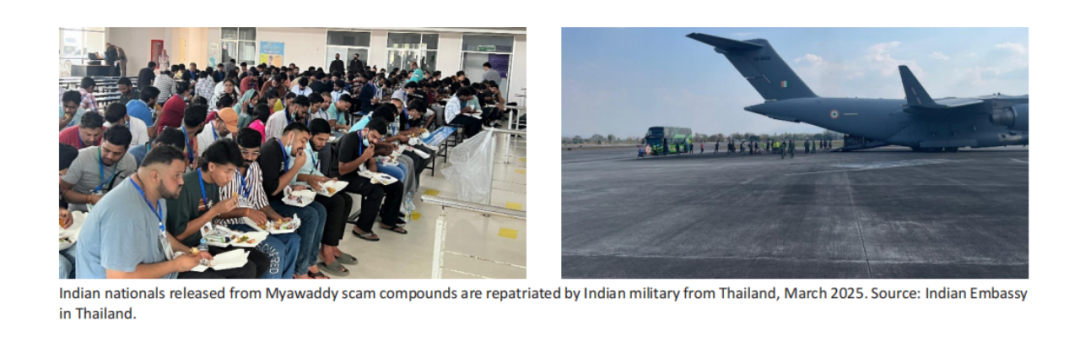

The expansion of the fraud industry is accompanied by systematic human trafficking and forced labor. The source of personnel in the fraud park is spread across more than 50 countries around the world, especially young people from China, Vietnam, India, Africa and other places. They are often deceived into entering the country due to false recruitment of "high-paid customer service" or "technical positions", and their passports are seized, violently controlled, and even resold many times. In early 2025, more than a thousand foreign victims were repatriated in Karen, Myanmar alone in one go. This "fraud economy + modern slavery" model is no longer an individual phenomenon, but a human support method that runs through the entire industrial chain, bringing serious humanitarian crises and diplomatic challenges.

Digitalization and crime technology ecology continues to evolve

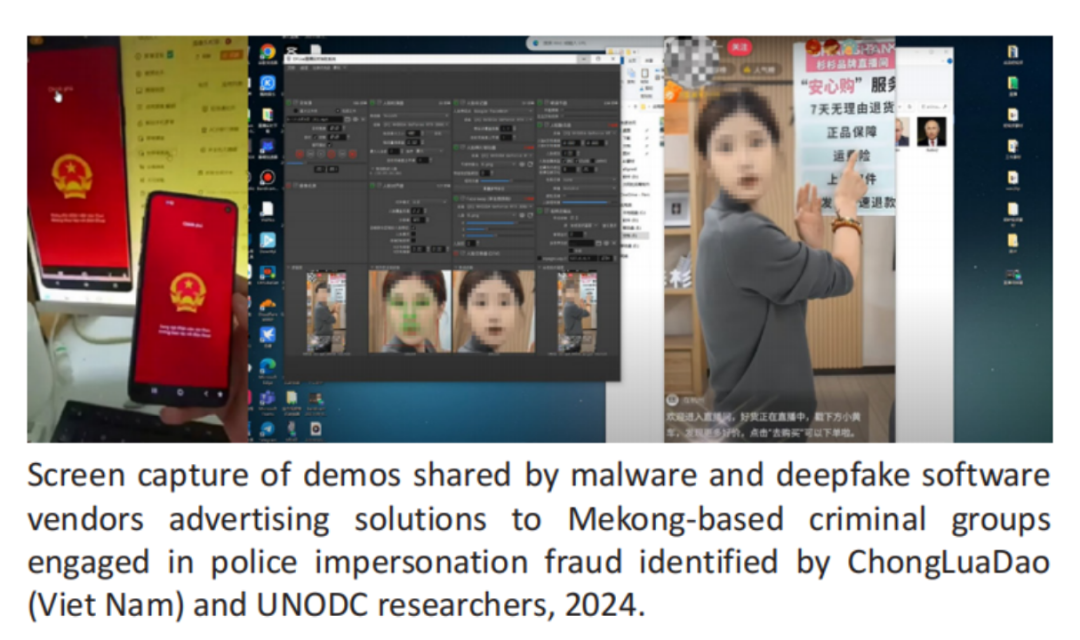

The fraud group has strong technical adaptability, constantly upgrades anti-investigation methods, and builds a criminal ecology of "technical independence + information black box". On the one hand, they generally deploy infrastructure such as Starlink satellite communications, private power grids, and intranet systems to break away from local communication control and achieve "offline survival"; on the other hand, they use encrypted communications (such as Telegram end-to-end encryption groups), AI-generated content (Deepfake, virtual anchor), automated phishing scripts, etc. to improve the efficiency and degree of fraud. Some organizations have also launched the "Scam-as-a-Service" platform to provide technical templates and data support for other gangs to promote the productization and service of criminal activities. This ever-evolving technology-driven model is significantly weakening the effectiveness of traditional law enforcement methods.

Global expansion outside Southeast Asia

Southeast Asian criminal groups are no longer limited to local areas, but are expanding globally, establishing new operating bases in other regions of Asia, Africa, South America, the Middle East and even Europe. This expansion not only increases the difficulty of law enforcement, but also makes criminal activities such as fraud and money laundering more international. Criminal groups take advantage of local regulatory loopholes, corruption issues and weak links in the financial system to quickly penetrate new markets.

Asia

-

Taiwan, China: Become a fraud technology research and development center, and some criminal groups have set up "white label" gambling software companies in Taiwan to provide technical support for Southeast Asian fraud centers.

-

Hong Kong, China and Macau, China: underground money house hub, assisting cross-border capital flows, and some casino intermediaries participate in money laundering (such as the Suncity Group case).

-

Japan: The losses of online fraud increased by 50% in 2024, and some cases involved Southeast Asian fraud centers.

-

South Korea: Cryptocurrency fraud surges, criminal groups launder money using Korean won stablecoins such as KRW-pegged USDT.

-

India: Citizens were trafficked to fraud centers in Myanmar and Cambodia, and the Indian government rescued more than 550 people in 2025.

-

Pakistan and Bangladesh: Become a source of fraudulent labor, some victims were lured to Dubai and resold to Southeast Asia.

Africa

-

Nigeria: Nigeria has become an important destination for Asian fraud networks to diversify into Africa. In 2024, Nigeria cracked a large fraud group and arrested 148 Chinese citizens and 40 Filipinos, involving cryptocurrency fraud.

-

Zambia: In April 2024, Zambia cracked a fraud group and arrested 77 suspects, including 22 Chinese fraud leaders, and was sentenced to up to 11 years in prison.

-

Angola: In late 2024, Angola carried out a large-scale raid, with dozens of Chinese citizens detained for suspected involvement in online gambling, fraud and cybercrime.

South America

-

Brazil: The Online Gambling Legalization Act was passed in 2025, but criminal groups still use unregulated platforms to launder money.

-

Peru: Destroy Taiwan's criminal gang "Red Dragon Group" and rescue more than 40 Malaysian workers.

-

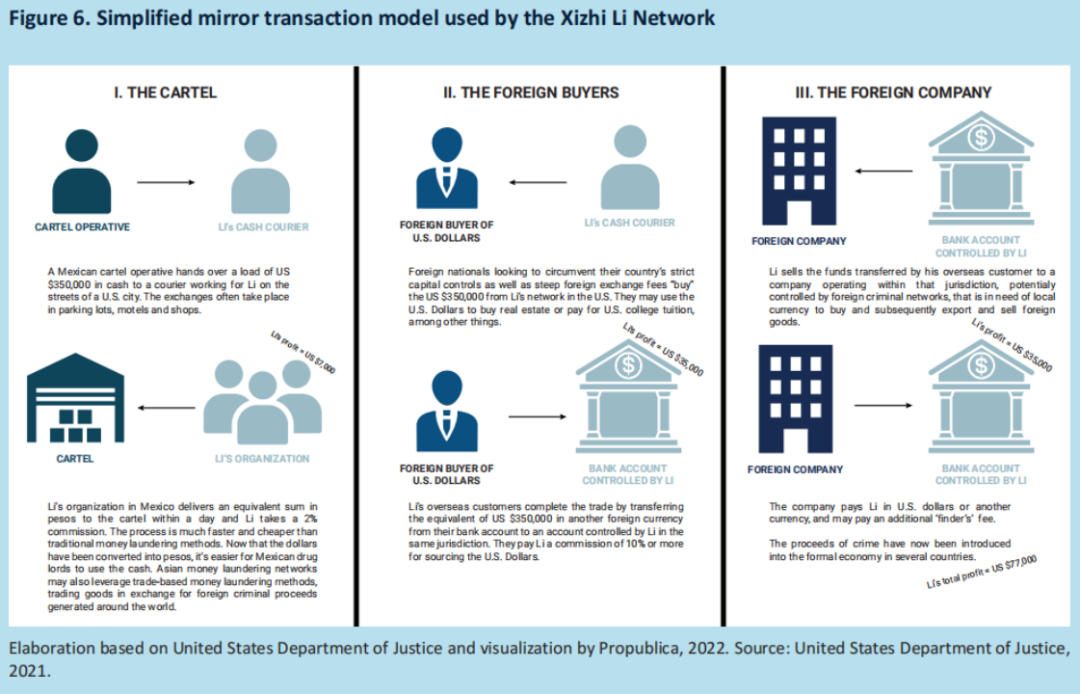

Mexico: Drug cartels launder money through Asian underground banks, charging 0% - 6% low commissions to attract customers.

middle East

-

Dubai: Become a global money laundering center. The main culprit of Singapore's $3 billion money laundering case purchased luxury homes in Dubai and used shell companies to transfer funds. The fraud group set up a "recruitment center" in Dubai to lure workers to Southeast Asia.

-

Türkiye: Some Chinese fraud leaders obtain Turkish passports through investment and naturalization programs to evade international wanted.

Europe

-

UK: London real estate has become a money laundering tool, with part of the money coming from Southeast Asia fraudulent income.

-

Georgia: "Little Southeast Asia" fraud centers appeared in Batumi City, and criminal groups used casinos and football clubs to launder money.

Emerging Illegal Online Markets and Money Laundering Services

As traditional criminal means are hit, Southeast Asian criminal groups have turned to more concealed and more efficient illegal online markets and money laundering services. These emerging platforms generally integrate cryptocurrency services, anonymous payment tools and underground banking systems, not only provide fraudulent toolkits, stolen data, and deep AI forgery software for criminal entities such as fraud groups, traffickers, and drug dealers, but also achieve rapid flow of funds through cryptocurrencies, underground banks and Telegram black markets, putting global law enforcement agencies facing unprecedented challenges.

Telegram Black Market

The scope of services provided by criminals in numerous illegal online markets and forums based on Telegram in Southeast Asia is increasingly global. In contrast, the dark web not only requires a certain professional background, lacks real-time interaction, but also has a high technical barrier; while Telegram makes Southeast Asian criminals more likely to commit fraud and scale their activities due to its easy access, mobile-first design, powerful encryption capabilities, instant communication capabilities, and automated operations through robots.

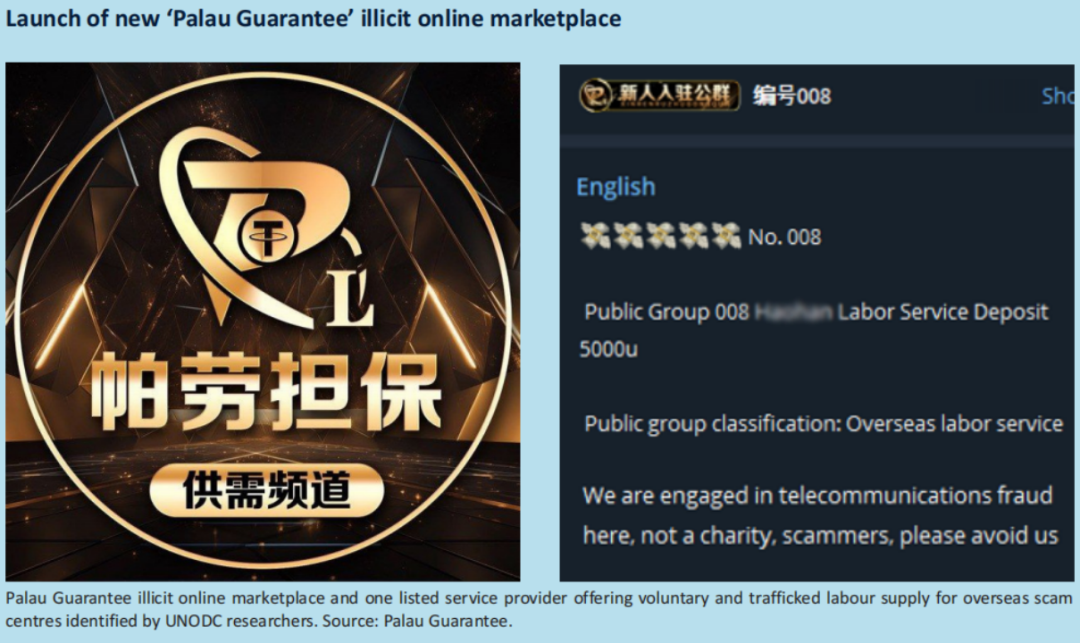

In recent years, some of the region’s most powerful and influential crime networks have controlled multiple Telegram-based platforms that have become the main venue for local criminals and service providers to gather, contact and conduct business. These illegal markets are often associated with cryptocurrency exchanges controlled by the same organization, with a large number of merchants gathering on the platform that specializes in selling stolen data, hacking tools, malware, as well as various underground banks, money laundering and cybercrime services, while other criminals — especially those engaged in cyber fraud — use these services to make profits.

Fully Light Guarantee

Fully Light Guarantee, the prototype platform for the early illegal market in Southeast Asia, was founded and operated by the Liu family controlled by the Kokang Border Force in Shan State, Myanmar. It attracted more than 350,000 users at its peak. The platform not only serves fraud centers in Kokang and Miaowadi regions, but also serves as a trading market for human trafficking, intermediary recruitment, informal cross-border money laundering and "black industry" technical support. Its operations rely on hundreds of public and private groups, covering the entire chain from basic tool supply to fund cleaning.

Although the Kokang Border Guard was overthrown in 2024, a large number of emerging markets supported by other criminal groups and adopted a similar "guarantee system" have emerged in the region before and after its arrest. These new platforms have quickly absorbed the business resources after being hit and are still expanding and evolving, posing a threat to the integrity of the financial system, regional stability and international security.

Huione Guarantee

Huione Guarantee has become one of the world's largest illegal online trading markets with user and transaction volume over the past year, and is a key infrastructure for the expansion of the Southeast Asian online fraud ecosystem. The platform is headquartered in Phnom Penh, Cambodia, and is mainly in Chinese. As of the time of writing, the number of users has exceeded 970,000 and thousands of Internet suppliers. The company is associated with subsidiaries registered in countries such as Canada, Poland, Hong Kong and Singapore, and has currently valid registered trademarks in the United States and other countries.

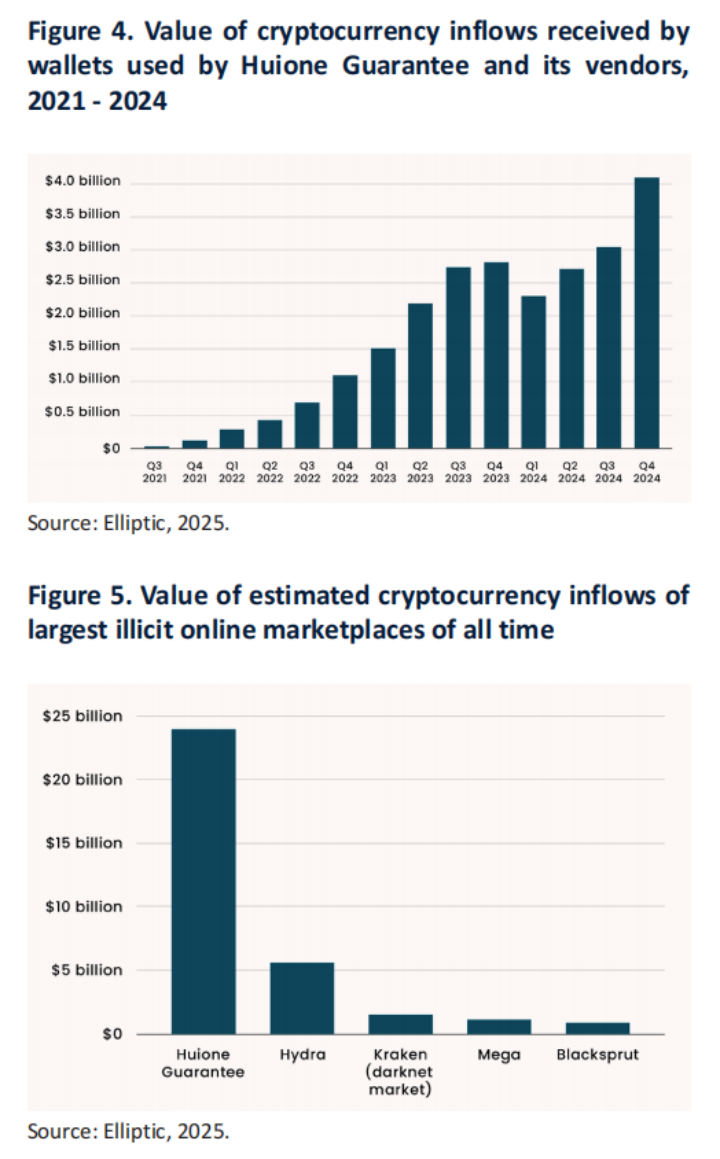

Huione Guarantee has processed tens of billions of dollars in cryptocurrency transactions since 2021, and on-chain analysis shows that the platform has become a one-stop service center for criminals to obtain the technology, infrastructure, data and other resources needed for cyber fraud, cybercrime, mass money laundering and evading sanctions. Some experts estimate that Huione Guarantee and its suppliers have received inflows of at least $24 billion in the past four years. Law enforcement and blockchain researchers report that there is a clear link between the market and criminal groups that are operating against victims around the world.

Huione has also launched a series of its own cryptocurrency-related products, including cryptocurrency exchanges, crypto-integrated online gambling platforms, Xone Chain blockchain network, and its self-issued dollar-backed stablecoins. The stablecoin claims to be "not subject to restrictions by traditional regulators" and aims to "avoid the common freezing and transfer restrictions in traditional digital currencies." In February 2025, the group announced the launch of the Huione Visa card and revealed it was investing heavily in other large illegal online markets, social media and messaging platforms, as well as professional money laundering services, including the acquisition of a 30% stake in Tudao Guarantee in December 2024. This series of actions highlights that Huione may be preparing for the future restriction of use by mainstream platforms.

Huione and Fully Light not only share some platform design and operation personnel, but also reflect an illegal business model that is being replicated

- that is, with platform-based guarantees as the core, traditional black market transactions are "financial technology" and "cross-border corporatization", forming an underground network economic system based on Southeast Asia and radiating the world. As countries strengthen supervision and law enforcement, such platforms are showing a trend of overseas transfer, diversification of financial products and intelligent technology tools, seriously interfering with the transparency of on-chain transactions and eroding the trust basis of the global crypto asset ecosystem.

Transnational Criminal Networks and Global Law Enforcement Collaboration

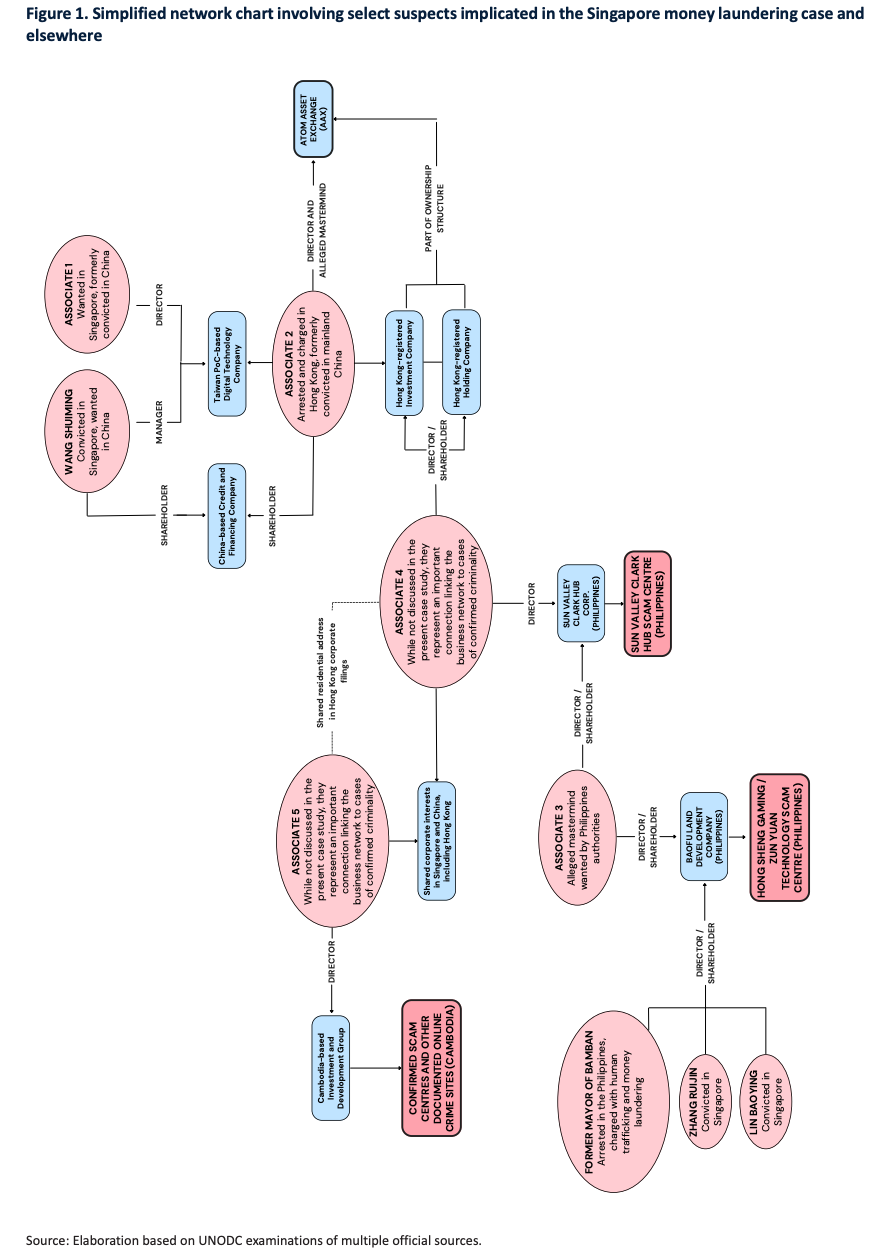

In Southeast Asia, some transnational criminal groups use complex business structures to cover up illegal activities, especially in the areas of money laundering and online fraud. For example, the billion-dollar money laundering case in Singapore in 2023 reveals a huge, cross-border, organized crime network that operates on multiple nationalities and crypto assets. Although most of the suspects in this case were born in China, they obtained passports from multiple countries through investment and naturalization programs in Cambodia, Cyprus, Turkey and other countries, and widely established companies, bank accounts and high-value real estate in Southeast Asia and overseas to cover up illegal gains such as telecommunications fraud and illegal online gambling. Through a flexible combination of on-chain transactions, stablecoin payments and offshore accounts, the criminal network is able to "horizon-jump" funds between different regulatory systems, greatly increasing the difficulty of transnational financial supervision and criminal investigation.

The case further reveals that the gang is directly related to multiple Southeast Asian fraud centers and bankrupt Hong Kong cryptocurrency exchanges (such as AAX). Its capital flow trajectory extends to the Philippines' Clark Freeport Area fraud park, Cambodia's Bayu Casino, and shell companies established in Taiwan, and even involve related assets in Canada. Some suspects are also involved in human trafficking and forced labor, and their illegal profits are laid out through false income certificates, forged documents and multiple underground stablecoin channels. With the advancement of law enforcement in the Philippines and Hong Kong, China, several senior executives involved were arrested and assets frozen in 2024, marking the beginning of results in international cooperation in the case. However, there are still core fugitives who use private jets and multiple passports to abscond, highlighting the deep technical and institutional challenges of cross-border law enforcement.

This case is a microcosm of the current reconstruction of the illegal online economy in Southeast Asia. The two major platforms, Huione Guarantee and Fully Light Guarantee mentioned earlier, are the key fulcrum for building this type of cross-border financial crime "infrastructure". While providing guarantee services, they actually act as "industry intermediaries" for criminal activities such as fraud, gambling, money laundering and human trafficking, providing integrated services from tools, accounts, transaction matching to fund cleaning to multinational organizations such as BG 2 (Mekong Crime Group). BG 2 also "whitewashed" illegal income by setting up legal enterprise guise and investing in real estate and sports clubs, successfully expanding its criminal network to Georgia and other places, and began to replicate the operating model of the Southeast Asian fraud industry chain.

On the one hand, these organizations use multi-national identities, complex shell company structures and on-chain payment methods to shuttle between different jurisdictions, forming a de facto "law enforcement black hole"; on the other hand, due to factors such as lengthy judicial assistance procedures, strong anonymity of crypto assets, and global distribution of victims, it is difficult for countries to implement law enforcement in order to form an efficient joint strike mechanism. Although countries such as Singapore and the Philippines have begun to strengthen anti-money laundering mechanisms, freeze on-chain assets, and initiate international wanted services, it is still far from enough to rely on single-point actions in the face of the black network economy centered on Southeast Asia and increasingly financial technology.

In order to curb such transnational organized crypto crimes, it is necessary to start from the following aspects to promote the construction of international cooperation and on-chain governance systems:

- Promote global unification of anti-money laundering (KYC) standards for cryptoassets;

- Relying on blockchain intelligence and judicial assistance agreements, strengthen cross-border asset freezing and crime traceability cooperation;

- Establish multilateral mechanisms to sanction "high-risk platforms" and "crime guarantee market" that provides illegal services;

- Strengthen tactical cooperation between law enforcement departments and on-chain monitoring companies and exchanges, and compress the space for illegal capital flow.

Conclusions and suggestions

- Improve awareness and awareness: Participation of high-level governments is essential to enhance awareness of fraud centers and related crimes. It is necessary to strengthen the understanding of risks such as online fraud, underground money houses, and strengthen anti-corruption measures.

- Strengthening regulatory frameworks: Existing legal frameworks need to be regularly reviewed and reformed, especially for money laundering, virtual assets, special economic zones and online gambling. Improve the supervision mechanism to monitor the flow of capital in high-risk industries and strengthen legal provisions for asset recovery and victim protection.

- Improve the technical and operational capabilities of law enforcement agencies: Develop monitoring and investigation technologies, collect and analyze digital evidence, strengthen cross-border cooperation and enhance judicial impartiality. Improve law enforcement effectiveness through professional training and inter-agency cooperation.

- Promote overall government response and inter-agency coordination: Establish national coordination mechanisms, promote cooperation between ministries and law enforcement agencies, and strengthen identification and protection of victims of forced crimes. Improve border management supervision and ensure cross-border crackdown on criminal activities.

- Promote pragmatic and effective regional cooperation: Strengthen cross-border cooperation, share information in a timely manner and coordinate actions. Support joint investigations through regional platforms, carry out risk-based response measures and strengthen multilateral cooperation.

These recommendations will help Southeast Asian countries respond to the key governance shortcomings identified in their reports, enhance awareness and response capabilities of governments, regulators and law enforcement agencies, thereby promoting regional security cooperation and combating transnational organized crime.

Summarize

Through the analysis of UNODC report, it can be seen that Southeast Asia has become the center of global cybercrime and illegal financial activities, and this trend is expanding globally. Faced with this threat of cross-border crime, governments, regulatory agencies and law enforcement agencies urgently need to strengthen cooperation to build a more efficient international anti-money laundering and anti-fraud governance system. Especially in the context of the increasing abuse of virtual assets and cryptocurrencies for money laundering and fraud, global information sharing and technological collaboration will become the key path to curb related crimes. Only through all-round and multi-level international collaboration can we effectively respond to the increasingly complex global cybercrime problems and protect the security and social stability of the global financial system.

Related links

[1]https://www.unodc.org/roseap/uploads/documents/Publications/2025/Inflection_Point_2025.pdf

jinse

jinse