Trader: BTC will follow gold trends to hit highs in the next 2-3 weeks

Reprinted from jinse

02/12/2025·2MAuthor: William Suberg, CoinTelegraph; Compilation: Baishui, Golden Finance

When Wall Street opened on February 11, gold prices entered the consolidation stage after hitting an all-time high, and BTC gave up its latest gains.

BTC/USD 1 hour chart. Source: Cointelegraph/TradingView

Binance chaos ruins Bitcoin price rise

Data from Cointelegraph Markets Pro and TradingView show BTC/USD fell $1,500 in an hour.

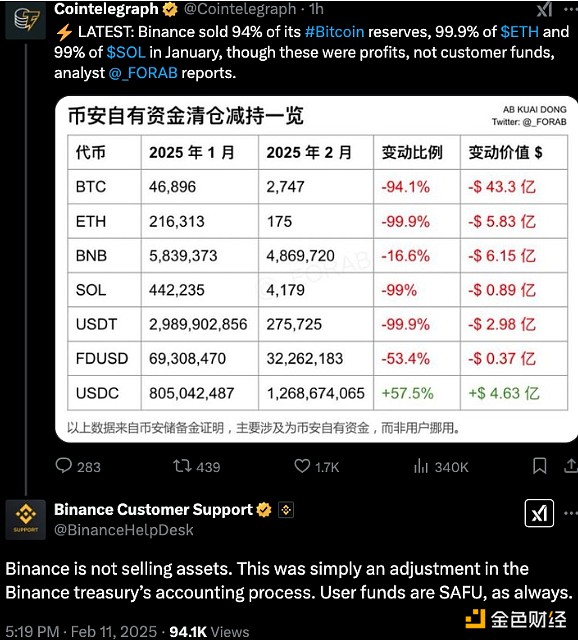

Binance, the world's major cryptocurrency exchange, has reportedly sold almost all Bitcoin, Ethereum, SOL, etc., which seems to exacerbate downward volatility.

While this is nothing new, Binance's cryptocurrency reserves are rumored to be a result of profits in its cryptocurrency holdings, the news became a hot topic on social media that day, but Binance later denied This statement.

As a result, as Wall Street began trading, Bitcoin price trends were in trouble, and the crazy upward momentum of gold prices gradually cooled down.

After the opening, gold hit a new high of $2,942 per ounce.

XAU/USD 1 hour chart. Source: Cointelegraph/TradingView

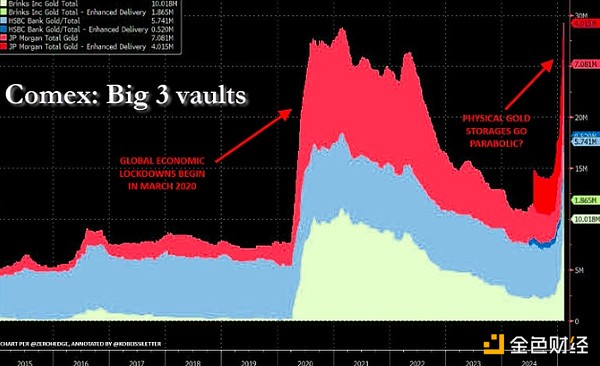

“The volume of physical gold purchases has reached its peak: the gold warehouses of COMEX’s three major vaults soared by 15 million ounces in 2 months,” said Kobeissi Letter, a trading resource, responding on X.

“This is an increase of 115%, bringing physical gold holdings above the level during the 2020 pandemic.”

COMEX Gold Storage Data. Source: The Kobeissi Letter/X

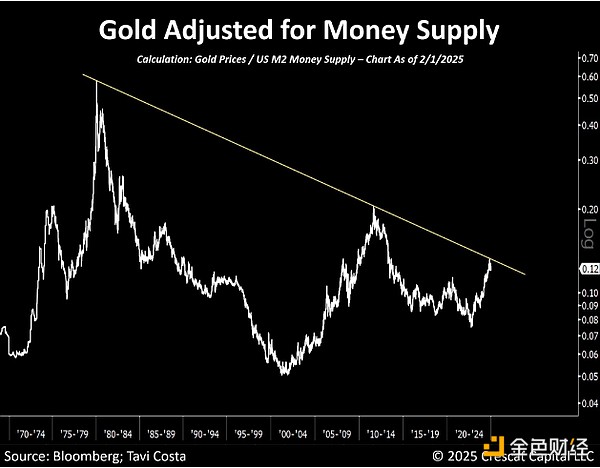

Kobeissi attributes this phenomenon to the injection of liquidity in the United States, as well as the uncertainty of inflation trends.

“This is especially true with the out-of-control U.S. deficit spending. The U.S. borrowed $838 billion in the first four months of fiscal 2025,” it continued.

“Bond prices have been hit hard as Treasury yields rise. Gold’s position as a global hedge will only increase as a result.”

Gold is adjusted for US M2 money supply. Source: The Kobeissi Letter/X

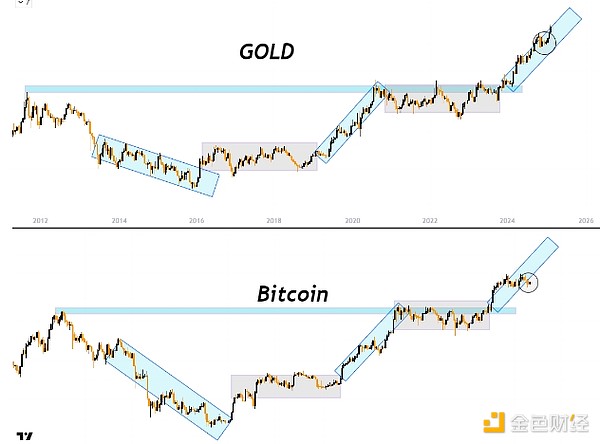

Bitcoin’s move to emulate gold enters the countdown

Others are optimistic that Bitcoin will follow in the footsteps of gold despite the traditional three-month delay.

These include cryptocurrency trader, analyst and entrepreneur Michaël van de Poppe.

“Bitcoin is likely to hit an all-time high,” he told X fans that day.

“Gold has been hitting record highs and I think we will see the same thing happening in Bitcoin in the next 2-3 weeks.”

The accompanying chart describes the “ideal entry area” for BTC/USD for approximately $90,000.

BTC/USDT 1-day chart. Source: Michael van de Poppe/X

Charles Edwards, founder of Capriole Investments, a quantitative Bitcoin and digital asset fund, likens the situation to the summer of 2024.

“Bitcoin will almost always see a similar (larger) breakthrough in 3-6 months as long as gold keeps trending. Hopefully this time it’s on the short end of that range,” X’s post section on the topic reads.

" Tariffs = uncertainty + possible inflation. Central banks + Asia is vigorously bidding for gold as an inflation hedge. Rotation to the hardest assets on the planet is inevitable."

panewslab

panewslab