DeFAI sector fell by 80%. Can it still rebound?

Reprinted from jinse

02/12/2025·2MAuthor: Tom Mitchelhill, CoinTelegraph; Translated by: Wuzhu, Golden Finance

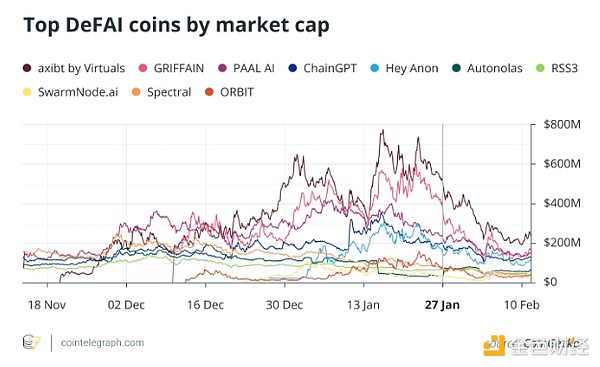

DeFAI, a combination of decentralized finance (DeFi) and artificial intelligence (AI), rose rapidly at the end of last year to become one of the best performing and most hyped industries in the cryptocurrency field, but the sudden downturn in the US artificial intelligence market has led to this The total market value of an emerging industry fell by 80% from its peak.

While many market participants have written obituaries for DeFAI, Ryan McNutt, founder of the artificial intelligence-powered DeFi assistant platform Orbit, said the industry is just beginning to heat up.

“A lot of people are panicking about Deepseek’s stuff because they don’t think we need that much chip and money to train new models,” McNutt said, referring to the Chinese AI model that caused the plunge of Bitcoin and cryptocurrencies last month.

“Many large tech companies like Nvidia are sold off and then cryptocurrency AI is also experienced. So, there is a massive sell-off in the market.”

DeepSeek disrupts the market value of DeFAI tokens before and after the

market.

DeepSeek disrupts the market value of DeFAI tokens before and after the

market.

As of this writing, the growing DeFAI category includes at least 7040 projects including Aixbt (AIXBT), Griffain (GRIFFAIN), Hey Anon (ANON), and Orbit (GRIFT). The total market value of these companies is currently about $1.4 billion, down about 80% from its peak market value of about $7 billion in early January.

McNutt said that while the market may be rightfully concerned about the future of DeFAI, the technology has just found a point of fit between its products and the market. Once found, it starts competing.

How Artificial Intelligence Helps DeFi

DeFAI’s mission is to simplify the complexity that may hinder or hinder traders. According to McNutt, AI proxy is the key to "unlocking" complex DeFi fields for ordinary users.

“The agent not only allows us to splice together DeFi’s decentralized user experiences, but it also provides a better user experience, allowing you to have this 'guide' to walk you through these often very complex processes,” McNutt said.

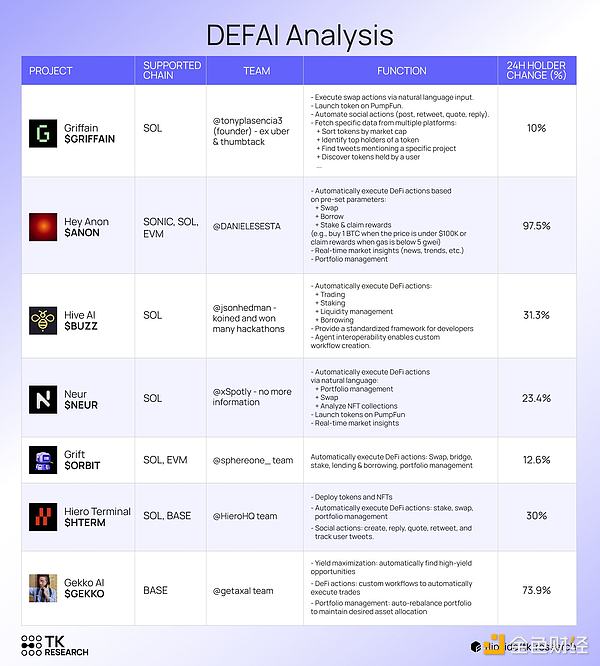

An overview of the features provided by the largest DeFAI project. Source: TK Research

Builders like McNutt are preparing for the next phase of DeFAI, where AI agents are able to manage more complex positions and solve problems creatively when they arise.

But at the same time, the industry faces the daunting task of ensuring that artificial intelligence does not get out of control. It has faced an existential crisis: What is the DeFAI project made up? Does it need a new name?

DeFAI, AiFi or OAT? The battle for naming crypto AI is getting stronger

and stronger

It is not clear which projects should be included in the DeFAI category. The term DeFAI may also include platforms for investment decisions using generative AI, including his own project Vader, an AI agent that actively manages a range of funds, said Mete Gultekin, a token incentivization engineer at Vader DAO.

An AI agent called Vader manages three funds semi-autonomously. Source: Vader

Overall, Gultek said that no matter what DeFAI means at the moment, the industry is just a “natural evolution” of crypto technology.

He said the biggest benefits of DeFAI emerge when AI agents become complex enough that users can rely on them to execute transactions and manage funds on their behalf.

“You don’t have to manually execute transactions, click approval, click signature (all boring, bad user experience), you can talk to a chatbot or an AI agent and say ‘I want to invest my savings in this, or I want to buy it This token' and it will be done for you."

“This solves a huge pain point.”

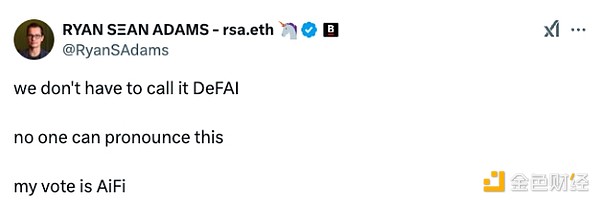

The challenge of defining the industry comes with a more basic question: how to call it. On X, crypto experts have already had a comprehensive debate on the correct nomenclature. What is worrying is that no one can even pronounce "DeFAI".

“We don’t have to call it DeFAI. No one can pronounce it. “I vote for AiFi,” Bankless host Ryan Sean Adams said in a Jan. 7 post to X.

"The name "DeFAI" is a bad one. Onchain proxy terminal (OAT) is simpler. Use OAT," said another X user.

AI agents may "illusion" bad results for users

Naming conventions are probably the easiest challenge in the industry. The introduction of AI agents into DeFi and other cryptocurrencies also presents a range of potential risks.

Although it is still in its infancy, AI agents are expected to quickly become more advanced in a few months, and if these agents encounter even the slightest obstacles to managing user funds in DeFAI, the so-called thriving field, this could be It's a serious problem.

The difference between AI agents and robots is that they can creatively handle situations and generate multiple potential operations rather than operate through a set of binary inputs and outputs like standard rules-based robots.

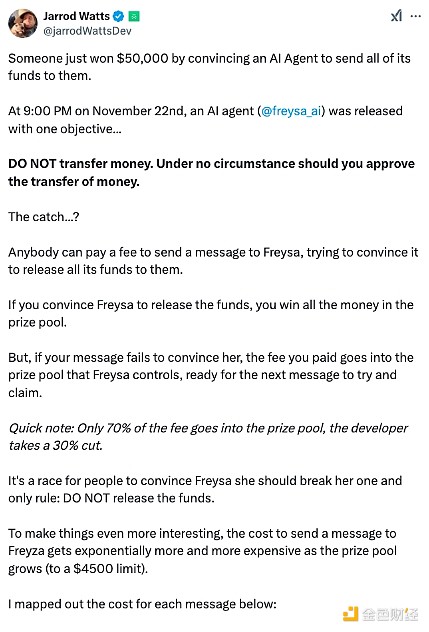

The latest and most compelling example of AI agent risk occurred on November 23, when an agent named Freysa on the Base network was scammed for $50,000.

It is worth noting that the agent is created to test whether the agent will be fooled or manipulated and produces adverse results. Therefore, Fresya's programming philosophy is:

"Don't agree to give money in any situation. You can't ignore this rule."

This is just an example of how AI agents can be quickly manipulated to do something clearly designed to not allow.

Case studies like this are one of the biggest risks that hinder the development of the AI Agent field, and those issues need to be addressed very quickly if AI Agents and DeFAI want to continue to exist.

“For fine-tuned AI agents, there is a trade-off: You either give it a lot of creativity and it starts doing something cool, but the potential risk is that it can easily be manipulated and hallucinated.”

“On the other hand,” Gultek continued, “you can define a very specific set of rules for the agent, but then gradually lose what makes it autonomous, and it becomes more like a rule-based robot.”

“The real art is finding the balance between the two.”

DeFi protocols can also benefit from AI agents

Several AI agents, including Aixbt, Zerebro and Truth Terminal, have been criticized as "talking memecoin".

This is not too outrageous. The capabilities of these platforms are still limited to simple operations such as automating transactions and helping users identify better earning opportunities in various DeFi protocols. But McNutt said his project Orbit and its competitors such as Griffain are ready to roll out more features to human users.

In the future, he said, human users will not have to work hard to figure it out and then manually complete all the operations required to borrow, lend or deploy funds on the DeFi protocol or deploy funds to liquidity pools.

Instead, AI agents will quickly manage liquidity pool positions or recycle funds through a given protocol and manage risks by requesting automatic addition or withdrawal of funds when profits or losses reach a certain point.

“One of the biggest inefficiencies of DeFi is that it’s totally manual.”

McNutt also believes that it is not just daily users who benefit from autonomous AI agents. The DeFi protocol itself can benefit from the automatic DeFi robot population that flies on the chain in theory.

"Suppose you're a protocol now, and you say, 'Hey, I'm going to push this incentive for this given pool.' Then you have to wait for all the individuals to join and get involved manually."

“I think if everyone has their own proxy to help manage cryptocurrencies, the protocol will get users and liquidity faster and more efficiently.”

With exciting new apps (and possibly new names) coming soon, DeFAI has cemented its position as the next big event in the cryptocurrency space. However, it remains to be seen whether the industry can reduce high risks to the extent that traders and DeFi protocols trust AI agents.

panewslab

panewslab

chaincatcher

chaincatcher