The True Value of Data Availability: Celestia’s Revenue Potential

Reprinted from panewslab

03/11/2025·2MAuthor: DE Analytics

Compiled by: Felix, PANews

This article aims to explore the income potential of Celestia and point out common misconceptions and narratives. These views and narratives are flawed, or at least lack substantive content. Finally, assumptions will be made to illustrate Celestia’s true income potential.

"Is DA a commodity"?

A common criticism to see about Celestia’s revenue model is that in the long run, DA (data availability) should be considered a commodity, meaning that expenses will inevitably tend toward the bottom.

To make this claim true, DA as a resource must be the same in all services. But this is not the case, for the following reasons:

Celestia DA ≠ any other DA

An important point to note here is that Celestia not only provides DA, but also provides consensus for rollups. Obviously, some DA providers offer stronger security than others. In addition, some providers will have stronger network effects. With this alone, DA services are differentiated, meaning that it is not a commodity by definition.

Let’s look at it from the perspective of rollup.

Rollup POV

Rollup is a consumer of DA and consensus. They won't choose who based solely on who is cheapest, they also have to consider security. In addition, they want to use things that everyone else is using so that they know they won’t be cheated because they have gone through actual combat tests.

Additionally, seeing other protocol replacements can increase confidence, further distinguishing DA providers from other providers. This is itself a network effect—a network effect that cannot be forked and difficult to replicate.

So DA is not a pure commodity – but how should it be evaluated?

Given that DA is not a commodity, it is reasonable to have a certain premium on its cost, but it cannot be too high to prevent Rollups from choosing it. After all, it should provide positive results for these rollups. At present, this positive factor is a significant reduction in costs. Here are some information:

The cost was deliberately set very low

You may have seen someone complaining on Twitter that Celestia is currently having too low revenues and valuations, even after a sharp drop in ATH. But they completely ignored that the current income was deliberately lowered. The reasons are as follows:

Win market share

Low fees are a strategic choice for Celestia to win market share and beat its competitors. The goal is to use free DA to attract users, let them try out products, and thus create dependencies. Once you have a large number of users (rollups), monetization is not a problem. However, winning users and beating competitors is difficult, which is why you can’t set high fees at the beginning and expect large user inflows.

Celestia Mustafa Al-Bassam has discussed this.

Celestia's annual income estimate

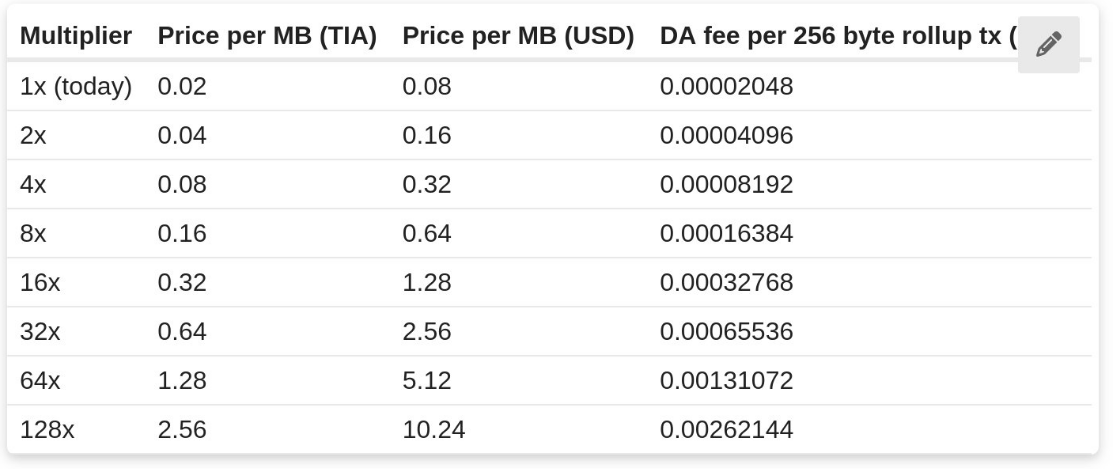

Recently, Mustafa Al-Bassam launched a discussion on the Celestia forum on whether to gradually increase current costs. The first proposed increase was 4 times (probably more), and the table shows that the cost increase ranged from 2 times to 128 times.

There is also discussion about anchoring the expenses to USD and preventing them from being affected by TIA fluctuations. It is worth noting that this is just the beginning and remains to be discussed.

Now with some available numbers, you can try to evaluate DA expense income. This is a very difficult task, so some assumptions must be made.

Assumptions

As more modular projects enter the mainnet, the total data released by Celestia will increase significantly (currently 1.5TB). So far, only Eclipse has been seen stress-testing on its chains, and more is expected to come.

To provide some background information, Initia, Movement, and Abstract are just some of the many projects that lay the foundation for building killer applications. But what do all these applications have in common? They will rely entirely on having a safe, fast and cheap DA.

With this in mind, assume that Celestia will eventually release 50TB of data per year and will continue to grow.

TIA Income Estimation

As of now, the total amount of fees paid by TIA is 313,000. If the TIA is $3.2, it will be about $1 million. But again, these fees are deliberately set very low.

If you increase the fee by 15 times, it is still much cheaper than ETH DA. Without adding much cost, it is still an excellent choice for rollups: about 66 times cheaper than EIP-4844. Although it can be adjusted up or down again, here is 15 times as the benchmark.

The revenue is now $15 million.

Next, substitute the DA requirements into the formula:

$15 million × 50TB = $750 million in annual revenue.

If the total data released increases year by year, annual revenue can easily exceed $1 billion.

The final thought

There are actually many variables that affect this calculation, and things are obviously not that simple either. If certain variables are added or decreased, revenue will be adjusted accordingly. But because people like exact numbers, here is a specific number that most people can agree with.

Of course, you can continue to adjust the numbers and obtain different incomes. But my personal opinion is that $1 billion in annual revenue is easy to achieve.

The above is just personal opinion, DYOR.

Related reading: Celestia is questioned about "pulling up shipments": packaging the selling coins into financing before unlocking large amounts

jinse

jinse