Review of Hyperliquid contract "Insider Brother" precise operation: the secret of making a profit of nearly 10 million US dollars after three orders

Reprinted from panewslab

03/11/2025·2MAuthor: Wenser, Odaily Planet Daily

In the recent decline and fluctuation, the traders with the most outstanding record are undoubtedly the players who frequently open contracts on Hyperliquid to make excess profits. In the ups and downs of mainstream currencies such as BTC and ETH, they seem to be able to take the lead in discovering the trend direction, quickly open orders, close positions accurately, and leave. Therefore, they are also called "Insider Brother" amid the jealous and suspicious discussions of the community.

At present, some retail investors have regarded it as a "order opening indicator" and have won actual results in orders. In view of this, Odaily Planet Daily will briefly take stock of the operations and onlookers related to the profit-making giant whale on the Hyperliquid platform for readers' reference in this article.

Hyperliquid becomes the latest gold rush site: monthly trading volume

increased by more than 4 times in 6 months

After experiencing the baptism of political Meme coins such as TRUMP, MELANIA, and LIBRA, the Meme market in the cryptocurrency market has been phased out, and replaced by the on-chain contract market, becoming the latest gold hunting place for countless traders.

In early February, according to a Messari report, Hyperliquid's monthly trading volume increased by more than 4 times since October 2024, indicating the platform's rapid rise in the decentralized trading market. Hyperliquid has cultivated a group of high-value, continuously active trading users and has become the only Layer 1 alternative in the market with a clear core user base.

In late February, Hyperliquid officially issued a statement saying that the HyperEVM main network is now online, introducing universal programmability into Hyperliquid's high-performance financial system. The initial release of its main network includes: The HyperEVM block is built as part of the L1 execution, inheriting all the security of the HyperBFT consensus; spot transfers between native spot HYPE and HyperEVM HYPE; a standardized WHYPE system contract, suitable for DeFi applications.

At the same time, on February 22, according to Degen News citing DeFiLlama data on the X platform, HyperliquidX protocol revenue was US$2.46 million in the past 24 hours, surpassing pump.fun and ranking third, second only to the two major stablecoin issuers, Tether and Circle. It has to be said that perhaps the trend had already appeared at that time.

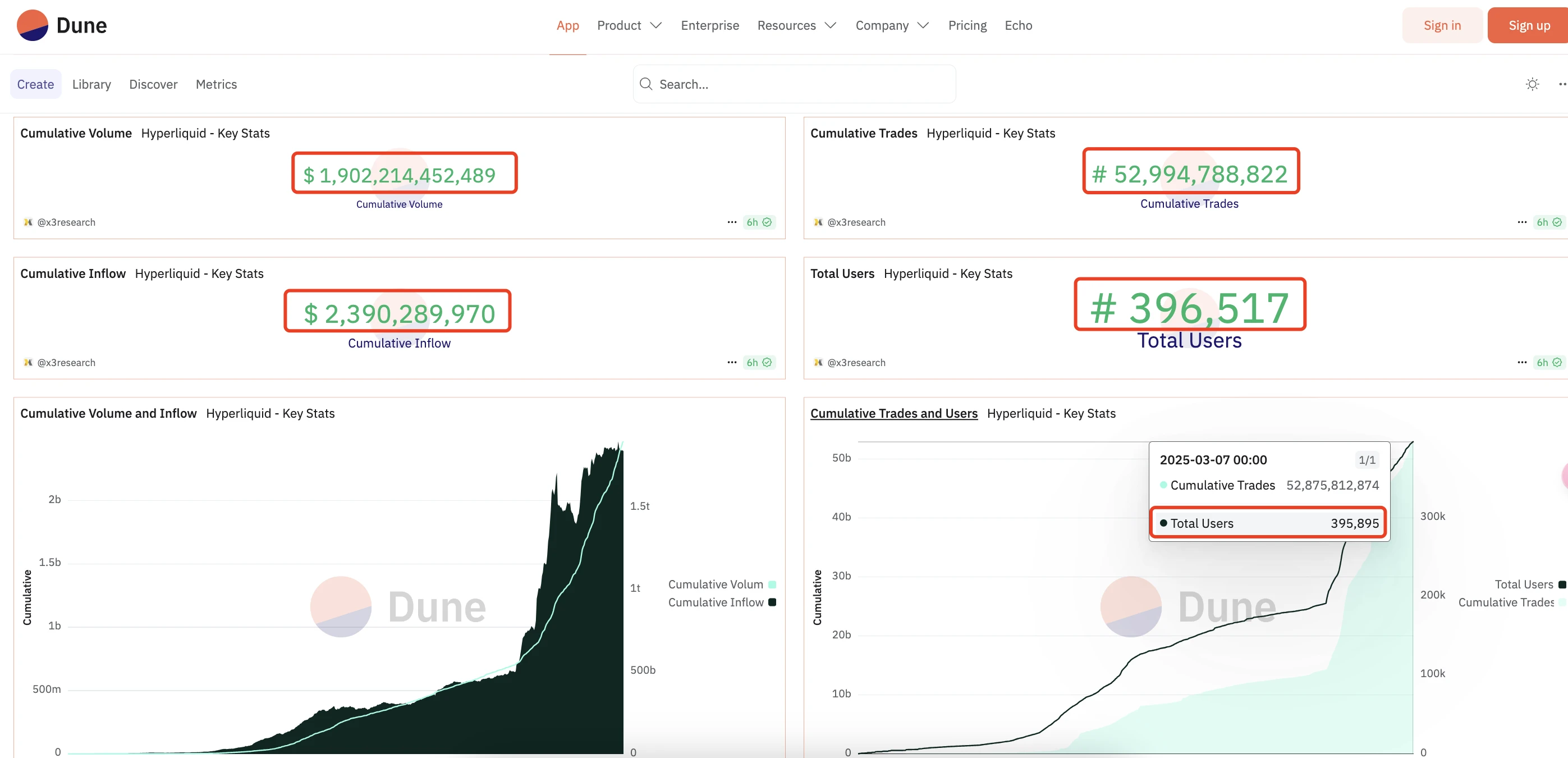

According to Dune data, as of March 7, the number of independent Hyperliquid users has reached nearly 400,000; the cumulative number of transactions reached 53 billion; the cumulative transaction volume of the platform exceeded 1.9 trillion US dollars.

\"Binance on the Chain\" is so terrifying

Since February, many big players have achieved good results from Hyperliquid -profits ranging from hundreds of thousands of dollars to tens of millions of dollars. Under the banner of "Binance on Chain", Hyperliquid has become a "order opening destination" with great trading depth in the monkey market.

The giant whale "Insider Trading" operation inventory: BERA, BTC, ETH,

etc. are all within range

Giant Whale Operation: Short BERA within 2 hours and earn $589,000

In early February, according to Lookonchain monitoring, after BERA went online, a giant whale earned $589,000 by shorting BERA in less than 2 hours. The giant whale deposited $1.6 million to Hyperliquid 16 hours ago and shorted BERA at the $13 price point, making a profit of $589,000.

Onlooker Address:

https://hypurrscan.io/address/0x0eC0A15e5763ED97A85e860fDCCd7D1e082b5AA9

It is worth mentioning that the address has been cleared.

Giant Whale Operation: Short ETH with 50 times leverage, with floating profit of more than US$62.4 million

At the end of February, according to Onchain Lens monitoring, a whale shorted ETH with 50 times leverage on HyperLiquid, and its floating profit was more than $62.4 million.

Onlooker Address:

https://hypurrscan.io/address/0x20C2d95a3Dfdca9e9AD12794D5fa6FaD99dA44f5

Currently, the address still has a contract position of US$98 million.

Suspected insider: When it fell sharply, it was long for ETH and BTC, and the ETH position was as high as 88,500, and it made a profit of US$6.83 million in 24 hours.

According to monitoring by Ai, an analyst on-chain, Hyperliquid's 88,510 long positions of 50 times long users have been cleared and taken profit. Now it has begun to take profit from Bitcoin, with 315 BTC left.

The address previously used 6 million USDC principal to open a long position of more than 200 million US dollars. Among them - ETH: 49384 pieces, the opening price is US$2196, the liquidation price is US$2133.9; BTC: 1260 pieces, the opening price is US$85671, the liquidation price is US$84629. Subsequently, the long position of this address increased 914 ETH and 41 BTC.

Everyone knows the story after that. Trump directly called for XRP, SOL, ADA, BTC, and ETH, saying that he would establish cryptocurrency reserves soon. Affected by this news, the address once made a direct floating profit of US$6.46 million. Because the opening time and clearance point were too extreme, many people in the market speculated that it might be an insider close to Trump. Although this view was subsequently refuted by Coinbase director Conor Grogan because his funding was phishing fraud funds. But the truth is still unknown.

At present, all of the address has been cleared.

Onlooker Address:

https://hypurrscan.io/address/0xe4d31c2541A9cE596419879B1A46Ffc7cD202c62

Brother Insider takes action again: he issued a short order of $13.45 million in Bitcoin

In early March, according to ai_ 9684 xtpa monitoring, there were still 20 minutes before the opening of the US stock market, "Hyperliquid 50 times leverage long BTC and ETH made a profit of US$6.83 million" issued another BTC short order of US$13.45 million, which was still a familiar 50 times, and it was still a sensitive time point, but it turned from long to short and the position was much smaller; the opening price of this time was US$93,117.5, and the liquidation price was US$94,083, and it was once a floating loss of US$60,000. But soon, the address finally successfully left the market with a "re-profit of nearly $300,000."

Institutional operations: Opening a short order of US$139 million with 50 times leverage, and once made a floating profit of US$78.19 million.

On March 4, according to Hypurrscan data, a giant whale opened an ETH short order worth US$139 million with 50 times leverage on Hyperliquid, with a floating profit of US$78.19 million, and the liquidation price was US$3507 USDT. Subsequently, it is understood that the position is actually opened by the stablecoin USR maintenance protocol Resolv Labs.

Onlooker Address:

https://hypurrscan.io/address/0x20c2d95a3dfdca9e9ad12794d5fa6fad99da44f5

Currently, the position value of the address contract is approximately US$97 million.

Suspected insider 's hat trick: open ETH with 50 times leverage, make a profit of 2.15 million US dollars in 40 minutes

Just this afternoon, according to the monitoring of the on-link analyst Aunt Ai, "Hyperliquid 50x leverage long BTC and ETH, made a profit of US$7.13 million in Giant Whale" recharged 1.95 million USDC as margin, and issued a 50x ETH long position, holding 27,809 ETH (about US$57.88 million), opening price of US$2,057.49, and liquidation price of US$2,008.

Shortly after it opened its order, ETH rose to a maximum of $2,149, and eventually it closed its positions and took profits of $2.15 million in less than 40 minutes. So far, he has made a cumulative profit of US$9.28 million through three leverages.

Onlooker Address:

https://hypurrscan.io/address/0xf3F496C9486BE5924a93D67e98298733Bb47057c

Giant whale operation: 4.06 million USDC with multiple BTC, floating profit of US$589,000

On March 6, according to Lookonchain monitoring, a wallet that had been dormant for two years sold 1,863 ETH at an average price of US$2,181 and received 4.06 million USDC. The address then deposited 4.06 million USDC into Hyperliquid, and went long BTC at $89,930 with a 20-fold leverage, with a floating profit of $589,000 and a liquidation price of $75,186.

Onlooker Address:

https://hypurrscan.io/address/0x523b21F469825D0104ac6A3c762a955EeDb75e5B

Summary: Eating meat and drinking soup depends on the speed of your hand

At present, it is suspected that the insider has a high winning rate in long and short operations. His real body or a hacker who cheats fish is still not ruled out that he is an insider or a giant whale accomplice.

Given that Hyperliquid infrastructure is not yet mature, current followers rely on hand speed. Odaily Planet Daily reminds here that when the market trend is unclear, be careful to increase leverage and do a good job in risk control before choosing "big brother".

jinse

jinse