Bitcoin may benefit from dominance of U.S. stablecoins

Reprinted from jinse

03/11/2025·2MAuthor: Zoltan Vardai, CoinTelegraph; Translated by: Wuzhu, Golden Finance

The U.S. maintains the dollar's global dominance by adopting stablecoins, which could bring unexpected benefits to Bitcoin, as Bitcoin is becoming a potential national reserve asset.

At the White House cryptocurrency summit on March 7, U.S. Treasury Secretary Scott Becent said the U.S. government will use stablecoins to ensure the dollar remains the world’s reserve currency.

“We will think a lot about the stablecoin system, and as President Trump directs, we will keep the dollar as the world’s major reserve currency,” Besent said.

The Treasury Secretary also reiterated the Trump administration’s commitment to ending the cryptocurrency war and pledged to revoke previous IRS guidance and punitive regulatory measures.

President Trump speaks at the White House cryptocurrency summit. Source: Associated Press

Trump's remarks come after Trump just signed an executive order to build Bitcoin reserves using cryptocurrencies confiscated in government criminal cases. While the order does not involve direct federal Bitcoin purchases, it represents a shift in the government's perception of cryptocurrencies.

Omri Hanover, general manager of the blockchain launch board at Gems Trade, said Bitcoin could benefit from growing stablecoin adoption and boost to regulatory transparency.

“If Trump’s policies strengthen U.S. financial dominance, then Europe’s hesitation and 'waiting' attitudes could undermine its economic influence,” he noted, adding:

“This disagreement creates two market reality: the United States accelerates the adoption of Bitcoin, attracting capital; while the EU prioritizes compliance, risking capital transfer to the U.S. market.”

Meanwhile, two major bills are awaiting Congressional approval: the Stablecoin Act and the Market Structure Act, designed to help eliminate uncertainty over regulation of the U.S. crypto industry.

Meanwhile, lawmakers supporting cryptocurrencies will focus on two major legislative priorities—stablecoins and general market structure clarity—that will help remove uncertainty over regulation in the U.S. crypto industry. However, Congress has not passed any relevant bills.

Stablecoin issuers' profits may increase or flow into Bitcoin investment

The growth in profits of stablecoin issuers may promote Bitcoin investment and further consolidate its store of value status.

Tether, the issuer of the world's largest stablecoin, said it will invest 15% of its net profit in Bitcoin to diversify its backed assets.

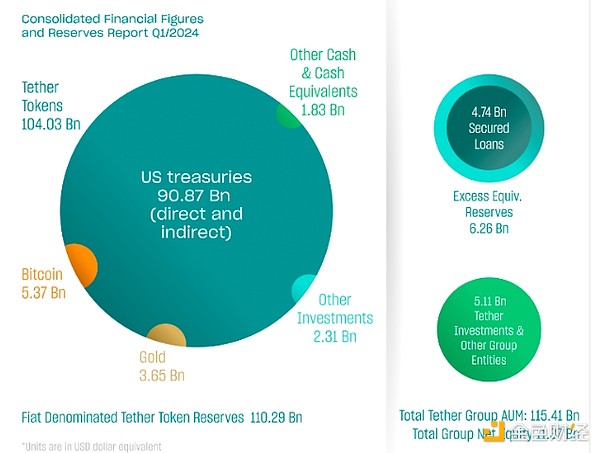

Tether's Bitcoin holdings proved profitable, with the company reporting a record $4.5 billion in the first quarter of 2024.

About $1 billion comes from operating profits held by U.S. Treasury bonds, while the remaining $3.52 billion includes the company's Bitcoin holdings and market capitalization gains from its gold positions.

Tether’s Financial Reserves, Q1 2024. Source: Tether

According to BitInfoCharts data, Tether's "bc1q" address currently holds more than $6.8 billion worth of Bitcoin, becoming the sixth largest holder in the world.

On January 31, it was reported that Tether's Bitcoin held by him brought $5 billion in profits to the company in 2024, while the company's total profit for the full year was $13 billion.

panewslab

panewslab