Tether, the world's most profitable company per capita: The head of the plastic surgeon is born as a plastic surgeon, and the profit of 10 billion yuan is accelerating diversified investment

Reprinted from panewslab

03/28/2025·1MAuthor: Nancy, PANews

In the crypto world, a "money printing machine" is operating with amazing efficiency: the stablecoin giant Tether. This team, which relies only on a hundred people, serves hundreds of millions of users around the world and leverages tens of billions of dollars in profits. Giancarlo Devasini, the behind-the-scenes driver of all this, not only achieved a gorgeous turn from plastic surgeons to crypto-financial powerhouses, but also led Tether from edge innovation to the center of the global financial stage through strategic layout.

Today, Tether not only firmly sits on the throne of stablecoin overlords, but also extends its tentacles to diversified fields such as mining, media, and agriculture through large-scale investment, launching an ambitious global expansion war.

**Teams of 100 people make 10 billion profits, the seventh largest buyer

of US debt**

As the world's largest stablecoin issuer, Tether has transformed from an initial niche financial experiment to a giant in the crypto industry, showing amazing profitability and market influence.

Tether has published net profits of tens of billions of dollars over the past decade. Although Tether lacks detailed financial data regularly disclosed in its early stages of development, the company has begun to fully disclose its financial reports to increase transparency since 2022. According to comprehensive public data, Tether's cumulative net profit reached at least US$19.9 billion in the more than two years from the fourth quarter of 2022 to the end of 2024 alone.

Especially in 2024, Tether achieved a total profit of more than $13 billion with a streamlined team of only about 150 employees, equivalent to an average profit of about $93 million per employee. This data makes it one of the world's most profitable companies, far exceeding traditional financial giants such as BlackRock, and even comparable to Visa in terms of transaction volume.

From the perspective of profit composition, US Treasury bonds are undoubtedly Tether's core profit engine. Since the Federal Reserve launched a rate hike in 2022, Tether has invested a large amount of reserve funds in U.S. Treasury bonds, gradually becoming one of the main buyers of U.S. Treasury bonds. In 2024 alone, Tether purchased $33.1 billion in U.S. Treasury bonds, making it the seventh largest buyer of U.S. Treasury bonds, which surpassed those of Canada, Mexico, Norway, South Korea, Germany and Saudi Arabia. The quarterly reserve report ended December last year showed that Tether's total U.S. Treasury bonds are worth $94 billion.

In addition to asset allocation, the widespread adoption of the stablecoin USDT is also an important pillar of Tether's profit capture. As a digital asset anchoring the US dollar, USDT not only surpasses the limitations of traditional financial instruments in function, but also plays multiple roles in global financial transactions: in high-inflation countries such as Venezuela and Turkey, USDT has become the first tool for residents to fight the depreciation of their local currency and evade capital controls, providing a safe-haven channel for people in economically turbulent areas. In some restricted markets and gray areas, USDT is a flexible and difficult-to-trace financial medium.

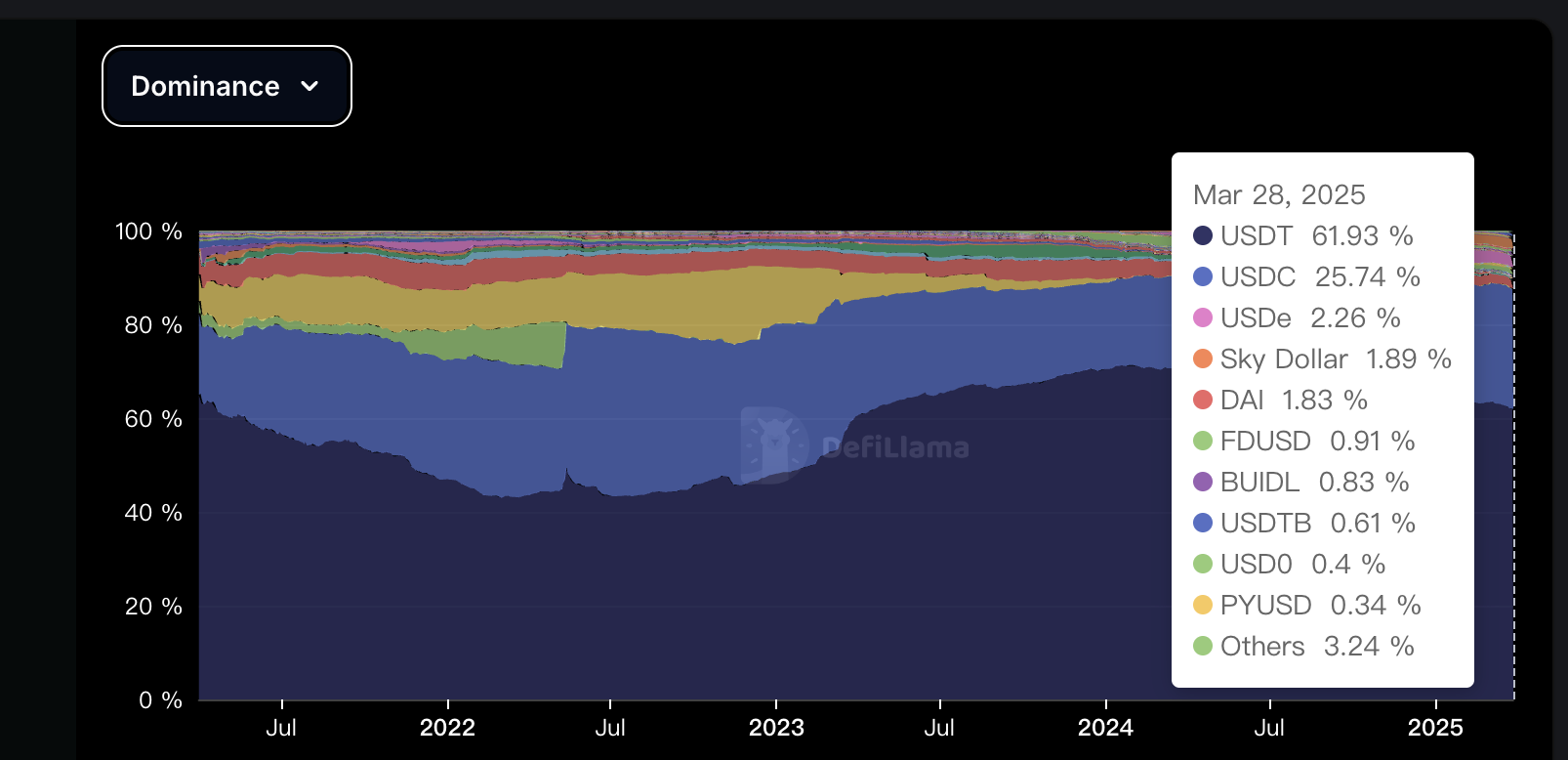

Today, USDT is dominating the global stablecoin market and becoming the most widely used stablecoin. DeFiLlama data shows that as of March 28, 2025, the issuance scale of USDT has exceeded US$143.7 billion, with a market value of US$144.8 billion, accounting for about 61.9% of the stablecoin market. According to further revealing that the number of USDT users around the world is conservatively estimated to have exceeded 400 million, and the growth momentum is rapid, and he is expected to reach 1 billion soon.

Behind the scenes, the actual helm was an Italian plastic surgeon

And the mastermind and actual helm of the largest crypto-money printing machine is recognized as Devasini, the former chief financial officer of Tether. According to Forbes, Devasini owns 47% of the shares, or is Tether's largest shareholder, with a net worth of up to $9.2 billion. However, the core Tether figure maintained a low-key life in Lugano, Switzerland's Bitcoin center, with almost no interviews, and even said "no title, no job, nothing".

Devasini's experience is quite legendary. According to a previous report by the Wall Street Journal, Giancarlo Devasini, who was born in Turin, Italy, started as a plastic surgeon and later started an electronic product import business in Hong Kong. In 1995, Italian prosecutors accused him of fraud by running a software piracy gang. Later, Devasini founded the technology company Solo in Italy, with an annual revenue of more than 100 million euros, and was later sold by him before the 2008 financial crisis broke out. Today, the Italian, about 60, has become one of the core figures in crypto finance.

It all starts in 2012, when the Bitcoin white paper ignited Devasini's interest in cryptocurrencies, he also posted on the Bitcoin forum asking if anyone would buy DVDs or CDs at a price of 0.01 bitcoin (about 11 cents at the time) and promised free shipping on bulk orders.

It was during that period that Devasini also met Bitfinex founder Raphael Nicolle. With his rich business experience and connections, he established key banking relationships for Bitfinex and promoted the internationalization of the platform, including moving his registered place to the British Virgin Islands and headquartered in Hong Kong, and gradually becoming the core figure of Bitfinex. In 2014, he co-founded Tether and launched USDT with Bitfinex executives.

Devasini is deeply involved in Tether's issuance decision-making and fund management, especially playing a key role in cooperation with major clients. Alameda Research, for example, applied to Tether and received billions of USDT support, and Devasini is considered the behind-the-scenes promoter. Bloomberg quoted chat records submitted by former Alameda CEO Caroline Ellison, which showed that Devasini had told Alameda traders: "We are a big family … we will conquer the world." FTX founder SBF also supported Devasini in a public interview. "Devasini is very proud of the career he has built in Bitfinex and Tether. He responds 24/7, not just to respond to crises or incredible opportunities, but to day-to-day operations. Those criticisms of Tether that have no reason to appear to be rash."

In addition, reports have pointed out that Devasini is actively seeking political allies to fight for regulatory "umbrellas" for Tether. The Wall Street Journal previously reported that Devasini had privately stated last year that Cantor Fitzgerald chairman and U.S. Commerce Secretary Howard Lutnick will use his political influence to resolve the threats facing Tether. U.S. Senator Elizabeth Warren also pressed him during the Howard Lutnick nomination to explain his relationship with Tether. It should be noted that Cantor manages part of Tether's reserves and holds 5% ownership. But Tether denied the market's claims that Lutnick influences regulatory actions.

Today, Tether is expanding at an astonishing speed, and Devasini has also moved from behind the scenes to the strategic front, becoming the chairman of the group, focusing on macroeconomic strategy, aiming to deepen the application of USDT in global digital assets.

Diversification strategy accelerates, **mining and media get heavy

bets**

Against the backdrop of stricter regulation and intensified market competition, Tether is weaving a cross-industry business network through diversified investment.

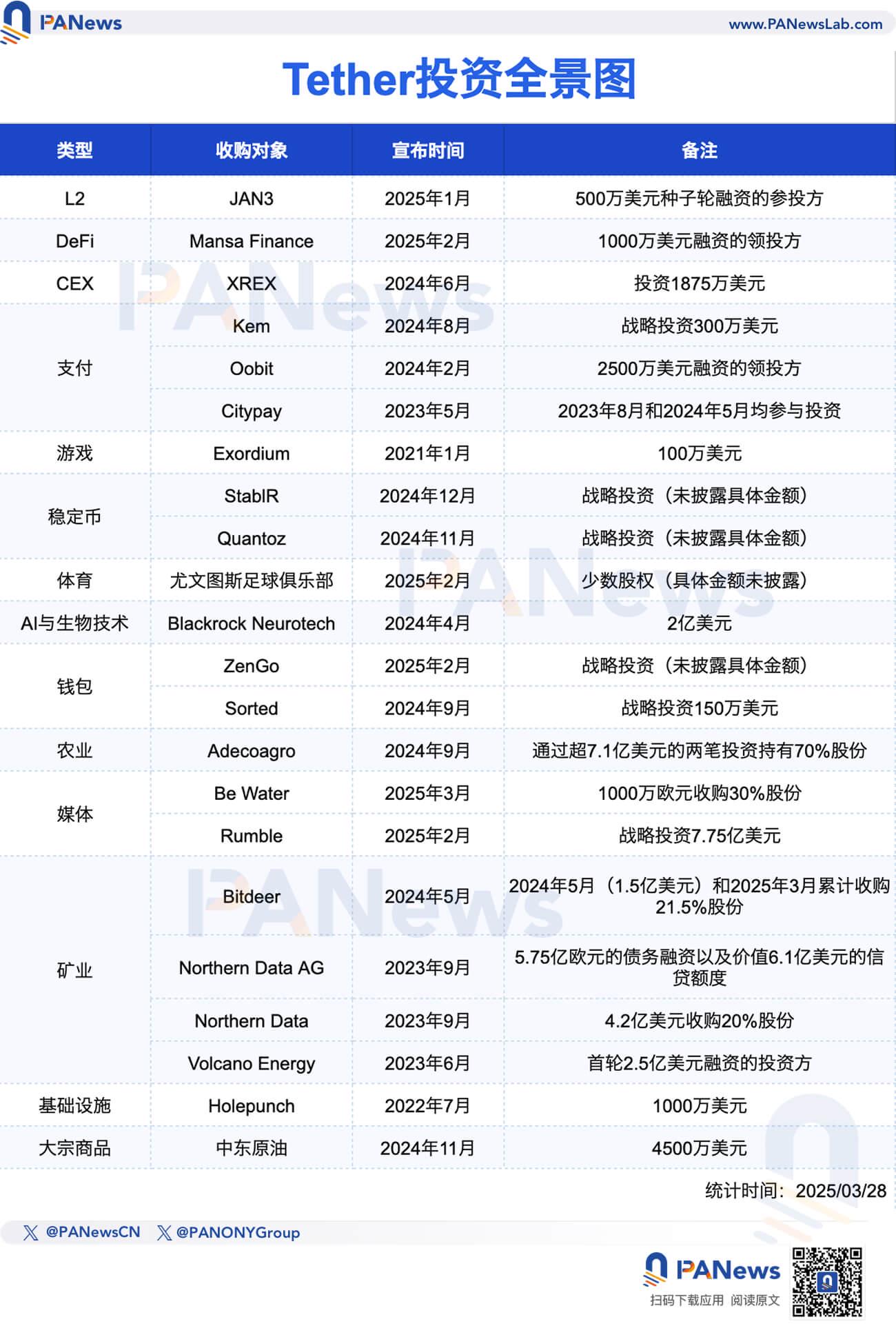

According to incomplete statistics from PANews, since 2021, Tether has disclosed a total of 22 investment projects, spanning multiple fields such as encryption, media, sports, agriculture, commodities, and biotechnology. Among them, the encryption field is Tether's most core investment direction, especially in mining, payment, stablecoins, wallets and other tracks, accounting for more than half of the total investment.

In terms of funding scale, Tether has the most generous investment in mining, with a cumulative investment of more than US$2.1 billion, far exceeding other areas. The largest of these is an investment in German mining company Northern Data AG, which Tether has provided $575 million in debt financing and $610 million in credit. Volcano Energy, Northern Data and Bitdeer also received hundreds of millions of dollars in investments. The second is the media industry, with Tether's total investment reaching $780 million, with the vast majority of which are invested in Rumble ($775 million). PANews once mentioned in the report that this high investment has a strong political color, which is more like a business backed by the Trump circle . Rumble has a deep relationship with US President Trump, and is even called "Trump concept stocks by the outside world. Narya Capital Management, a venture capital fund of US Vice President JD Vance, has also participated in Rumble's investment. In the agricultural field, Tether holds up to 70% of the shares of Argentine agricultural giant Adecoagro through two investments, with a total amount of more than US$710 million. In addition, Tether acquired a majority stake in biotechnology company Blackrock Neurotech for US$200 million, with a valuation of US$350 million.

From a time perspective, from 2021 to September 2024, Tether mainly focused on crypto construction, especially mining and payment. Since then, its investment pace has accelerated significantly, and its strategic direction has become increasingly diversified, gradually expanding from a single field to a global layout of multiple industries.

Although Tether has successfully built a strong crypto business empire through diversified investment and stablecoin market dominance, Tether will face more complex challenges in the future as the crypto market matures and the regulatory environment continues to change, which will depend on how to balance innovation, compliance and expansion in the unpredictable global stage game.