Korean institution Four Pillars and other researchers: Investment opportunities and personal holdings in 2025

Reprinted from panewslab

03/28/2025·1MAuthor: Four Pillars

Compiled by: Bai Ding, Xian Rang

Note: Four Pillars is a South Korean investment and research institution. The team has in-depth insights into the development trends of the market and industry. Based on its own analysis and judgment, it has invested in many star projects such as INJ, SUI, Ethena, Virtuals, Hyperliquid and other star projects. This article is a research report explaining investment logic and position reasons. Four Pillars members have expressed their views on future market development in depth. We recommend everyone to read it here.

Whenever we talk about engaging in blockchain research, some people always ask: "What coins should we buy now?" "What projects are worth investing in?" In fact, the responsibility of VC researchers is to analyze blockchain-related technologies and analyze market trends rather than provide investment advice, so we are usually reluctant to answer such questions.

But the special thing about the Four Pillars research team is that we are both industry observers and in-depth participants in the crypto market, so instead of giving vague "investment advice", it is better to directly disclose our holding structure and explain the investment logic.

You may be curious: What assets do these Four Pillars researchers who are immersed in blockchain research around the clock? What is the basis for decision-making? Before explaining each investment target in detail, we will use charts to visually present the overall position distribution of the team:

Observing the above picture, it is not difficult to find that the team's holdings show diversified distribution characteristics, covering multiple tracks and ecological systems. Next, we will analyze the investment logic of each researcher one by one and their analysis of the future potential of these assets.

Steve: Ethereum's dominance declines, focusing on products that are

already in the market PMF

Portfolio: Sui, Injective, Jito, Ethena, Azuki, Rootlets, Kumo

Smart contract platform no longer wins all

Four Pillars was founded in May 2023, when a group of new public chains considered Ethereum challengers were collectively defeated after the Terra crash and the FTX incident, when Ethereum firmly dominated the market. But I was convinced at the time that in the next bull market, Ethereum's market share will definitely fall back to around 30%. There are three core logics:

First, the number of users entering the new cycle will be far beyond the past;

Second, incremental users will inevitably bring about diversified value orientation;

Third, Ethereum cannot meet the needs and preferences of all groups.

The Ethereum ecosystem puts the "decentralization concept" at the highest priority, which has led me to notice its key contradiction - to achieve a true "Mass adoption", it must be compatible with user groups that do not regard decentralization as the ultimate value.

Of course, blockchain technology essentially requires "a certain degree of decentralization", but I think not all scenarios require Ethereum-level decentralization. On the contrary, other value dimensions such as execution efficiency, compliance framework, user experience, etc. may be more prioritized than decentralization. This diversity of value orientation will continue to create market demand for other public chains besides Ethereum.

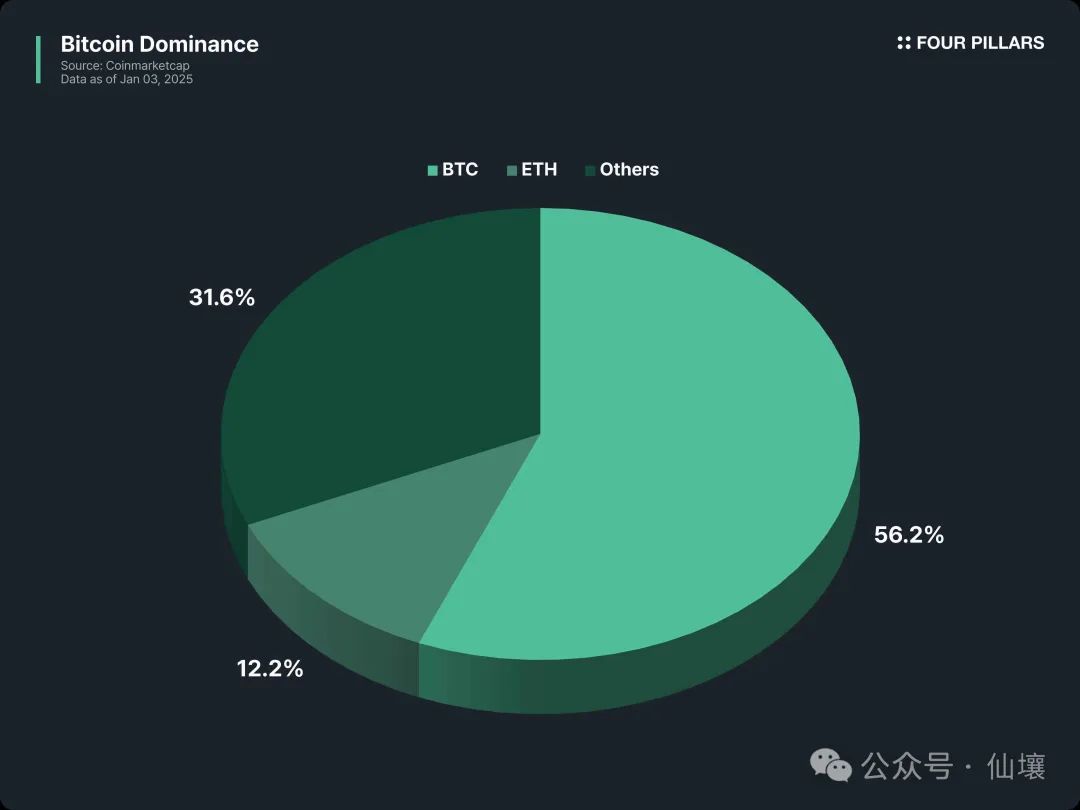

The subsequent market performance verifies my judgment: compared with 2023, the current Ethereum market share has stabilized in the range of 20-30%. As of January 9, 2025, Ethereum had a market value of US$398.5 billion, and the total market value of the entire crypto market was US$1.35 trillion.

And I think the biggest problem with the Ethereum ecosystem is not at the technical level, but its arrogant attitude of "everything will eventually belong to Ethereum". To some extent, this runs contrary to the decentralization concept they advocate. The open world that blockchain is trying to build will never operate according to the will of any particular group. Therefore, I think the smart contract platform field is almost impossible to form a winner-takes-all situation in the future.

Because anyone can create a new public chain, innovation may emerge at any time. As time goes by, more and more people will be familiar with blockchain technology. The threshold for using new public chains will continue to be lowered, and smart contract platforms are likely to maintain a fierce competition. Of course, this does not mean that we will return to that era of random chain posting. In the future, the number of major public chains participating in competition may decrease, but new frameworks and platforms will continue to emerge, and existing leading public chains will continue to improve their infrastructure.

Based on this judgment, the new blockchain framework and technology have always been my focus. My interest in Sui will continue until 2025, and it is at the forefront of the field of "new infrastructure technology". In addition, I think public chains like Solana and Injective that rely on their respective advantages to build a unique ecosystem will eventually gain greater market attention - Solana is known for its strong community foundation and scalability comparable to Sui, while Injective is known for its fast transactions, flexible business expansion capabilities and unique token economic model.

Source:X (@leptokurtic_)

There are new opportunities in the track

When asked "what areas of the blockchain industry have realized PMF", my answer is always the three cornerstones of exchange, stablecoins and public chains. Before exploring unproven emerging market opportunities, deepening the existing mature track and iterating technology is also a valuable direction.

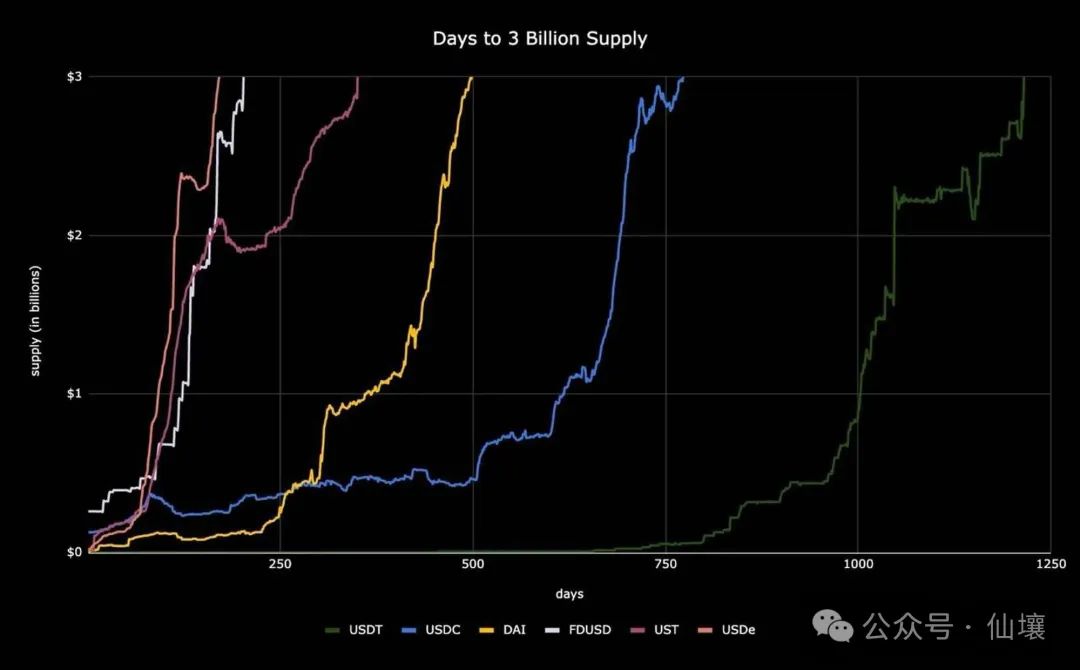

Taking the stablecoin track as an example, its development space is actually far from reaching its peak. If differentiated models can be constructed while avoiding risks that have occurred in history, such as defects in model design similar to Terra, it is entirely possible to create new market demand. The rise and fall of Terra has proved that outside USDT and USDC, there is indeed a real demand for Web3 native stablecoins.

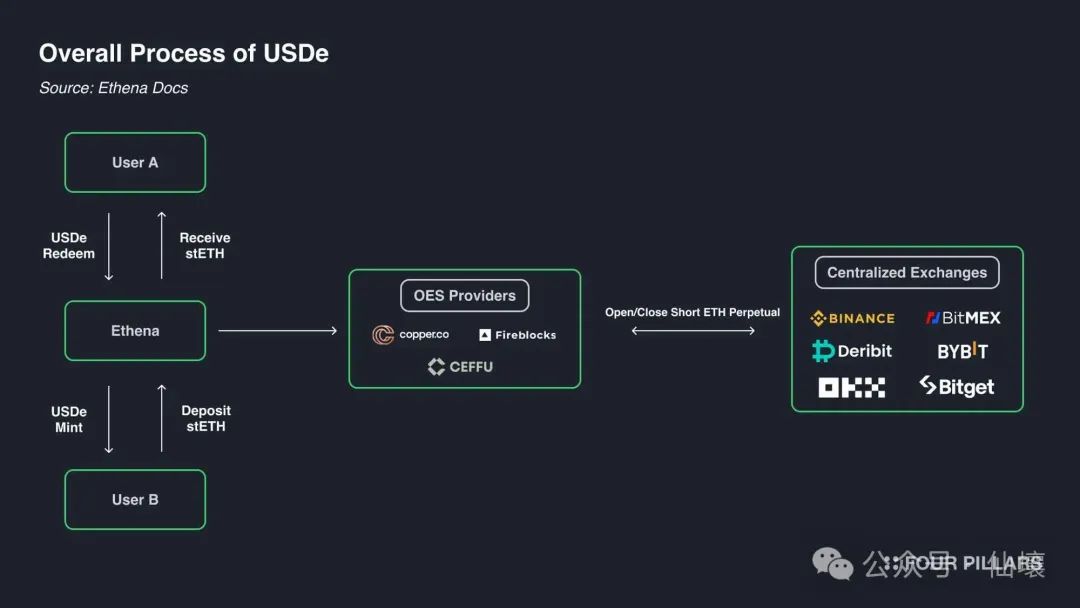

And this is exactly the core logic of my optimism about Ethena - it builds high returns through capital rates, and forms essential innovations in the underlying architecture compared with USDT and USDC. Ethena's breakthrough lies in: In addition to the basic appeal of "high interest rates", it is a good example to continue to expand USDe's application scenarios, such as the integration of USDe with Bybit, which can be used as collateral assets to trade perpetual contracts.

Although Ethena's capital rate returns may narrow in the bear market, the project party has begun to develop derivatives such as USDtb to hedge market volatility, showing mature risk control awareness.

Based on the above reasons, I have maintained a high attention to the innovative practices of three types of tracks that have been verified by the market - exchanges, stablecoins, and public chains. Taking Hyperliquid as an example (although I have not held a position yet), it has innovated its derivatives trading experience through the order book model, showing an innovative gene similar to Ethena. This type of project "opening up the blue ocean in the Red Sea Track" has always been my focus of observation.

What is a real community

"Community" is perhaps one of the most abused words in the Web3 field. Almost all projects claim to be "serving the community", but in most cases, the community is nothing more than their "liquidity export" or "coin threshold" -this hypocritical community narrative has now been seen through by most retail investors.

I am not here to deny the value of airdrops. As a cold start tool, airdrops are indeed an effective means to build an initial community. But airdrops are just means to start, and the community can truly survive only when users feel something outside the currency price. Blockchain is similar to the state in some ways, but lacks coerciveness, making it closer to religion.

In addition to economic incentives, the only thing that can bring people together spontaneously is fascinating narratives, which is why Ethereum and Solana have strong (or even slightly fanatical) communities - they experienced the collapse of DAO attacks and FTX incidents, but were reborn from the ashes, forming a unique community narrative.

In the NFT field, Azuki is one of the few projects that have constructed such "narratives". Despite the amazing start, the Azuki team and founder Zagabond have gone through many tests over the past three years of operations. It is precisely because they overcome these challenges that they have built a solid community foundation today. It can be seen that real communities cannot be just about spending money. People need to gain a sense of belonging outside of economic incentives through the "experience of sharing weal and woe".

Based on this, I am optimistic about projects that have established communities of such nature and believe that projects with a solid community foundation will perform well in the industry. After all, the code can be forked, but the community cannot copy it.

Jay: Which projects will really drive Adpotion?

Portfolio:Solana, Sui, Jito, Ondo Finance, Ethena, Send, SOON Girl, MadLads, Kumo, SOON

Virtual machines outside of EVM

2024 is a key turning point in the development of non-EVM ecosystems. Taking Solana as an example, multiple DeFi projects and consumer-level applications under the SVM ecosystem, such as Pump.fun, Photon, Daos.fun, etc., have shown performance that they are comparable to or even surpass the leading projects in the Ethereum ecosystem. Especially in the stablecoin payment field, Solana has successfully integrated mainstream companies such as Visa and Shopify, which has greatly increased the market's expectations for its mass adoption prospects.

In addition to Solana, Sui continues to strengthen its ecosystem with "Move on SUI" and achieves extremely low transaction delays through the introduction of breakthrough technological innovations. In addition, the release of SuiPlay0X1 handheld console designed specifically for Sui marks an explosive growth in the gaming ecosystem.

From a macro perspective, an obvious trend is that more and more ecology is gradually getting rid of the EVM framework, developing or integrating their own exclusive virtual machines, and building a customized ecosystem. Although Ethereum, as the first smart contract platform, has indeed led the development of the industry and nurtured many innovative ideas, I am optimistic that non-EVM public chains surpass the Ethereum ecosystem. The root cause is: EVM lacks a clear mission orientation and has many inherent flaws.

We are witnessing the rise of diverse virtual machines, and these innovations are breaking through the boundaries of the EVM ecosystem. Ultimately, the diversity and quality of applications will depend on the development level of virtual machines. The key challenge lies in how to give full play to the advantages of each VM and build a full-stack application that is optimized for specific scenarios. Looking ahead to 2025, non-EVM infrastructure and its portfolio innovations may usher in broader development space to meet the market's increasingly evolving needs.

Really understand the RWA project with Web2 and Web3 synergies

What is the greatest value of blockchain? I think it is its ability to tokenize assets. Tokenization can enable any asset to obtain liquidity, which can bring many advantages, such as improving capital efficiency and accessibility, building fast infrastructure, realizing smart contract automation, and enhancing compliance and transparency. The long-term Mass adoption problem faced by the crypto industry also fundamentally needs to make breakthroughs in the tokenization mechanism.

However, despite countless projects attempting to tokenize various assets over the years, we have rarely seen success stories. The fundamental reason is that these projects have failed to build a compelling value transfer system and cannot show the advantages of tokenization. As traditional industries continue to heat up interest in the crypto field, the most popular projects in the future will be those that can effectively implement tokenization.

Source:How Ondo Finance Is Redefining Tokenization to Lead the RWA Market

Let’s take Ondo Finance, the leader in the RWA field as an example to illustrate. Ondo not only tokenize US Treasury products to the chain, but also achieves two major goals by building a partnership across Web2 and Web3 ecosystems:

-

Ensure that assets are protected by institutional investors;

-

Maximize its effectiveness through interaction with various protocols.

This strategy can create value for Web2 and Web3 investors. Deeply understanding the characteristics of off-chain and on-chain fields, and based on this, the organic expansion and collaborative innovation of both will be achieved. Such projects will receive more and more attention in the next few years.

Projects that create real value for the community

The launch of Hyperliquid can be said to be revolutionary. Without external financing, the team relies entirely on internal resource development to grow together with the community. Despite over 30% of the tokens circulated at TGE, the project still exceeded $10 billion in FDV in just one week. The price of HYPE tokens then soared, triggering a warm response. This is like a protest against the traditional model of the industry, highlighting the importance of community-friendly projects.

So, what is a truly community-friendly project? In short, it is a project that can provide substantial value to the community. In my opinion, this value can be realized through two major channels: economic benefits and cultural identity.

First, look at the economic income level. Given the sensitivity of the Web3 ecosystem to incentive mechanisms, the project party has long explored various ways to maintain the token holder community and encouraged ren to continue to participate. As I have discussed before, these economic incentives have traditionally been achieved in two ways: one is to share the benefits directly with token holders, and the other is to increase the value of native tokens through indirect methods such as airdrop, repurchase, destruction, or DAO vault.

However, there have been some more sophisticated and community-oriented strategies recently. For example, more and more projects open investment opportunities to the public at low valuations in the early stages to establish mutually beneficial values with the community. Projects such as Legion and Echo are typical cases in this regard. Projects that use such strategies to carefully design community relations often gain high attention during the initiation phase.

If economic incentives are an effective means to attract users from the outside, then cultural identity is committed to cultivating users' sense of belonging and establishing and unifying community identity. This process is similar to the cohesion of religious groups under common concepts and is an important driving force for maintaining development momentum and promoting innovation and grand plans.

To achieve this, the project party cannot just fabricate slogans and share emoticons, but also needs to hold various large-scale and cross-regional activities to promote in-depth interaction between members. In addition, project parties should create a suitable environment so that community members can organize their activities independently and strengthen their connections. This way of actively shaping communities will be more effective than non-spontaneous activities organized simply for one-time airdrops, and will also help build a more lasting and cohesive community.

Heechang: DeFi is in long-term development

Portfolio: Ethena, LayerZero, Morpho, Ondo Finance, Uniswap

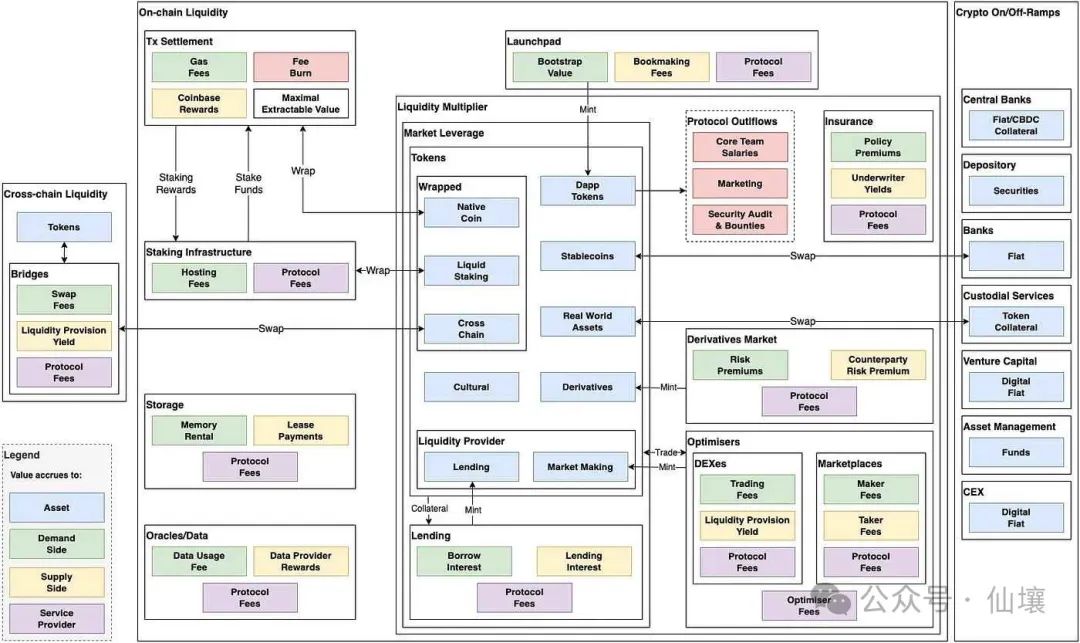

I devote myself to the crypto field for long-term development, not to gain short-term benefits within two or three years. I think DeFi is the core of the crypto world, and without DeFi, blockchain will always be limited to niche groups. Most people enter the crypto field to make money and to obtain higher asset returns. This is the potential of DeFi, not to mention diversified income methods such as self-custody.

All users’ behavior in the crypto market stems from a tendency to participate in finance, and that’s why I focus on and hold the tokens of those DeFi projects that are continuing to grow.

DeFi's history is short but rapid development. Early AMMs gained development momentum by implementing on-chain transactions, and then other primitives such as on-chain lending and perpetual contracts emerged. Each primitive has undergone multiple mechanism testing, especially in the field of on-chain trading, where DEX, based on AMM and order book, explores different product directions respectively.

Today, with Defi eco-primitives such as spot DEX, perpetual contract DEX and lending agreements achieving sustained and substantial transaction volume, they are moving towards a stage of further development and creating more value. That's why I'm focusing on DeFi infrastructure.

The crypto space has an open, license-free nature, and it’s natural for projects to expand their infrastructure to capture more value. DeFi applications used to be just smart contracts, but this perception is changing. These DeFi applications are expanding their infrastructure to address issues such as MEV and high Gas fees. With the advent of new tools such as Rollup frameworks, application-specific sorting (ASS), and interoperability frameworks, building new DeFi infrastructure is becoming easier.

Next, I will explore the evolution of DeFi's trend from smart contracts to underlying infrastructure, as well as the more innovative DeFi projects I think.

Source:Application Activity | Artemis Terminal

**DeFi 's "Lego of Money" is piled up even more large (taking Morpho and

Ethena as examples)**

The "Money Legos" in the crypto field refers to the composability of DeFi, a term that describes how different DeFi protocols are combined to create more complex financial products. A typical example is the cross-chain transaction aggregator LI.FI. LI.FI allows users to exchange tokens or cross-chain operations through more than 15 DEXs and more than 20 cross-chain bridges in one interface, which is a reflection of the openness of DeFi applications.

By mixing different DeFi building blocks, the Defi protocol can create customized solutions that meet specific market needs and leverage the advantages of multiple platforms to solve problems. This is fully reflected in the cooperation between Morpho (MORPHO), MakerDAO (MKR), Spark and Ethena (ENA).

Morpho's infrastructure Morpho Blue and MetaMorpho as the underlying architecture enable Spark to allocate liquidity from MakerDAO to obtain sUSDe benefits in Ethena. This collaboration highlights the potential of Defi composability to facilitate innovation in financial instruments, which is difficult to achieve in traditional finance.

As mature DeFi protocols establish good reputation and achieve a more simplified integration method, composability among protocols will accelerate development. Protocols like Morpho that offer customizable lending services, and protocols like Ethena that provide high stablecoin returns will lead the wave of Defi integration across protocols and DAOs.

Source:DeFi Value Flows: Understanding DeFi Business Models and Revenues | by Aw Kai Shin

**DeFi infrastructure is developing rapidly (taking Uniswap, Ethena, and

LayerZero as examples)**

In 2022, Dan Elitzer published an article discussing the inevitability of "Unichain", which he believes is the reason for this trend lies in inefficiency and value loss in existing DEX systems. As mentioned in this article, Uniswap traders face three major costs: transaction fees paid to liquidity providers, gas fees paid to Ethereum validators, and MEV costs.

Uniswap announced its own Unichain in 2024, aiming to address issues related to execution quality, user experience and liquidity fragmentation, which allows Unichain to capture more value from its user base and add application scenarios for UNI tokens. Not only Uniswap, but other DeFi protocols have also announced the launch of their own dedicated infrastructure - Fraxtal of Frax Finance, Swell Protocol's Swellchain, Worldcoin's Worldchain, Zerion's Zero Network, etc.

What’s unique about these facilities is that no entity can control its “value stream” and each participant can participate in building or scaling to maximize the capture of value. In traditional business systems, how value is captured by others and how much value can be captured through expansion are very vague, and there is very little public information. However, it is different in the field of encryption. Agreements are sovereign, while the market is driven only by supply and demand.

In this trend, I think Ethena and LayerZero are the two protocols that capture the most value. Ethena grew from 0 to $6 billion in a year, becoming the most successful DeFi project in this cycle. They are preparing to launch their own infrastructure to increase the application scenarios of ENA tokens and build an ecosystem for their stablecoin USDe.

As Ethena's infrastructure implements token deployment through LayerZero's OFT (Omnichain Fungible Token) framework, the protocol's revenue will further grow. In addition, the DeFi protocol extends the infrastructure by building its own Rollup or deploying it to multiple public chains, with cross-chain security being crucial. In this scenario, LayerZero (ZRO) can provide the best experience.

**The integration of DeFi and traditional finance is deepening (taking

Ondo and Ethena as examples)**

In the past, users in the crypto space were basically limited to anti-government and radical traders. However, as DeFi's advantages in asset management become increasingly obvious, traditional finance (TradFi) has gradually entered the field of crypto. At present, the two major traditional financial groups are slowly integrating into the DeFi ecosystem.

First, there are fintech companies, which have been promoting innovation at the traditional financial level within the scope of regulation. Fintech was relatively late in the rise - before 2010, mainstream payment methods were limited to bank transfers and cash. The advent of mobile Internet has promoted the development of financial technology, and companies such as Stripe, Robinhood and Revolut have emerged one after another, providing better services for payment, transactions and asset management.

The DeFi protocol is also designed to improve the financial system, but is outside the regulatory boundaries. The experimental spirit of fintech companies has prompted them to enter the crypto field. More obvious examples include PayPal's stablecoin PYUSD launched in the Solana ecosystem, TVL has reached $500 million, and bridge.xyz acquired by Stripe for $1.1 billion. In addition, Robinhood is also preparing to launch stablecoins, and Revolut is also participating in DeFi activities, which show that the integration of DeFi and fintech is accelerating.

In addition to fintech companies, traditional financial institutions such as BlackRock and JPMorgan Chase are also actively exploring the crypto ecosystem. Compared with the $5.2 billion revenue that Tether has set in the first half of 2024, BlackRock's net profit in the same period was only $3.126 billion. This comparison makes traditional institutions also hope to get a share of the cryptocurrency field.

It is worth noting that BlackRock has launched BUIDL, a stablecoin with a source of income from Treasury bonds. Encrypted native protocols such as OndoFinance (ONDO) are working closely with financial institutions within the regulatory framework, while protocols such as Ethena have integrated with BUIDL to provide a wider channel of treasury bond yields for on-chain users. With the lowering of regulatory thresholds and the continued growth of the stablecoin market, the integration of DeFi and traditional finance will continue to accelerate.

JW: Adoption of consumer applications and application-centered ecological

transformation

Portfolio:Pengu, Abstract, MegaETH

The rise of speculation as a product and consumer application

2025 is expected to become a breakthrough year for consumer applications in the crypto field. Historically, the crypto space has always followed a familiar evolutionary model: starting with early users represented by fund traders and gradually expanding to a wider audience. We have witnessed this model in the development of Bitcoin, stablecoins and DeFi. Now, the consumer application track is gradually active in the public eye.

In order to make the crypto field no longer only have experienced traders to compete with each other, it is necessary to expand the influence of the crypto field and attract new users and capital to drive the growth of the ecosystem. This evolution is likely to be achieved through more simplified applications that can take advantage of some of the unique advantages of encryption technology, including meme, SocialFi, NFT and Gamefi. I predict that these areas will regain market attention, but compared with the previous few cycles, the approach will be more mature and complex.

Excitingly, the industry is turning to developing products that are easy to use for users. Whether through meme, NFT or AI-related applications, we have seen a new wave of applications that effectively leverage the unique advantages of encryption technology and create a unique user experience.

The AI Agent and DeSci projects that have begun to gain attention in 2024 can be seen as classic cases of speculation evolved into unique tracks and use cases. Users who initially entered the field due to speculation tend to delve into a broader crypto use case such as DeFi, stablecoin payments and forecasting markets.

Current market conditions are particularly suitable for mainstream consumer applications in the encryption field, because the user experience has been significantly improved compared to before: wallets are more intuitive and seamless, mobile accessibility is greatly improved, and previous technical obstacles surrounding scalability have been basically solved. These improvements have enabled the crypto market to gain a user experience close to traditional financial services.

As market sentiment generally develops in a positive direction, we may see the continued growth of user Adoption. In addition, with the Trump administration turning to more friendly crypto regulations, the United States may have a more favorable regulatory environment for crypto and catalyze the active evolution of global markets in regulation.

The rise and decline of AI Agent

After $GOAT appeared at the end of 2024, AI Agent has become the hottest track in the crypto field and is expected to reach a higher peak in 2025. As we have seen, new technologies are good at capturing public imagination and spawning powerful Memes. From the metacosmic boom to modular blockchains, to today's AI Agent, each wave represents extreme optimism driven by technological innovation and speculative fanaticism. It should be clear here that we are discussing AI Agents in the field of encryption, rather than the traditional AI industry.

There is a key difference between the AI Agent and the previous tracks. Fields such as DeFi and modular blockchain have successfully gained a foothold after their bubble burst, entered the "enlightenment slope" stage based on actual utility, and have been steadily adopted. However, today's AI Agents are different from them, and are more similar to the hype cycle like the metaverse. Both face the same problems: unclear use cases, unclear target users, and value propositions are covered up by buzzwords.

Looking ahead, although AI Agent may continue to dominate market attention and achieve rapid price increases driven by technological narratives, the field also faces major hidden dangers. Without significant long-term growth momentum or specific use cases, AI Agent may only decline sharply and it will be difficult to recover. Whether investors in the AI Agent track can make profits can only depend on whether they can cash out their profits and exit before the bubble bursts.

Dynamic changes between chains and applications

In 2025, the crypto industry may undergo a fundamental shift in the traditional relationship between chains and applications. Public chains have long been seen as the center of the ecosystem, but this concept is being challenged as the industry accelerates its transition to an application-driven paradigm. The traditional model of the crypto industry is top-down, and blockchain is the basis for the development of the ecosystem. Although the highly anticipated public chains in 2025 will enter the public eye, including Monad, Bera, MegaETH and Initia, this may be the last generation of universal blockchains that can be successfully launched.

The future trend of blockchain development is shifting from general public chains to two completely different models: one is to expand mature applications into a complete ecosystem like HyperLiquid and Ethena, and the other is to launch its own blockchain with successful protocols like Uniswap.

The industry's financing landscape is also evolving with this change. Community-centric token distribution has become increasingly important, MegaETH successfully revives the ICO model, and large-scale airdrops from HyperLiquid and Pudgy Penguins are also successful. The focus of such projects has shifted from traditional VC financing to user adoption and community engagement. Especially when mature applications launch their own tokens or chains, they can use existing user groups to generate liquidity and network effects to reduce their dependence on traditional financing channels.

Ingeun: The blockchain infrastructure behind Bitcoin is ready to go

Portfolio:Ethereum, Solana, Ethena, Mantle, EigenLayer, Puffer Finance, Zircuit, EtherFi

In the 2024 bull market, the price of Bitcoin rose by more than 2.4 times from its previous lows. Although factors such as Bitcoin’s four-year halving cycle and Trump’s re-election of the US president have brought positive effects, I think this is not the main driving force for Bitcoin’s growth, but the gradual transformation of the public’s perception of cryptocurrency, the further development of the blockchain industry, and the participation of traditional financial forces in the crypto ecosystem.

As a weather vane for the blockchain industry, the rise in Bitcoin’s price will naturally drive the rise of other cryptocurrencies. However, because Bitcoin is dominant and capital is highly concentrated on Bitcoin, capital redistribution in other areas of the crypto industry has not yet fully occurred. In past bull markets, the price increase in Bitcoin was often accompanied by a decline in its dominance as capital flowed into altcoins.

While many are still concerned about Bitcoin’s continued rise, capital is expected to be redistributed to other projects such as Ethereum and other public chains, as well as L2 in 2025. These projects have been silently prepared under the light of Bitcoin, and as capital flows in, they may shine this year. My investment portfolio is exactly the idea of extending this, and below I will explain my views on some excellent projects.

Critical Infrastructure Chain: Ethereum and Solana

Ethereum is facing considerable challenges in this bull market. Although Ethereum holders have high expectations for it and ambitiously announced the Beam Chain and its future roadmap at the 2024 Devcon Conference, Ethereum's development is overshadowed by the continued progress of the new public chain led by Solana. The comparison with the latter makes Ethereum quite difficult in 2024, which is fully reflected in its price performance.

Judging from the ETH/BTC price trend, Ethereum has been on a downward track recently. While it still maintains its second largest cryptocurrency position, second only to Bitcoin, the momentum has weakened significantly. Despite this, I believe Ethereum is about to rebound. Although many public chains are competing for the throne of Ethereum, Ethereum still has an overwhelming advantage in scale. Among its competitors, Solana is the strongest rival, yet Ethereum's market value (as of January 14, 2025) is still more than four times that of Solana, and its assets locked in the Ethereum DeFi ecosystem are also seven times that of Solana.

In addition, Ethereum is the first crypto asset to be approved by ETFs after Bitcoin, which is easier for traditional financial institutions and institutional investors to participate. Funds inflows through Ethereum ETFs have steadily increased, with net inflows reaching a record $2.08 billion in December 2024, more than double the $1 billion in November. It is worth noting that BlackRock's ETHA fund flowed in $1.4 billion in December, while Fidelity's FETH fund flowed in $752 million.

Ethereum is continuing to strengthen its foundation both internally and externally. The previously unstable Layer2 ecosystem is now mature and plays a role, and Ethereum's emphasis on ZK is also growing steadily with the support of numerous projects. At the same time, Ethereum's Restaking Service originated from the consensus system within its ecosystem, has a unique positioning and is constantly improving.

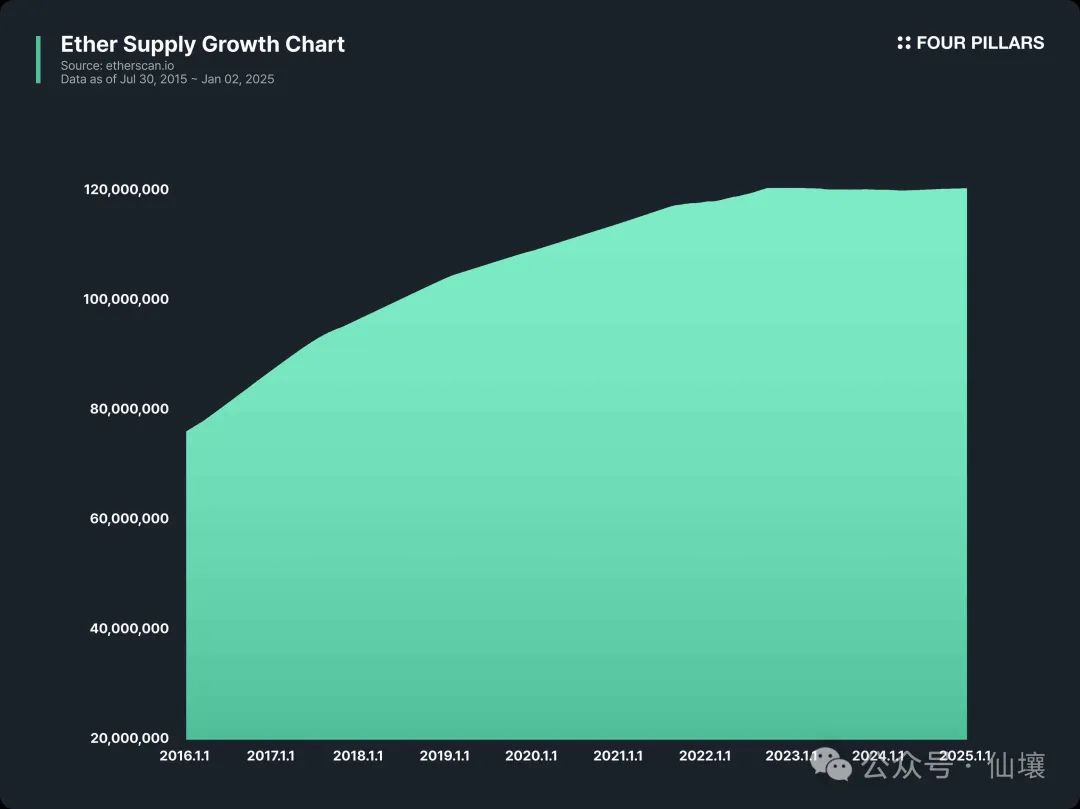

The lack of fixed caps for ETH is one of the biggest concerns among Ethereum investors, but the problem has been greatly alleviated. Since the London hard fork in August 2021, Ethereum's additional issuance has decreased, and its current circulation supply is partially deflated, promoting the stability of ETH prices.

Is Ethereum in crisis in early 2025? My answer is yes. But crises are often accompanied by the best opportunities. Ethereum has introduced the global computer concept that Bitcoin cannot be structurally realized and has continuously improved itself. In 2025, Ethereum will overcome its own crisis and prove its value as a trump card public chain.

Ethereum’s most powerful competitor, Solana, is actively catching up with the former in various areas of the blockchain ecosystem. Solana's ecosystem has developed to a considerable scale, unparalleled in public chains outside Ethereum, and has a unique scale advantage.

Source:Solscan

Solana prioritizes performance and user-friendliness rather than emphasizing decentralization like Ethereum. While this means that Solana's operating structure is slightly centralized, it can achieve TPS of thousands of transactions per second, which provides Solana users with a near-seamless environment without taking unnecessary risks.

Additionally, Solana leverages its vast developer and user community to maintain its position at the forefront of technology and markets. In the early stages of this bull market, Solana led the trend of Meme coins and surpassed other chains through faster cultural Adoption. Recently, Solana has followed the AI trend by organizing activities such as AI Hackers and others, demonstrating its ability to continue to lead new trends.

Unlike Ethereum's narrative development, Solana has been reshaping the crypto field's view on decentralization. It raises a fundamental question: If the high decentralization advocated by Ethereum ultimately has a negative impact on users, should we still pursue decentralization at all costs?

With Ethereum as a powerful opponent and various L1 chain challenges below, Solana's next move is crucial. As it continues to blaze its own unique path, I will continue to pay close attention to how Solana evolves in the crypto space.

The continued growth of the Restaking ecosystem

“Restaking allows users to reuse pledged assets, providing additional economic security for multiple public chains or applications, allowing pledged assets to be reused, improving scalability and liquidity, and receiving additional rewards.”

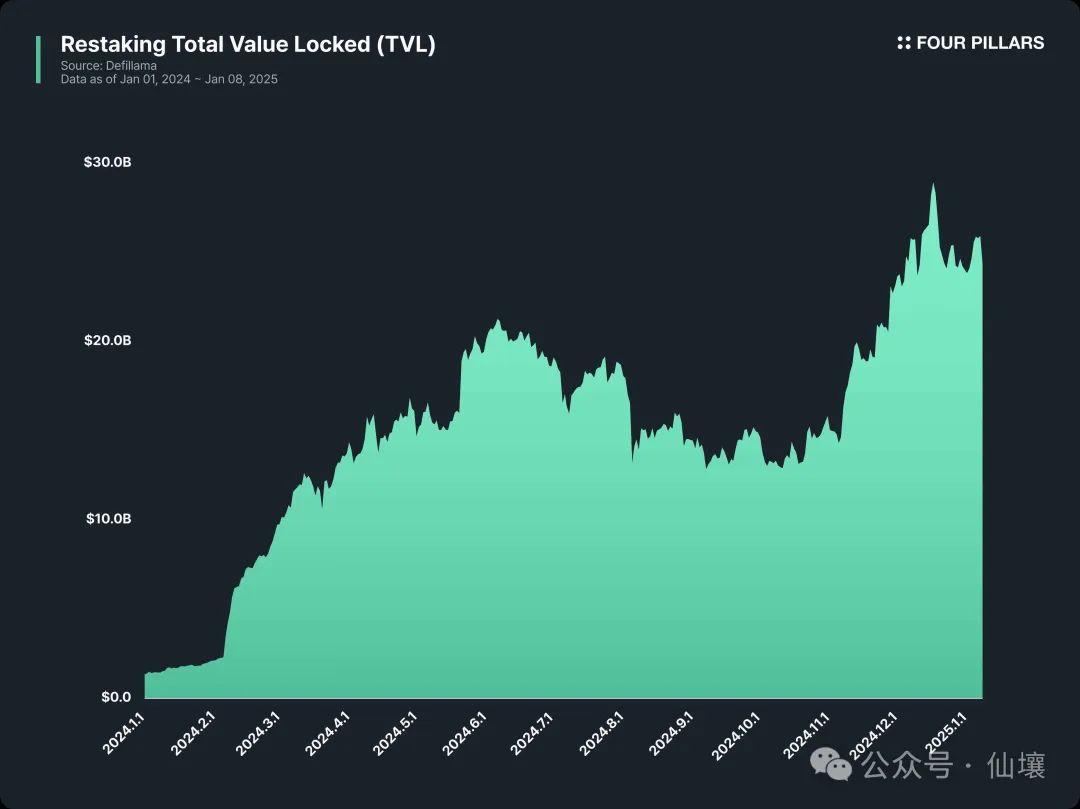

As mentioned above, Restaking is a financial engineering-based solution. Significant growth was achieved in 2024 by reusing pledged assets to improve scalability and liquidity.

It is worth noting that EigenLayer, which is a Restaking ecological facility, and platforms such as EtherFi, PufferFi and Zircuit, have attracted a lot of funds and promoted the expansion of the Restaking market.

If the keywords of Restaking in 2024 are “Restaking debuts” and “Focus on Ethereum,” then the keywords of 2025 may be “The emergence of more Restaking participants” and “The expansion of Restaking to other L1 chains.”

Ethereum is arguably the birthplace of Restaking, and competition among infrastructure providers such as EigenLayer, Symbiotic and Karak is intensifying. Although Symbiotic and Karak are new entrants to Eigenlayer and currently manage less pledged assets than EigenLayer, they are actively opening up their own niche.

For example, Symbiotic supports the resting of multiple assets such as Ethena (ENA) to attract more deposits, while Karak makes itself more unique and competitive by supporting cross-chain asset pledges, including Arbitrum, Mantle and BSC.

Therefore, in 2025 we may witness fierce competition among Restaking providers within the Ethereum ecosystem. Meanwhile, the Restaking narrative may expand to ecosystems outside Ethereum and enter a new stage of growth. Among them, BTC and Solana are the key ecology of the expansion of Restaking narratives.

Using its unparalleled total asset size, Bitcoin can use Restaking as a means of generating additional profitability on other blockchains. Babylon is a project that uses Bitcoin staking and Restaking mechanisms to enhance the security of other PoS chains. It is worth noting that Babylon allows BTC to be staked directly on the Bitcoin network without bridging or mapping encapsulation, providing greater usability and simplicity.

Solana's high-speed transaction speed and low fees have promoted the development of numerous Restaking services such as Jito and Solayer. As a well-known staking provider in the Solana ecosystem, Jito has expanded its expertise to the Restaking field and provides stable and reliable Restaking solutions based on its mature staking technology.同样,受EigenLayer启发的Solayer专注于提高便利性,同时进一步推动Solana生态系统的发展。

2025年,Restaking赛道内的竞争将不仅在以太坊内部加剧,还会在比特币和Solana等其他L1链中展开。Restaking将继续作为区块链生态系统中的关键创新不断演进。

新年值得关注的区块链项目

2024年出现了众多新项目。2025年,那些在2024年夯实基础的项目与今年新涌现的项目之间会有一番角逐。从这个角度来看,我们可以着重关注Ethena和Mantle。

Ethena在美元稳定币中脱颖而出,成为了增长最快的项目之一。它通过独特的高收益策略、BlackRock BUIDL支持的安全抵押管理、靠美国国债实现的稳定性,以及Ethena网络的全面扩展计划,在2024年实现了显著增长。

Source:The Verge of Crypto Dollar War and Strategy of Ethena (Feat. UStb, Network) | 4Pillars

Ethena的美元稳定币USDe通过质押奖励、delta中性市场策略和流动性稳定币收益为用户提供明确收益而脱颖而出。这导致大量资金从USDT和USDC等其他美元稳定币流入USDe。随着用例的持续增长以及金融科技公司越来越多地采用稳定币,其在市场中的主导地位应会持续下去。基于这样的趋势,Ethena和USDe的增长也应会在2025年继续。

Mantle在2024年通过推出Mainnet V2、提供质押奖励和分发其他代币的空投来扩大其影响力。这些努力使得Mantle扩大了用户群体,并建立了强大的存在感。在技术方面,Mantle与Succinct合作,探索从基于Optimism rollup过渡到ZK rollup的模型。此外,Mantle与Chainlink合作,整合Chainlink跨链互操作性协议CCIP,为将Mantle生态升级为多链生态奠定了基础。

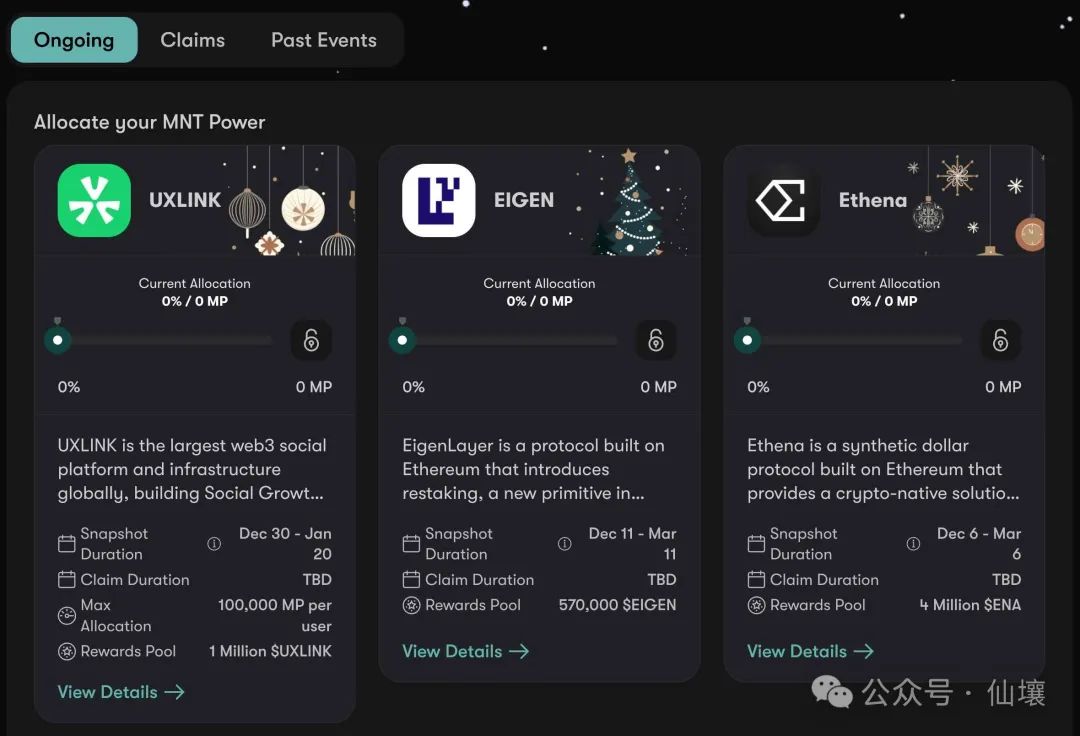

Source:Mantle Reward Station

从生态系统角度来看,Mantle巩固了与Bybit的合作关系,扩展了Mantle的用例并增加了其用户基础。此外,Mantle的质押计划允许用户赚取MNT Power(MP)作为奖励,可以参与其他空投,从而促进用户积极参与。这些举措使得Mantle在市场中的推广非常有效,且我预计这一势头将持续到2025年。

Mantle与Bybit有着密切的关系。Bybit是一个正在迅速追赶币安的交易所,Mantle与Bybit的合作为其进一步增长奠定了良好基础。Mantle持有者数量的增加可能会带来主网上更多的活跃度,形成有利于整个Mantle生态的正向反馈循环。在这一趋势下,2025年有望成为Mantle生态大幅扩张的一年。

Eren:链上市场的新角色与AI Agent热潮引领的发展方向

投资组合:Virtuals Protocol, Axal , Tetsuo , Redacted Research and Development

零散资金流入的催化剂:链上小市值交易

链上流动性向中小型资产的流入预计将进一步加速。与中心化交易所上上线大市值资产相比,这些资产将创造更多元化的机会,因高预期回报成为吸引散户进入加密市场的关键驱动力。这种链上发行资产的模式在去年的memecoin周期中已经显现。过高的VC币估值导致了所谓“高FDV”的现象,VC币的回报预期下降,很多人将注意力从CEX上的VC币转向链上memecoin交易。

在此背景下,去年最令人印象深刻的,或许就是memecoin价格大幅上涨,比如Chillguy和Moodeng。Phantom钱包在应用商店下载量中名列前茅,这也表明即使是之前没有链上经验的用户,现在也开始积极使用链上钱包和Moonshot等工具,交易memecoin这样高回报预期、高风险的资产。

这一场景标志着加密Adoption的重要转折。虽然我们此前判断,通过基础设施开发和新的应用来吸引和承载链上用户是关键,但加密市场独特的投机性及其高回报预期,无疑可以成为推动加密Adoption的催化剂。

因此,2025年相较之前更加明显的变化将是,链上中小市值资产交易不再仅限于老用户,而是成为零散资金流入的强大催化剂,由此产生的趋势值得关注。例如,DEX交易量相对于CEX的占比预计将持续增加,适合创建中小市值资产的新叙事可能会不断出现,就像AI Agent和DeSci赛道那样。

此外,如Daos.Fun在Pump.fun模型之外整合融资过程,这样的项目构建方法预计将成为主流,同时项目必须保证公平启动。

AI Agent浪潮中,哪些会存活,哪些会消亡

去年,AI Agent在整个市场中占据超过70%的关注度,是表现最突出的叙事。即使在2025年的今天,AI Agent周期仍在继续,加密与AI Agent的结合仍将是一个关键话题,因为AI被认为是几乎所有行业的关键词。然而,假设加密市场逐渐消退并进入长期的调整阶段,我们预计一旦由短期投机需求推高的兴趣消退,将只有一部分AI Agent项目存活下来,而另一批会走向消亡。

在这种市场条件下,能够存活的项目是那些超越技术想象和具备新颖想法,又不乏实际价值的项目,Virtuals Protocol就是一个典型例子。考虑加密与AI Agent结合在创建可持续用例和业务方面的长期可行性,Virtuals Protocol为AI Agent开发框架和AI Agent代币创建启动平台,提供了集成服务,这将保证其在AI Agent市场中作为生态系统基础层的独特地位。

值得注意的是,$VIRTUAL代币与所有AI Agent代币配对交易,并在人们使用启动板等工具时像基础货币一样被消耗。这种“从所有平台互动中积累价值”的代币模型,是支持Virtuals Protocol可持续增长的关键基础。

与此同时,从AI Agent生态系统必须产生实际利润的角度来看,DeFi与AI Agent的结合似乎是最合理的路径。DeFi协议中的交易费用、借贷利差和通过结构化产品产生收益,已经被明确验证有PMF空间。

因此,与其让AI Agent在游戏或社交等领域开拓新业务,不如将其作为解决DeFi低效问题的解决方案引入尤其是作为自主投资组合管理工具、基于自然语言的用户体验改进和自动化交易工具的AI Agent,预计将成为引领AI Agent与加密整合的关键用例。

Ponyo: AI, DeFi, Hyperliquid

投资组合:Pudgy Penguins , Ethena, FARM, MIZUKI

今年加密领域的三大趋势是:

- 加密与AI的融合

- 由费用开关模型激活驱动的DeFi复兴

- 由Hyperliquid推动的空投和ICO的复苏。

第一个趋势已经引起了前沿AI研究分析师的广泛关注,本节将深入探讨后两个主题。

DeFi复兴:费用开关革命

如今,大多数DeFi代币仅作为治理工具。虽然这与去中心化的理念一致,但只作为治理工具而没有赋能,代币为持有者提供的实际经济价值有限。尽管许多DeFi协议的运营表现强劲,但其代币价格仍然被低估,也反映了这些资产的有限效用。

在此背景下,费用开关模型——将协议收入的一部分直接分配给代币持有者——长期以来一直被认为是重新评估DeFi代币,并提升对投资者吸引力的潜在催化剂。

然而,此类机制的落地多次被监管阻碍。美国证券交易委员会(SEC)将收入分配代币归类为证券,给协议带来了重大的合规负担。Uniswap通过三次独立的治理投票多次尝试激活费用开关功能,但因监管风险的担忧而受阻。值得注意的是,a16z等有影响力的利益相关者反对这些提案,突显了DeFi领域内更多元化的隐患。

该情况在2024年唐纳德·特朗普赢得总统选举后发生了戏剧性转变。随着共和党控制了白宫、国会和最高法院,加密政策的前景显著改善。新政府已表示有意将美国定位为全球“加密之都”,甚至探讨将比特币纳入其战略储备。

这一政策转变体现在很多关键岗位的任命上。保罗·阿特金斯(Paul Atkins)作为新任SEC主席,大卫·萨克斯(David Sacks)作为白宫加密政策顾问,引入了更具建设性的方法。诸如撤除“Chokepoint 2.0”和成立专门的加密咨询委员会等举措,剑指当下亟待解决的监管清晰度问题。加里·根斯勒(Gary Gensler)的离职以及随后SEC立场的转变,显著缓解了市场参与者的合规压力。

在这种乐观情绪的推动下,几个前沿的DeFi协议正在积极重新考虑费用开关模型。像ENA、UNI、AAVE和RAY这样已证明有收入流的知名协议正在参与治理讨论,以实施收入分享机制。随着监管范围逐渐清晰,这些协议有望将其代币经济学锚定在可持续的收入分配上,从而缩小投机价值与基本财务指标之间的差距。

这一演变标志着DeFi复兴的新曙光,与2020年由流动性挖矿和创新产品激增推动的DeFi Summer爆炸式增长不同,这次复兴优先考虑可持续模式、持续的收入生成以及DeFi代币的重新估值。随着这些变化不断发生,DeFi协议有机会巩固其相对于传统金融系统的竞争优势,提供基于实际经济利益的去中心化解决方案。

由Hyperliquid推动的空投和IC0复苏

2024年市场的决定性时刻之一是Hyperliquid的崛起。在11月29日TGE后,HYPE代币在一个月内突破了340亿美元的FDV,截至2025年1月14日,其交易估值约为200亿美元。然而,Hyperliquid的影响力远不止体现在估值上,其对社区至上理念的坚定承诺,为未来几年Web3项目的发展轨迹树立了先例,可能重新定义行业标准。

Hyperliquid完全通过自筹资金运营的决定打破了传统模式。通过确保所有参与者机会均等,并拒绝向私人投资者或做市商分配代币,该项目直接挑战了通过VC融资抬高估值的常见做法。后者通常让散户投资者在高价位上承受代币抛售的压力。Hyperliquid的模式迫使行业重新审视代币分配标准,推动行业朝着更公平和透明的方向发展。

随着我们进入2025年,基于社区融资模式的复兴似乎是不可避免的。虽然2018年的ICO热潮因骗局和监管模糊而蒙上阴影,但在特朗普政府下更清晰的监管可能会使市场恢复相互信任的环境和结构。像Echo和Legion这样的平台已经在利用这一转变,这也标志着Web3去中心化理念的广泛回归。

Hyperliquid还重塑了人们对空投的看法。在传统模式下,空投因未能培养长期社区信仰而受到批评,通常作为短期激励措施,影响有限。一些项目创始人对此持怀疑态度,认为它们是成本效益低下的营销活动,加速了用户流失而非促进留存。事实也确实如此,许多用户参与空投只是为了获得一次性奖励,随后迅速退出。市场普遍认为空投是一种无效且不可持续的营销工具。

然而,Hyperliquid通过将70%的HYPE代币供应分配给社区,并展示如何利用空投分享奖励和共同促进增长,挑战了传统模式下空头的叙事。通过优先考虑社区,Hyperliquid展示了空投在建立忠诚度和长期参与方面的潜力。受此成功的启发,其他项目也开始采用类似策略。例如,Azuki最近宣布将50.5ANIME代币分配给社区。因此,空投模式有望复苏,且可能成为2025年的决定性主题之一。

Hyperliquid的成功得益于其对产品质量的承诺。通过在代币发行前实现PMF,Hperliquid将实用性和社区信任置于投机收益之上。这一策略不仅巩固了其声誉,还为旨在实现Web3长期可行性的项目提供了路线图。

Hyperliquid的开创性方法为Web3的未来提供了蓝图。虽然复制其成功可能具有挑战性,但其公平、透明和产品优先增长的原则将影响新一代项目。随着这些新模式、新思路获得关注,2025年可能朝着实现Web3去中心化价值创造和公平参与的基础理想迈出重要一步。

chaincatcher

chaincatcher