"312" previewed in advance? Over US$120 million on-chain liquidation is approaching, and the crypto market is still waiting for key catalysts

Reprinted from panewslab

03/11/2025·2MAuthor: Nancy, PANews

On the occasion of the fifth anniversary of the 312 incident, the crypto market once again suffered a decline in the entire line, and the wave of large-scale liquidation on-chain increased the market's panic.

It may be liquidated on-chain of more than US$120 million, and **the

risk of liquidation of giant whale** holdings exceeding 100 million

As multiple negative emotions such as intensifying concerns about the US economic recession ferment, the crypto market has suffered a cyclical blow again, and market confidence has suffered a severe blow. CoinGecko data shows that the total market value of the crypto market has fallen to $2.66 trillion in the past 24 hours. Among them, the price of Bitcoin has fallen below $80,000, and the price of Ethereum has fallen below $2,000.

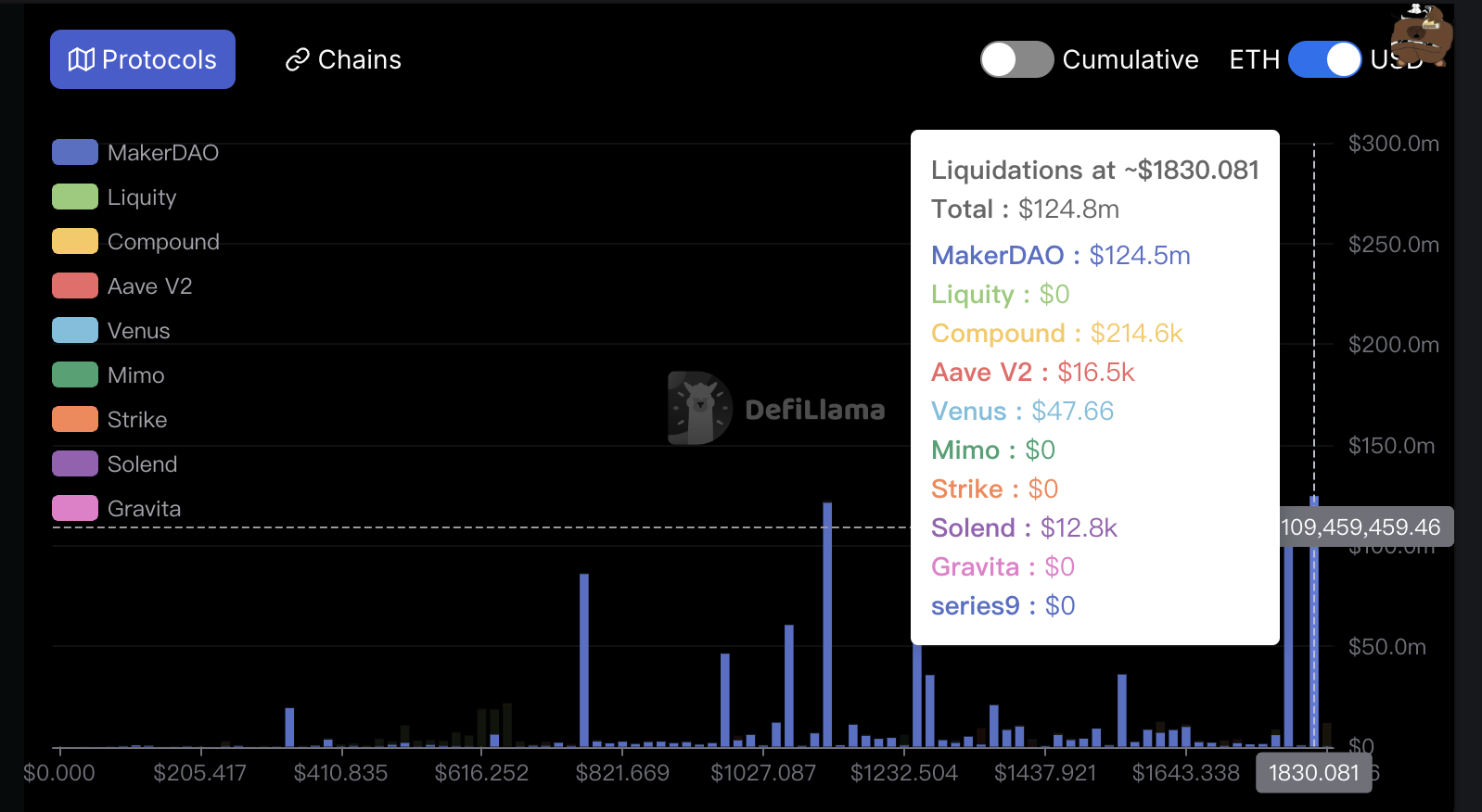

In this market environment, the continued decline in Ethereum prices significantly amplifies the on-chain clearing risks and scale. DeFiLlama data shows that Ethereum has a potential on-chain liquidation of nearly $124.8 million at the price of $1830.08. The liquidation mainly comes from the MakerDAO agreement, with a scale of US$124.5 million, accounting for as much as 99.7%.

In order to avoid forced liquidation, some giant whales had to bear the pain of cutting their flesh. For example, according to Paidun Monitor, an address holding 6370 weETH (total debt is approximately US$10 million) and 1500 weETH (total debt is approximately 2.27 million DAI) leveraged long positions have been liquidated. After the ETH price fell below $1,800, 2,160 rETH (worth about $4.63 million) and 6,4378weETH (worth about $1.23 million) were confiscated respectively; DeBank showed that a certain Aave giant whale 0xa33...e12c reduced the liquidation line in order to avoid liquidation selling 25,800 ETH to reduce the liquidation line, and the leverage loss reached $31.75 million.

At the same time, many giant whales of the MakerDAO protocol are also facing liquidation pressure, but the OSM mechanism of the protocol has demonstrated resistance to stress in the current environment. It is understood that since Maker uses the oracle security module (OSM), there is a delay of about 1 hour for system price updates (the median is calculated as a reference price through the Medianizer contract to prevent short-term fluctuations from being maliciously exploited), which provides these investors with supplementary collateral to avoid liquidation, and some of the giant whales have taken action to save themselves. Currently, the price of Maker oracle is still $1,806.31, and the price of ETH has rebounded. The latest oracle price is also higher than these liquidation lines. These giant whales temporarily avoid the risk of forced liquidation.

For example, Summer.fi data shows that a giant whale (address 0xab...2313) who holds 67,000 ETH (about 124 million US dollars) reduced its holdings of 2,882 ETH (about 5.21 million DAI) for repayment before the 10-point oracle price update, reducing the liquidation price from $1,798 to $1,781. Another address suspected to belong to the Ethereum Foundation (0x22...1246) deposited 30,098 ETH (about $56.08 million) into Maker 5 hours ago, increasing its total position in Maker to 100,394 ETH (about $185 million), and the liquidation price also dropped to $1127.06; a Maker giant whale (address 0x6b...30b3) holding 60,810 ETH (about $109 million) was cleared at $1,798.72.

As the on-chain liquidation activities and its risks intensify, the giant whales' self-rescue and the system mechanism's stress resistance are testing the resilience of the crypto market. Once the market deteriorates further, the space for the capital transfer of Giant Whale will be further limited, and these leveraged players may face more severe challenges. More large-scale liquidation events may aggravate the downward pressure on the market and form a vicious cycle.

**The resilience of the crypto market is facing a big test, and it still

needs key catalysts**

With the interweaving of global macro pressure and the deleveraging wave of crypto clearing, the resilience of the crypto market is facing severe tests. Market analysts generally believe that the uncertainty of the global macroeconomic combined with the tightening expectations of the Federal Reserve's monetary policy is the main driving force for the sharp pullback of crypto assets.

According to Bloomberg, escalating tariff war tensions and weaker expectations of further rate cuts in the Federal Reserve offset the positive impact of a series of U.S. President Donald Trump’s series of statements supporting cryptocurrencies last week. Risk assets such as cryptocurrencies have been under pressure since the Fed hinted in mid-December last year. Employment data last Friday showed that the U.S. unemployment rate rose from 4% to 4.1%, further exacerbating market uncertainty. "The 'underemployment' rate soared to a five-year high, exacerbating recession concerns and driving yields lower as rate cuts are expected to be advanced into early summer," said Augustine Fan, partner at SignalPlus, a crypto derivatives software provider.

Nexo analysts also said that the Fed is now facing a difficult policy environment. While weaker job growth supports the justification for rate cuts, ongoing inflation concerns — especially those stemming from supply-side restrictions and geopolitical uncertainty — may prompt the Fed to act cautiously, and an uncertain environment could put pressure on the cryptocurrency industry.

Deutsche Bank analyst Marion Laboure said that cryptocurrency volatility may continue to be high in a situation where Trump's Bitcoin reserve plan lacks clear details. There is uncertainty about the schedule, funding and allocation of the plan. The market is cautious and expects profit if the plan goes well, and may suffer losses if it encounters setbacks.

Matrixport also stated in its latest report that the White House crypto summit and the confirmation of the US strategic Bitcoin reserves failed to ignite market sentiment, the crypto market did not show a significant increase, and the perpetual contract funding rate still hovered at the single-digit level. This shows that retail investors' enthusiasm remains sluggish, in stark contrast to April and December 2024, when capital rates soared to double-digit highs. Even the market momentum brought by Trump's official inauguration is relatively flat, which clearly shows that Bitcoin still needs a more influential catalyst to usher in a new round of rise.

"Bitcoin's price trend is closely related to U.S. economic indicators. Here is a possible scenario: if there is an economic recession, the maximum potential decline of Bitcoin is about $50,000; if there is no recession, its base price is expected to be between $70,000 and $75,000. Key market observers are closely watching the Consumer Price Index (CPI) data released on Wednesday, which could have a significant impact on Bitcoin's price trend." DeFi analyst Adaora Favour Nwankwo said.

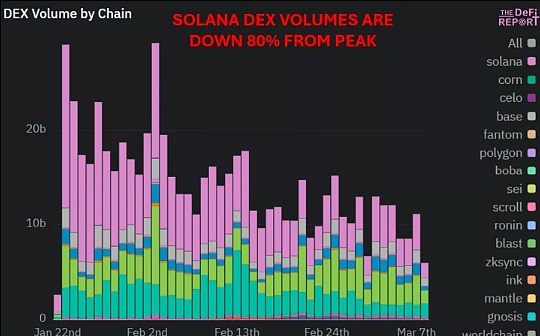

According to Bravos Research, the current crypto market is experiencing the largest altcoin liquidation since the LUNA crash in May 2022. The market has liquidated about $10 billion, far exceeding the situation after the FTX crash. Data shows that Bitcoin’s dominance continues to rise, indicating that there is no obvious seasonal signal for altcoin in the short term.

BitMEX co-founder Arthur Hayes believes that Bitcoin is a real free market and the stock market is subject to policy intervention, so in the event of a fiat currency liquidity crisis, the price of BTC will often lead the stock market to fall and also lead the stock market to rebound. Bitcoin may bottom around $70,000, which is equivalent to a 36% pullback from an all-time high of $110,000, which is a normal adjustment in the bull market. The next step is to pay attention to the plunge in U.S. stocks (SPX, NDX) and bankruptcy of traditional financial institutions. The Federal Reserve, the Bank of China, the European Central Bank and the Bank of Japan may adopt loose policies to stimulate the economy. He suggested that traders wait patiently. If their risk preference is high, they can try to buy at the bottom; if they are more stable, they can wait for the central bank's policy to turn and then take a heavy position to avoid the psychological pressure caused by long-term sideways or potential floating losses.

Degen Spartan suggested that the crypto market has gradually evolved from a "winner's game" that required superb technical abilities in the early days to a "loser's game". The core of the crypto market is to "don't die". By avoiding unnecessary risks, you will have the opportunity to wait for the future of the market when you survive.

jinse

jinse