Pantera Partner: Selling caused by tariff war has passed, BTC will re-enter the bull market

Reprinted from panewslab

04/30/2025·1MSource: Pantera Capital April 2025 Blockchain Letter

Author: Cosmo Jiang, partner at Pantera Capital; translated by AIMan@Golden Finance

In 2025, a series of events that occur in the cryptocurrency sector and in the broader macro environment have had an impact on the market. Large macro forces clearly dominate, with risk appetite in most industries and asset classes continuing to decline. While digital assets are leading the way in growth investments, they are far from being affected by them.

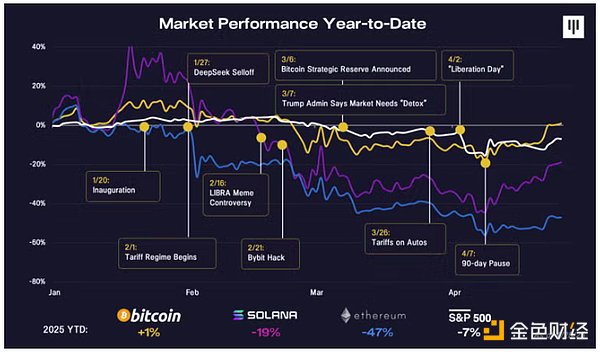

2025 started with an optimistic start, with political attitudes turning to cryptocurrencies, driving cryptocurrency prices to rise from the November election to January this year. However, after Bitcoin and Solana hit record highs in January, Trump's inauguration became a typical "buy the rumor, sell the news." Both the S&P 500 and Bitcoin fell 15-20% (although Bitcoin has rebounded since then). But from an internal perspective, high-growth and small-cap stocks performed worse. For example, Ethereum, the second largest token in market capitalization, fell 47%. This callback can be mainly attributed to macro factors and some problems unique to digital assets.

From a macro perspective, the market is worried about increased policy uncertainty and stagflation, which is a combination of slowing economic growth and rising inflation. Trump continues to implement his tariff plan (currently, "peer-to-peer" tariffs over 10% of the benchmark tax rate for 90 days, excluding China), which has reduced consumer confidence, corporate profits and GDP forecasts. This started with the first executive order at his inauguration, but the market did not really value him until the first round of tariffs against Mexico, Canada and China came into effect on February 1. Since then, every major tariff statement has caused the market to fall, and eventually peaked on the "Liberation Day" on April 2.

While tariffs have been the biggest driver of price movements, other adverse factors have also emerged, such as the Ministry of Government Efficiency (DOGE). The impact of DOGE is difficult to quantify, but from a qualitative perspective, it has a significant impact on the mindset of government employees and businesses serving the government. Given that government spending accounts for 23% of GDP and 25% of new jobs in recent years, any DOGE-driven spending cuts will have a tangible short-term impact on the economy. Whether these policies are good or bad, the speed and extent of their changes are completely different from previous governments. The market is concerned about uncertainty, and we have seen the default reaction: sell and take a more defensive position.

In addition, from the perspective of fundamental growth, the stock market was once supported by optimism about unlimited demand for AI hardware. But that optimism took a hit after the market began to digest the impact of DeepSeek's achievements. All public shares related to AI – and AI-related tokens – were sold out sharply, with many falling more than 50%.

The digital asset industry also faces some unique challenges. First, the bursting of the memecoin bubble. The decline began after Trump launched his own memecoin, and the decline accelerated further after the uproar caused by Argentina President Javier Milei and the manipulated LIBRA memecoin incident.

There has been a lot of debate about whether these events are good or bad—perhaps both. On the plus side, high-profile figures like Trump are bringing attention and new users to the field, inspiring imitators from the Web2 world. Tokens are the most disruptive form of capital formation we have ever seen, and I hope this will inspire more creative and productive token offerings in the future.

Meme, on the other hand, reinforces the average observer's perception of cryptocurrencies: cryptocurrencies are full of scams, which is a joke, which damages the reputation of developers who are serious about building cryptocurrencies. They also suck away liquidity and attention from other tokens. Moreover, since Meme coins are usually grabbing, it is difficult for other tokens to recover once the fanaticism fades.

The second largest exception in the quarter was the world's second largest exchange Bybit, which was hacked. While no loss of customer funds—Bybit successfully compensated—it still undermines confidence in the overall market structure.

When you put all these events together, you see how they drag the market down.

Cryptocurrency price performance

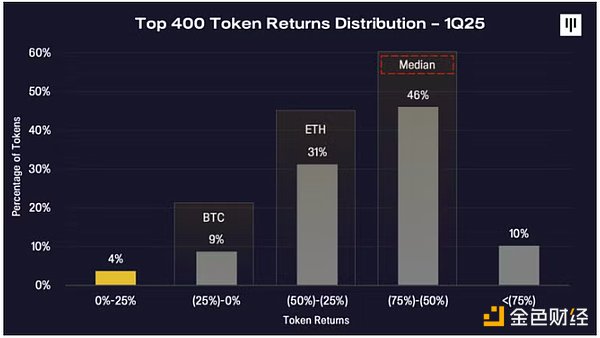

The sale is wide. In the first quarter, the median token price fell by more than 50%, and almost 100% of the token prices have fallen this year. It should be noted that this price trend is similar to the trend of the S&P 500 and its underlying components.

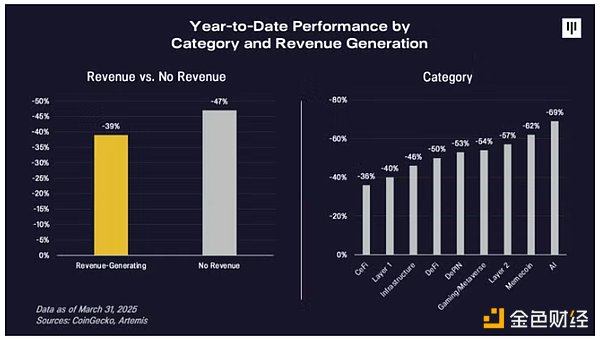

We believe that the market is increasingly focusing on tokens with stable fundamentals, and we also see this trend reflected in relative performance. Tokens with solid fundamentals (i.e. tokens with revenue and cash flow) have performed 8 percentage points higher than tokens without revenue. Memecoin and AI also performed worse than other tokens.

While this may be painful, we believe it is healthy to destroy capital for fundamentally worthless tokens.

Price performance, placed in historical context

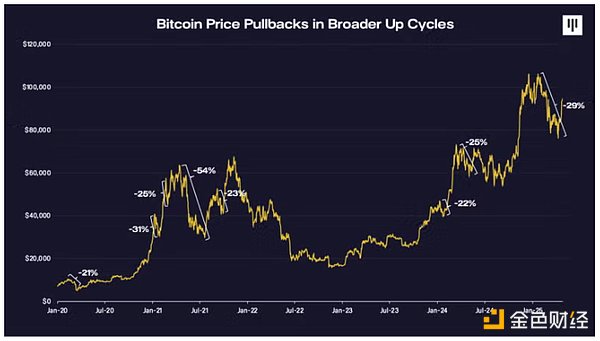

We've experienced many similar callbacks before. This is common in a wider bull market.

In the previous uptrend from 2020 to 2022, BTC has experienced five major pullbacks of more than 20%. Other tokens experienced a 40% to 50% callback. This happens from time to time even in strong markets.

In the current long-term uptrend, we have experienced three such pullbacks—including the one we are in now. Every time, being oscillated is a mistake. In fact, in the past week, the price of Bitcoin has rebounded to $95,000, with most of the gains occurring on Wednesday. For those with long-term investment vision, being able to withstand this volatility is a huge advantage.

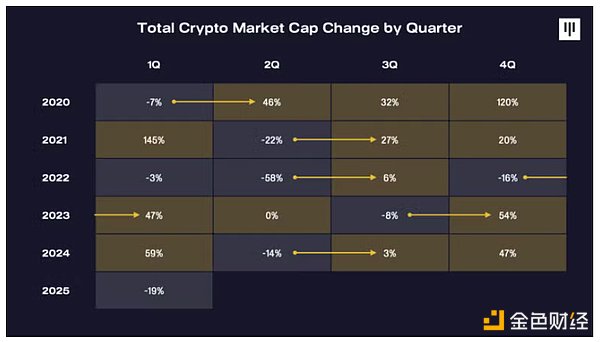

When analyzing quarterly changes in cryptocurrency market capitalization, a strong rebound is usually followed by a sharp decline, as indicated by the arrow.

Q1 2025 was the worst quarter for cryptocurrencies since the summer of 2022, when the market plummeted across the board. While past experience may not predict the future, a strong rebound will almost always occur after a sharp decline—although the magnitude of the rebound depends on current market conditions and, crucially, whether the overall trend can remain upward.

Are you greedy when others are afraid?

On April 15, 2025, I hosted a crypto market outlook call to discuss my views on the cryptocurrency market. I talked about some indicators that track market sentiment, which we think have reached all-time highs, indicating that some of the worst selling phases have passed. Although the market did rebound from the bottom, I would like to share my thought process on how I monitored market sentiment at the time:

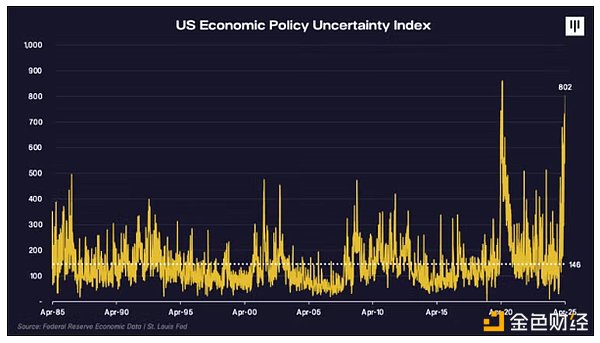

“The U.S. Economic Policy Uncertainty Index is at its highest level in 40 years, similar to the level during the COVID-19 pandemic and above any time since the investigation began in the 1980s, including above the level during the 9-11 incident and the 2008 financial crisis.

Uncertainty causes risk configurators to retreat. At this critical moment, you

need to ask yourself whether the environment will become more uncertain. From

a historical context, this seems unlikely to happen, instead, we should have

reverted to the mean.

Uncertainty causes risk configurators to retreat. At this critical moment, you

need to ask yourself whether the environment will become more uncertain. From

a historical context, this seems unlikely to happen, instead, we should have

reverted to the mean.

“The Crypto Fear and Greed Index takes into account a variety of factors such as technical momentum and social media sentiment to calculate the overall index score for the degree of greed and fear among market participants.

“During the sell-off period, we were once again caught in levels of extreme fear that had never been seen since the bear market trough and the FTX crash at the end of 2022. Whenever the market reaches this extreme level, negative sentiment often indicates a local bottoming for prices and a good point for future returns.

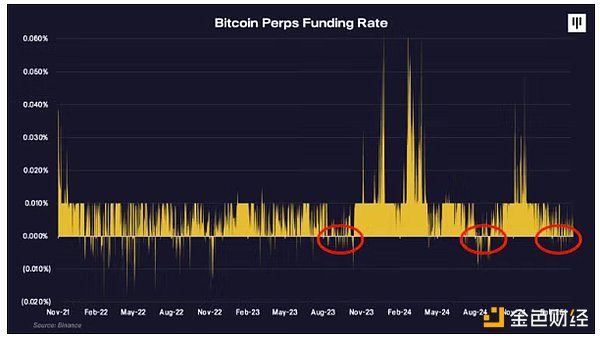

Next is the Bitcoin futures financing rate, which shows the proportion of participants in the futures market for long and short. Binance Bitcoin Futures' financing rate shows that more people short than those who go long in this market. This only happens during market downturns in previous cycles, usually before a significant rebound, as it did in late 2023 and late 2024.

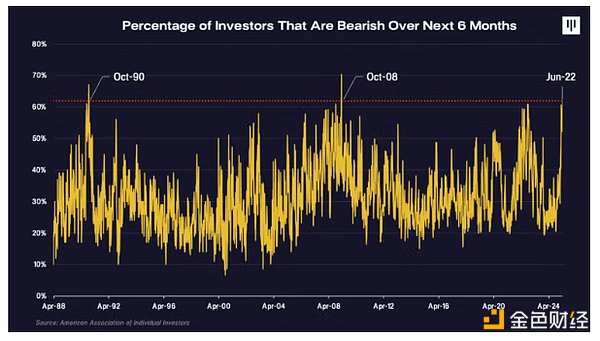

The last metric is the American Association of Individual Investors (AAII) Investor Sentiment Survey—a weekly survey conducted by the American Association of Individual Investors (AAII) shows that more than 60% of investors are pessimistic about the next six months. This has only happened three times since the survey began in the 1980s, during a period of sharp market corrections in 1990, 2008 and 2022.

Summarizing current market sentiment, these charts show that regardless of specific focus on crypto sentiment, cryptocurrency native positions and leverage, or the broader retail investor sentiment and policy uncertainty, have reached historical extreme levels. We may have passed the early stages of a radical sell-off based on this sentiment.

– Cosmo Jiang, General Partner, Pantera Capital, Crypto Market Outlook Call

The impact of macro events on cryptocurrencies

**Interest rate and liquidity conditions are beneficial to risky

assets**

At the same time, favorable interest rates and liquidity conditions are beneficial to risky assets.

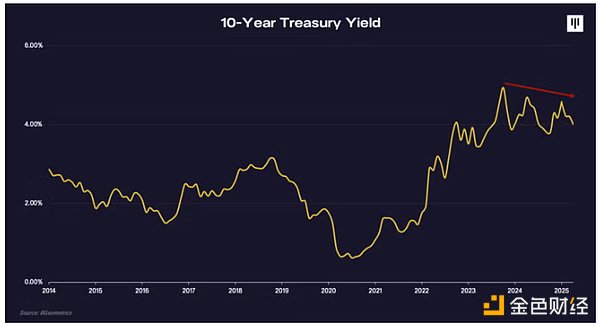

The 10-year U.S. Treasury yield has steadily declined after hitting a high in 2023, and has fallen rapidly in recent days. Interest rates remain at high levels longer and may continue to maintain against the backdrop of high inflation, but more importantly, the overall trend is downward. The Trump administration — especially Treasury Secretary Becente — has spoken about the importance of lowering long-term interest rates, and their policy actions aim to achieve that. Lower long-term interest rates are crucial for the U.S. to maintain spending financing and are also conducive to risk asset valuation.

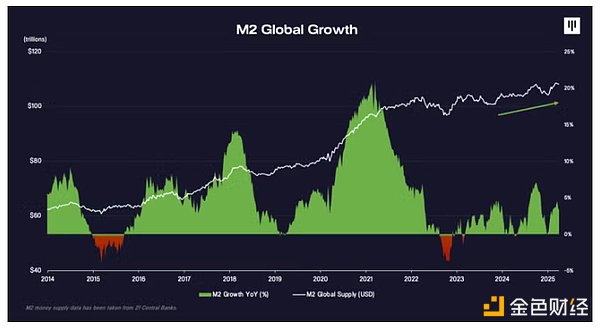

Global liquidity situation is also continuing to increase. After a period of austerity, Europe and China are currently implementing stimulus measures. We may be about to turn to quantitative easing. Treasury Secretary Becent and Fed Director Collins have both spoken over the past few weeks to deal with the turmoil in the bond market caused by soaring long-term bond yields. Their natural response will be to provide liquidity support, when several of the world's largest economies will work together. Increased liquidity is beneficial to risky assets.

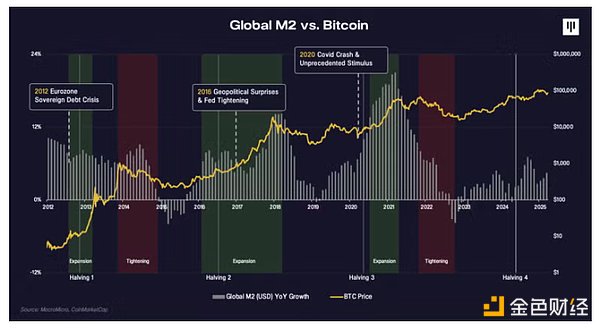

If we compare global liquidity with Bitcoin price, it is clear that the main upward trend of Bitcoin price occurs during periods of increased liquidity. And during periods of stress usually caused by tightening liquidity, Bitcoin will fall back along with all other assets. Therefore, we believe that the rise in global liquidity is an important indicator worth monitoring.

Another perspective on the four-year cycle of cryptocurrencies

This is a historic moment for the global economy: the S&P has just experienced its worst and best week-once happening. Typically, Bitcoin’s price fluctuates significantly due to major macro events that often coincide with the global liquidity cycle. 2012 is the euro zone sovereign debt crisis. 2016 is Brexit. 2020 is the economic collapse caused by the COVID-19 pandemic. Many people blame the Bitcoin price cycle on halving, but another explanation is that there are some major macroeconomic events every four years that just support the bull market in Bitcoin. We are in such a moment again.

Recent macroeconomic events are turning into a confidence crisis in the US dollar. Many pointed out that rising long-term Treasury yields predict turmoil in bond markets or capital flight triggered by foreign companies and entities divest savings from the dollar. The main function of Bitcoin is that it is a non-sovereign store of value. This does not necessarily mean that prices must be stable, but it is seen as an attractive alternative and diversified investment vehicle in an increasingly uncertain world. This de-dollarization undoubtedly confirms this argument.

Early signs of relative strength of cryptocurrencies

We are starting to see signs that digital assets perform better in a short period of time. As of April, digital assets performed relatively better than stocks and the US dollar. Solana and Bitcoin rose, while U.S. stocks fell. It’s too early, but just as digital assets are the first to pull back, they may also be the first to bottom out and rebound.

Positive industry development is ignored

Furthermore, we should keep in mind that many positive industry developments are overlooked in the context of price fluctuations. As far as policy actions are concerned, this includes the White House’s appointment of the “cryptocurrency tsar” and the establishment of a digital asset working group, the establishment of a strategic Bitcoin reserve, the revocation of strict regulations such as SAB-121 and DeFi broker rules, and the US SEC rejecting more than a dozen lawsuits against large companies. Arguably, the cryptocurrency industry has experienced the most positive headlines in history, many of which are structural changes, yet it has experienced its worst quarter since 2018. We believe that these good news is definitely not digested by the market, but is just ignored by market volatility.

Fundamentals are improving

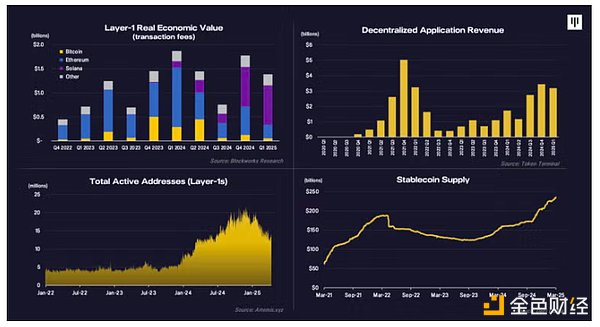

Most importantly, digital assets need real adoption and use to maintain. Blockchain companies are currently generating billions of dollars in revenue. Real Economic Value—a measure of total demand and value acquisition of L1 blockchain—was $1.5 billion last quarter, with an annualized $6 billion. During the same period, the total revenue of on-chain applications was approximately US$3 billion, with an annualized US$10 billion. Daily active addresses (measures of user activity) continue to hit new highs. As more and more people choose to use cryptocurrencies for payments and savings, the transfer volume of stablecoins and on-chain stablecoins has also hit record highs. In the early stages, innovation in key investment key areas such as stablecoins, artificial intelligence, DePIN and DeFi continued to be strong. We expect these basic indicators to be on the rise as more and more people discover the wonderful applications and opportunities offered on the chain.

in conclusion

All in all, this is a challenging quarter, with huge macro forces clearly dominating, resulting in a sharp decline in risk appetite. The biggest hidden danger remains the uncertainty surrounding tariffs and their impact on the global economy. The market outlook remains highly uncertain, which is reflected in the sentiment indicators at historical lows. However, these emotional signals also suggest that we may have passed the most radical selling point.

After we get through this tariff-driven volatility, I believe investors will start to appreciate all the long-term positives and strong fundamentals, and I still expect digital assets to perform strongly this year. As a pioneer of growth assets, cryptocurrencies are the first to pull back, but may also be the first to rebound and the fastest to rebound.

chaincatcher

chaincatcher