US stocks fell 5% vs Bitcoin rose 5.6%: The first asset rotation signal in the Trump era has appeared

Reprinted from panewslab

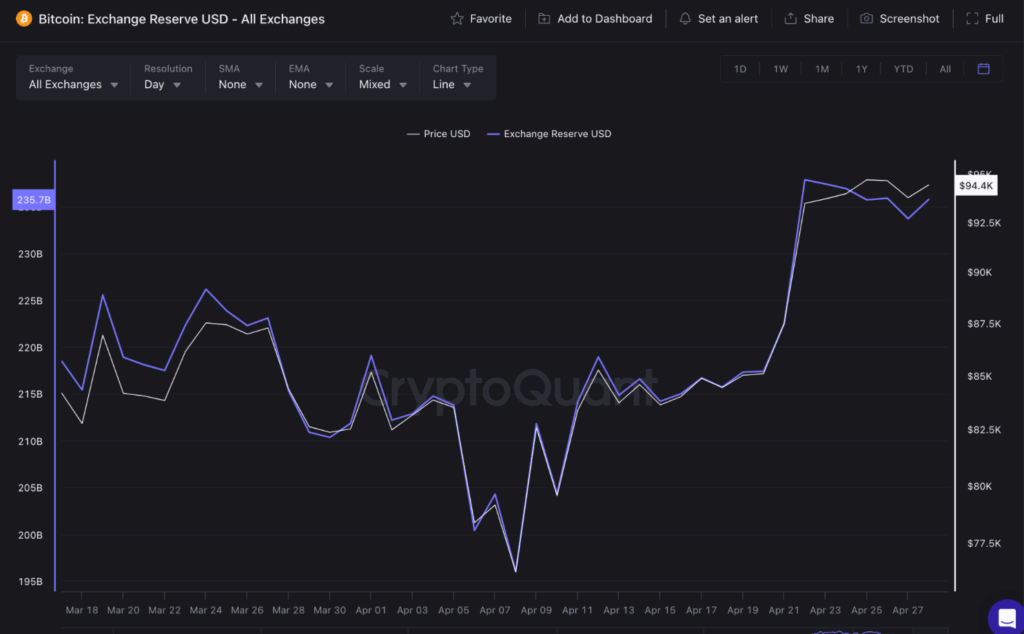

04/30/2025·1M- Bitcoin soared to $95,490, and the market was waiting for Trump's 100-day governing speech with breathtaking care. Investors withdraw more than $4 billion in BTC from exchanges in the past week, sending a strong bullish signal.

- Trump’s policy combination—including the potentially established Bitcoin strategic reserves and the threat of restarting tariffs—is creating a situation where opportunities and risks coexist, and Bitcoin is benefiting from growing demand for safe-havenity as stocks are under pressure.

- On-chain data shows that exchange Bitcoin reserves have dropped sharply. If market momentum and supply tightening continue, the conditions for breaking through the $100,000 mark are ripe.

Strong rebound on Monday

Bitcoin (BTC) rebounded strongly to $95,490 on Monday, coincided with the market preparing for Trump's 100-day speech. As the announcement of special cryptocurrency policies approaches, investors have begun to adjust their positions - the on-chain data has begun to show clues.

Drive above $95,000

CoinGecko data shows that Bitcoin rose 0.8% in 24 hours to hit $95,490.92. During the trading session on Monday, BTC fluctuated between $92,953 and $95,490, maintaining recent upward momentum. The weekly performance was also stable, up 8.9% from last Monday, and the cumulative increase in the past 30 days was about 15%. The crypto market is closely watching whether Trump will make a clear statement on the rumored proposal for Bitcoin strategic reserves.

Fund migration

Just after Trump's controversial call for a rate cut, more than $4 billion of Bitcoin has flowed out of exchanges alone in the past week. Investors are clearly transferring tokens to cold wallets, which is usually a precursor to the bullish price.

The crypto effect of Trump's 100-day rule

Bitcoin's rise is not an isolated event - it is fluctuating in parallel with US stocks (especially tech giants), and the market is trying to predict the possible signal from Trump's speech. Analysts say that if Trump formally supports Bitcoin reserves, it may trigger a parabolic rise directly to $100,000. On the contrary, if the focus is excessively shifted to tariffs or severe budget cuts, it may impact the overall market and limit the short-term upward space of Bitcoin.

TradingEconomics data shows that inflation has dropped from 9.1% in 2022 to 2.4% in March 2025. Trump quickly attributed this to himself, but economists warned that his pro-tariff policies could reignite inflationary pressures.

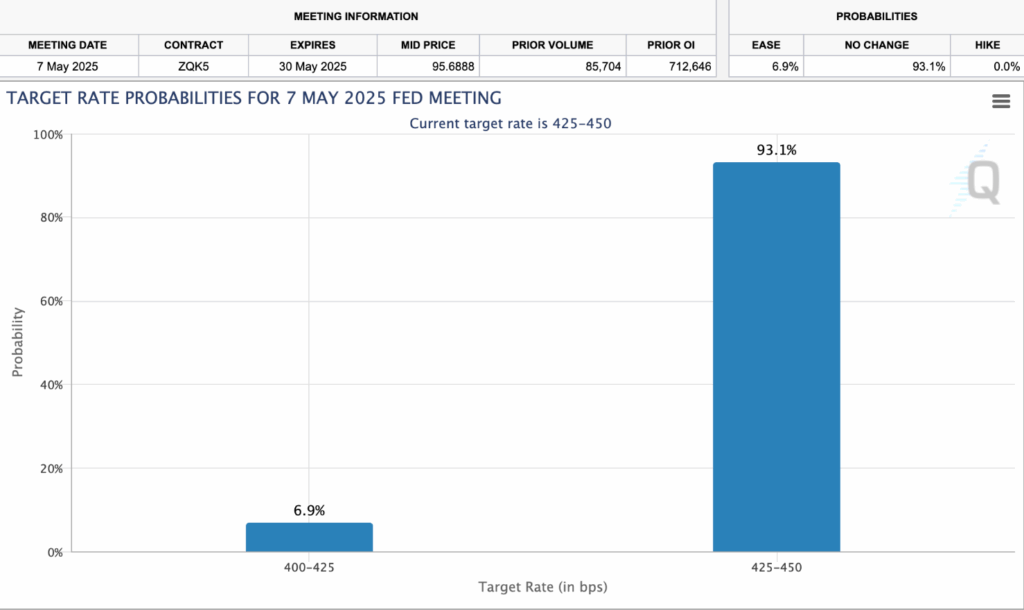

Rate cuts are expected to cool down

Although Trump has put strong pressure on interest rate cuts and even threatened to replace Fed Chairman Powell, the CME FedWatch tool shows that the probability of keeping interest rates unchanged on the May 7 meeting is as high as 90.1%. In short: The market has heard Trump’s request, but has not bought it yet.

Asset rotation under the cloud of tariffs

Trump's continued tariff remarks continue to hit U.S. stocks (especially technology stocks known as the "magnificent seven"), and this uncertainty actually helps Bitcoin - its safe-haven attribute as "digital gold" is being recognized.

In comparison, Bitcoin rose 5.6% this year, while the Nasdaq, S&P 500 and Dow Jones index all fell 5% during the same period. Investors who flee from the turbulent traditional financial markets have begun to favor Bitcoin's relative strength.

$100,000 in sight?

Geopolitical tensions and market anxiety within 100 days of Trump's administration unexpectedly became a good wind for Bitcoin. BTC is of great significance to stick to the $90,000 mark in the hustle and bustle, which not only demonstrates resistance to declines, but also retains the hope of hitting $100,000.

CryptoQuant on-chain data reveals key trends:

• Exchange Bitcoin reserves have dropped by more than $4 billion since April 22

• Weekly deposit size plummeted from US$237.8 billion to US$233.8 billion

• Potential supply tightening is forming

If demand continues to be hot and available supply continues to shrink, the time when Bitcoin breaks through the six-digit mark may arrive earlier than most people expect.

jinse

jinse

chaincatcher

chaincatcher