PA Daily | Upbit launches SIGN; Bitcoin exchange supply drops to its lowest level in 7 years

Reprinted from panewslab

04/29/2025·13DToday's news tips:

Bitcoin exchange supply drops to its lowest level in seven years

French jewelry brand Messika supports crypto payments worldwide

Mastercard plans to integrate stablecoins into global payment network

1inch announced expansion to Solana

Upbit will launch SIGN in Korean won, BTC, USDT markets

Bithumb will launch AI16Z won trading pair

Regulatory/Macro

French jewelry brand Messika supports crypto payments worldwide

According to Bitcoin.com, French jewelry brand Messika announced the launch of cryptocurrency payments in global stores and official websites, supporting four mainstream digital assets: BTC, ETH, USDT and SOL. By cooperating with the payment service provider Lunu, the system will complete fiat currency settlement in real time at the discounted exchange rate. Customers only need to scan the QR code to complete the payment, and there are no additional fees throughout the process. Messika has become another luxury brand that embraces crypto payments after Farfetch and Off-White. Its CFO Nicolas Zanelli said that the plan has covered all offline boutiques and e-commerce platforms. The founder of Lunu pointed out that this move is aimed at meeting the payment needs of high-net-worth tech people, and the current annual penetration rate of cryptocurrency payments in the luxury sector has increased by 47%.

According to Bitcoin Magazine, U.S. Commerce Secretary Howard Lutnick said that the United States will "full efforts to promote the development of the Bitcoin mining industry in the local area."

According to CoinGecko data, today is 100 days after Trump was sworn in, and the total market value of cryptocurrencies rebounded to $3.084 trillion. The total market value of cryptocurrencies was US$3.621 trillion since the day of his second term (January 20), and the market has evaporated by US$537 billion. The market shows that Bitcoin reached a historical high of $109,588 on the day of Trump's inauguration, and is now at $95,006.07, with a drawdown of more than 13%; Ethereum reached $3,453 on the day of his inauguration, and is now at $1,799.61, with a drawdown of more than 47.8%.

Mastercard plans to integrate stablecoins into global payment network

Payment giant Mastercard is taking action to allow consumers to spend on stablecoins and allow merchants to use stablecoins to collect payments, The Block reported. "To enable consumers and businesses to use stablecoins as easily as they use funds in their bank accounts, Mastercard is providing an integrated and all-round solution. Consumers will be able to earn rewards, pay and use stablecoins from traditional bank cards at over 150 million merchants around the world, and can also withdraw stablecoins from crypto wallets using Mastercard Move to withdraw stablecoins into their own bank accounts." Mastercard said in a press release released on Monday. In addition to partnering with crypto exchange OKX to issue cards, it is also working closely with stablecoin issuers Circle and Paxos to enable merchants to receive payments in stablecoins.

Arizona Legislature passes Bitcoin Reserves Act and sends it to the governor

According to The Block, the Arizona State Legislature passed the Strategic Bitcoin Reserves Act SB 1025, authorizing the state finance department and pension system to invest up to 10% of available funds in digital assets such as Bitcoin. The bill has been submitted to Democratic Gov. Katie Hobbs, and if it goes into effect, it will make the state the first U.S. state to require public funds to invest in Bitcoin. The bill was jointly initiated by Republican lawmakers Wendy Rogers and Jeff Weninger to bring cryptocurrencies into public finance. Several states, including Iowa, Missouri and Texas, are considering similar legislation. In addition, SB 1373, another Bitcoin reserve bill in the state, was passed by the House of Representatives and submitted to Democratic Governor Katie Hobbs, to establish a strategic reserve fund for digital assets managed by state fiscal officials. The funding sources include seizure of assets and legislative appropriations. Up to 10% of the investment in digital assets such as BTC per fiscal year, and lending without increasing risks.

Beijing releases blockchain action plan, aiming to achieve more than 10 breakthrough results in 2027

The Beijing Science and Technology Commission, the Zhongguancun Science and Technology Park Management Committee and other departments jointly issued the "Beijing Blockchain Innovation Application Development Action Plan (2025-2027)". The plan sets goals by 2027, aiming to improve the ability of independent and controllable blockchain technology to support the country's digital infrastructure, and strive to achieve more than 10 breakthrough results in core technology fields such as blockchain-specific chips and privacy protection. In addition, it is planned to form more than 20 excellent application cases in five key areas such as artificial intelligence models, and initially build a national blockchain hub node. The action plan will provide important guidance for the development of blockchain technology in Beijing.

Viewpoint

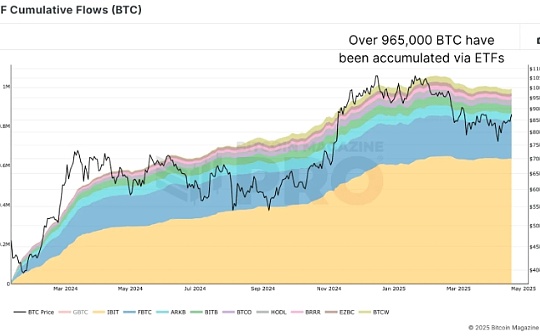

According to The Block, this year's Bitcoin price narrative fluctuates between the correlation between "gold" and "Nasdaq", but Bernstein analysts believe that short-term correlation is highly misleading, and the depletion of retail sell-offs, corporate holdings surges and ETF funds are the key indicators, which may promote "supply tightening" to lead to price new highs. Last week, Twenty One Capital announced initial stockpiling of 42,000 BTC (about $4 billion) to join the ranks of competition among companies such as Strategy. Currently, about 80 companies hold a total of 700,000 BTC, accounting for 3.4% of the total supply. US spot Bitcoin ETFs had a net inflow of US$3 billion last week, a five-month high, with total holdings accounting for 5.5% of Bitcoin circulation, and the institutional share rose from 20% in September last year to 33%, of which 48% were held by investment consultants, reflecting asset allocation demand. Combined with corporate holdings, institutional capital has controlled 9% of the BTC supply. If the US government implements its strategic reserves, it may trigger sovereign countries to compete to hoard coins. The share of BTC balance on the exchange has dropped from 16% at the end of 2023 to 13%, but some assets have only been transferred to the ETF custodian. Bernstein analysts estimate that Bitcoin will reach a cycle peak of about $200,000 by the end of 2025, reach $500,000 by the end of 2029 and $1 million by the end of 2033, during which there will be an intermittent year-on-year bear market.

Riot Platforms executive: Suggest the Ethereum Foundation to conduct IPO on Nasdaq

Ethereum co-founder Vitalik Buterin posted a post emphasizing that the Ethereum Foundation (EF) has set two core goals: 1. Improve Ethereum usage rate; 2. Enhance Ethereum decentralization and elasticity. In response, Pierre Rochard, vice president of research at crypto mining company Riot Platforms, expressed doubts. Rochard pointed out that the two goals proposed by the Ethereum Foundation, "enhanced Ethereum usage" and "enhanced Ethereum decentralization and elasticity", are not helpful to increase the value of ETH, because the use of Ethereum can be achieved through wBTC or USDT. He believes that these goals are partly basic clichés and partly superficial. As an alternative, Rochard suggests that the Ethereum Foundation should conduct an initial public offering (IPO) on the Nasdaq Stock Exchange and implement the ETH bank strategy through convertible bonds.

According to The Block, on April 25, the correlation coefficient between Bitcoin and gold in 30 days reached 0.54, close to the annual high of 0.73. Previously, the two were "decoupled" in February, and the correlation coefficient plummeted from 0.73 to -0.67 in three weeks. At the beginning of February, the price of Bitcoin was about $102,000 and gold was $2,800 per ounce; by the end of February, Bitcoin fell to $84,000 and gold rose to $2,850, and the price difference caused the correlation coefficient to plummet. Since then, the correlation coefficient has rebounded sharply to 0.52, and this "recoupling" may cause macroeconomic uncertainty due to the imposition of tariffs by the United States. From a historical perspective, "recoupling" can be attributed to periodic fluctuations. Since 2020, the correlation coefficient has approached or below -0.50 18 times, of which 17 rebounded within a week, with only exceptions in December 2022. Historically, whenever the coefficient drops to an extreme level of -0.50 or lower, the correlation coefficient between Bitcoin and gold will then experience a strong "recoupling" that will usually rebound to 0.8 or higher before a new round of "decoupling" cycle begins.

Project News

Bitcoin exchange supply drops to its lowest level in seven years

According to Decrypt, CryptoQuant data showed that supply on Bitcoin exchanges fell to a seven-year low, falling to 2.488 million BTC last Friday. Exchange reserves are currently 2.492 million BTC, adding about 40,000 BTC over the weekend, but that level remains the lowest since October 2018. However, CoinShares reported that inflows of $3.2 billion in Bitcoin funds reached the week ending April 28. The dual factors of the decline in foreign exchange balance and the increase in capital inflow indicate that a new round of share increase is coming. But retail investors seem to have played a bigger role in the past week's uptrend than in recent weeks. This is clearly manifested in the "exchange whale ratio", which has dropped from 0.512 on April 17 to 0.36 on April 27.

1inch announced expansion to Solana

1inch announced that it has expanded to Solana, where users can perform secure MEV protection token exchanges through 1inch dApp. With the help of the Fusion protocol, 1inch optimizes liquidity, reduces slippage, and ensures the best exchange rate. Users can exchange them on 1inch through Phantom or Trust wallets, and more wallets will be supported in the future.

Hyperliquid: The new fee system and pledge level will be launched on May 5

Hyperliquid posted on the X platform that the new fee system and pledge level will be launched at around 11:00 on May 5th, Beijing time. Changes include: pledging HYPE can reduce transaction fees; perpetual contracts and spot transactions use different fee rate tables; spot transaction volume is calculated at double when calculating the fee level. The linkage function of pledged accounts and transaction accounts is now online on the test website. This feature allows users to apply pledge discounts for one account to another different transaction account. This feature is expected to be officially launched shortly after the new fee system and pledge level are launched.

Upbit will launch SIGN in Korean won, BTC, USDT markets

PANews reported on April 29 that according to the official announcement, South Korean crypto exchange Upbit will launch SIGN in the Korean won, BTC, and USDT markets, and the transaction will begin later.

Regarding traders tracking profits from their wallets, Tom (@SolportTom), a developer of Letsbonk.Fun, a Meme coin issuance platform under BONK, posted on the X platform that the main goal now is to develop this platform and help creators reach a certain number by trying new things. In order to create more markets that are not related to BONK, he disclosed his wallet address and bought related tokens. After the platform announcement was released, he purchased the first non-BONK cryptocurrency (GRASSITO). Tom mentioned that his wallet was tracked and felt a heavy responsibility. "I bought only one token and then destroyed it and rebuy it because I would not abuse this influence," he said. He also revealed that he privately increased the token with a market value of $6 million. Tom emphasized: "I am not a developer, I have no secret supply, nor have I made any profit from it. I just bought the first token that appeared and did not expect subsequent developments. However, given the increasingly crazy situation, I decided to become a holder and provide support within my capabilities." In addition, Tom announced that he held HOSICO, LetsBONK, and GRASSITO tokens, and said that he was communicating with excellent technical teams to discuss cooperation in token deployment. At the same time, the platform's native translation and advanced trading functions are also being promoted in an orderly manner.

According to the official announcement of Binance Wallet, the participation threshold for MilkyWay TGE has been announced, and users must reach 75 points of Alpha points before they can participate.

The Sui ecological liquidity staking agreement Haedal released token economics, with a total token of 1 billion, and the initial circulation accounted for 19.5% of the total supply (of which Sui ecological airdrop accounts for 5%). The total amount of incentive distribution in ecosystems is 55%, liquid funds account for 10%, investors account for 15%, and teams and consultants account for 20%. Previous news, Binance Alpha will be launched on Haedal Protocol (HAEDAL) on April 29. Related reading: HaedalProtocol analysis: No. 1 seed player in Sui liquid pledge track, TVL crushes competition

Bithumb will launch AI16Z won trading pair

According to the official announcement, the South Korean crypto exchange Bithumb will launch an AI16Z won trading pair.

Ethereum Fusaka Hard Fork to Launch by the End of 2025

According to Cointelegraph, Ethereum co-executive director Tomasz Kajetan Stańczak revealed on social platforms that the Fusaka hard fork upgrade is planned to be implemented in the third or fourth quarter of 2025, and the specific time has not been finalized. Core developer Tim Beiko announced on the same day that the controversial EVM object format (EOF) upgrade has been removed from Fusaka due to technical uncertainty that may affect the upgrade progress. EOF originally planned to comprehensively reform the smart contract development method through 12 EIP proposals, including the introduction of RJUMP instructions to replace traditional JUMP and the adoption of structured bytecode containers and other optimization solutions. Supporters believe this will improve EVM efficiency, but opponents point out that it is overcomplicating the system and requires synchronous update of the development toolchain. A special poll on Ethereum voting platform ETHPulse shows that 39 addresses holding 17,745 ETHs opposed the upgrade.

Important data

Coingecko: Global governments hold 463,741 bitcoins, down to about 2.3% of the total supply

According to a report by Coingecko, as of April 2025, global governments held a total of 463,741 bitcoins, accounting for about 2.3% of the total Bitcoin supply. This figure is down from 529,591 in July 2024. The United States remains the largest holder, owning 198,012 Bitcoins and strengthening management through the "Digital Fort Knox" strategic reserve. China holds 194,000 bitcoins, mainly from the 2019 PlusToken scam. The UK seized 61,000 Bitcoins through criminal investigation. Bhutan conducts sustainable mining through hydropower, holding 8,594 bitcoins. El Salvador buys 1 bitcoin every day and now holds 6,135. Ukraine has received 256 Bitcoin donations since 2024 for military and humanitarian aid. Germany has liquidated its 46,359 bitcoins in mid-2024.

Bitcoin spot ETF total net inflows of US$591 million yesterday, lasting 7-day net inflows

According to SoSoValue data, the total net inflow of Bitcoin spot ETFs yesterday (April 28 Eastern Time). Yesterday, the Bitcoin spot ETF with the largest single-day net inflow was Blackrock ETF IBIT, with a single-day net inflow of US$971 million. Currently, the total historical net inflow of IBIT has reached US$42.171 billion. Yesterday, the Bitcoin spot ETF with the largest single-day net outflows were Ark Invest and 21Shares ETF ARKB, with a single-day net outflow of US$226 million. Currently, the total historical net inflow of ARKB reached US$2.879 billion. As of press time, the total net asset value of Bitcoin spot ETF was US$109.301 billion, the net asset ratio of ETF (market value compared to the total market value of Bitcoin) reached 5.83%, and the historical cumulative net inflow has reached US$39.023 billion.

Market maker Cumberland DRW recharged 300,000 TRUMPs to OKX 5 hours ago, worth US$4.4 million

According to monitoring by the on-link analyst @ai_9684xtpa, market maker Cumberland DRW recharged 300,000 TRUMPs to OKX 5 hours ago, worth US$4.4 million. It is reported that leading market makers such as Cumberland DRW / Wintermute / GSR Markets have participated in TRUMP market making.

According to Lookonchain monitoring, Galaxy Digital's OTC wallet has deposited 23,900 ETH (worth $42.52 million) into Coinbase in the past 8 hours.

PANews reported on April 29 that according to the on-link analyst Ember Monitor, an address suspected to be a TRUMP team transferred 1.346 million TRUMPs ($19.53 million) to CEX nine hours ago. 700,000 (US$10.21M) were transferred to Binance; 350,000 (US$5.08 million) were transferred to OKX; 296,000 (US$4.32 million) were transferred to Bybit.

The gap in Bitcoin holdings between BlackRock's IBIT and Strategy has narrowed to just 20,000

According to Cointelegraph, the Bitcoin position gap between BlackRock's Bitcoin spot ETF "IBIT" and Strategy has narrowed to only 20,000 BTC. Currently IBIT holds 573,869 BTC, and Strategy holds 553,555 BTC.

Kaiko: Trump's dinner plan launches on-chain transfer of TRUMP tokens $2.4 billion

According to The Block, cryptocurrency data company Kaiko reported that after Trump-related Meme coin TRUMP announced on April 23 that "the top 220 holdings can attend the presidential dinner", the token's daily price soared by 60% ($9 to $14.5), triggering on-chain transfers of TRUMP tokens of up to $2.4 billion, and on-chain activity surged by 200%, setting the highest daily trading volume of CEX since mid-February. Kaiko pointed out that although Trump is challenging the claim that "Meme coins are worthless", the move has also sparked controversy. Both political opponents and moral advocates have questioned the president's practice of providing exclusive access to those who buy their Meme coins. Kaiko also said: "As the excitement fades, the transaction volume also decreases, similar to on-chain activities. However, based on the website's competition rules, we expect the activity to be more active in the coming weeks. As the deadline approaches, holders may increase in activities."

Financing

According to official news, parallel MPC network Ika announced that it had received strategic investment from the Sui Foundation. Since then, Ika has received more than $21 million in financing and has a maximum valuation of $600 million in FDV in the private placement phase, and has received support from dozens of institutions in the Web3 field, including Sui Foundation, DCG, Big Brain Holdings, Blockchange, Node Capital, Amplify Partners, Liquid2 Ventures, FalconX, Tykhe Block Ventures, Lightshift, Token Bay Capital, Collider, Zero Knowledge Ventures, NoLimit Holdings, Rubik Ventures, Dispersion Capital, Insignius Capital, Impatient Ventures, Cerulean Ventures, Earl Grey Capital, HDI Ventures, Flowdesk, TPC Ventures, Purechain Capital, Solr DAO, Heroic Ventures, as well as Naval Ravikant, NotVCs, G-20 Group, Artifact Capital, DSRV, Encapsulate, etc. According to reports, Ika is a parallel MPC (multi-party computing) network that will be launched on the Sui blockchain soon.

According to official news, ether.fi announced that it has launched a $40 million venture capital fund ether.fi Ventures Fund I, designed to support fearless entrepreneurs who redefine the possibilities of the industry. In addition, the fund has now disclosed its first batch of investment projects, namely Resolv, Rise Chain, and Symbiotic.

Blockchain-driven payment company Next Generation completes $5 million seed round

According to FF News, blockchain-powered payment startup Next Generation announced a $5 million seed round of financing, with two Cypriot companies, an Austrian company and an international investor consortium participating. The specific investor information has not been disclosed yet. This round of financing will accelerate the launch of the company's B2B payment ecosystem, which aims to connect traditional finance and digital finance through its proprietary MiCA-compliant, euro-pegged stablecoins.

According to Beincrypto, one of Brazil's largest banks, Itaú announced an initial investment of US$210 million to establish Oranje, which will specialize in the accumulation of strategic reserves of Bitcoin. This new move follows Strategy (formerly MicroStrategy) business model. The project aims to create a strong BTC reserve, expand the brand, and provide a new investment model in Brazil. Oranje will become the first publicly traded company in Latin America to focus on Bitcoin. The project aims to create a strong Bitcoin funding reserve, expand brand influence, and provide innovative investment models for the Brazilian market. If the business plan is implemented smoothly, the first year target is to achieve a 45% return on investment in Bitcoin. Oranje plans to adopt financing strategies such as debt issuance and stock sale, similar to Strategy's approach. In addition, the company promises to provide tax and operational convenience to investors who want to hold Bitcoin directly (without the need to go through an intermediary). Its governance team includes well-known crypto people Eric Weiss and Fernando Ulrich, and has been supported by Itawu Investment Bank, Pinheiro Neto Law Firm and one of the four major auditing agencies.

jinse

jinse