PA Daily | Binance Alpha will launch HAEDAL; 45.4% of South Korean investors are optimistic that BTC will surpass gold in the next six months

Reprinted from panewslab

04/27/2025·19DToday's news tips:

Binance Alpha will be launched on April 29th Haedal Protocol (HAEDAL)

Market News: IMF says El Salvador has stopped using public funds to invest in Bitcoin

Willy Woo: Bitcoin fundamentals have turned bullish and the market may rise sideways or slowly

BONK launches Meme coin issuance platform Letsbonk.Fun

A smart trader exchanged 1.18 million Fartcoin positions to 78,671 TRUMP 18 hours ago

Regulatory/Macro

Nike sued for closing cryptocurrency business

Nike (NKE.N) was sued on Friday by a group of buyers who bought Nike-themed NFTs and other crypto assets, alleging that they suffered significant losses after the company suddenly shut down its business unit responsible for creating the assets. In a proposed class action lawsuit filed in a federal court in Brooklyn, New York, the group of buyers led by Australian resident Jagdeep Cheema said Nike's RTFKT division suddenly closed in December 2024, causing a sharp drop in demand for NFTs it holds. The buyer group claims that if they knew in advance that the tokens were unregistered securities and that Nike would "suddenly leave", they would never buy these NFTs at the price or any price at that time. The lawsuit accused Nike of alleged violations of consumer protection laws in New York, California, Florida and Oregon. The amount of the claim was not specified, but it exceeded $5 million.

Market News: IMF says El Salvador has stopped using public funds to invest in Bitcoin

According to posts and screenshots published by KOL Crypto Rover, the International Monetary Fund (IMF) said El Salvador has stopped using public funds to invest in Bitcoin.

Viewpoint

Ethereum founder Vitalik responded to X user Paolo Rebuffo's comment on Pectra's implementation of account abstraction, pointing out that the account abstraction process is only half completed. He said that the ultimate goal is to make non-ECDSA (elliptic curve digital signature algorithm) accounts the mainstream account type on Ethereum. These accounts include features such as multi-signature, key changes, anti-quantum attacks and privacy protocols. A lot of progress has been made recently in simplifying the 7701 standard to promote the achievement of this goal.

Willy Woo: Bitcoin fundamentals have turned bullish and the market may rise sideways or slowly

Crypto analyst Willy Woo said Bitcoin’s fundamentals have turned bullish and capital inflows are increasing, creating good conditions for it to break through its all-time highs. He pointed out that the overall and speculative capital flows in the market have bottomed out, and when the two are combined, a favorable market environment will be formed. Currently, the market liquidity has rebounded and the downward risk is relatively small. Woo mentioned that Bitcoin’s medium-term target price of 90,000 and $93,000 have been reached, and the $108,000 target is still there, and the new mid-term target is $103,000. Since on-chain indicators show that prices are too high, it may be difficult to rise quickly in the short term, and the market may trade sideways or slowly rise. In addition, new capital inflow channels facilitate traditional investors, recognized by banks and brokerage firms as collateral, avoiding the regulatory issues facing Bitcoin.

Regarding Binance Lianchuang CZ's view that "CEX and DEX should not have a currency listing process", some community users questioned CZ "has always emphasized that the most important thing is to protect users, but also emphasized that CEX should be listed without permission like DEX. CEX has greatly relaxed the currency listing, and a bunch of worse projects have emerged, and even wantonly manipulated. How to protect users?" In response, CZ responded: "The user should not be blocked from freedom of choice, but people who attempt to harm the user should be tried to stop."

10x Research: Institutional FOMO, DeFi boom and regulatory positives drive altcoins to rise

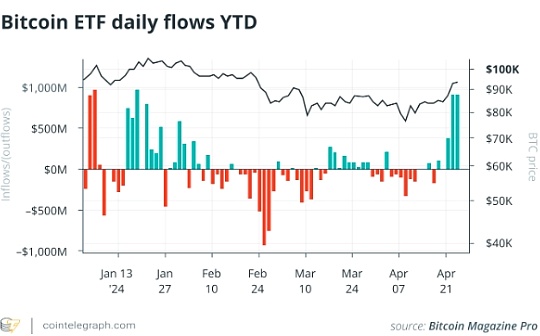

10x Research said in its latest report that the cryptocurrency market soared across the board this week, with Bitcoin breaking through the $95,000 mark, driven by factors such as easing macro risks, record inflows of ETF funds and weakening of the dollar. Altcoins followed closely, with surges in institutional interest, ecological expansion, DeFi outbreak and warming regulatory direction becoming the main driving forces. Specifically, Solana (SOL) rose 6.7%, supported by institutional buying, DeFi growth, short squeeze and Meme coin activity; Ripple (XRP) rose slightly, and CME launched XRP futures and increased integration with banking, despite legal risks, market enthusiasm remained unabated. Stellar (XLM) rose 18.1% as South Asian retail giants cooperated, surge in transaction volume and relaxed new regulations on US crypto banks; Polkadot rose 10.1% against the trend. Although the SEC delayed ETF approval, the market was optimistic about the final approval and the opening of the crypto market. SUI soared by 64.3%, driven by the explosion of DEX trading volume, stablecoin ecosystem expansion and well-known cooperation; Raydium Protocol (RAY) rose 27.9%, thanks to the recovery of Meme coin incentive plan and DeFi on the Solana chain; Aave (AAVE) rose 21.5%, due to the rebound of Bitcoin, repurchase plan, GHO stablecoin growth and locked value increase. Trump tokens soared 86% as plans to go with Trump's dinner were announced, and investors are still attracted by political controversy. After the Algo Foundation launched the decentralized ID project, the price of ALGO rose by 18.4%. BONK rose 55.7%, regaining Solana's status as the top Meme coin, benefiting from token destruction and NFT market acquisitions. Ondo rose 16.7% as positive dialogue with the SEC on tokenization and Treasury bond tokenization boosted confidence.

Greeks.live macro researcher Adam said on the X platform that next week (4/28-5/2) the most important thing is Friday's non-farm and surplus data. Three months after Trump took office, the US economy and trade have suffered a big blow, and the US stock market has been relatively weak. However, there has not been a clear trend in economic data. Every time, the large macro data is worth paying attention to whether there will be black swans. The implicit volatility is continuing to decline recently, especially the medium and short-term decline of BTC has been significantly reduced, which has approached 45%. The market does not expect future volatility. Although the price of BTC fluctuated at $95,000, the market sentiment on the cryptocurrency is not high, so it can only be said that it has improved.

Project News

Binance Alpha will be launched on April 29th Haedal Protocol (HAEDAL)

Binance announced that its platform Binance Alpha will first launch Haedal Protocol (HAEDAL), and the transaction will be opened on April 29, and the specific time will be announced. Previous news, Sui's ecological liquidity staking agreement Haedal Protocol completed a seed round of financing, with Hashed, Animoca Ventures and others participating in the investment.

Synthetix stated in its official blog that according to the proposal of SCCP-403, Synthetix has officially completed the transition to the 420 pledge pool, and all old SNX pledged positions have been liquidated as planned. However, most positions can still be restored. If the user is a historical stakeholder who has not yet migrated to the 420 pool, please be sure to follow the following steps as soon as possible. This upgrade will promote the Synthetix system to fully support future products, including the upcoming Perps v4 perpetual contract platform and automated Vaults and other core functions. Key Rule Description: If the user's pledge bit is less than 160% during liquidation, the pledge bit has been permanently liquidated and cannot be restored. If the mortgage rate during liquidation is ≥160%, your pledge position can be restored, but the migration must be completed within 6 months from the date of liquidation. Things to note after recovery: The moved pledge bit will retain the debt scale at the time of liquidation, and users can repay the debt at any time to unlock SNX tokens; the new pool allows pledges to gradually reduce debts within 12 months (certain conditions must be met), and the specific rules and sUSD pledge reward plan will be announced in the next few weeks. The target user can apply to participate in the sUSD staking test.

According to Finance Magnates, after years of market speculation, Ripple has clearly denied that it will launch an IPO in 2025. In an interview with CNBC, Ripple President Monica Long said that the IPO was not within the company's plan. She stressed that Ripple's current financial situation is solid, holding billions of dollars in cash reserves, and does not need to raise funds through listing or increase market exposure. Long further pointed out that companies usually go public for two major motivations: raising funds or expanding brand influence, but Ripple currently has "no demand for both". Previously, Ripple CEO Brad Garlinghouse also repeatedly reiterated that Ripple neither seeks external capital injection nor has "no short-term listing plan." In fact, the rumors of Ripple's listing have lasted for several years. In 2022, Garlinghouse said that after the legal dispute with the U.S. Securities and Exchange Commission (SEC) was settled, the possibility of an IPO will be reassessed. However, with the two sides reaching a settlement at the end of 2023, Garlinghouse once again emphasized that listing is not a priority for Ripple.

Arbitrum withdraws from Nvidia's accelerator program after it refuses to work with crypto firms

According to The Block, the Ethereum Layer 2 network Arbitrum Foundation announced its withdrawal from the Nvidia-backed Ignition AI accelerator program, due to the chip giant's request that cooperation be not be mentioned in encryption-related announcements. Previously, the two sides originally planned to reach an exclusive cooperation, and Arbitrum will become the only representative of the Ethereum ecosystem in the AI acceleration plan. A spokesperson for the Arbitrum Foundation said that Nvidia has changed its position recently and is willing to maintain cooperation but prohibits public disclosure, which shows that it lacks long-term commitment to the crypto field. The accelerator program will provide AI development guidance and cloud service points for Arbitrum. It is worth noting that another public chain Aptos still maintains a cooperative relationship with the accelerator. The foundation emphasized that the exit decision is based on business considerations and will choose "a partner who fully supports blockchain innovation" in the future.

BONK launches Meme coin issuance platform Letsbonk.Fun

According to official news, BONK announced the launch of the Meme coin issuance platform Letsbonk.Fun, which is jointly developed by members of the BONK community and Raydium. Part of the handling fees of Letsbonk.Fun platform will be used to: strengthen and ensure Solana network security through BONKsol verification nodes; repurchase and destroy BONK tokens to reduce circulation.

Important data

According to a South Korean investor market survey conducted by Coinness and Cratos, 45.4% of respondents believe that Bitcoin will surpass gold in the next six months. In the survey, 46.2% of respondents expect Bitcoin to continue to rise or rise sharply next week, while 38.9% are expected to remain flat and 14.9% are expected to fall. Regarding market sentiment, 49.9% of respondents said neutrality, 31.5% said optimistic or extremely optimistic, and 18.6% said fear or extreme fear. Against the backdrop of increased preference for safe assets by global investors, 27.9% of respondents believe gold will perform better, 22.7% expect both to rise, while 4% believe both Bitcoin and gold will fall.

According to data compiled by on-chain analyst @ai_9684xtpa, since the announcement of Trump's TRUMP dinner plan, in just nine days, Binance TRUMP spot trading volume increased by 202% month-on-month in nine days, of which 0423, a single-day trading volume of 74.69 million tokens, with a transaction volume of up to US$940 million; Binance TRUMP 24H spot/contract trading volume was US$2.782 billion, ranking TOP3; DEX TRUMP 24H transaction volume was US$489 million; TRUMP price rose by 94.6% on nine days, with an amplitude of up to 112%.

Analyst NotAMickey disclosed abnormal trends in BIO tokens on X platform: Recently, many giant whale accounts in the top 20 BIO tokens have transferred a large number of tokens to unknown addresses, including 15 million BIOs and 10 million transferred from Binance two weeks ago to addresses marked "trading bot" but actually originated from Binance, as well as the subsequent two transfers of 8.8 million and 8.7 million. Venture capital institutions (VCs) appear more densely among the top 40-60 addresses, and most of the tokens have entered the unlocking period. The key discovery: Sigil Fund suddenly withdrew 4.5 million BIOs worth US$330,000 from the exchange yesterday, and the funds remained unmoved. It is worth noting that the fund CEO Zee Prime is actually the same person as DevmonsGG, and it "precisely" fills the position when the price bottoms out, and also holds the token share in the VC channel.

A smart trader exchanged 1.18 million Fartcoin positions to 78,671 TRUMP 18 hours ago

According to Lookonchain monitoring, a smart trader exchanged all the 1.18 million Fartcoin (worth $1.22 million) positions he held 18 hours ago to 78,671 TRUMP tokens. The trader previously completed 5 swing transactions on Fartcoin, each of which achieved a profitable profit of 100% and achieved a cumulative profit of US$669,000.

Financing

According to official news, Alpaca, an API platform focusing on stocks, options and cryptocurrency trading, announced that it has completed a US$52 million Series C financing. 850 Management, Derayah Financial, National Investments Company, Portage Ventures and Unbound participated in the investment. According to reports, Alpaca is a self-clearing brokerage and brokerage infrastructure company headquartered in the United States, covering stocks, ETFs, options and cryptocurrencies, and has raised more than $170 million in funds. Alpaca's investors include Portage Ventures, Spark Capital, Tribe Capital, Social Leverage, Horizons Ventures, Unbound, SBI Group, Derayah Financial, Elefund and Y Combinator.

WineFi, a blockchain-backed wine platform, completes a £1.5 million seed round

According to CrowdfundInsider, London-based fintech company WineFi announced a £1.5 million (about US$2 million) seed round. This round was led by British fine wine group Coterie Holdings, with SFC Capital, Founders Capital and an angel investment consortium. New capital will accelerate product development, including enhanced valuation models and real-time market data feeds. According to reports, the company was co-founded by former Fidelity International and JPMorgan asset manager Oliver Thorpe and Callum Woodcock, and is committed to providing high-net-worth clients with structured high-quality wine investment channels. To increase liquidity and transparency, WineFi has taken a strategic move to segment high-quality wine assets on a blockchain platform in partnership with digital asset provider Lympid.

jinse

jinse

chaincatcher

chaincatcher