How does the sentiment engine of Bitcoin ETFs reshape the market structure?

Reprinted from jinse

04/27/2025·19DAuthor: Michael Tabone, CoinTelegraph; Compilation: Baishui, Golden Finance

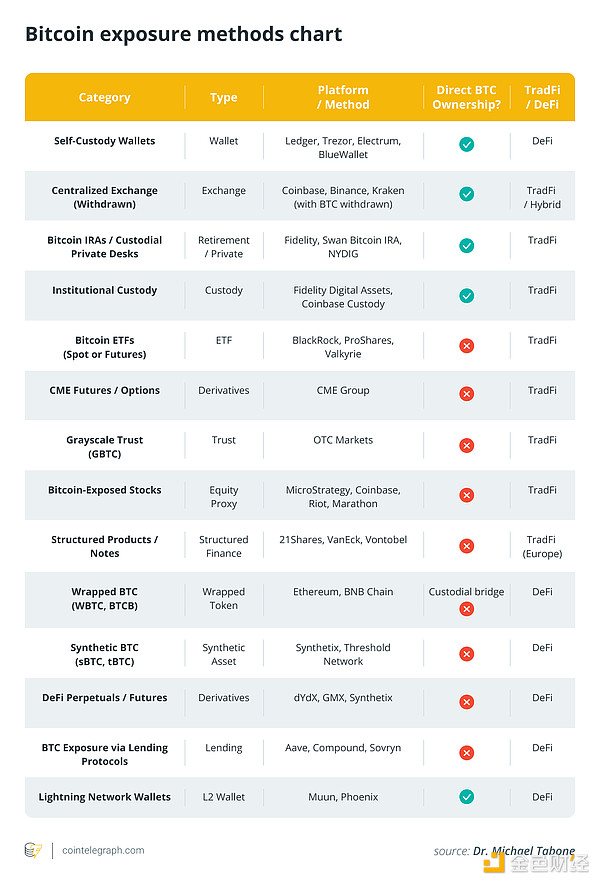

The capital trend that once flowed to original spot Bitcoin has begun to flow through institutional channels, spot exchange-traded funds (ETFs), structural products and parcel exposure. Although enthusiasm has risen rapidly, the wave is not exactly the same.

Eric Balchunas, senior ETF analyst at Bloomberg, pointed out on X that leveraged long ETFs are moving more vigorously, while safer bets such as gold and cash are also more active. Suppose people have to choose whether Bitcoin is a risk asset or a risk-averse asset. In this case, it may depend on how investors interpret their narrative, whether they see it as digital gold or another speculative tool.

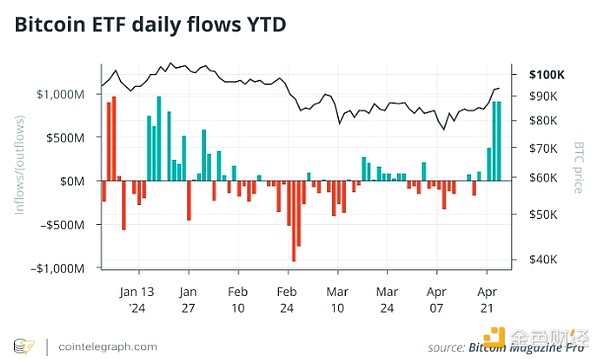

The Bitcoin ETF ecosystem has entered a new stage of capital absorption. On April 23, 2025, the daily inflow exceeded US$912 million, setting an annual record. This seems to mark a sharp return to bullish sentiment after a few weeks of long-term capital outflows.

But this surge is more than just a simple recovery state. What is being formed is a strategic reallocation of investor positioning, and its structural impact may ease the speculative heat that is common in the past cryptocurrency bull cycle.

By 2025, Bitcoin will no longer be a single asset. This is an exposure spectrum. BlackRock's iShares Bitcoin Trust (IBIT) was named "Best New ETF Product" by etf.com. From IBIT to derivatives, trusts and leverage tools, the market is now defined not only by price but also by access mechanisms.

This is not a cycle of liquidity out of control.

When exposure replaces ownership

More than a dozen products have appeared since the United States approved the spot Bitcoin ETF in January 2024. By April 2025, ETF inflows have become the main barometer of market sentiment. Net inflows from these ETFs have exceeded US$2.57 billion so far this year.

On January 6, the maximum daily increase reached US$978.6 million. On the contrary, on February 25, the largest outflow of this year was $937.9 million. As of now, of the 81 trading days in 2025, only 37 trading days have achieved net profit. The average daily net traffic was only $31.8 million, indicating that despite strong institutional interest, it is still unstable and reliant on external signals.

These data points reveal a new structural rhythm. ETF capital tends to flow pulsedly, reacting to macroeconomic headlines rather than to cryptocurrency native momentum. Unlike 2021 financing rates and leverage dominate market directions, today 's price trend depends on whether allocators see Bitcoin as a hedge asset, a risky asset, or both.

This new market channel is both a blessing and a bottleneck. Liquidity is deeper than ever, but less active. It also suppressed the retail craze that once catalyzed the copycat season and speculative parabola.

The boundary didn't disappear—it was just absorbed.

When everyone buys Bitcoin, but no one buys risk

The forces that drive the rise of Bitcoin institutions may also be killing the lifeblood of altcoin speculation. One of the most notable changes in 2025 is the disappearance of the classic altcoin season. BTC’s dominance has risen over the past cycle and then rotated to Ether, medium and small cryptocurrencies. But this year, this trend has stalled.

Capital that once flowed into altcoins is now stopped at the ETF portal. With Larry Fink et al. proposing a $700,000 BTC forecast, the capital behind this optimism remains in the structural product. It goes into IBIT, not centralized exchanges like Uniswap or Coinbase.

ETF liquidity spreads exposure. Sovereign Wealth Fund Buys Bitcoin. They won't imitate Solana NFT. They buy stock codes and rebalance quarterly. Their entry provides stability, but squeezes out chaos, which has been a native accelerator for cryptocurrencies.

The Ether and Solana ETF proposals are currently under consideration. If approved, they may not resume the altcoin season, but will institutionalize it. We may see ETF pairs trading, not MetaMask and Bloomberg terminals, not meme rotations. This is capital concentration, not dispersion.

Macrocatalysts reinforce this trend. Both February and March CPI data exceeded expectations. Each Bitcoin ETF issuance has more than $200 million inflows, turning inflation anxiety into passive accumulation. This behavior reflects the prosperity of gold ETFs after 2008, when monetary policy began to affect commodity flows.

Bitcoin has now entered this state. It's still speculative, but no longer crazy. Still unstable and increasingly easy to calculate. The market still operates on belief, but transactions rely on compliance.

chaincatcher

chaincatcher

panewslab

panewslab