Crypto market rebounds sharply: Solana's development ushers in a new stage, and MCP becomes a new hot spot in the AI track

Reprinted from panewslab

04/27/2025·19DMarket Overview

Overall market overview

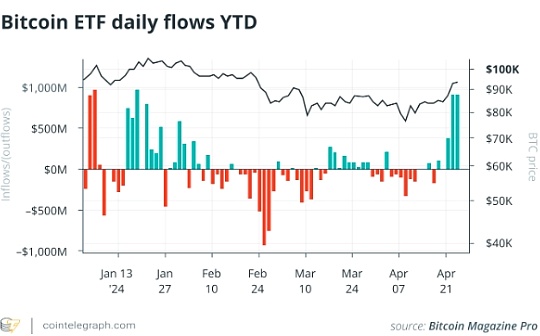

The cryptocurrency market is on an upward trend this week, with the market and most Altcoin showing up. The recent sluggish market sentiment has been greatly alleviated, with the market sentiment index rising from 55% to 79%, and the overall market has entered the bull range. The market value of stablecoins continued to continue the rise that began last week, and continued to rise this week (USDT reached 145.7 billion and USDC reached 61.9 billion, up 0.62% and 2.32% respectively), indicating that institutional funds have increased their entry, mainly based on the growth rate of US funds. It can be seen that the rising market this week has greatly driven the sentiment of US investors and began to accelerate entry.

The rise this week was mainly affected by the easing of US tariffs on China and the influence of Trump's claim to not fire Fed Chairman Powell and new SEC Chairman Paul Atkins and his friendly attitude toward the crypto industry, which promoted a strong rebound this week. However, the market is still facing the uncertainty of the United States' upcoming economic recession and tariffs, so this week's rise can only be seen as a rebound from the oversold period some time ago, and it cannot be seen as a reversal of the market.

Predictions for next week

Bullish targets: SOL, SNX

SOL: Solana ecosystem is fully recovering, and the rise of Meme tokens, stablecoins and decentralized trading platforms drives market recovery

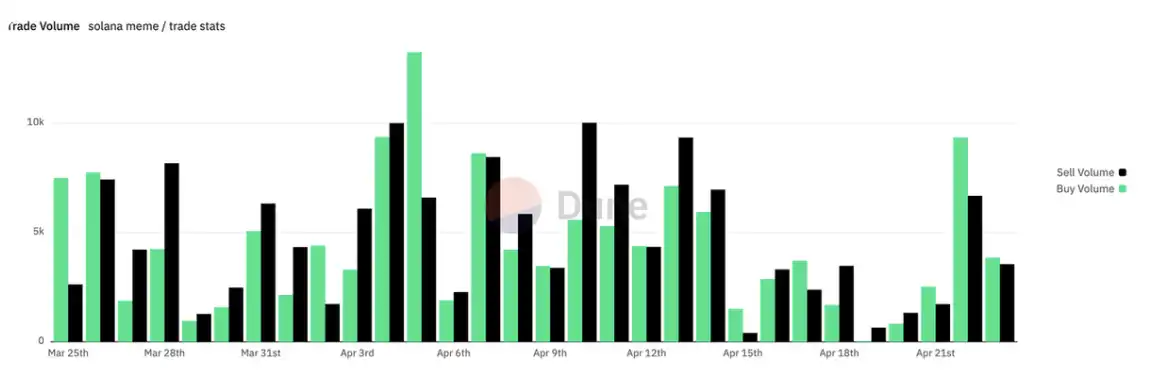

Meme token market recovers

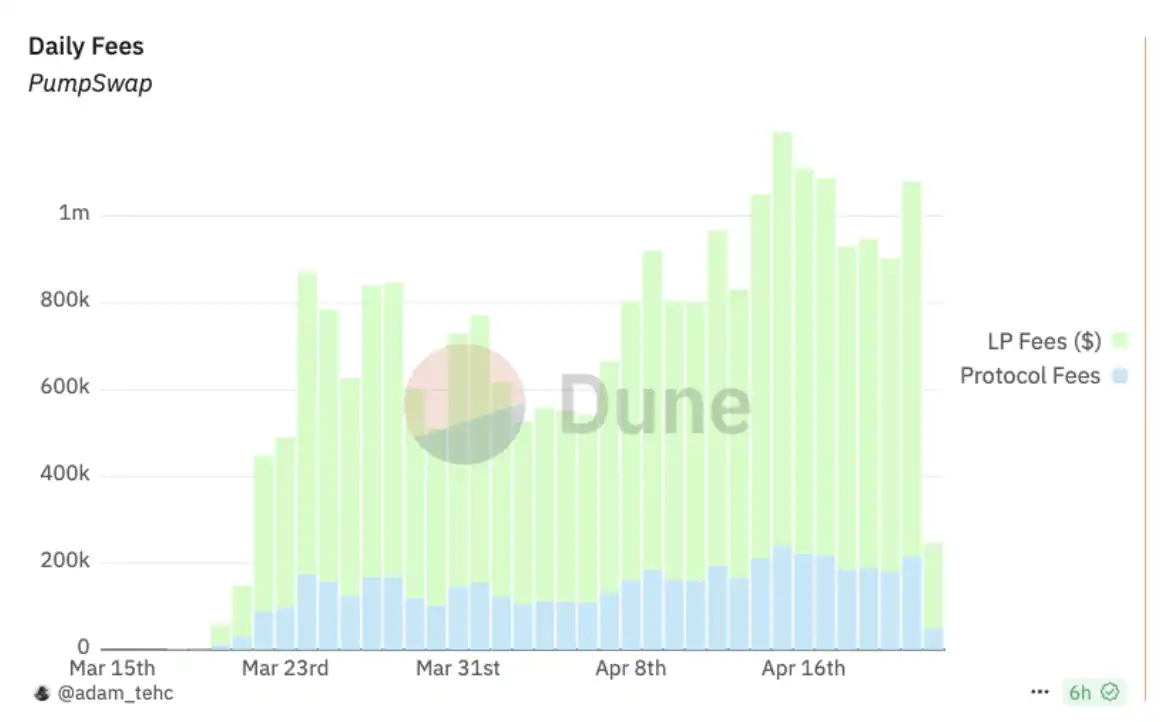

This week, as the market conditions pick up, the trading volume of Meme tokens on Solana's on-chain has increased significantly. The number of Meme tokens purchased continues to be higher than the number sold, driving the rapid recovery of Solana's on-chain data. This shows that although the previous retreat of Meme Inspur caused losses to on-chain users, investors are still very interested in Meme tokens. And after Pump.fun launched PumpSwap, the daily trading volume of PumpSwap gradually increased, maintaining between US$300 million and US$480 million, accounting for 9% to 19% of Solana's on-chain DEX trading volume. It can be seen that the Meme market is gradually recovering. The activity of the Meme token market will help increase the price of SOL in the short term.

Meme coins on Solana chain (data source: https://dune.com/pseudocode88_aux/solana-meme-token-analysis)

PumpSwap daily trading volume (Data source: Data source: https://dune.com/pseudocode88_aux/solana-meme-token-analysis)

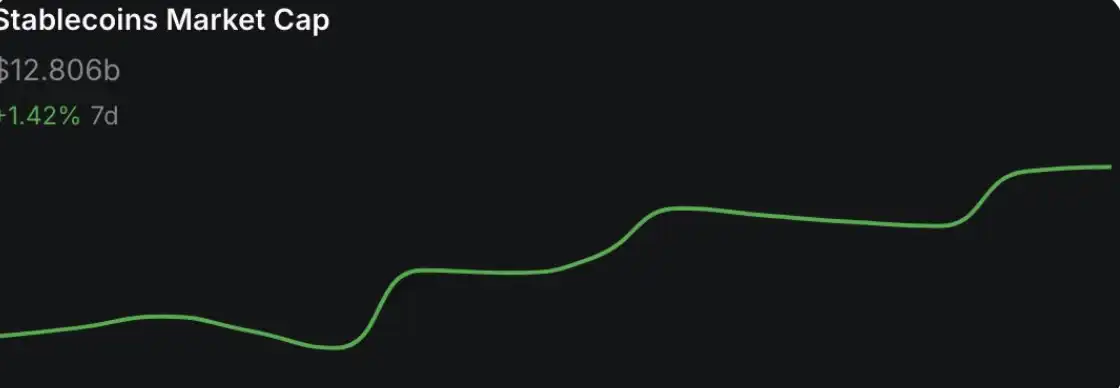

On-chain stablecoin supply growth

The supply of stablecoins on Solana's chain continues to grow rapidly, and has now exceeded US$12.8 billion, setting an all-time high. This growth reflects investors’ confidence in the Solana ecosystem and the need for on-chain liquidity support. The adequate supply of stablecoins provides important liquidity support for financial activities on Solana on-chain and promotes the development of on-chain ecology. This liquidity not only enhances the activity of on-chain transactions, but also provides investors with more trading and investment opportunities.

Solana\'s on-chain stablecoins (data source: https://defilama.com/chain/solana)

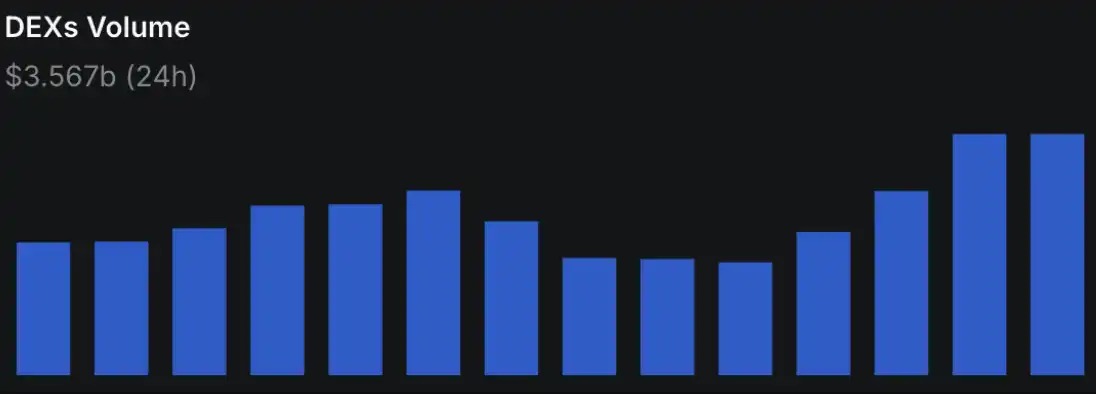

Solana on-chain DEX trading volume growth

Solana's on-chain decentralized trading platform (DEX) has exceeded US$3.5 billion in transaction volumes over the past 24 hours, showing a recovery in on-chain activity. The supply of stablecoins is also continuing to grow, and has recently exceeded US$18.2 billion. This reflects investors' confidence in the Solana ecosystem and provides more liquidity support to the chain.

Solana on-chain DEX trading volume (data source: https://defilama.com/chain/solana)

Solana Decentralized Policy

The Solana Foundation has introduced new policies to strengthen decentralization. For new validators added to their entrusted plans, three of them will be removed if some validators are eligible for the Solana Foundation commission on the mainnet for at least 18 months and have less than 1,000 SOLs pledged outside the Foundation commission. This policy aims to reduce reliance on foundation delegations and encourages community-supported validators.

Institutional companies ' entry to increase holdings

Canadian listed investment company SOL Strategies has issued $500 million in convertible bonds to purchase and pledge SOL. SOL Strategies' shares rose 23.5% after SOL Strategies sent the message. SOL Strategies is interested in learning from Michael Saylor's MicroStrategy, constantly issuing convertible corporate bonds to increase its holdings in BTC, and achieve the goal of raising its stock price. Therefore, if SOL Strategies' move is successful, it will have substantial support and benefit the SOL price. And the recent emerging trend is that traditional companies have gradually begun to increase their holdings in SOL through various methods.

Good news from SOL spot ETF

SOL's spot ETF application has been delayed, but things may change with the new SEC chairman Paul Atkins taking office. Paul Atkins is friendly to the crypto industry and regards the construction of a clear digital asset regulatory framework as a priority, which is good news for the approval of SOL spot ETFs and may further drive SOL prices.

**SNX: From the deanchoring crisis to hope for recovery, how Synthetix

rebuilds market confidence**

Recently, the algorithmic stablecoin sUSD issued by Synthetix has undergone serious deaning incidents due to the adjustment of Synthetix's debt management mechanism in the SIP-420 proposal. sUSD price fell to $0.68, while Synthetix's token SNX also fell to $0.55. Synthetix's total lock-in value (TVL) reached a minimum of $72.23 million. Market investors' confidence in Synthetix has been shaken.

Repair measures

· Liquidity Incentive: Synthetix increases yield to 49.18% by pledging sUSD/sUSDe LP on Convex to attract more liquidity.

· Deposit Incentive: Through the Infinex project, Synthetix incentivizes users to deposit sUSD, and distributes 16,000 OP rewards to users with deposits of more than 1,000 sUSD per week, and the incentive lasts for six weeks.

· Staking incentives: Allow users to pledge sUSD to 420 pools, and staking can receive 5 million SNX per year as incentives.

· Negative incentives and pledge optimization: The pledger is required to deposit a certain proportion of sUSD. If the standard is not met, the debt exemption will be suspended, and the proportion will be increased when the anchor deviation is deviated. At the same time, SNX pooled staking is implemented, sUSD supply is expanded, and Perps V4 is launched that supports multi-collateral and post-chain order matching.

Market reaction

Driven by these measures, the price of sUSD rebounded to a maximum of US$0.88 and the price of SNX also rose to US$0.74. In addition, Synthetix's total lock-in value (TVL) rose from $72.23 million to $89.25 million, an increase of 23.56%.

Follow-up impact

Although the deaning problem of sUSD has not been completely resolved, Synthetix's aggressive measures have given the market a hope of recovery. If the sUSD price can be restored to $1, investors' confidence in Synthetix may be re-increased, thereby promoting further increase in SNX prices.

Synthetix TVL situation (data source: https://defilama.com/protocol/synthetix#information)

Bearish targets: REZ, OMNI

**REZ: Restaking 8.64% token unlocking may trigger concentrated selling

of investment institutions and teams**

Renzo is a liquidity re-staking protocol based on the EigenLayer ecosystem, aiming to simplify complex pledge mechanisms for end users and realize rapid cooperation with EigenLayer node operators and active verification services (AVS). Due to the recent poor performance of the Ethereum ecosystem and the price of ETH continues to be in a downturn, the staking rate of ETH has also declined, which has led to the Restaking track project losing market attention. REZ will be unlocked on April 30, accounting for 864 million REZ tokens, accounting for 8.64% of the total locked volume. Now the total circulation rate is only 21%. It can be seen from the linear unlocking chart published in its white paper that the main targets of this unlocking are investment institutions and project teams. Because the Restaking project is currently low in popularity, few participants, and the Ethereum ecosystem performs poorly, this large unlocking may trigger a large sell-off, which will have a certain impact on the price of REZ tokens.

**OMNI: Large token unlocking approaches, and market selling risks are

intensifying**

Omni is the interoperability layer of Ethereum, which establishes low-latency communication between all Ethereum Rollups, allowing Ethereum to run as a running system in the era of modularity. Omni itself is also a public chain project. Due to the recent continued downturn in the Ethereum ecosystem and the recent performance of each Layer-2 project has been poor in this round, Omni, who is a link between each Layer-2 project, has also lost its value. OMNI will unlock 16.63 million OMNI tokens on May 2, accounting for 16.64% of the total locked amount. At this stage, the circulation rate is only 19%, which is equivalent to double the amount of existing circulating tokens. It can be seen from the linear unlocking chart published in its white paper that the main targets of this unlocking are investment institutions and project teams. And because Omni is relatively low at this stage, this large unlocking may trigger a large sell-off, which will have a certain impact on the price of OMNI tokens.

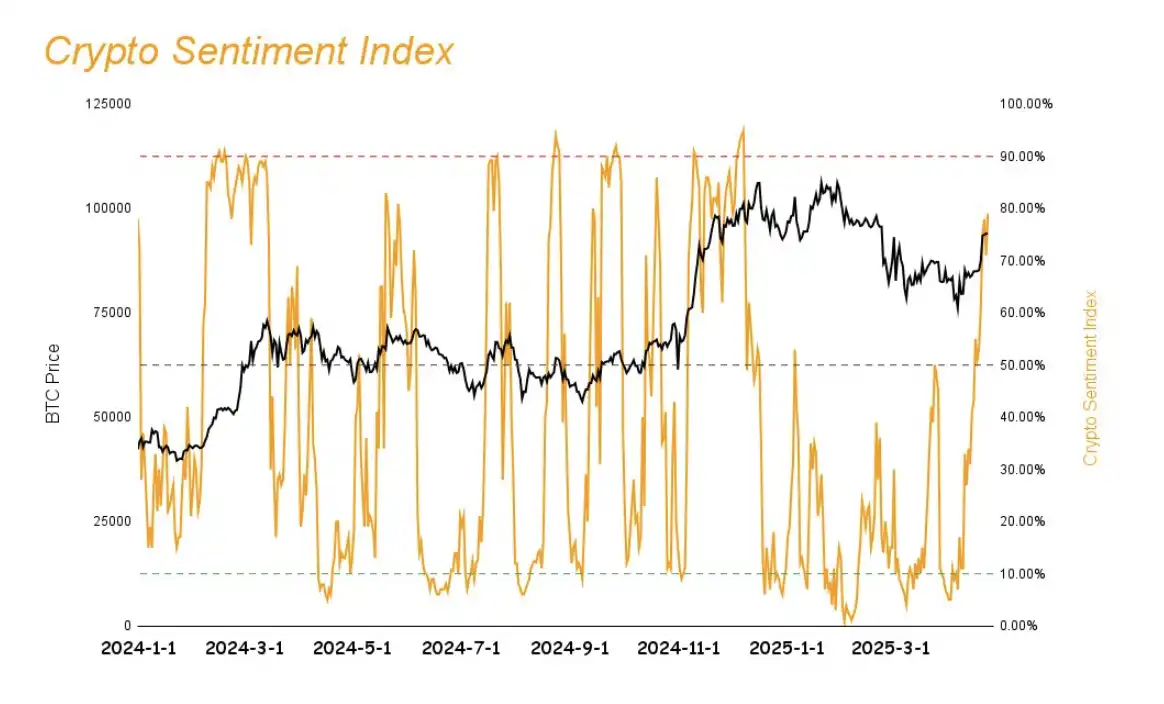

Market sentiment index analysis

The market sentiment index rose from 55% last week to 79%, and entered the bull range overall.

Hot tracks

MCP: Can it lead the future development direction of Crypto✖️AI

MCP means Model Context Protocol (MCP), which was launched by Anthropic on November 25, 2024. After its launch, it was not sought after by the market. After Deepseek's impact on existing AI software, the market began to gradually pay attention to the issue of optimization algorithms and resource scheduling, changing the previous development method of AI relying on accumulated computing power. Thus, the idea that MCP standardizes how external data and applications interact with large language models (LLMs) and provide context has been gradually appreciated by the market.

Recently, with the MCP-related token Dark on the Solana chain performing well after the launch of Binance Alpha, investors in the market have begun to solicit and invest in MCP-related tokens, making MCP one of the few concentrated hot tracks recently.

The concept of MCP

Model Context Protocol (MCP) is an open source standard launched by Anthropic. It was originally an extension of the Claude ecosystem and aims to solve the fragmentation of AI models with external tools and data interactions. Now evolved to MCP as a secure and standardized way to enable large language model-driven AI agents to interact with external systems to obtain real-time data. MCP can act as a universal adapter in actual use, allowing AI to access content repositories, business tools, development environments, etc.

The core goal of MCP is to improve efficiency through standardized processes, shift AI agents from "understanding" to "working", provide developers with efficient tools, and enable enterprises and non-technical users to easily customize their agents. In this way, MCP can become a bridge connecting virtual intelligence with the real world, thereby promoting personalized innovation and development in various industries.

How MCP works and techniques

MCP adoption technology

The technical basis of MCP is JSON-RPC 2.0, which is a lightweight and efficient communication standard that supports real-time two-way interaction, and is similar to WebSockets' high performance. It runs through the client-server architecture:

· MCP Host: User-interactive applications, such as Claude Desktop, Cursor, or Windsurf, are responsible for receiving requests and displaying results.

· MCP client: Embedded in the host, establish a one-to-one connection with the server, handle protocol communication, and ensure isolation and security.

· MCP Server (Server): A lightweight program that provides specific functions to connect to local (such as desktop files) or remote (such as cloud API) data sources.

Transmission methods include:

Stdio: Standard input and output, suitable for local rapid deployment, such as file management, with latency as low as milliseconds.

· HTTP SSE: Server push events, supports remote real-time interaction, such as cloud API calls, suitable for distributed scenarios.

How it works

MCP adopts a client-server architecture. Simply put, if an MCP host wants to retrieve data or operate, it needs to communicate and cooperate between the MCP client and the MCP Server. To ensure efficiency and security, MCP assigns dedicated clients to each server, forming a one-to-one isolated connection. Its core components include:

· Host: User portal, such as Claude Desktop, is responsible for initiating requests and displaying results, and is the "facade" of interaction.

· Client: Communications intermediary, using JSON-RPC 2.0 to interact with the server, manage requests and responses, and ensure isolation.

Server: Function provider, connects external resources and performs tasks such as reading files or calling APIs.

The transmission methods are flexible and diverse:

Stdio: Local deployment, suitable for fast access to desktop files or local databases, with latency as low as milliseconds.

· HTTP SSE: Remote interaction, supports cloud API calls, and has strong real-time performance.

Advantages of MCP

MCP solves the problems faced in AI applications through standardized interfaces:

· Real-time access: AI can obtain the latest data in a very short time.

· Security and control: Direct access to data avoids intermediate storage, the reliability of permission management is as high as 98%, and users can restrict AI to access only specific files.

· Low computing load: no need to embed vectors, reducing computing cost by about 70%.

· Flexibility and scalability: The number of connections has been reduced from the traditional 100 million to 20,000, greatly simplifying the configuration process.

· Interoperability: A MCP Server can be multiplexed by multiple models.

· Supplier flexibility: Switching LLMs does not require refactoring infrastructure, USB-C-like compatibility.

· Autonomous proxy support: supports AI dynamic access tools to perform complex tasks.

MCP Ecological Project

Dark

Dark is an experimental MCP network based on Solana focusing on Trusted Execution Environments (TEEs). By automatically integrating new tools and on-chain interaction, Dark aims to achieve innovation in decentralized technology, but most project functions have not been launched. It is currently in the concept speculation stage, and coins have been issued, and the token is DARK.

SkyAI

SkyAI is a native AI infrastructure based on BNB Chain that provides multi-chain data access and AI proxy deployment. The project is still in the conceptual stage and the actual product has not yet been launched. Coins have been issued, and the token is SKYAI. With a market value of US$43 million, it is the leading project in the MCP track.

Solix

Solix is a DePIN network using MCP, focusing on smart bandwidth sharing. Users can share bandwidth through browser extensions and receive rewards, covering 63 countries around the world. Project technology is implemented quickly, but it is necessary to verify user participation and the sustainability of economic models. No coins have been issued at this stage.

HighKey

HighKey is a DeFAI project compatible with MCP and DARP protocols, focusing on DeFi arbitrage and professional analytics. The coin has been issued, and the token is HIGHKEY, with a small market value of only US$5.68 million. The project development function is clear, but it still needs to improve user experience and differentiation.

DeMCP

DeMCP is a decentralized MCP project focused on trust and security and provides SSE proxy services. The coins have not been issued at this stage and are still in the development stage. The actual products need to be displayed.

UnifAI

UnifAI is a DeFAI project that provides on-chain and off-chain tasks execution capabilities. Its flagship product UniQ simplifies complex on-chain operations, and although coins have not been issued, the points plan has been launched.

Future development direction

At present, most Web3 AI projects based on the MCP protocol are in the early stages of development, and substantial products have not yet been released, but some have been issued tokens. Although MCP is an emerging hotspot in the AI segment at this stage, given the previous experience of failing AI Agent track, we still need to be cautious about whether MCP track projects are just a flash in the pan of the issuance of AI Meme assets, or whether they can really make products that promote the development of AI track. Therefore, the future development direction of MCP should mainly focus on the implementation and application of decentralized technologies. With the rapid development of AI and blockchain technologies, MCP will continue to optimize its technical architecture to support more efficient computing and data sharing. In addition, MCP will strive to improve interoperability, simplify developers' usage processes, and promote the popularization of decentralized applications.

Overall overview of market themes

Source: SoSoValue

By weekly return, the AI track performed the best, while the Cefi track performed the worst.

AI track: TAO, RENDER, FET, WLD, and FARTCOIN account for a large proportion of AI tracks, accounting for 86.32%, while this week's increase was: 50.96%, 18.93%, 53.36%, 33.58%, and 29.95%, respectively. The average increase was higher than that of other track projects, making the AI track perform the best.

Cefi Track: BNB, BGB and OKB account for a large proportion of the Cefi Track, accounting for 89.97%, while this week's increase was: 2.35%, 2.51%, and 2.29%, respectively. The average increase was lower than that of other tracks, so the Cefi Track performed the worst.

Crypto big event preview next week

Wednesday (April 30) US real GDP annualized quarterly rate correction value; US core PCE price index annual rate in March; US ADP employment in April

Thursday (May 1) US April ISM Manufacturing PMI

Friday (May 2) US April seasonally adjusted non-farm employment population; US4 unemployment rate

Summarize

This week, the cryptocurrency market ushered in a significant upward trend, with market sentiment turning from a sluggish state to positive. This change was mainly affected by the easing of U.S. policy and the friendly attitude of the new SEC chairman towards the crypto industry. With the change of the policy environment, investors' confidence in the market has gradually recovered, causing funds to flow into the cryptocurrency market and driving prices to rise. However, the market still needs to be wary of recession and uncertainty in tariff policies, which may continue to affect the market's trend. While enjoying market growth, investors need to be cautious to deal with possible volatility.

Projects such as Solana and Synthetix show potential for recovery, especially positive progress in technology upgrades and community support. Solana’s accelerated development and Synthetix’s innovative initiatives have attracted more investors’ attention, and these projects are expected to continue to expand their market reach in 2025. However, projects such as Omni are facing selling pressure from token unlocking, which may negatively affect their prices. Investors should make reasonable allocations based on the specific situation of the project and the market environment to avoid potential risks.

Although the overall industry trend is improving now, the market is still facing the uncertainty of the United States' upcoming economic recession and tariffs. Therefore, this week's rise can only be regarded as a rebound from the oversold period some time ago, and cannot be regarded as a reversal of the market. Next week, we will face multiple additional macro data releases, including:

· The annualized quarterly rate correction for the first quarter of the United States;

· The annual rate of the core PCE price index in the United States in March;

· US April ADP employed; US April ISM Manufacturing PMI;

· The non-farm employment population in the United States after the seasonal adjustment of April; the unemployment rate in the United States for 4 months.

These data can affect future market trends. It is recommended that investors maintain moderate positions and do a good job in risk management and wait for the policy to be clear. This will be the best strategy to deal with the current market.

jinse

jinse

chaincatcher

chaincatcher