Is BTC fighting the "tariff stick" hard?

Reprinted from jinse

04/09/2025·1MSource: Blockworks; Compilation: Baishui, Golden Finance

When Trump said that "tariffs" are the most beautiful word in the dictionary, he ignored that beauty is subjective.

The S&P 500 has fallen by about 10.6% since Trump announced “reciprocal” tariffs on April 2.

Even gold, which is usually considered unrelated to stocks, fell by about 6.4% due to tariff news.

To everyone's surprise, the cryptocurrency market performed strongly over the weekend.

Many theories have been proposed to explain this phenomenon.

Some believe crypto assets show resistance under expected rate cuts and quantitative easing; some say Friday 's stock market sell-off was just an outflow of institutional funds; while Galaxy's Alex Thorn believes BTC is just "resistant to tariffs."

However, after briefly considering that crypto assets will be decoupled from the stock market, it turns out to be just a fantasy.

As the weekend ended, Bitcoin plunged 6% at noon Sunday, from $825,000 to its current trading level of $772,000. During the same period, ETH fell even more, reaching 15.7%.

Thomas Erdösi, product manager at CF Benchmarks, said the price fell, but it was not a panic. He noted that “the CME basis is still firmer than 6%, and the demand for downside protection highlights caution but does not signal panic.”

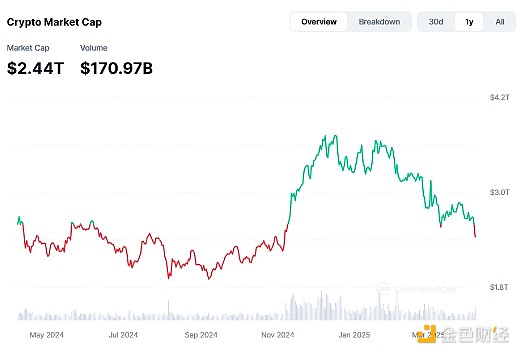

So far, the total market capitalization of cryptocurrencies has evaporated by about $0.23 trillion, or 8.6%.

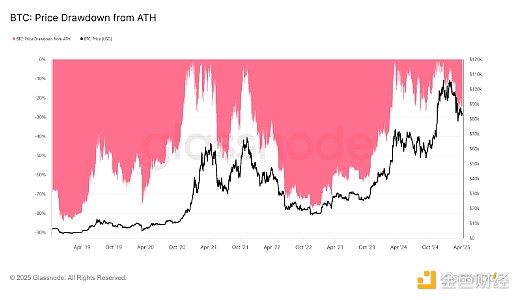

At Bitcoin’s current price of $77,000, this is about 27.2% lower than its all- time high of $106,000 in January, but the decline remains relatively small compared to the past few years. The pink section of the Glassnode chart shows yesterday's decline relative to the previous cycle.

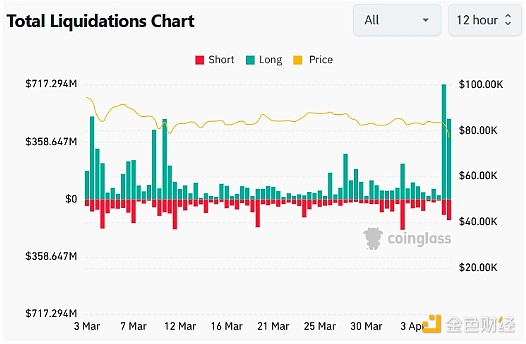

According to CoinGlass, the total liquidation of crypto assets in the past 24 hours is estimated to be approximately US$1.42 billion. BTC's liquidation amount is approximately US$479 million, while ETH's liquidation amount is US$418 million.

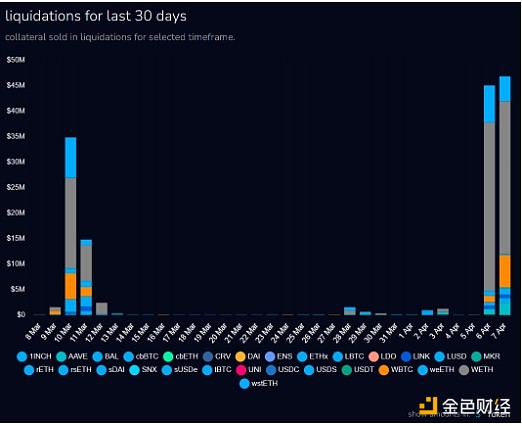

According to Blockanalitica data, from April 6 to 7, Aave v3 on Ethereum liquidated a total of US$91.85 million, with a total of zero bad debts.

If you are not looking for opportunities during a downturn, it is not a cryptocurrency.

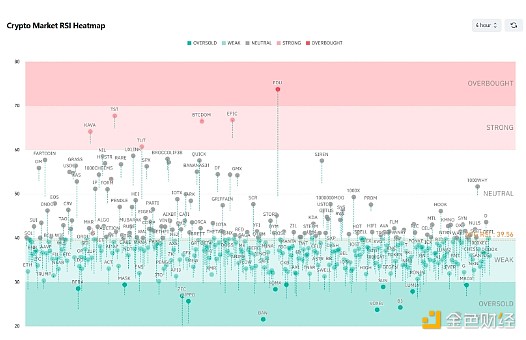

According to the four-hour chart of the CoinGlass Relative Strength Index (RSI) heatmap, well-known tokens with market capitalization in the range of $400 million to $500 million show relatively strong, including AI memecoin FART (RSI: 51), DePIN token GRASS (RSI: 54), and DeFi token PENDLE (RSI: 47).

All three tokens traded within the neutral RSI range, performing better than the market that is biased towards oversold conditions. This may indicate bullish upward momentum, as these tokens differ from downward pressure elsewhere.