Hayes: China's tariff response may cause more capital to flow to crypto markets

Reprinted from jinse

04/09/2025·1MAuthor: Martin Young, CoinTelegraph; Translated by: Deng Tong, Golden Finance

BitMEX founder Arthur Hayes said China 's response to the full U.S. trade tariffs could lead to capital flight to Bitcoin and cryptocurrencies.

“If it weren’t for the Fed, the People’s Bank of China would also provide us with the ingredients for Yahtzee,” Hayes said on X on April 8, referring to the catalyst needed to resume the bull market in the cryptocurrency market.

Hayes said that if the yuan depreciates, “capital will flow into bitcoin” , adding that “this will work in 2013, 2015, and it will work in 2025.”

Bybit co-founder and CEO Ben Zhou said China will try to lower the RMB exchange rate to deal with tariffs, adding that historically it is favorable for Bitcoin whenever the RMB depreciates.

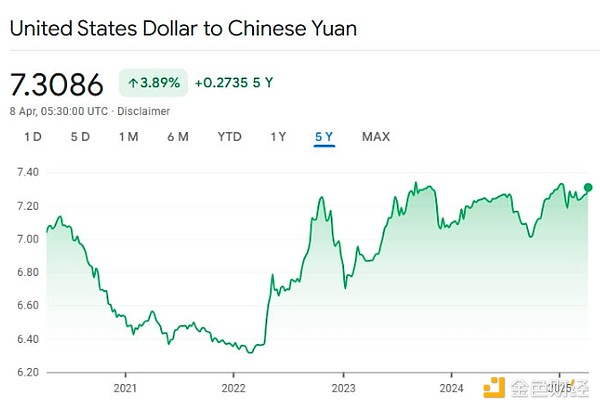

The RMB has weakened against the US dollar since 2022. Source: Google Finance

In August 2015, China depreciated the RMB against the US dollar by nearly 2%, marking its biggest single-day decline in decades. During this period, Bitcoin did attract some investors’ interest, although the direct causality is still controversial.

When the RMB exchange rate against the US dollar fell below a symbolic 7:1 in August 2019, the price of Bitcoin also rose during the same period. Some analysts believe that Chinese investors are using Bitcoin as a hedge tool as the asset rose 20% in the first week of the month.

In 2019, crypto asset manager Grayscale noticed the depreciation of the yuan and attributed it to a factor that stimulated the Bitcoin market at that time.

Avoid currency control and wealth preservation

According to analysts, wealthy Chinese citizens may have used cryptocurrencies to preserve their wealth in the past, keeping them out of government control and avoiding domestic capital controls and restrictions.

It is also believed that currency devaluation will also damage people's trust in central banks and government financial management, prompting people to turn to decentralized alternatives such as Bitcoin.

On April 7, US President Trump threatened to impose more tariffs on China, while China responded that he would "fight to the end."

"If the United States implements escalation of tariff measures, China will firmly take countermeasures to defend its own interests," the Ministry of Commerce of China said in a statement.