Bitwise: What does the Trump tariff stick mean for Bitcoin

Reprinted from jinse

04/09/2025·1MAuthor: Matt Hogan, Chief Investment Officer; Translated by: AIMan@Golden Finance

The Trump administration wants the dollar to depreciate, even if it means ending the dollar's position as the world's reserve currency. This also has a certain impact on Bitcoin.

In today's era, it's not easy to be an investor. The market is volatile and news is constantly coming.

Is Trump's tariff policy a negotiation strategy, or will it become a long-term measure? Can we actually usher in a 90-day tariff suspension period? Financial media are full of market experts with bold opinions. When browsing X (original Twitter), you may see a variety of different views from AQR Capital Management (“Tariffs are bad”), Bill Ackman from Pershing Square Capital Management (“Tariffs are OK in themselves, but these are badly designed”), or Anthony Pompliano from Professional Capital (“Tariffs may be beneficial”). It's hard to know who to believe.

My strategy to deal with market chaos is to narrow the scope of attention. Instead of guessing about all kinds of things that might happen, I try to focus on the few things I'm sure will happen.

So, when it comes to tariff measures, the most certain thing I am: the Trump administration wants the dollar to depreciate sharply, even if it means sacrificing its position as the world's only reserve currency.

This has a significant impact on Bitcoin.

The most important content you're going to read today

The most important thing I read on Monday was this speech by Steve Milan, chairman of the White House Economic Advisory Council. Just as the tariff dispute reached a heightened sensation, the White House delivered the speech on Monday. I don't think this is a coincidence.

I want to quote a lot of this speech because I think it really matters:

The dollar's reserve function has caused long-term currency distortions and, along with the unfair trade barriers set by other countries, leads to an unsustainable trade deficit. These trade deficits have greatly damaged our manufacturing industry, as well as many working-class families and the communities in which they live, but are only for the convenience of trade between non-Americans.

…Granted, demand for the US dollar keeps our lending rates low, but it also keeps the money market in a distortion state. This process has put an overload on our businesses and workers, making their products and labor uncompetitive on the global stage, and has dropped by more than one-third since the manufacturing workforce peaked, while our share of world manufacturing output has also dropped by 40%.

The implicit information is clear: the US dollar needs to depreciate .

What does this mean for Bitcoin?

This insight has both short-term and long-term effects on Bitcoin.

In the short term, I expect a weaker dollar to be favorable to Bitcoin. Over the past five years, Bitcoin has correlated between -0.4 and -0.8 with the U.S. dollar index (DXY, a measure that compares the value of the dollar to a basket of six major currencies). When the US dollar falls, Bitcoin will rise. I expect this trend to continue.

In the long run, the impact is even more positive. The turmoil in the global macro system has created opportunities for the emergence of new reserve assets. This makes sense: the reason why governments and enterprises choose the US dollar in international trade is precisely because of the stability of the US dollar. When this stability is questioned, they have to find another way out.

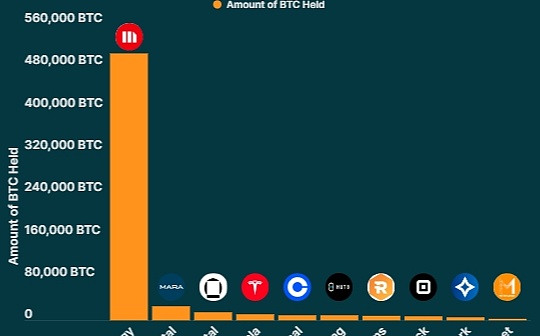

I think we will move from a single reserve currency (USD) system to a more fragmented reserve system, and hard currency like Bitcoin and gold will play a bigger role than it is now. In this case, the reason for choosing Bitcoin is simple: When the international situation is tense and the global monetary system is in turmoil, where can investors find a scarce, global means of digital value storage that is not controlled by any government or entity?

As the old saying goes, “Confusion is the ladder to progress.”

In December 2024, Bitwise predicted that Bitcoin will reach $200,000 by the end of this year. I still think this is possible.