Hyperliquid: Transparent dark pool first step

Reprinted from jinse

06/06/2025·14DSource: Zuo Ye Waibo Mountain

I'm not crazy, and the title is not sensational, let me explain it all.

Around 2008, Josh Levine (@bigjoshlevine) and others hoped to end the "conspiracy" of the US exchange. The exchange would give major customers an advantage in order information, which was only a little faster than ordinary users. Ordinary users did not know that their orders would contribute profits to professional teams.

Unfortunately, the transaction data display tool created by Levine was eventually absorbed by quantitative transactions. The information is of course transparent, but there is always someone 's information a little more transparent than others.

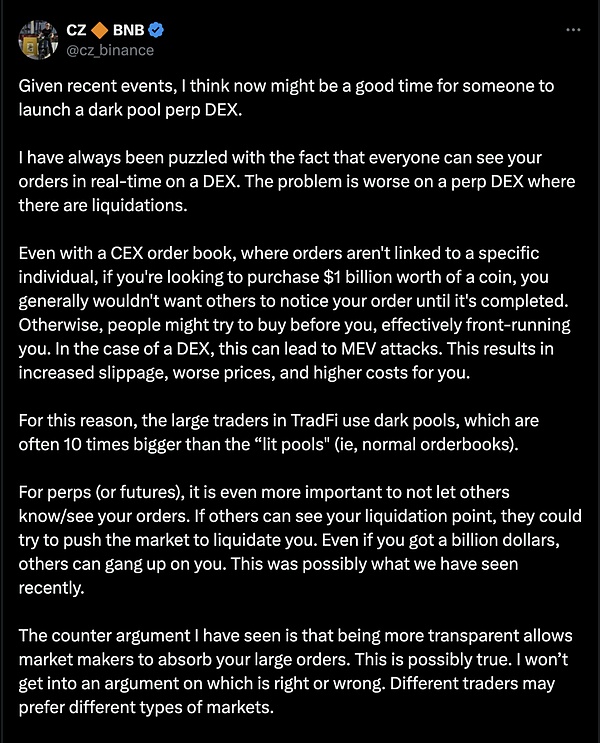

As a long-term follower of FHE, I am very happy to see someone, especially CZ, discussing the "Dark Pool" dark pool, which is also a potential application scenario for true encryption technologies such as ZK, MPC, and FHE. However, it has to be said that CZ's understanding of dark pools does not seem to be completely consistent with the blockchain-based dark pool practice.

In the narrative about the dark pool, CZ targets large-scale order information to avoid potential targeted attacks. In the view of this victim, James Wynn, this is definitely the technology he wants. Hyperliquid's on-chain mechanism plus hidden information function, a more free world is waving to us.

Image description: CZ Comment Dark Pool Image source:

https://x.com/cz_binance/status/1929246168833229243

Image description: CZ Comment Dark Pool Image source:

https://x.com/cz_binance/status/1929246168833229243

You can't be wrong, but at least CZ's idea is not the same as James's experience. Let's answer the first question first, why James chose Hyperliquid instead of Binance for large-scale transactions. At the root of this, he can get more and be subject to fewer restrictions.

-

No KYC, no funding review

-

On-chain transactions, beware of pin insertion

Although Hyperliquid is not very centralized, and the leverage multiples and liquidity cannot be compared with Binance, the on-chain characteristics of Hyperliquid have successfully attracted its own giant whale users, which is consistent with Curve War's premise that Curve is the only professional trader to adopt DEX on the chain.

However, Hyperliquid's incident, strictly speaking, does not depend on mechanism design. It can even be said that the on-chain transparency is the reason why the "attackers" can see James' position and liquidation price, so CZ said that the dark pool DEX is needed.

No, this is not the same thing. The on-chain privacy trading track has been explored to the extreme. Not to mention Arcium's FHE dark pool route, "true" privacy protection tools such as Bitcoin, Zcash, Tornado Cash have not been mainstreamed in the market. Instead, there are many problems such as ERC-7702, but the reality is that more convenient functions are conquering the city.

People like convenience, and pay for privacy is a very small number of people.

Going back to CZ's dark pool theory, I can say directly that what he is talking about is actually " Hyperliquid after MEV ". CZ is born in the traditional trading market and should understand that the emergence of TradFi dark pool is an excessive inversion of high-frequency quantitative trading. Large-value transactions can go to the OTC channel. The core of high- frequency trading is to compete for the price advantage over ordinary users.

-

Be the first to wait for ordinary users to trade

-

Forecast or attack large-value transaction orders

-

A little faster than high-frequency peers

The answer is about to come out. TradFi's dark pool and blockchain's MEV effects are the same. In essence, this has nothing to do with protecting privacy, but the transparency of transactions on the chain has led to no real good solutions at this stage except "centralization". If you have an impression, BNB Chain directly "commands" nodes not allowed to be clipped, so he barely controlled the MEV.

If Hyperliquid completely eliminates MEV, then you see that James' orders can't manipulate the market, and the only question is, how can we achieve all this:

-

1. Eliminate MEV routes

-

2. Improve privacy route

Remember: the dark pool is not a "hidden transaction intention", but a "hidden transaction price", which is closer to the execution process of MEV. The dark pool of blockchain that everyone imagines is more like the ZK/FHE-based Hyperliquid completed by MEV optimization. The reason why it cannot be CEX is that centralization is the biggest MEV process.

Risc-V opens the imagination space

The traditions of all dead ancestors entangled the minds of living people like nightmares.

Again, the privacy route looks very similar to MEV, but the two have no direct relationship. The source of the blockchain privacy technology is Bitcoin, PoW+P2P+small amount+one-time address, and the source of blockchain MEV and prevention and control technology is Ethereum. The decentralized blockchain consensus formation mechanism will inevitably lead to dissonance and noise.

After Ethereum has greatly embraced Risc-V, the MEV problem will still exist. Upgrading the pledged node to 2048 will even increase the voice of the super nodes, but Risc-V will have new development opportunities in the software and hardware integration level, especially the dark pool of FHE.

The current EVM is incompatible with overly complex opcodes. The new VM mechanism will fundamentally change all this. This is not an alternative to SVM and Move VM, but a real innovation. In short:

-

OP Code and EVM: The new opcode will support complex technologies from a more low-level level, with one iteration and comprehensive improvement.

-

New VM, New Compatibility: Risc-V VM will improve from hardware and software collaboration, not just software optimization.

Here we briefly mention the significance of Risc-V. Architectures such as RAM are chip hardware, which can build OS such as Windows, macOS or Harmony. However, in essence, it is a product of a commercial company. Risc-V is an open source chip instruction set. Ethereum can completely customize its own system and get rid of its complete dependence on existing commercial hardware. Customization will bring new potential.

Back to the dark pool, we divide it into three levels: subject anonymity, transaction anonymity, and interaction anonymity:

-

1. Blockchain itself is an anonymous system of subjects. Unlike TradFi, bearer is the essence of blockchain. James' self-destruction or the address association of data analysis platform are all a probabilistic match. The private key cannot be seen and the fund cannot be truly determined;

-

2. Transaction anonymity can be divided into price protection and order anonymity. Price protection means that the price cannot be changed after determining the price. Order anonymity can include price protection, but it can also only hide the on-chain address of the transaction order without forcing the transaction price to be restricted;

-

3. Interactive anonymity is a stage feature of blockchain, such as the most classic deposit and withdrawal problem. If USDT is used, there is always a possibility of being tracked or frozen. This is why hackers let Bybit's USDT wallet go.

Starting from the privacy route, Risc-V has the necessary conditions for building a dark pool, but the MEV problem still exists. In current practice, the combination of ZK and TEE is the mainstream choice. TEE can isolate private keys, especially the multi-private key management system. ZK can hide order details, but whether MEV can be completely eliminated depends on subsequent development.

At this point, FHE may be a better technical route. Its encrypted computing features can achieve subject anonymity and transaction anonymity. The only problem is that it is expensive and slow. Under the expectation of Risc-V custom hardware, it is possible to support spot DEX. For Perp DEX, a question mark is required.

To sum up, the deep integration of Risc-V and ZK technology can provide a useful set of Perp DEX dark pool mechanisms. The integration of FHE's dedicated Risc-V accelerates chips and Ethereum can achieve the ideal blockchain version of TradFi dark pools in CZ - anonymous, high-frequency, and large-value three-in-one.

Conclusion

Whether the dark pool will come true will not be the case, but this is obviously a capital and technology-intensive track, and now there are only:

Opportunities for historical events – CZ wants to be a dark pool and knows that CEX is not suitable for this;

The increasing relaxation of regulation - Tornado Cash and DeFi are decriminalized, transparent dark pools are not ridiculous, everyone just wants to trade safely, not money laundering

Clear market demand - DEX's evolution direction is finally not about playing Meme. Professional traders need such tools, and Curve and Hyperliquid are role models.

Satoshi Nakamoto believes in Bitcoin, so Bitcoin was born. This time, can the transparent dark pool appear in the world?

chaincatcher

chaincatcher