Why is Goldman Sachs wrong in judgment on Ethereum

Reprinted from jinse

06/05/2025·15DWritten by: Brendan on Blockchain Compiled by: Vernacular Blockchain

A few years ago, Ethereum was also the "little brother" of Bitcoin, known for its decentralized finance (DeFi), pixelated NFT and highly creative smart contract experiments, far from being the choice of "serious" investors. However, by 2025, Ethereum has become the focus of Wall Street.

Goldman Sachs perfectly embodies the mindset of traditional institutions in 2021, when they derogated Ethereum to "overly volatile and speculative" and called it "finding solutions to problems." Their research team believes that smart contract technology is overhyped, with limited real-world applications, and institutional customers have "no legal use cases" for programmable currencies. They are not an isolated case. JPMorgan calls it "pet stone", and traditional asset management companies are even more avoiding it.

However, this view is as outdated as the first time to call the Internet a "flash-of-the-pan". Today, Goldman Sachs is quietly building an Ethereum-based trading infrastructure, JPMorgan Chase handles billions of dollars in transactions through its Ethereum-powered Onyx platform, while asset managers that once shunned are now launching Ethereum-related products as fast as possible.

The real turning point happened in 2024, when the Securities and Exchange Commission (SEC) finally approved the Ethereum spot ETF. This may not sound like an exciting dinner table topic, but it means a lot. Unlike Bitcoin being simply classified as "digital gold", Ethereum is a difficult problem for regulators: how to regulate a programmable blockchain that supports the digital art market from decentralized trading platforms to the digital art market? They finally solved this problem and released it, which is enough to illustrate the direction of the industry.

The ETF's floodgates open

There have been doubts over the years about the regulatory clarity of Ethereum, especially the SEC's ambiguous attitude towards whether Ethereum is a securities company. But the approval of ETFs marks an important signal: Ethereum has matured into an investable asset for pensions, asset management companies and even conservative family offices.

BlackRock pioneered the iShares Ethereum Trust, and frankly, watching the launch is like witnessing the "Fear Missing" (FOMO) of institutional investors in real time. Fidelity followed closely with Grayscale converting its existing products into ETFs, and suddenly every major asset manager launched Ethereum products. But even more striking is that these products are not limited to ordinary ETFs that track ETH prices, but some also incorporate pledge rewards, meaning institutional investors can earn profits through holdings like DeFi participants.

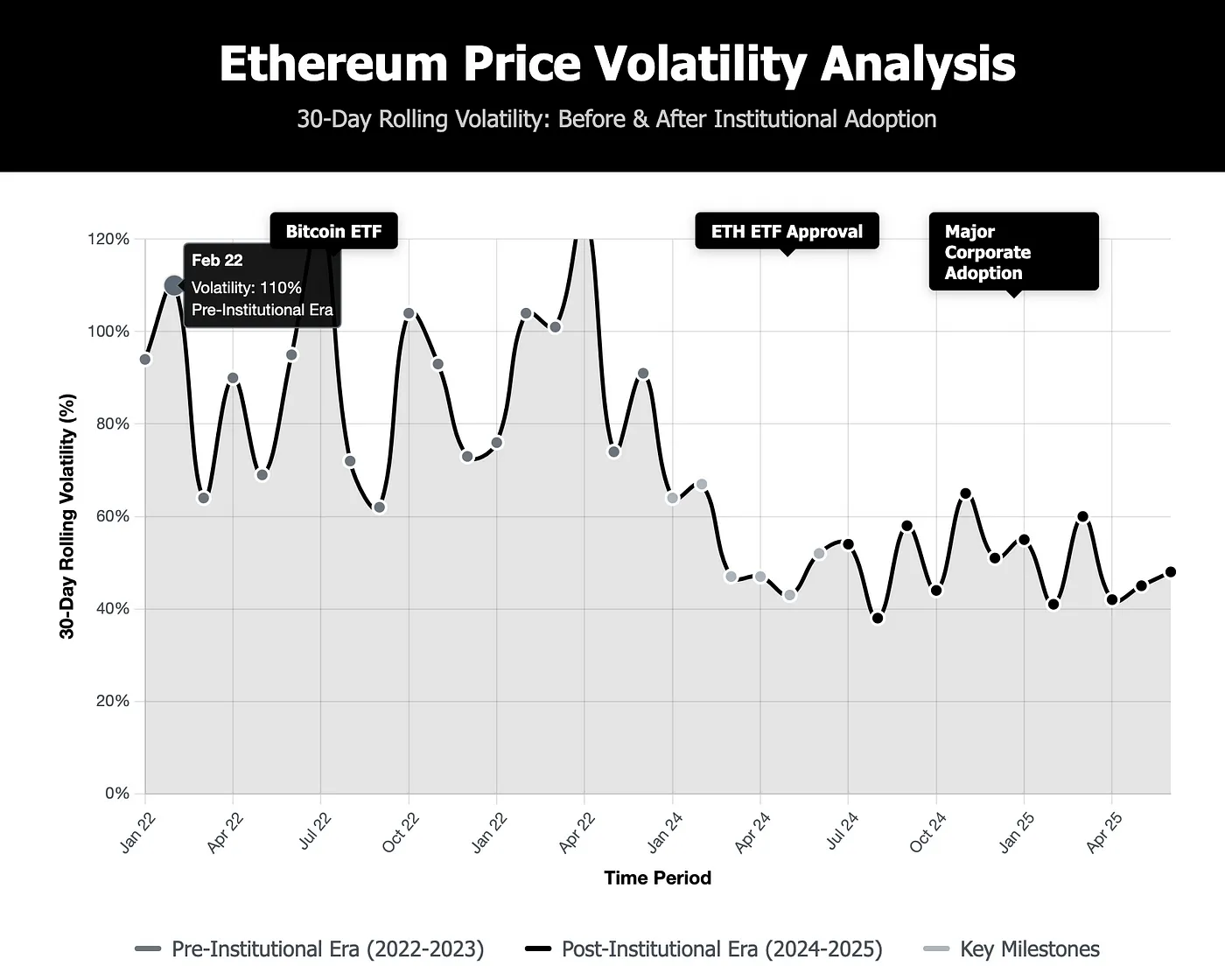

Price fluctuations of Ethereum before and after the visual display agency adopts

A comprehensive embrace of enterprises

What is really fascinating is how businesses integrate Ethereum into their actual business operations. This is not a speculative asset reserve like Bitcoin, but rather a company building a digital infrastructure on Ethereum because it can solve practical problems.

The real value of Ethereum to institutions lies in its ability to handle Tokenized currencies, digital contracts and complex financial workflows as the infrastructure of programmable blockchains.

Organizations are quickly joining the wave:

Franklin Templeton, a company that manages $1.5 trillion assets, tokens one of its mutual funds on Ethereum, and investors now hold digital shares on blockchain, enjoying the benefits of transparency and 24/7 settlement.

JPMorgan uses Ethereum-compatible networks (such as Polygon and their enterprise version of Ethereum Quorum) to test tokenized deposits and asset swaps through its blockchain division Onyx.

Amazon AWS and Google Cloud now offer Ethereum node services, allowing businesses to easily access the network without building their own infrastructure.

Microsoft partnered with ConsenSys to explore enterprise use cases from supply chain tracking to compliant smart contracts.

These are no longer just realms of encrypted native players. Traditional financial giants are awakening to the rapid, secure, and automated, non- intermediary financial services provided by Ethereum.

The conversation between the CFOs 500 companies has completely changed. Instead of questioning whether blockchain makes sense, they ask how to apply smart contract automation to supplier payments, supply chain financing and internal processes as soon as possible. The efficiency improvement is obvious.

The gaming and entertainment industry is particularly radical. Mainstream game studios are tokenized in-game assets, music platforms are automated distribution of royalties, and streaming services are experimenting with decentralized content monetization. Ethereum's transparency and programmability solved decades of problems in these industries almost overnight.

Why is Ethereum so attractive to institutions?

Ethereum allows assets (whether in US dollars, stocks, real estate or carbon credit) to be digitized, tokenized and programmed. Combined with stablecoins (such as USDC or USDT) that run primarily on Ethereum, you suddenly have the cornerstone of building a brand new financial operating system.

-

Need instant cross-border settlement?

-

Need programmable payments based on contract milestones?

-

Need transparency but without losing control?

-

Ethereum can do it, and even more.

Coupled with Layer 2 networks such as Arbitrum and Optimism, these solutions extend Ethereum’s capacity, reduce fees and significantly increase speed. Many organizations choose to build on a Layer 2 network to improve efficiency while still taking advantage of Ethereum's liquidity and security.

All of this institutional adoption cannot be separated from the infrastructure layer that most people ignore. Companies like BTCS Inc are increasingly supporting traditional financial institutions to participate in the necessary infrastructure for products such as Ethereum and ETH ETFs. BTCS focuses on operating secure enterprise-level Ethereum verification nodes, maintaining network integrity and allowing institutions to participate in staking without dealing with technical complexity. Although they are not custodians or ETF issuers, their verification node operations support Ethereum’s functionality and credibility, enhancing the network resilience and transparency required by institutional investors.

Looking to the future

What is the future trend? I think the direction is very clear. Ethereum is becoming the infrastructure layer of programmable finance. We are no longer talking about cryptocurrency transactions, but about automated borrowing, programmable insurance, Tokenized real estate and 24/7 supply chain financing.

Integration with central bank digital currency (CBDC) is another huge opportunity. As countries develop digital currency strategies, many are considering Ethereum-compatible solutions to enable seamless interaction between government-issued digital currencies and the wider DeFi ecosystem.

More importantly, this institutional embrace is driving the long-awaited regulatory clarity across the industry. When major financial institutions build products around Ethereum, regulators have strong motivation to define a viable framework rather than a comprehensive limit.

We are witnessing a technology that started with an experimental platform that has gradually become a key financial infrastructure. The approval of the ETF is significant, but it is just an opening remark. The real story lies in how Ethereum fundamentally changes how financial services operate, how businesses operate, and how value flows in the global economy.

Honestly, I think we are still in the early stages of this transformation. Current institutional adoption is only the beginning of a large-scale integration of programmable currencies and traditional finance.

chaincatcher

chaincatcher