How does a short -term US Treasury yield affect the price of Bitcoin?

Reprinted from jinse

01/31/2025·3MAuthor: Mark Mason, Bitcoin Magazine; Compilation: White Water, Golden Finance

US Treasury yields have recently differentiated, short -term yields have declined, and long -term yields have risen, which has caused great interest in the entire financial market. This development provides important insights to Bitcoin investors to provide macroeconomic conditions and potential strategies in response to these uncertain periods.

Treasury yield dynamics

The national bond yield reflects the return required by investors to hold US government bonds, and is an important indicator for measuring expected economic and monetary policy. The following is the snapshot of the current situation:

-

Short -term rate of return: Short -term Treasury yields (such as 6 months yield) decline indicates that the market is expected to turn interest rate cuts in response to the risk of economic slowdown or inflation expectations decreased.

-

Long -term rate of return: At the same time, the rise in long -term bond yields such as 10 -year Treasury yields indicates that people are increasingly worried about continuous inflation, fiscal deficit or investors' higher term premium required for long -term bonds.

This difference in yields usually suggests changes in the economic pattern, which can re -adjust the investment portfolio signal as investors.

Why is the national bond yield more important than Bitcoin investors

The unique attributes of Bitcoin as non -sovereign and decentralized assets make it particularly sensitive to macroeconomic trends. The current yield environment may affect Bitcoin's narrative and performance in various ways:

- Inflation hedging attraction:

The rise in long -term rates may reflect continuous inflation concerns. Historically, Bitcoin has been regarded as a tool for hedging inflation and currency depreciation, which may increase its attractiveness to investors seeking wealth.

- Risk preference emotion:

The decline in short -term yields may indicate that the future financial environment will be more loose in the future. Loose monetary policy often creates a risk -preference environment. Investors seek higher returns, and assets such as Bitcoin will benefit.

- Financial unstable hedging:

The yield is differentiated, especially when the yield curve is upside down, it may indicate the risk of economic instability or recession. During this period, Bitcoin's image as a hedid asset and traditional financial substitute may be sought after.

- Consider liquidity:

Lower short -term yields will reduce borrowing costs, which may lead to increased liquidity of the financial system. This liquidity usually spreads to risk assets including Bitcoin, thereby promoting the rise in price.

More extensive market insights

The impact of differences in yields is not limited to Bitcoin, but also extends to other areas of the financial ecosystem:

-

Stock market: lower short -term yields usually boost the stock market by reducing the cost of borrowing and support valuation. However, rising long -term yields may put pressure on growth stocks, especially those stocks that are sensitive to higher discount rates.

-

Debt sustainability: Higher long -term return will increase the financing cost of government and enterprises, which may bring pressure on the entity of debt, and generate a chain reaction in the global market.

-

Economic Outlook: This difference may reflect the market's expectations of the market's slowdown in growth and long -term inflation, which indicates the risk of potential stagflation.

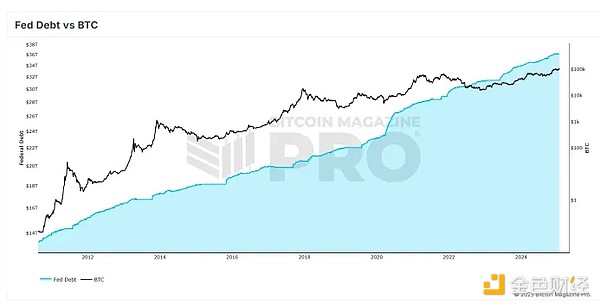

US Treasury bonds are the total amount of US federal government owed claims, and creditors include individuals, enterprises and foreign governments. The Fed is the biggest holder of US government debt. Source: Bitcoin Magazine Pro -Federal Reserve debt and Bitcoin

Points of Bitcoin investors

For Bitcoin investors, understanding the interaction between the yield of government bonds and the macroeconomic trend is essential for making wise decisions. Here are some key points:

-

Monitoring monetary policy: Pay close attention to the Fed's announcement and economic data. The steering of the pigeon faction may bring a smooth wind to Bitcoin, and the tightening policy may bring short -term challenges.

-

Diversification and hedging: Long -term rate of return can lead to fluctuations in asset categories. As a part of a wider investment portfolio strategy, the diversification of Bitcoin can help hedge inflation and economic uncertainty.

-

Using Bitcoin 's narrative: In the environment of fiscal deficit and currency loose, the story of Bitcoin as non -inflation value storage has become more attractive. Education new investors understand that this narrative may promote further adoption.

in conclusion

The differences in US Treasury yields highlights the continuous changes in the market's expectations of growth, inflation and monetary policy -these factors have a profound impact on Bitcoin and broader financial markets. For investors, understanding these dynamics and performing positioning correspondingly can unlock opportunities, and use Bitcoin's unique role in the rapid economic pattern. As usual, maintaining knowledge and active initiative is the key to driving these complex periods.

chaincatcher

chaincatcher