Is Ethereum still ushered in highlights? Will it be subverted by SOL?

Reprinted from jinse

01/31/2025·3MAuthor: Michael Nadeau, The Defi Report; Compilation: Tao Zhu, Golden Finance

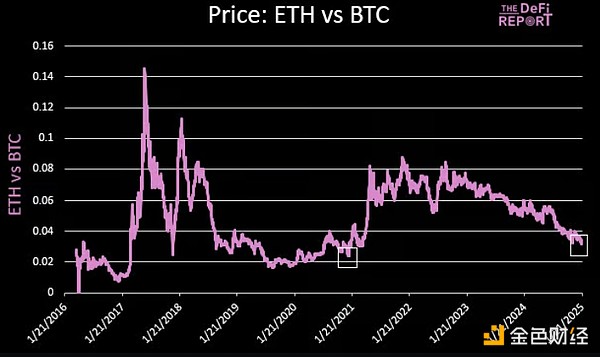

ETH VS BTC

ETH/BTC continues to reach a new low. The dominant position of BTC has been unabated -now it is 59.2%. The white box above shows that ETH/BTC is even lower at the same time at the same time of 21 cycles. At that time, Bitcoin Maxi was rejoicing, because the leading position of BTC at the time was 63%.

Of course, ETH continued to rise 5 times in the next five months -because the dominant position of BTC fell to 40%.

In some cases, if ETH/BTC returns to .08 (like twice in the previous cycle), this will make ETH reach more than $ 8.2K at the current BTC level.

We still think that ETH will have its high light moment.

But I admit that my belief is weakening.

What I have been thinking is that there are still many ETH brothers. But I also saw that the community was a bit split. Just this week, we saw that several outstanding members of the Ethereum community deleted. ETH from their X profiles.

This may be just noise or bottom indicators. At the same time, you now have an interesting setting between ETH and SOL:

-

The market value of Ethereum is 3.2 times that of Solana, but in terms of fundamentals, developers' interest and mental share, Ethereum has been far surpassed by Solana.

-

ETH's Maxis began to question their loyalty to the chain.

-

Solana continues to attract developers and launch New Types (Trump Memecoin and Pudgy Penguins Memecoin)

If you look far away, you can start thinking about what Solana needs to do to subvert Ethereum from now on. For example, does Solana have to rise 3.2 times? Or how percentage of the Ethereum community will eventually yield and replace part of the part they hold to SOL?

If it is the latter, then "subversion" may occur faster than people expect. In this case, ETH will fall, and SOL will rise at the same time.

When Trump launched Memecoin last weekend, we saw this. As many investors replaced their existing Memes with Trump, almost all other Memes fell immediately.

As mentioned earlier, the condemnation of Ethereum. Ethereum may actually be the bottom.

Of course, this does not mean that there are serious problems in ETH or Ethereum. As far as we know, the community is performing its route map. There are still a large number of innovation, developer talents, chain value and network effects in Ethereum.

But you don't have to believe in my words. You can study the basic knowledge on your own ...

Fundamental update on the chain

In this section, I will use some new data to introduce some key chain indicators and share some key points of each indicator.

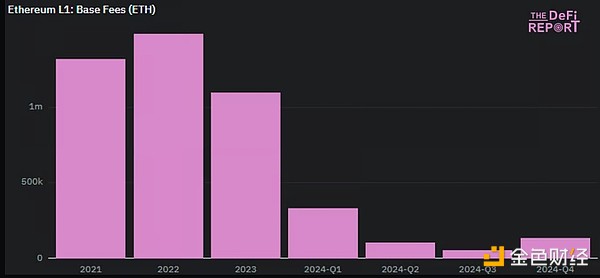

L1 fee

Base fee

Key points:

Since 2022, basic expenses (destroyed) have risen in the fourth quarter (an increase of 135%over the third quarter). However, compared with 2023, the basic costs in 2024 fell 42%.

UNISWAP, Tether, MEV BOT, Circle, and Banana Gun (Telegram Trading Bot) are currently five contracts consumed by L1.

**The top -ranking contract reveals the current main use of cryptocurrencies:

- speculative transactions of assets, 2) stablecoin.**

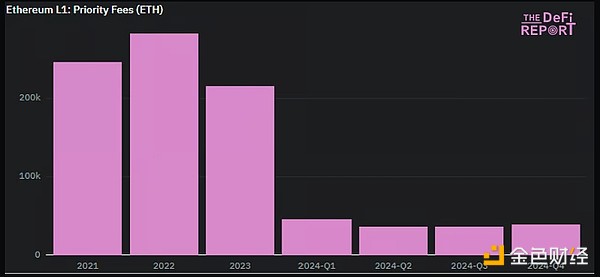

Priority cost

Key points:

Priority costs (paid to ETH verifications and pledges) rose 8%in the fourth quarter, but fell 21%compared to the first quarter. This year, the priority fee fell by 26%.

The priority fee in the fourth quarter is less than the first quarter, which is surprising. This means that there are fewer speculation on L1 in the fourth quarter (after the election) L1 than the beginning of the year (before the ETF announcement).

We believe that there are two main reasons: 1) Users are turning to L2, 2) Users are turning to Solana.

L1 and L2 transaction

Speaking of L2. The reason why Ethereum L1 struggled last year was the EIP4844 network upgrade -it introduced a new data type called "blob" on Ethereum. These "BLOB" allows L2 to store transaction data on L1 at a very low cost.

This leads to 1) cheaper L2 costs and 2) without L1 congestion -because L2 transactions no longer compete with conventional L1 transactions. The lower the degree of congestion of L1 = the lower the priority cost.

But let's take a look at the user activities of the L2 level. As we pointed out, users are turning to L2 (short -term losses, long -term bullish ETH) and Solana (short -term+ long -term loser ETH).

Key points:

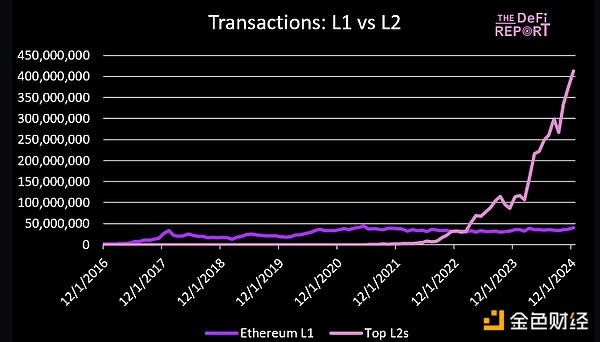

At present, the number of top L2 transactions is 10 times that of Ethereum L1. One year ago, this number was 3 times. Two years ago, it was double.

Mi Lu played on the 2nd floor. Base controls 64% of the transaction activities in top L2 in December. Arbitrum ranked second with a 18% share. OP has a 7% market share. Six months ago, Base had a market share of 42%, while Arbitrum had a market share of 27%, and OP had a 9% market share.

We expect large institutions to open the door of the cryptocurrency field, and many institutions will choose to build their own L2. Given the current power law, see how this will play a fun. Will the institution launch its own general L2? Construction on Unichain? Construction on OP stack? Time will tell us the answer.

But what does this mean for the value of Ethereum L1? After all, if L2 is successful, shouldn't this be promoted to the demand for ETH (users on L2 need ETH for transactions)+increased the settlement/accounting cost of paying to Ethereum L1?

Let's see what the data says ...

L2 fee paid to L1

Publishing spend

The above picture shows us the cost of L2's payment of data to Ethereum L1.

Key points:

EIP 4844 upgraded in March. The chart shows the impact to us: On March 10, L2 paid a total of 577 ETH to publish data to L1. Yesterday, they paid a total of 3.6 ETH (decrease 99.5%) to publish data to L1.

Ethereum is subverted through EIP4844, so that the network can expand. If it wants to recover these costs, we need to see the surge in L2 and new use cases -this may ultimately fill a large number of new supply provided by technology upgrades that are conducive to L2.

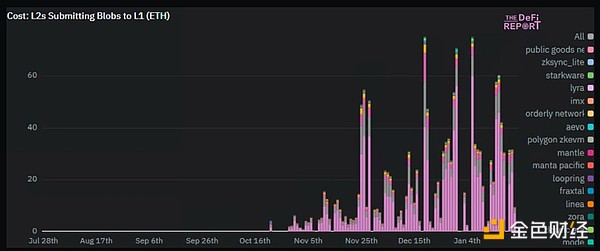

BLOB cost

Please note that L2 pays two types of fees from L1: 1) call data/release costs, 2) "blob" cost. Both should be regarded as the "income cost" of L2. The cost of calling data is more expensive than "BLOB", which is a change brought by EIP4844.

Key points:

In the figure above, we can see that as L2 transitions from the traditional "calling data" and accelerates, the cost of BLOB is also increasing. The peak activity occurred at 1/6. But only 75 ETH paid L1 ($ 277,000).

At 1/6, L2 requires 16.06 million transactions to generate $ 277,000 BLOB costs ($ 0.017 per transaction).

At the peak period of the 21st cycle, the L1 cost of Ethereum was about $ 70 million per day. To return the cost of BLOB to this level, we need to see that the transaction volume on L2 increases to 4,117,647,058 pens.

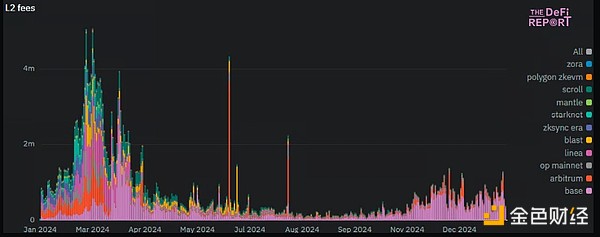

L2 user fee

Instead of paying user fees to L2 (instead of paying L2 fee to L1).

Key points:

We can see that due to the EIP 4844, the cost of L2 also decreased significantly.

Before the upgrade is implemented, the daily total user fee of L2 reached a peak of about 5 million US dollars. They now cost about $ 1 million daily.

With the increase in BLOB costs recently paid to L1, the profit margin on the L2 chain is currently about 85%(initially increased to 99%).

Base dominates the field of L2, currently accounting for 70-80%of all L2 costs. Arbitrum ranks second, and OP ranks third in terms of user costs.

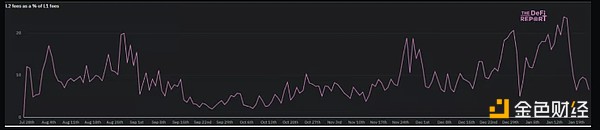

L2 user costs account for a percentage of L1 user costs

Key points:

Although the transaction volume of L2 is 10 times that of Ethereum L1, the current transaction fee of L2 accounts for only 9%of the L1 fee -this indicates that although the transaction fee is much higher, the demand for L1 block space continues.

Earlier this year, L2 costs accounted for 24% of L1. In the future, we expect that more than 90% of Ethereum L1 costs will come from L2.

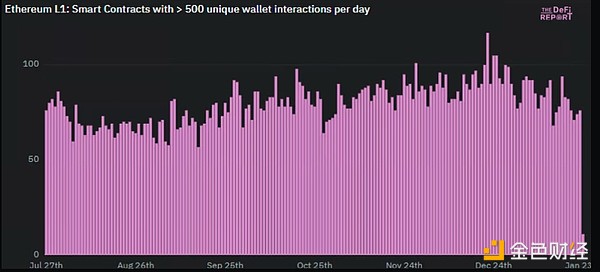

Ethereum L1: Smart contracts that interact more than 500 times a day

Key points:

There are about 75 contracts in Ethereum L1, and more than 500 unique wallets are interactive every day.

The leading contracts are Uniswap, Tether, Circle, MEV Robot, Banana Gun, top L2 and top DEFI projects.

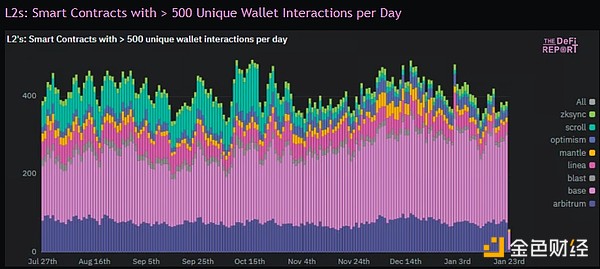

Key points:

The number of smart contracts with more than 500 daily independent interactions of top L2 adds up to 5 times that of Ethereum L1.

Base once again dominates the L2 field. It has about 55% of the daily independent interaction of more than 500 smart contracts. Arbitrum ranks second with a market share of about 20%.

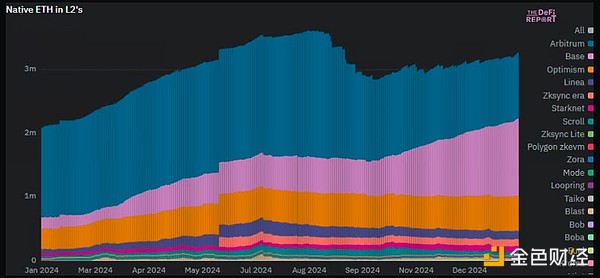

Native ETH in L2

Key points:

Native ETH (excluding ETH with pledge or packaging) reached a peak of 3.6 million in July. It has now dropped to 3.25 million (2.7%of the supply of circulation).

Base leads 1.23 million Eth. Arbitrum has a 1.03 million eth (the picture above tells us, a large amount of eth on Arbitrum flows to Base), and OP has 542,000 ETH. This is equivalent to 86% of the market share.

2.7% of ETH migration to L2 surprised us. This shows that users still do not trust the L2 bridge -because the current 97.3% ETH is located on L1 (a small amount is now in ETF).

If we include pledged ETH and packaging ETH, the number of ETH on L2 will increase to 4.3 million.

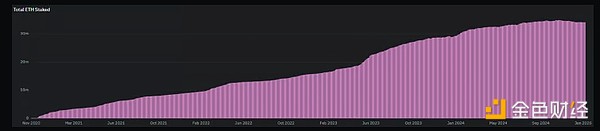

ETH pledge

Key points:

After reaching the peak of 35 million (29%of the circulation supply), the total pledge of ETH in the fourth quarter decreased. It is currently 34.17 million.

In the past few years, Ethereum pledge yields have fallen from 5.5% to about 3%. The reason for the decline is 1) the number of pledges increase, and 2) the reduction of user costs.

If the cost continues to increase and the total pledge of ETH is stable, we may see that the pledge yield of ETH has begun to rise.

This may surprise you, but in terms of overall economic security, Ethereum has a value guarantee of $ 110,984,160,000. Solana has 961,818,000,000 US dollars -mainly because SOL's pledge percentage is much higher than ETH on Ethereum. The leading position of Ethereum as a safer and decentralized network is gradually weakening with the fading of the network.

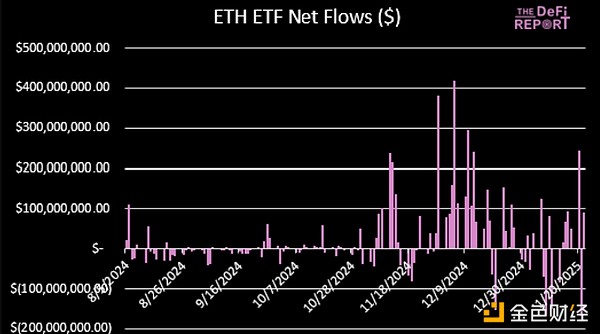

ETH ETF

Key points:

ETH ETF currently holds 3.65 million ETH ($ 11.8 billion). This accounts for 3%of the amount of circulation (exceeding the current L2 holdings). For reference, BTC ETF holds 5.8% of the supply ($ 121 billion).

In terms of net traffic, ETH ETF is currently $ 3.2 billion. BTC has a net traffic of $ 37 billion.

Given that ETH accounts for about 20%of the market value of BTC, we believe that in the later period of the cycle, traffic may be tilted towards ETH, because ETH currently only accounts for 9.7%of BTC ETF holdings.

ETH ETF does not return the income to the holder, but we expect this to change. When this happens, ETH ETF may attract investors more than BTC.

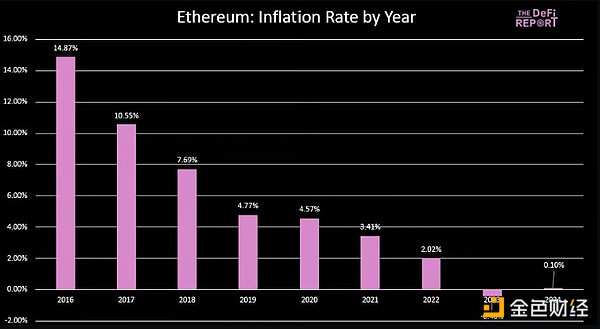

Inflation rate

Key points:

After the tightening of the currency in 2023, ETH supply increased by 0.10%in 2024.

The network was in a deflationary state in the first quarter, but after the implementation of EIP4844 in March, it turned from the second to fourth quarter to inflation.

In the third quarter (0.11%) and the fourth quarter (0.11%), inflation levels were the highest.

Considering the challenges faced throughout the year, we believe that Ethereum is almost optimistic in a deflation state in 24 years.

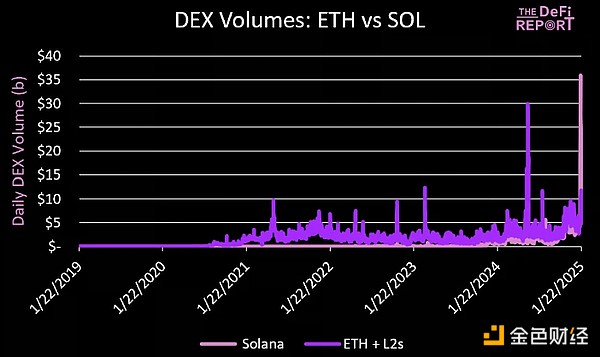

Eth vs sol

We will conduct comprehensive data -driven analysis in the upcoming report, so I will not introduce it here in detail. But I want to talk about the most important indicators of Ethereum and Solana:

DEX transaction volume

Key points:

In the past month, Solana's DEX trading volume was 220 billion US dollars, and Ethereum+ L2S trading volume was 172 billion US dollars.

Last Saturday (Trump Memecoin's first day trading), Solana's transaction volume was $ 36 billion. This is three times the highest water level in Ethereum+ L2S.

For reference, Nasdaq's daily transaction volume is about 20-400 billion US dollars.

We believe that at this stage of cryptocurrencies, DEX transaction volume is the most important tracking indicator. Why? In the end, we believe that all financial asset transactions will be transferred to public blockchain.

For Solana, an unreasonable question is whether institutions like Bellaide will trust it as the place of storage of assets, bonds, and private assets.

Qualitative analysis

Finally, I want to share some views of my Ethereum Foundation, community and overall leadership.

-

I am more and more worried about Vitalik as leaders. This is not a blow to Vitalik and everything he has established. It is just that Ethereum now needs to locate yourself for the commercial/institutional community. Not a password punk crowd. I feel that new leaders need to be needed in the next stage.

-

The Ethereum Enterprise Alliance should be able to help solve this problem. This is the position of Paul BRODY (head of E & Y blockchain) and leaders from Microsoft, Fidelity, JP Morgan Chase, Intel, Oracle and other companies. Ethereum needs to see this group stand out and act as a BD for institutional cases.

-

The Ethereum Foundation recently released the 2024 report. It covers internal and external expenditures ... Ethereum is a microcosm today.

-

Obviously, Solana 's development speed is faster. Have a more consistent community. Focus on its end users (instead of ideology). And have a technically superior L1 architecture. But this does not mean that Solana does not encounter the need to expand the L2. This situation has happened.

In short, Ethereum subverted himself through the EIP4844 network in 2024. Soon after that, it lost motivation.

Having said that, Ethereum is still steadily advancing. It is executing its roadmap. We have seen highlights in the entire ecosystem, especially on Base. In some ways, Ethereum feels like a value game. The challenge is that the encryption market does not run by value. Therefore, Ethereum needs a major catalyst. We believe that this may appear in the form of a major statement of L2 in the form of a large Tradfi participant using Coinbase.

Is this enough to reverse the situation?

In the long run, do we remember the failure of EIP4844 and. ETH in 2024?

Time will prove everything.

panewslab

panewslab

chaincatcher

chaincatcher