Does Trump's New Deal Council break the BTC's four -year market cycle?

Reprinted from jinse

01/31/2025·3MAuthor: Mark Mason, Bitcoin Magazine; Compilation: Deng Tong, Golden Finance

For a long time, the Bitcoin market has always been characterized by its seemingly unchanged four -year cycle, that is, the price of three years has soared, and then a significant callback has occurred. However, the major transformation of the Washington policy under the leadership of President Donald Trump may break this cycle and open a new era of long -term growth for the cryptocurrency industry.

Bitwise Asset Management chief investor Matt Hougan recently raised an interesting question: Can Trump 's administrative order break the four -year cycle of cryptocurrencies? Although his answer is subtle, he tends to be sure.

Four -year cycle

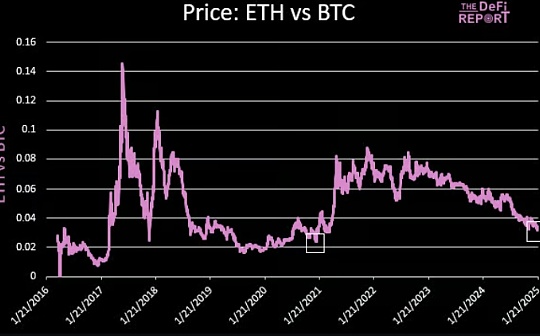

Hougan clarified his personal point of view, that is, the four -year Bitcoin market cycle was not driven by Bitcoin 's halves. He said, "People are trying to connect it with Bitcoin once every four years, but these decreases are inconsistent with the cycle, which occurs in 2016, 2020 and 2024, respectively."

Source: bitwise asset management. The data range is from December 31st to December 31st, 2024.

The four -year cycle of Bitcoin has always been promoted by factors such as investor emotional, technical breakthroughs, and market dynamics. Generally, the bull market will appear after major catalysts (whether it is infrastructure improvement or institutional use), which attracts new capital and promotes speculation. Over time, the leverage is constantly accumulated, and excessive behavior continues to occur, and major events (such as regulatory strike or financial fraud) can cause severe callbacks.

This model has been staged repeatedly: from the beginning of the MT. GOX crash in 2014 to the rise and fall of ICO from 2017-2018, and the deleveraging crisis caused by the closure of FTX and Sanjian capital in the past 2022. However, after every winter, a stronger recovery will appear. In the end, the Bitcoin ETF was stimulated by the mainstream in 2024, and the latest bull market in Bitcoin was ushered in.

Administrative order: Factors to change the rules of the game

The basic question discussed by Hougan is whether the recent administrative order issued by Trump will destroy the established cycle, which gives priority to developing the United States' digital asset ecosystem. The order outlines the clear regulatory framework, and even envisages the establishment of a national digital asset reserve, representing the most optimistic position of the current US or predecessor in Bitcoin.

Its influence is very far -reaching:

-

Regulatory clarity: By eliminating legal uncertainty, administrative orders have paved the way for the inflow of institutional capital into the unprecedented scale into Bitcoin.

-

Wall Street Integration: With the US Securities and Exchange Commission and financial regulatory agencies now support cryptocurrencies, major banks can enter the field to provide customers with Bitcoin custody, loan and structured products.

-

The government adopted: The concept of national digital asset reserve implies that the US Treasury Department can use Bitcoin as a reserve asset in the future and consolidate its status as a digital gold.

These development will not happen overnight, but their cumulative effects may fundamentally change the market dynamics of Bitcoin. Unlike the previous cycle of the speculative retail fanaticism, this transformation is supported by institutions and regulatory recognition -this is a more stable foundation.

The end of cryptocurrency cold winter?

If the history is repeated, Bitcoin will continue to rise to 2025, and then face a sharp recovery in 2026. However, Hougan said that this time may be different. Although he acknowledged the risk of excessive speculative and leverage driving bubbles, he believes that the absolute scale used by institutions will prevent the long -term bear market that appeared in the past.

This is a vital difference. In the previous cycle, Bitcoin lacks a strong value -oriented investor foundation. Today, as ETFs make pensions, hedge funds, and sovereign wealth funds easier to allocate Bitcoin, the asset no longer depends on the enthusiasm of retail investors. How about it? Amendments may still occur, but the correction amplitude may be smaller and the duration may be shorter.

What will happen next?

The price of Bitcoin has exceeded the $ 100,000 mark, and the predictions of industry leaders such as Larry Fink, CEO of Belle, show that the price of Bitcoin in the next few years may reach $ 700,000. If Trump 's policy acceleration agencies are adopted, the typical four -year model may be replaced by more traditional asset -category growth -similar to the reaction of gold at the end of the golden standard system in the 1970s.

Although the risks still exist -including unpredictable supervision reversal and excessive leverage -but the development direction is clear: Bitcoin is becoming a mainstream financial asset. If the four -year cycle is driven by the initial and speculative nature of Bitcoin, its maturity may make this cycle outdated.

in conclusion

For more than ten years, investors have used the four -year cycle as a roadmap for the Bitcoin market trend. However, Trump 's administrative command may be a decisive moment of breaking this model, and replaced it with a more durable and more agency -driven growth stage. As Wall Street, enterprises and even the government accept Bitcoin more and more, the question is no longer whether the crystal cold winter will arrive in 2026, but whether it will come.

chaincatcher

chaincatcher

panewslab

panewslab