Glassnode: What does the sharp decline in seller risk in the current market mean?

Reprinted from jinse

01/22/2025·4MSource: Glassnode; Compiled by: Baishui, Golden Finance

summary

-

Capital inflows into Bitcoin remain positive, although inflows have declined since first reaching $100,000. This highlights a period when seller pressure is declining as the market approaches short-term equilibrium.

-

Sell-side pressure from long-term investors has also declined, as has the volume deposited for sale on exchanges.

-

Several volatility indicators are tightening, with the market trading within historically tight 60-day price ranges, which typically indicates the market is almost ready to move again.

Capital flows are close to equilibrium

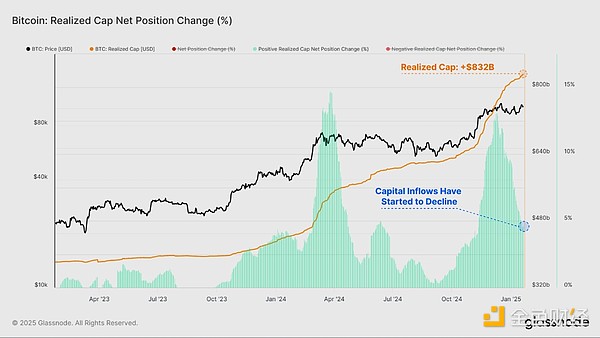

Bitcoin has seen a surge in net capital inflows as the price reaches the $100,000 level, suggesting investors are locking in substantial profits. These capital inflows have begun to decline as the market consolidates and adjusts to the new price range.

The slowdown in profit-taking represents a net reduction in seller power, so less new capital is needed to keep prices within the trading range.

Currently, the actual market capitalization is trading at $832 billion and growing at a rate of $38.6 billion per month.

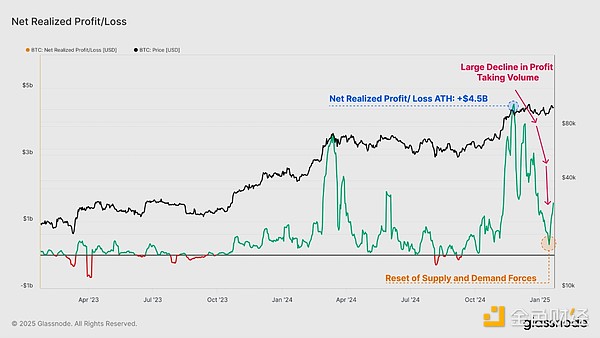

The Net Realized Profit/Loss metric is the first derivative of realized market capitalization, allowing us to discretely observe the size of on-chain net capital flows in USD terms.

As the market digests profit-taking distribution pressure, the balance of realized profits and losses gradually moves towards a neutral position. This suggests that the forces of supply and demand are resetting and that most tokens currently trading do not have a large value increment locked in relative to the price at which they were first acquired.

Profit-taking volume peaked at +$4.5 billion in December 2024 and has now fallen to +$316.7 million (-93%).

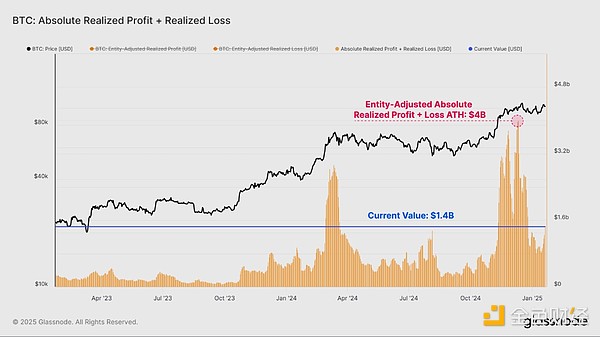

The absolute volume of realized profits and realized losses (entity adjusted) is another set of tools that helps us gauge the direction and sentiment of capital flowing into and out of Bitcoin.

When we add realized profits and losses together, we can see that this composite metric has declined sharply from a high of $4 billion to a value of $1.4 billion. Despite a 65% decline, current values remain high from a historical perspective, underscoring the scale of daily demand to absorb this capital during bull markets.

supply side slowdown

We have determined that overall seller pressure has dropped significantly. We can further examine these dynamics using indicators such as Coinday Destruction and exchange inflows to confirm this view.

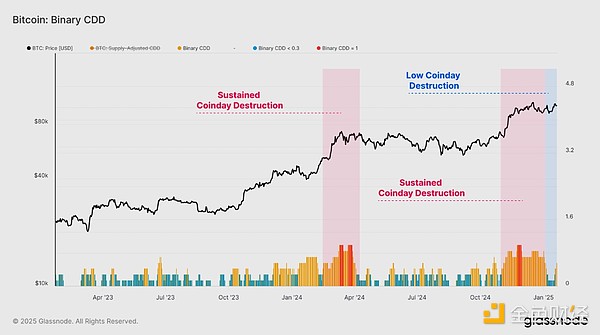

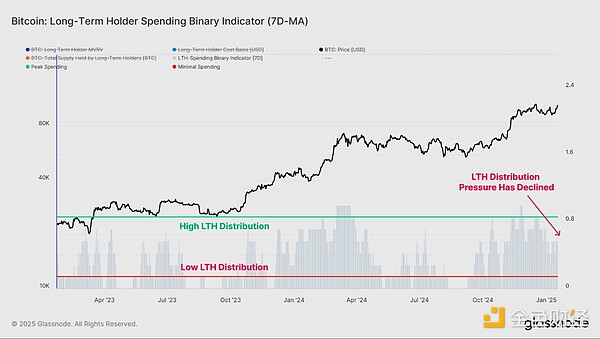

The first tool we can use to better characterize investor allocation pressure is the Binary CDD indicator. This metric tracks “time-to-hold” spending across the market, tracking when holders of old supply are trading in increasing amounts.

We saw a sustained period of severe coinday disruption in late 2024 and early January. In recent weeks, this indicator has begun to cool as relatively minor coinday disruptions have taken hold.

This suggests that a large number of investors planning to take profits may have already taken profits within the current price range. Generally speaking, this suggests that the market may need to "move elsewhere" to attract and unlock the next wave of supply.

The Long Term Holders (LTH) binary spending indicator is another indicator we can use to assess the duration of ongoing seller pressure. This tool is specifically targeted at long-term investors.

Consistent with previous heavy profit-taking volumes, we can see that total LTH supply dropped significantly as the market reached $100,000 in December. The rate of LTH supply decline has since stalled, indicating that this allocation pressure has weakened in recent weeks.

Currently, total LTH supply is starting to show signs of picking up, suggesting that accumulation and HODLing behavior is now greater than distribution pressure for this group.

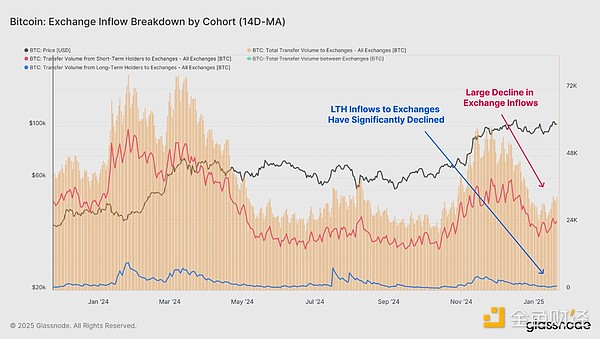

Centralized exchanges remain the primary venue for speculation and trading, handling billions of dollars in flows every day. Exchange inflows have fallen sharply from a peak of $6.1 billion to $2.8 billion (-54%), highlighting the recent sharp decline in speculative activity.

Notably, LTH inflows to exchanges have dropped from $526.9 million in December to $92.3 million currently, with deposit volumes down -83%.

This further supports the argument that long-term investors may have completed significant profit-taking in this price range.

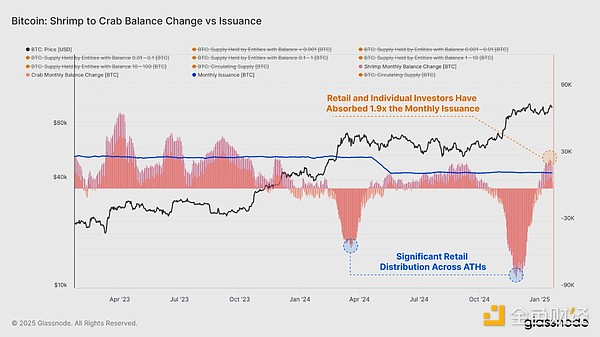

To further analyze the supply and demand balance, we can compare the balance change rates of different groups and normalize them to BTC mined volume. This provides a relative measure compared to the amount of new issuance each cohort would theoretically absorb.

Taking the shrimp and crab group (holding <10 BTC) as a representative of retail and individual investors, we note that this group absorbed approximately +25.6k BTC in the past month. In comparison, miners issue approximately +13.6k BTC per month.

As a result, these retail and individual holders effectively absorbed 1.9x the new supply entering the market via primary production.

coiled wave

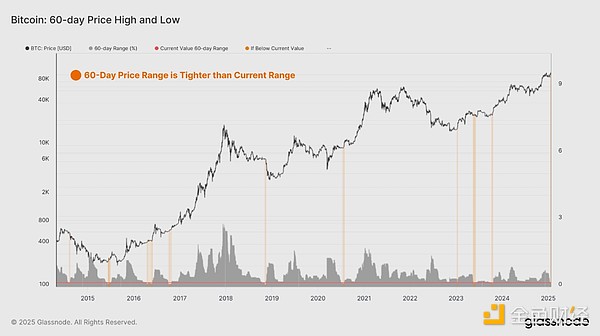

As can be seen, there is a strong convergence between the two on-chain models and the historically narrow 60-day price range, allowing investors to capture increased volatility.

By measuring the percentage range between the highest and lowest prices over the past 60 days, we can see how market volatility has changed over time. The chart below highlights a period when the 60-day price range was narrower than the current trading range. All of these situations occur before major bursts of volatility, mostly early in a bull market, or before sell-offs late in a bear market cycle.

Sustained sideways price action within a narrow range allows a large portion of circulating supply to be reallocated and concentrated on a relatively higher cost base.

The actual supply density indicator quantifies the supply concentration within the ±15% price change range of the current spot price. When supply is highly concentrated near the spot price, small fluctuations in price can significantly affect investors' profitability, thereby exacerbating market volatility.

After Bitcoin price peaked in December, it began to consolidate, creating a dense supply concentration with a cost basis close to the spot price. Currently, 20% of supply lies within ±15% of the spot price.

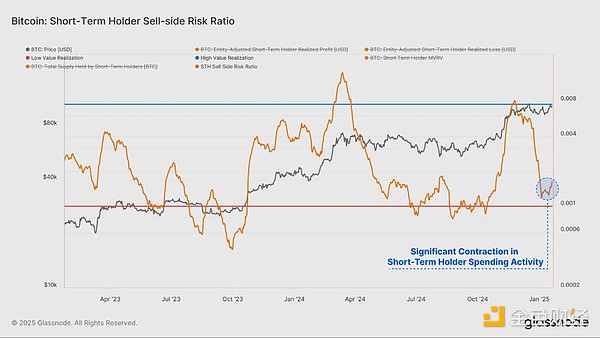

Sell-side risk ratios describe this phenomenon from a different perspective. This metric evaluates the total realized profits and losses locked in by investors relative to the size of assets (measured by realized market capitalization). We can consider this indicator within the following framework:

-

A high value means that when an investor spends a token, it makes a large profit or loss relative to its cost basis. This situation indicates that the market may need to re-find its balance and often follows high-volatility price action.

-

A low value indicates that most tokens are spent relatively close to their break-even cost base, indicating that some level of balance has been achieved. This situation typically indicates that "profit and loss" has been exhausted within the current price range, often describing a low-volatility environment.

Spending activity among short-term holders has contracted sharply in recent weeks, leading to a sharp decline in sell-side risk. This usually means that all profit and loss events planned by the investor have now been carried out. It often indicates that the market is close to a partial equilibrium and is a precursor to the next wave of fluctuations.

Summarize

Bitcoin price experienced a violent intraday swing, first surging to a new high of $109,000, then plummeting, before stabilizing above $100,000. The macro backdrop leading up to and during the U.S. presidential inauguration is challenging and uncertain, exacerbating market hesitancy.

In this article, we assess and analyze the conditions that preceded the explosive but volatile price action. We propose a framework that uses reductions in on-chain transaction volume and capital flows, as well as tightening price ranges, to identify signs of impending volatility.

chaincatcher

chaincatcher

panewslab

panewslab