Trump’s currency issuance disturbed the Solana DeFi landscape: Meteora’s daily trading volume soared 8 times, and Raydium’s short-term share fell to less than 30%

Reprinted from panewslab

01/22/2025·4MAuthor: Frank, PANews

With the market enthusiasm triggered by the issuance of the personal token TRUMP by US President Trump, the Solana ecosystem has become the biggest beneficiary. Not only did the DEX transaction volume hit a record high for two consecutive days, but the single-day on-chain transaction fee also reached US$33.3 million. , setting a historical record.

If you look closely at the changes within the Solana ecosystem, you can see the projects that benefit Jupiter and Meteora most directly. Jupiter has long been the most active aggregator on Solana, so it is expected that it will take on this popularity. What is slightly surprising is Meteora. Meteora has been relatively low-key in this cycle, and its previous data volume has always been ranked behind Raydium. In terms of growth rate, Meteora may be the biggest beneficiary of the TRUMP token craze. Is this dividend a flash in the pan or the beginning of change?

Undertaken the presidential currency issuance, the transaction volume

increased 8 times in a single day

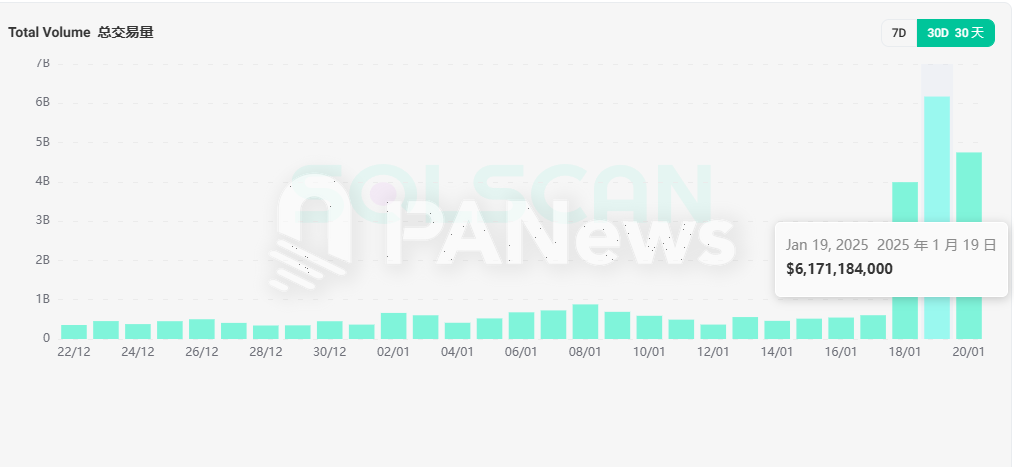

Before January 18, Meteora’s daily trading volume was approximately US$500-600 million per day. On January 18, this figure surged to US$3.99 billion, a single-day increase of approximately 8 times. From the 19th to the 20th, it also broke new highs again, setting transaction sizes of 6.1 billion and 4.7 billion respectively.

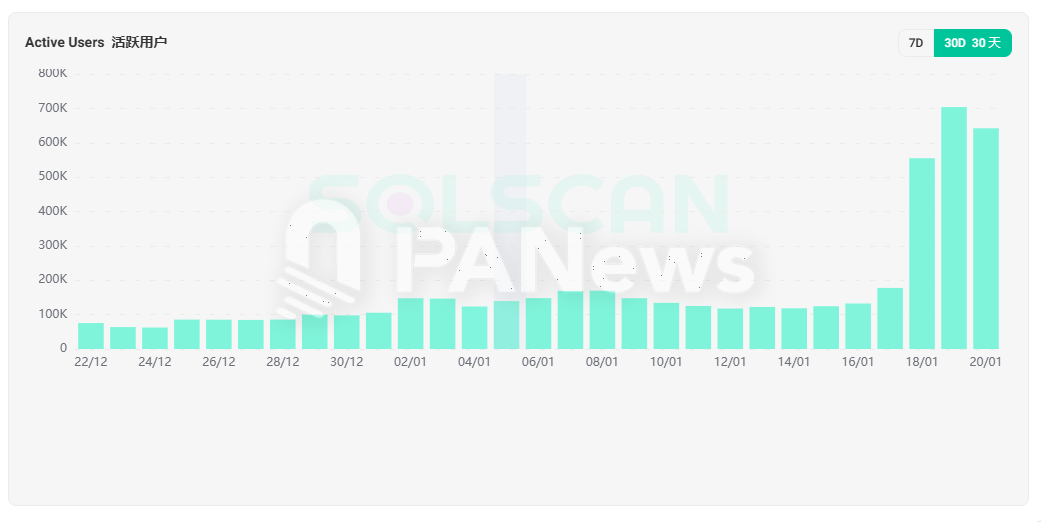

Such data changes are reflected in the number of active addresses and also show a significant increase in the number of active addresses. Generally speaking, the number of active addresses in Meteora remains between 120,000 and 130,000, with no particularly big changes. This figure increased to 550,000 on January 18, 700,000 and 640,000 on the 19th and 20th respectively, with the largest increase reaching about 5.8 times.

Hitching a ride with Jupiter?

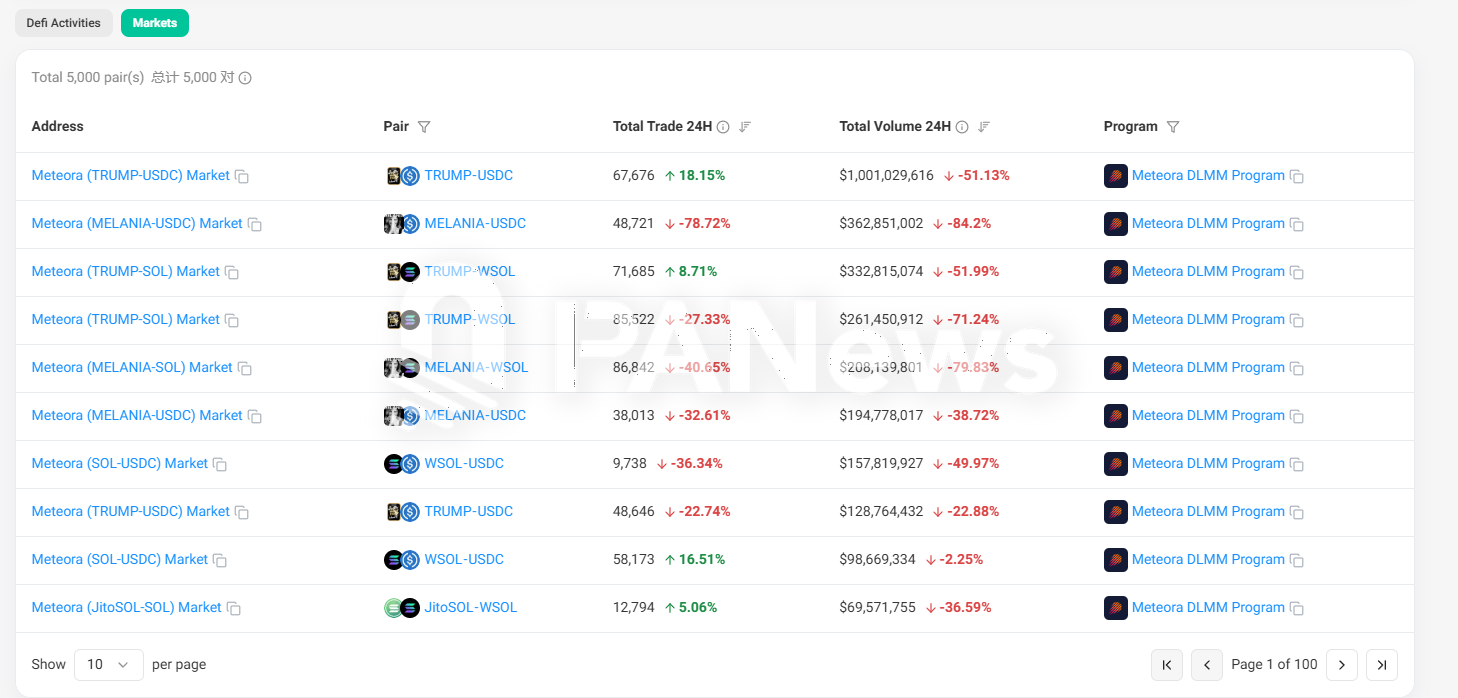

The main reason for these changes obviously comes from the trend of the Trump family issuing tokens. Judging from the data, as of January 21, seven of the top ten most popular trading pairs on Meteora were related to Trump tokens, mainly surrounding the two tokens TRUMP and MELANIA.

Of course, the above changes all come from the dividends brought by the Trump family’s currency issuance. From an ecological perspective, what are the characteristics of Meteora that made it chosen by the Trump family?

In fact, there is not much news about Meteora, a project created in 2021 and one of the first liquidity platforms on Solana. There are two co-founders of Meteora, namely Ben Chow and the well-known Meow, both of whom are also co-founders of Jupiter. It can be said that Meteora and Jupiter come from the same source. The earliest Meteora was named Mercurial Finance, and the token MER was issued in 2022. However, due to the impact of the FTX incident, the team decided to rename the brand to Meteora, abandon MER, and Plans to reissue new token MET. As of now, the new token MET has not yet been issued. According to previous announcements, the issuance of MET may take place in February 2025.

By comparing the data between Meteora and Jupiter, it can be found that Meteora's user scale and capital flow volume are not as good as Jupiter's, but the dividends brought by TRUMP tokens have indeed increased significantly this time. On January 18, Jupiter’s daily trading volume surged to US$16.8 billion, and on the 19th it set a new record of US$20.6 billion. The previous daily data size was generally maintained at around US$6 billion. From this perspective, this issuance of TRUMP tokens mainly focuses on Jupiter’s user scale and liquidity. The addition of Meteora is more like a support move made by the same team background to boost expectations for the subsequent Meteora currency issuance.

The Solana ecological DeFi landscape is quietly changing

In addition to Meteora and Jupiter as the preferred partners for this issuance, other DEX products have also experienced significant data increases as trading popularity increases. Raydium’s trading volume also more than doubled after the 18th, with the highest daily trading volume reaching $13.8 billion. However, the increase in active users is not large, with an increase of about 30% compared to usual, with a maximum of about 4 million daily active users. In addition, several protocols such as lifinity, orca, and phoenix have also experienced significant growth.

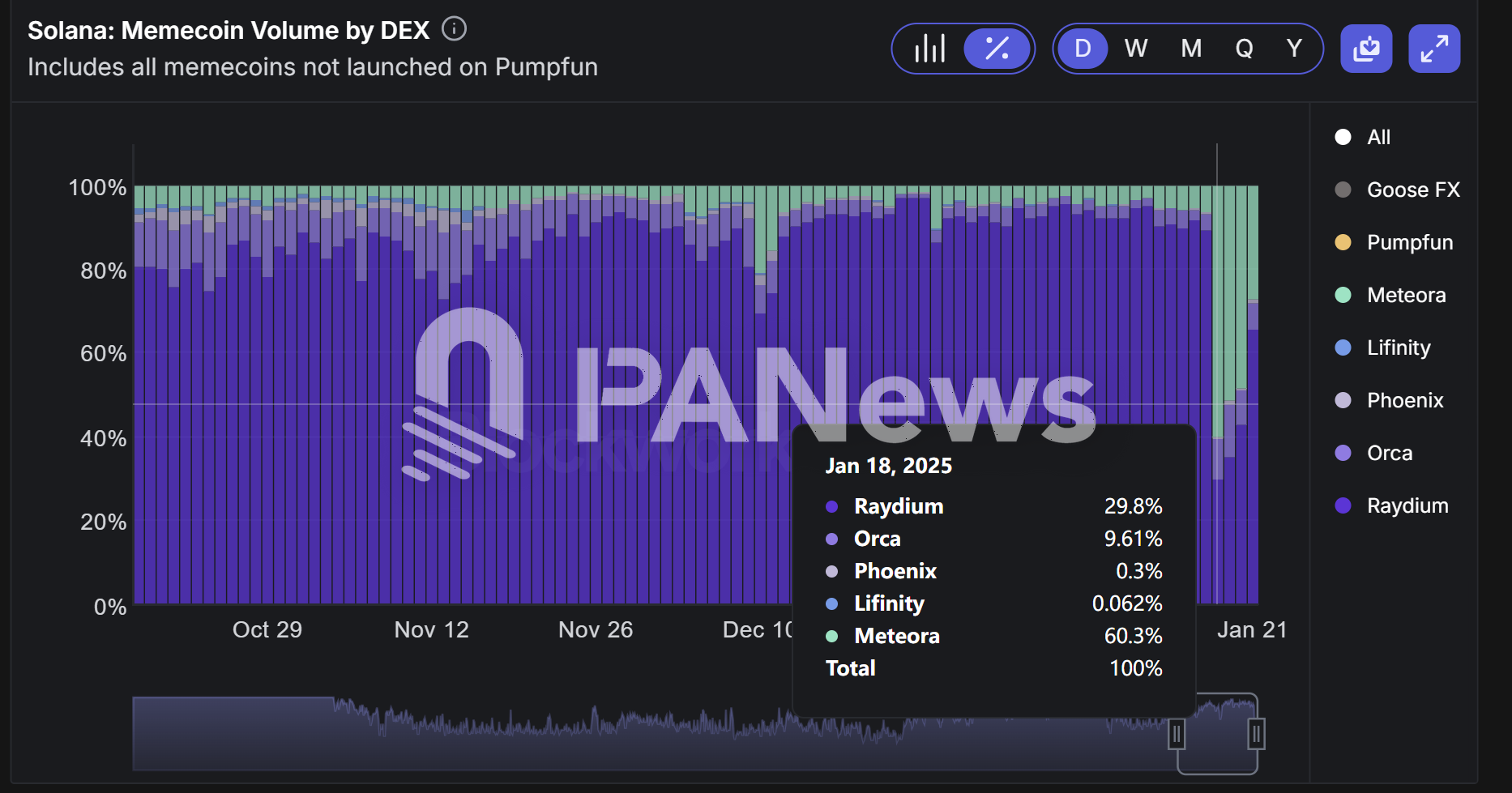

However, the biggest winner seems to be Meteora. According to data from Blockwork, Meteora’s share of MEME currency transactions on Solana is always less than 10%. Starting on January 18, this proportion rose to 60%. The main thing that is eroding is Raydium's market share. Previously, Raydium's market share was generally around 90%. After the issuance of TRUMP tokens, this proportion dropped to less than 30%.

In fact, as the most popular transaction aggregator on Solana, Jupiter has previously launched a MEME launch platform such as APE pro to try to break the monopoly of Pump.fun, but the development of the platform has obviously failed to meet expectations. As a product of the same ecosystem, Meteora also launched similar functions, but it also failed to have an impact on social media.

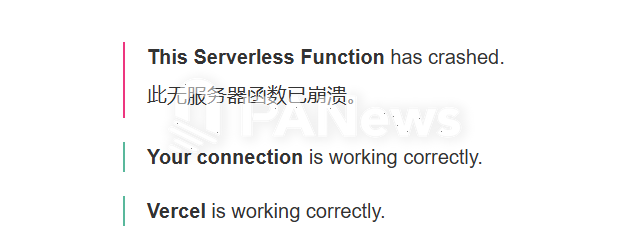

In addition, PANews has tried to use the feature several times, but feedback always showed that the server had crashed.

It can be seen that as Solana’s position in the MEME track is unassailable, competition within the Solana ecosystem has become increasingly fierce. The Trump family’s currency issuance this time is a historic opportunity for Jupiter and Meteora. According to Jupiter and Meteora, the TRUMP token issuance is the largest launch in the cryptocurrency space.

Judging from the results, the opportunity that Jupiter and Meteora seized did bring about huge changes. Judging from the reasons, compared to the pair of Pump.fun and Raydium, Jupiter and Meteora seem to be more in line with the president’s needs for currency issuance from a compliance or brand perspective.

I just don’t know whether Trump’s coin issuance will really lead to more politicians or celebrities following suit as expected by the outside world? If a new trend can be formed, then the combination of Jupiter and Meteora seems to have more opportunities to completely take away market share from Pump.fun and Raydium through this planned currency issuance.

After all, at present, it seems that it is difficult for MEME coins issued by individuals to become golden dogs, including the recently popular AI Agent tokens, which have professional teams and organizations behind them. Judging from Meteora’s performance, Pump.fun’s advantage seems to be weakening. (Related reading: Estimating Pump.fun’s billing: the official income from sending one coin is US$68, and users will make 70% of the profit or pay handling fees. )

jinse

jinse