Comprehensive interpretation of Ethena: The new generation of currency circle Fed

Reprinted from panewslab

03/10/2025·2MAuthor: 0xCousin

1. Who is behind Ethena?

Ethena 's team members

Ethena team members have a rich background and have deep expertise and practical experience in Crypto, finance and technology.

Founder Guy Young worked for a hedge fund with a market value of $60 billion. After Luna collapsed, he founded Ethena; COO Elliot Parker was previously a product manager at Paradigm and also worked at Deribit; Jane Liu, head of institutional growth at Asia Pacific, has served as head of investment research at Fundamental Labs and head of institutional partnerships and fund relations at Lido Finance.

Ethena 's financing situation

According to Rootdata information, Ethena has carried out three rounds of financing, with a cumulative financing amount of US$119.5 million. Leading investment institutions mainly include Dragonfly, Maelstrom Capital, and Brevan Howard Digital.

Ethena has attracted the attention and investment of many well-known investment institutions, not only bringing considerable funds to the development of Ethena, but also providing valuable industry resources for Ethena's business development. Ethena's investment institutions include exchanges (YZi Labs, OKX Ventures, HTX Ventures, Kraken Ventures, Gemini Frontier Fund, Deribit, etc.), market makers (GSR, Wintermute, Galaxy Digital, Amber Group, etc.), and investment institutions with traditional financial backgrounds (Paypal Ventures, Franklin Templeton, F-Prime Capital, etc.).

2. What is Ethena?

In summary, Ethena is a synthetic dollar (Synthetic Dollar) protocol that launches the dollar stablecoin USDe and the dollar savings asset sUSDe. The stability of USDe is backed by crypto assets and corresponding Delta neutral hedging (short futures) positions.

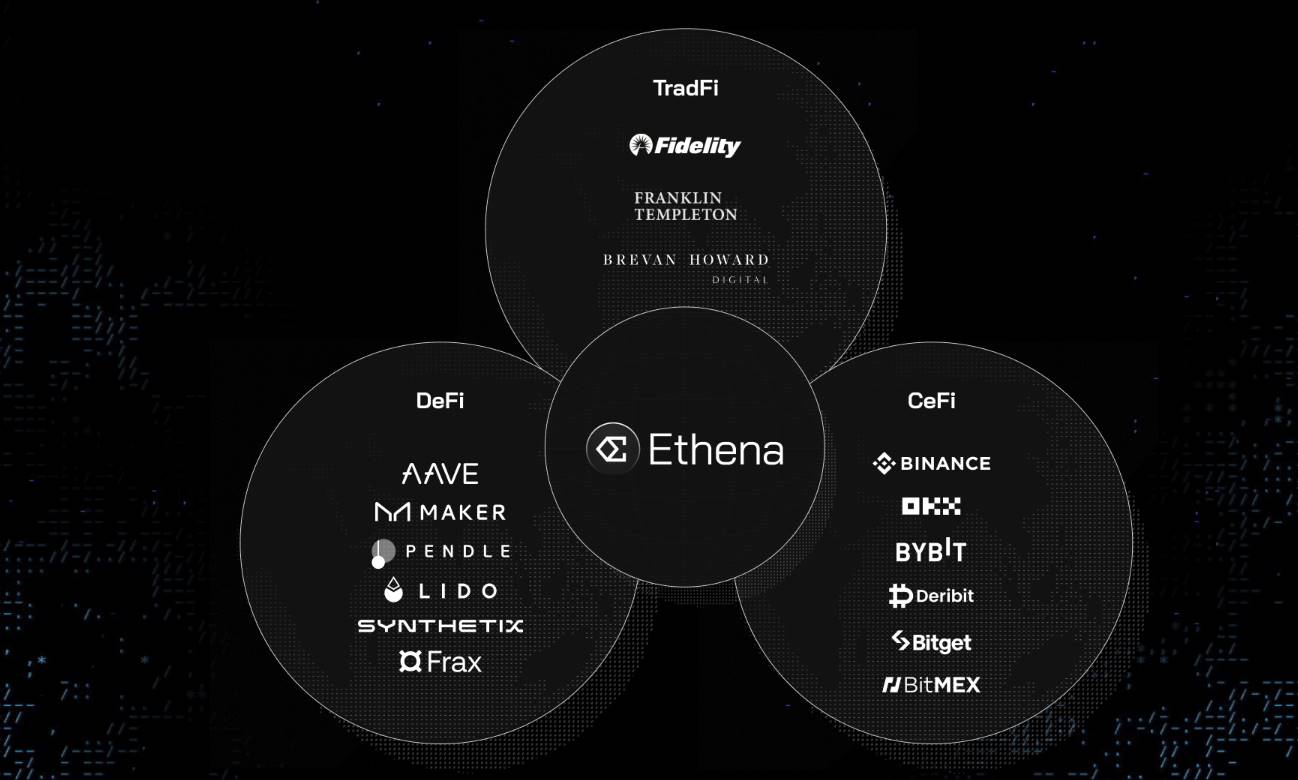

From the perspective of the project mission, Ethena aims to connect funds in the three fields of CeFi, DeFi and TradFi through the stablecoin USDe. At the same time, Ethena captures the interest rate difference between the funds in these three fields (exchange, on-chain, traditional finance), thereby providing customers with more benefits. If USDe grows large enough, it may also promote the convergence of capital and interest rates between DeFi, CeFi and TradFi.

The mechanism of stablecoin USDe

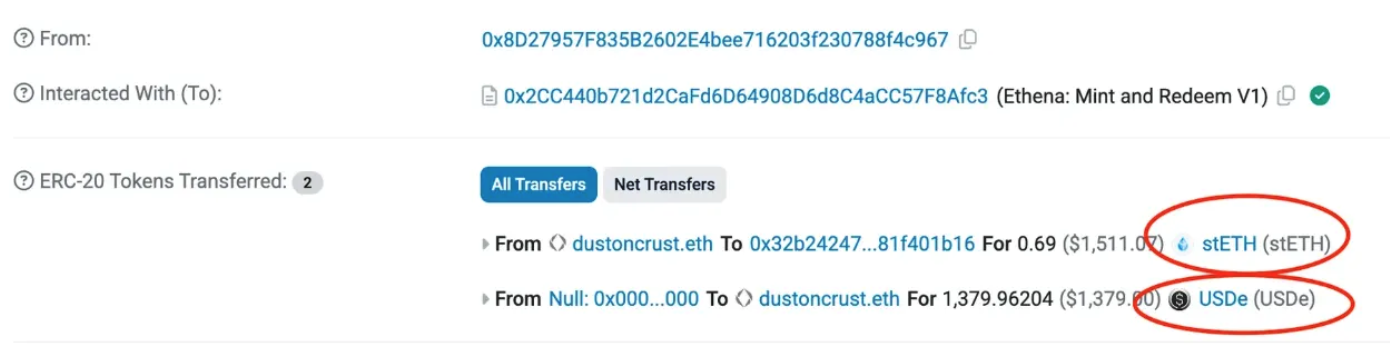

Molding/Reden Mechanism: USDe's Molding/Reden Only two independent legal person minters (Ethena GmbH, Ethena BVI Limited) listed on the whitelist are eligible for minting and redemption. The coin minter needs to interact with USDe Mint and Redeem Contract with BTC/ETH/ETH LSTs/USDT/USDC as collateral. As shown in the figure below:

Ethena Agreement USDe Mint and Redeem Contract V1\'s first USDe casting

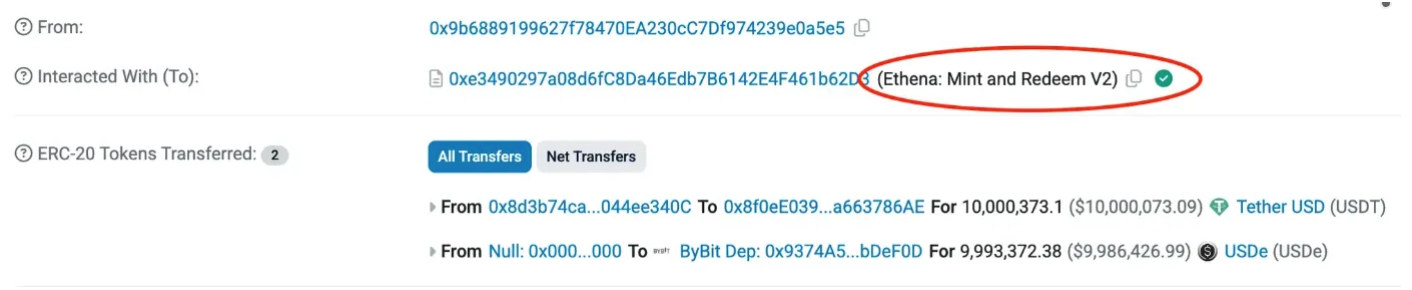

A recent USDe casting based on the Ethena protocol USDe Mint and Redeem Contract V2

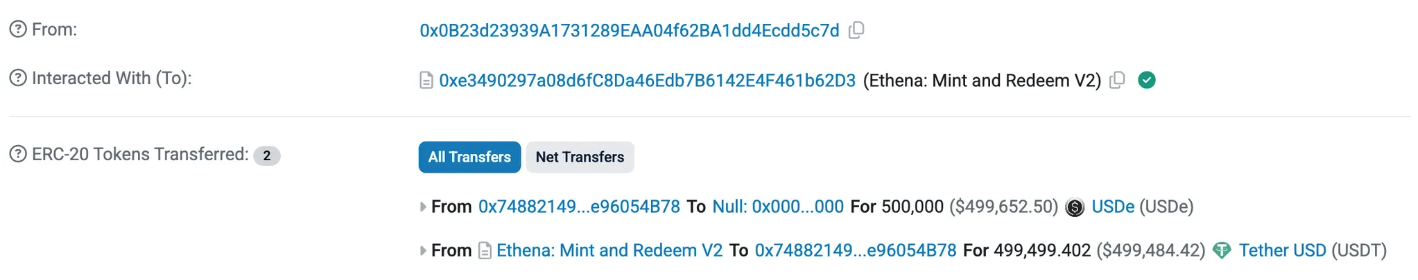

This is a record of USDe redemption of USDT

When casting/redemption, Backing Assets pricing is acquired and continuously verified by multiple different sources, including CeFi Exchange, DeFi Exchange, OTC Markets, and Oracles such as Python and RedStone to ensure that pricing is correct and reasonable.

USDe stability maintenance mechanism: To ensure USDe stability, the key is to hedge the price fluctuations of Backing Assets. Ethena adopts an automated, programmatic Delta-neutral strategy.

Source of income of sUSDe

The proceeds of sUSDe are derived from Ethena's disposal of collateral.

When Ethena receives collateral, it can hold it as a stablecoin to earn a fixed deposit interest rate;

You can also set up an airdrop futures position in the CEX to hedge the price fluctuations of Backing Assets through the custodian entrusted to the selected CEX, and earn capital rates;

Backing Assets If it is ETH, you can also staking and earn ETH Staking APR.

These proceeds will be distributed to the user in the form of returning more USDe to the user when the user cancels the pledge and redeems USDe.

The purpose of stablecoins (USDe/sUSDe/iUSDe)

In the DeFi field:

- USDe/sUSDe serves as collateral for lending agreement platforms such as AAVE and Spark;

- USDe/sUSDe serves as margin collateral for platforms such as Perps DEX;

- USDe/sUSDe as collateral for the Stablecoin agreement;

- USDe/sUSDe serves as the underlying asset of the interest rate swap agreement;

- USDe is the denominated currency in Spot DEX (constituting a trading pair);

In the CeFi field:

- USDe is the denominated currency in CEXs (constituting a trading pair);

In the TradFi field:

- iUSDe is Ethena's stablecoin for the TradFi market, allowing regulated traditional companies to subscribe, allowing these traditional investment institutions to provide high yields in the Crypto market to traditional customers without exposure to Crypto.

3. Ethena’s innovations

Delta neutral strategy hedges price volatility in Backing Assets

Many stablecoin projects with Crypto Assets as Backing Assets ultimately insolvent lead to exchange rate decoupling. The key is that they do not hedge the price fluctuations of Backing Assets. Ethena is the first project to perform automated and programmatic Delta neutral hedging on Backing Assets using the Delta-Hedging algorithm and execution model, bringing the Delta value of the portfolio to close to 0. Although the early Ethena's Delta-Hedging algorithm and execution model are a black box, whether Delta neutral results can be achieved in the long run is a potential risk point, and this stability maintenance mechanism is an innovation. The later stage may turn to an open RFQ model, when all market makers can intervene in competition to perform hedging tasks.

Under normal circumstances, when redeeming USDe, it will be redeemed according to the benchmark of 1 USDe = 1 USDC; if the hedging mechanism does not work, or the capital fee rate of hedging futures positions is in a loss, resulting in a decrease in the value of asset reserves. The quote at the time of redemption by the USDe holder will include a corresponding reduction to reflect a proportional reduction in the redemption price, and the quote displayed to the user includes a compensation fee of 10 basis points.

Much higher than the capital efficiency of most stablecoin projects

Centralized stablecoins, such as USDT and USDC, are greatly affected by traditional financial supervision, and the collateralized assets are mainly fiat currencies, which are basically mainly buying US Treasury bonds and savings. They also have centralized single-point risk and are not highly efficient in capital.

Decentralized stablecoins, such as MakerDAO's DAI, generally require 120%-150% excess collateral. If you consider avoiding the safety margin of liquidation, the actual collateral rate may exceed 200%, with low capital efficiency, and when the market is extremely fluctuating, customers' collateral assets will cause additional liquidation losses if they are liquidated.

Ethena's USDe has approached 1USD:1 USDe in terms of asset mortgage ratio, and is also supplemented by Delta neutral strategy to hedge price fluctuations, with high capital efficiency and guaranteed stability.

More importantly, Ethena's positioning allows other projects in the stablecoin track to become Ethena's partners. For example, Sky, Frax, and Usual have already combined/fusion Ethena's products in their own products.

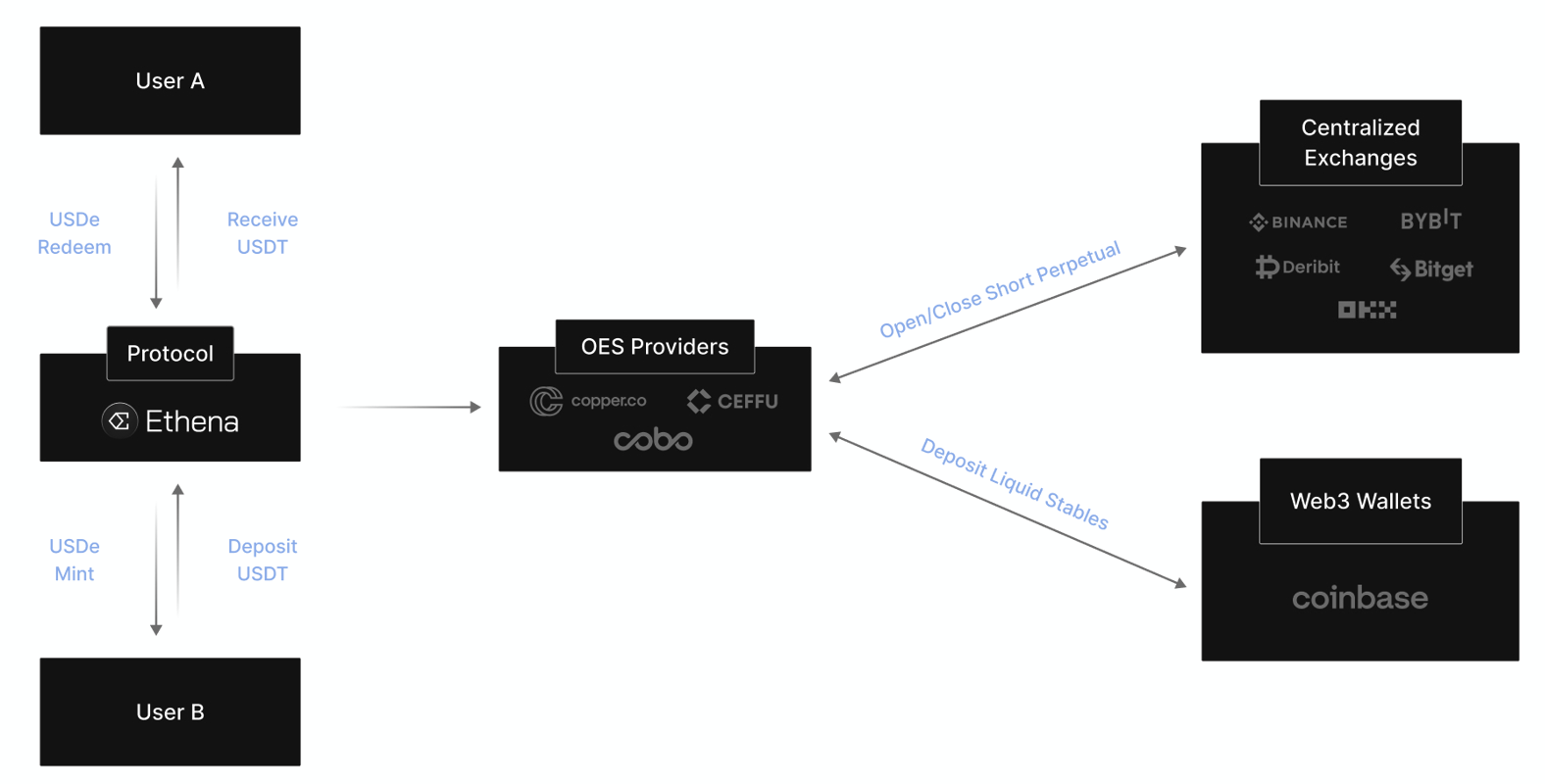

OES custody model ensures asset security

Ethena currently works with multiple custodians, including Copper, Ceffu, and Cobo. The cooperation adopts the OES (Off-Exchange Settlement) model. In this model, backing assets do not need to leave the on-chain wallet, so there is no need to worry about the risks of CEX; there is no need to worry about the risks of the custodian, because the custodian cannot control these custodians separately. Taking the custodian as a Cooper as an example, these backing assets are stored in an over-the-counter vault. Ethena, Cooper, and over-the-counter vault each hold a key, which requires signatures from both parties to execute the transaction; or are stored in a bankruptcy-remote trust.

Integrate traditional finance to make it bigger and stronger USDe

Ethena connects funds in the three fields of CeFi, DeFi and TradFi through the stablecoin USDe. By capturing the interest rate difference between the funds in these three fields (exchange, on-chain, and traditional finance), it can bring higher returns to customers.

There are generally not many high-yield products in TradFi, but the low-yield fixed-yield market size is very large. In the Crypto field, due to users' leveraged trading needs, more demand for currencies (USD stablecoins), thus allowing the Crypto industry to often have "risk-free" high-yield opportunities.

Ethena acts as a bridge to integrate traditional finance to make USDe bigger and stronger. When the Fed's interest rate is low (or interest rate cut cycle), Crypto's trading will be more active, and the perpetual contract funding rate in the Crypto market will be relatively high, and the short futures positions used by Ethena for Delta hedging can earn more funding rates. This has led to a phenomenon that when the yield of traditional finance is very low, customers can actually obtain higher yields through Ethena.

Therefore, iUSDe can meet the asset allocation needs of traditional financial customers during the low interest rate period. This may be part of the reason Franklin Templeton and F-Prime Capital, a venture capital firm owned by Franklin Investments, invested in Ethena's $100 million strategic round last December. In addition, the USDtb launched by Ethena in collaboration with BlackRock BUIDL may also drive a large amount of funds from TradFi to Ethena and then to the Crypto market.

4. Current status of project development

Ethena's USDe has become the third largest dollar stablecoin. As of March 7, 2025, USDe's issuance has reached US$5.5 billion, second only to USDT and USDC. Transfer Volume ranks fourth, second only to USDT, USDC, and DAI. However, the number of Active Addresses is small, with only 1,612, and the C-end application scenarios need to be expanded. Ethena's revenue is also growing rapidly, making it the second fastest cryptocurrency startup behind Pump.fun to reach $100 million in revenue.

Ethena has become a key cornerstone of many DeFi protocols. More than 50% of Pendle’s TVL is attributed to Ethena; about 25% of Sky’s revenue is attributed to Ethena; about 30% of Morpho’s TVL comes from leveraging Ethena assets; Ethena is the fastest growing new asset on Aave; most EVM-based Perps integrate USDe collateral;

Ethena is building an ecosystem around USDe. According to the public information on Ethena's official website, two projects will be launched in Q1 2025 - the decentralized trading platform Ethereal and the on-chain trading protocol Derive (supports options, perpetual and spot trading). Ethena is also very stable in external cooperation, and cooperated with BlackRock to launch USDtb and reached a cooperation with World Liberty Financial, the Trump family’s DeFi project.

Ethena also has some risk points:

The core returns of USDe are unstable - As mentioned earlier, USDe has three major sources of returns: one is the deposit interest rate returns of Backing Stablecoin, the second is the capital fee returns of short futures positions, and the third is the pledge income of ETH in Backing Assets. Among them, the capital charges of futures positions may experience continuous negative capital charge rates in the bear market, resulting in a shortfall in USDe's returns.

CEX's ADL mechanism may cause the Delta neutral strategy to fail - because CEX has an automatic deleveraging (ADL) mechanism that may affect Ethena's Delta neutral strategy in a specific period.

Partners may bring liquidity risks – Bybit is the exchange with the highest adoption rate of USDe, holding nearly USDe 700 million at its peak. At the same time, Layer2 Mantle, which is closely related to Bybit (BitDAO, founded by Bybit co-founder, merged with the Mantle ecosystem), is the second largest chain in USDe's supply. The Bybit's hacked coins triggered more than $120 million in redemption demand for USDe. Ethena currently has $1.9 billion in Backing Assets, which is Liquid Stables, so it is enough to cover these sudden increase in redemption demand. But it cannot be ruled out that there may be huge concentrated redemptions beyond their Liquid Stables reserves in the future, resulting in short-term liquidity risks.

V. Ethena (ENA) investment value

ENA currently has FDV 5.6B, and the market value of 2B. Ethena has conducted three rounds of financing, with the financing amounts of 6M, 14M and 100M respectively, of which the second round of valuation is US$300 million, and the current currency price is still 18 times + profit.

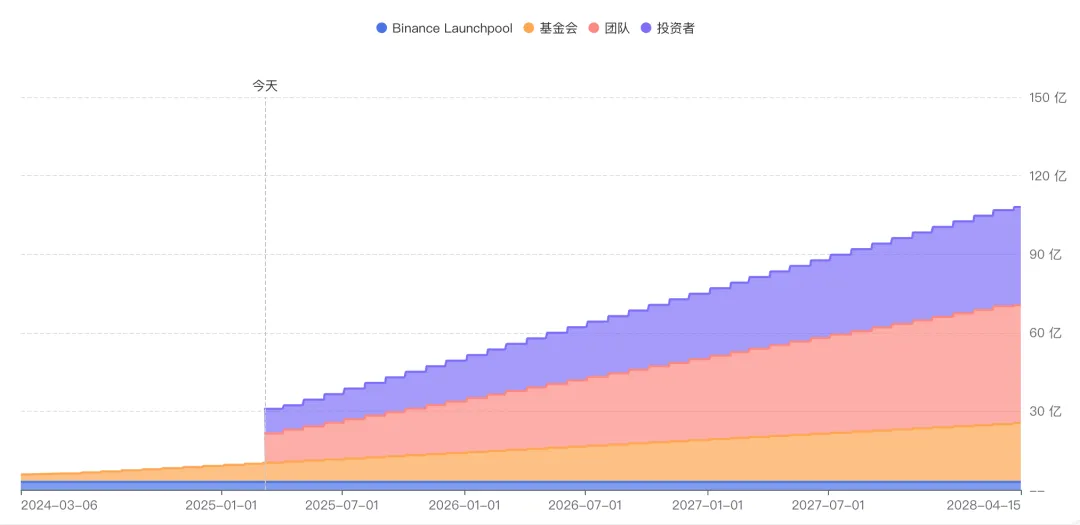

Before May 5, 2025, the tokens in circulation are mainly 2% of Binance Launchpool, and there are also foundation and team shares that are being unlocked linearly. In April, some OTC purchase shares will begin to be unlocked, with a cost price of about 0.25U; starting from May 5, the share of investment institutions will be increased each month and will be linearly unlocked by 7800w+ENA/month.

The Crypto market has generally pulled back recently, and ENA has performed very weakly. BTC has pulled back 25% from its high point, ETH has pulled back 50% from its high point, and ENA has pulled back about 70% from its high point. The negative news that the above-mentioned ENA Token is about to be unlocked may have been fully reflected in the current currency price.

Overall, Ethena's short- and medium-term currency price is under pressure, and the project's core business has long-term value.

jinse

jinse