Coinbase's latest monthly outlook: Global monetary system shifts, Bitcoin begins to perform on stage

Reprinted from panewslab

05/16/2025·22DBy David Duong, CFA - Global Head of Research

Compiled by: Daisy, ChainCatcher

Editor's note:

This article is compiled from Coinbase's latest monthly outlook research report. The report pointed out that as the US "double deficit" continues to expand and trade protectionism intensifies, market confidence in the US dollar continues to weaken, and the world may usher in a round of large-scale asset portfolio reconstruction. Against this background, Bitcoin is being regarded as a potential supranational reserve asset by more and more countries because of its sovereign neutrality and uncontrolled properties. According to the report's conservative estimates, if the global reserve system is gradually included in Bitcoin, its total market value is expected to increase by about US$1.2 trillion.

The following content is the compilation and compilation of key points of the report.

summary

Global capital flows are being reshaped by intensified trade protectionism, and the dollar's dominance as a global reserve currency is being challenged. As the U.S. fiscal and trade deficit continues to expand, debt levels are on an unsustainable path, and market confidence in the U.S. dollar as a safe-haven asset is shaken. This trend may lead to a reversal of the inflow of US dollar funds, prompting large global institutions to readjust their asset allocation. In the long run, the US dollar may face continuous and significant selling pressure.

It is worth noting that we believe that the turmoil over the past few months has further exacerbated the downward trend of the dollar dominance for a decade. The next changes may become a key turning point in Bitcoin and the entire crypto market. The changes in the current US dollar system have made stored-value assets such as gold and Bitcoin a more attractive alternative in the emerging currency landscape. This is a typical example of the promotion of gold from a third-level asset to a first-level asset by Basel III. Bitcoin, in particular, is expected to become a viable supranational accountancy unit in international trade due to its sovereign neutrality, sanctions and capital controls.

We believe that the decline in demand for the US dollar may prompt more countries to diversify international reserves. According to conservative estimates, this trend is expected to bring about $1.2 trillion in increments to Bitcoin’s market capitalization. This also partly explains why more and more countries are beginning to pay attention to strategic Bitcoin reserves, further highlighting the increasing importance of Bitcoin in geopolitics.

Continuation of dangerous years

Over the past half century, the United States' economic management model has undergone profound changes. Since the stagflation crisis in the 1970s, economists such as Milton Friedman have questioned Keynesian demand management theory, which has promoted the formation of a modern central bank system, a system based on the stable inflation target and the "natural unemployment rate" theory as its core. Since then, this framework has been institutionalized through the political independence of the central bank, which mainly relies on interest rate policies (and later some macro-prudential tools) to regulate money supply and achieve economic stability.

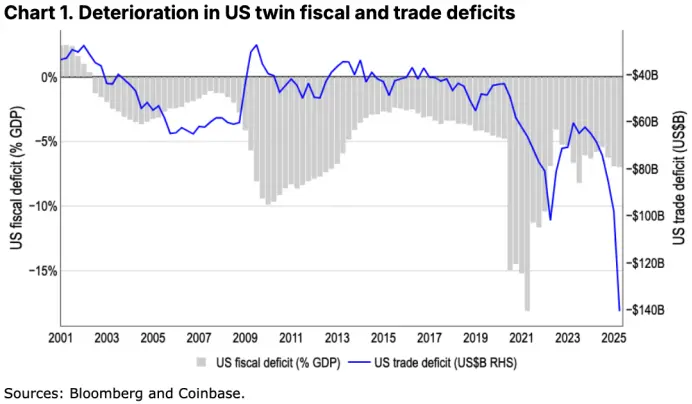

For years, the framework is facing ongoing pressure from fiscal activism, including massive deficit spending and trillion-dollar stimulus packages. While some of the spending is indeed necessary to deal with challenges such as the global financial crisis and the COVID-19 pandemic, the U.S. debt-to-GDP ratio has soared from 63% in 2008 to about 122% now, clearly on an unsustainable track. In addition, the Fed's aggressive interest rate hikes between 2022 and 2023 have significantly increased the U.S. government's borrowing costs, and the surge in related interest expenditures has further exacerbated the fiscal deficit issue. See Figure 1.

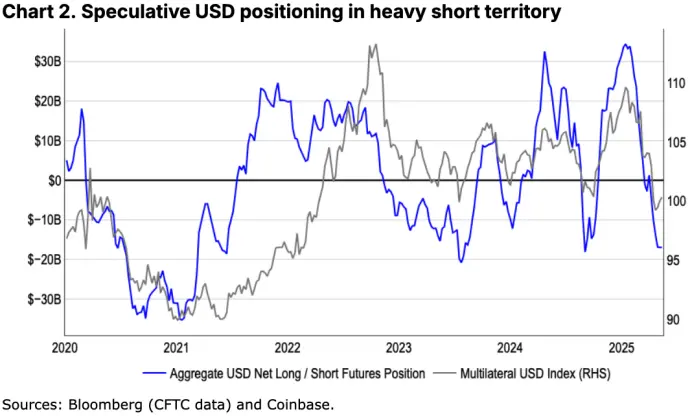

In this context, the rise of trade protectionism may reshape the global capital flow pattern. The dollar's position as a safe-haven asset is being hit, which means that some large institutions (such as non-U.S. pensions, life insurance companies, and sovereign wealth funds) may change their previous investment strategies. Over the past two decades, about half of these institutions have not made systematic hedging in about $33 trillion of dollar asset exposure (including $14.6 trillion in bonds and $18.4 trillion in stocks). We believe that a new round of large-scale asset portfolio adjustments may occur worldwide in the next few months or even years. See Figure 2.

This is not the first time that the United States has caused a reversal of US dollar capital inflows due to the "double deficit" (i.e., the fiscal deficit and trade deficit expand at the same time), but this time coincides with profound changes in the global economic landscape. We believe that the world is currently in the process of a major transformation of the US dollar system, and this trend may trigger a new round of large-scale US dollar selling pressure.

Even if the retaliatory tariffs are eventually lifted, we still believe that the above trend is difficult to reverse. The reason is: (1) The impact of confidence shock has left a deep impression on many investors; (2) Tariff reduction and tax cuts will weaken government fiscal revenue and further increase deficit pressure. Of course, a weaker dollar will help to some extent reduce the debt burden by "inflation" by reducing interest costs, while also potentially boosting U.S. exports. However, the cost of this process is to weaken the credibility of the US dollar as a storage value tool and a global reserve currency, and accelerate the market's search for alternative assets.

When we discussed the theme of “de-dollarization” in December 2023, we pointed out that the US dollar was at a critical turning point, but at the time it was believed that this process might take “many generations” to truly achieve. However, a series of events that have occurred in recent months seem to have significantly accelerated the process. In fact, the decline in the dollar's influence has long been traced to follow - Kenneth Rogoff, an economist at Harvard University and cryptocurrency critic, once pointed out that the peak of dollar hegemony occurred around 2015, and this trend has accelerated further due to sanctions on Russia since the outbreak of the Russian-Ukrainian war.

The next air outlet

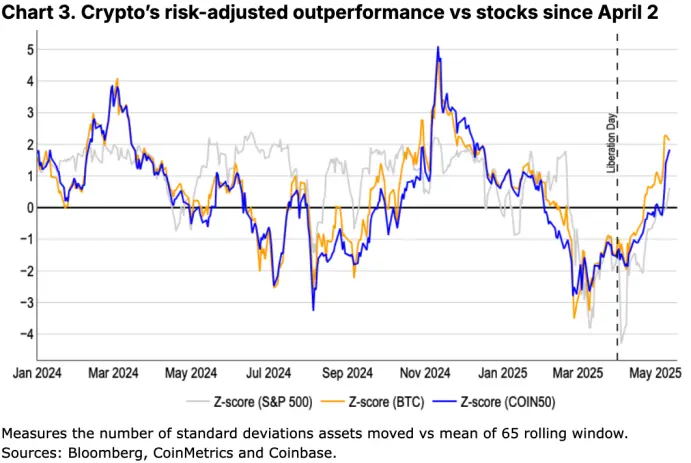

But the question is, where is the alternative? When the monetary system undergoes fundamental changes and the basis of monetary value is redefined, stored-value assets such as gold and Bitcoin that have received widespread attention in recent years often become particularly important. In fact, in recent weeks, Bitcoin’s “digital gold” has become increasingly clear in position, especially in the context of its performance over US stocks after risk adjustment, its value advantage has become more prominent. Coinbase Asset Management noted in a latest report that the global stored-value asset market may grow from the current $20 trillion to $53 trillion over the next decade, with an expected average annual return (adjusted by inflation) of 6%.

The logic is that incorporating assets such as Bitcoin and gold into the portfolio will help diversify risks (we have previously had relevant analysis) and improve the stability of returns during the transition of the economic system. Although Bitcoin is more volatile than gold, its higher potential returns can complement the stability of gold, thus building a more balanced wealth preservation strategy.

Furthermore, we believe that Bitcoin is not affected by government arbitrary expropriation and capital controls, which is significantly different from gold. A typical case is that in 1934, Roosevelt signed the Golden Act, which prohibited private ownership of gold and forced it to be custodialized by the U.S. Treasury Department. At the international level, gold relies on traditional financial infrastructure and physical custody (such as banks and vaults), and it is prone to sanctions when held on a large scale; while Bitcoin has the ability to achieve digital self-management by various income groups. Taking 2022 as an example, more than 2,000 tons of gold stored by Russia in friendly countries have been frozen and cannot be cashed out. As for capital controls, previous Argentina governments not only restricted citizens from obtaining US dollars, but also banned the sale of gold to prevent capital outflows.

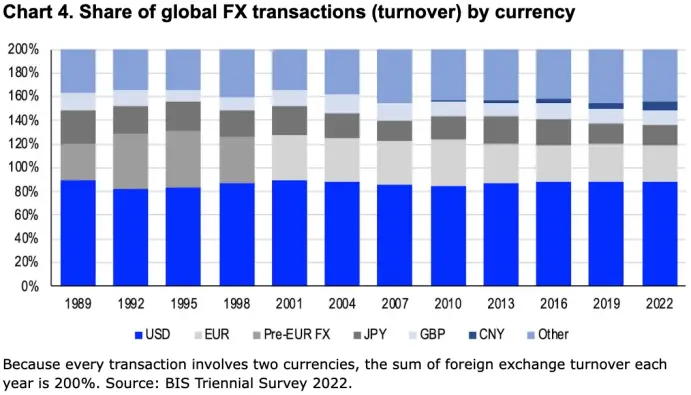

Because of this, we regard Bitcoin as a supranational stored value asset and believe that it has unique advantages in building monetary credit in international trade. At present, more than 80% of global international trade is still settled in US dollars (see Figure 4), but as the world gradually moves towards a multipolar system, more and more countries are uneasy about their continued reliance on US dollars as intermediaries in their balance of payments. However, alternatives to be available in reality are still very limited.

For example, currencies in countries with current account surplus may be insufficient global circulation (this is the "Triffen puzzle" raised by economist Robert Trifin, who once suggested to deal with this by setting up new reserve currency units). At the same time, due to the high dispersion of fiscal policies in the euro zone and the many institutional restrictions of the European Central Bank, although the euro is the world's second largest reserve currency, its influence is still far less than that of the US dollar.

We believe that assets that are censor-resistant and sovereign neutral (i.e., supranational assets) will be more attractive for politically sensitive trade relations, especially for countries with current account surplus. Of course, the options for such assets are very limited, so Bitcoin may be the most promising competitor at the moment. In the long run, this could bring huge asymmetric upside potential for Bitcoin. But it should be noted that its widespread popularity may still be restricted because many countries are unwilling to give up their dominance over their monetary policy. Of course, given that most commodities are still denominated in US dollars, from a practical perspective, the Federal Reserve has actually greatly influenced the policy direction of most central banks around the world.

Why now?

This is also the reason why we emphasize not to confuse "stored value assets" and "anti-inflation assets", although the two are closely related. We define "stored value assets" as assets that can maintain their value in the long-term investment cycle, while "anti-inflation assets" are tools used to deal with price shocks and protect purchasing power in the short term. Even a high-quality value storage tool may not be an effective anti-inflation method, and vice versa.

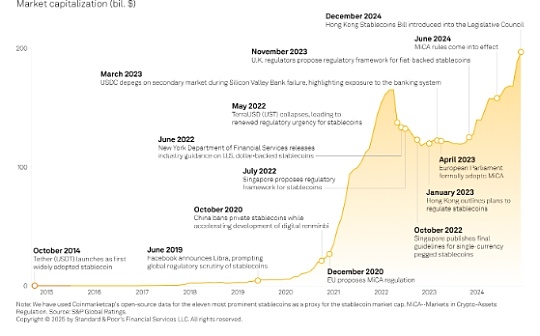

From this perspective, we believe that the potential capital inflows into Bitcoin may be quite considerable, especially in 2025, where cryptocurrencies are expected to truly enter the mainstream market. Bitcoin holdings surged (see Figure 5), mainly due to the launch of investment tools such as spot Bitcoin ETFs, which significantly lowered the investment threshold; at the same time, the liquidity and depth of the market have also increased significantly in the past five years. In addition to Bitcoin, the crypto payment field is also beginning to accelerate, and more and more institutional participants are gradually recognizing the unique advantages of blockchain infrastructure in improving efficiency and controlling costs.

The continuous expansion of the Bitcoin investor base is being promoted in parallel with the initiatives of establishing strategic Bitcoin reserves (or digital asset reserves) in multiple countries (and some states in the United States). In March 2025, the White House passed an executive order to formally establish a strategic Bitcoin reserve, using Bitcoin seized by the US government, with a total amount of approximately 198,000 BTC. It is worth noting that China may be the world's second largest national Bitcoin holder, with an estimated holding of about 190,000 BTC, mainly due to the seizure of assets, although the Bitcoin reserve plan has not yet been officially launched. At the same time, countries such as the Czech Republic, Finland, Germany, Japan, Poland and Switzerland are also studying the feasibility of incorporating Bitcoin into the national reserve system.

By comparison, global on-ground gold reserves have exceeded 216,000 tons by the end of 2024, with central banks and sovereign fiscal departments holding about 17% (about US$3.6 trillion) as reserves. On the other hand, affected by exchange rate fluctuations in 2024, global foreign exchange reserves fell from US$12.75 trillion to US$12.36 trillion in the fourth quarter of 2024. This means that gold holdings (excluding foreign exchange reserve statistics) currently account for about 23% of the global comprehensive international reserves, compared with only 10% a decade ago. In addition, Basel III will officially come into effect on July 1, 2025, when gold will be reclassified from third-level assets to first-level "high-quality current assets", which may further promote the global de-dollarization asset allocation process.

As demand for the US dollar weakens, we believe that more countries will seek to diversify their foreign exchange reserves in the future. Conservative estimates are that if only 10% of the global total international reserves are used to allocate Bitcoin, in the long run, the total market value of Bitcoin is expected to increase by about $1.2 trillion.

in conclusion

The global monetary system is undergoing a major shift, manifested by increased concerns about U.S. fiscal and trade policies and a gradual weakening of the dominance of the dollar, creating unique development opportunities for alternative stored-value assets. We believe that Bitcoin is gradually being regarded as a potential strategic reserve asset by more and more countries, due to its sovereign neutrality and its non-influence of international sanctions, and is expected to benefit significantly from this trend in the future. At the same time, the Basel III re-dividing of gold asset classes and the slowdown in the pace of gold holdings increase in some central banks also further confirm this structural change. Overall, we believe that the world is accelerating its traditional dependence on the US dollar, and Bitcoin may become a key component of the future global financial system.

jinse

jinse

chaincatcher

chaincatcher