What is the impact of 10-year U.S. Treasury yield on cryptocurrency yields?

Reprinted from jinse

05/16/2025·22DAuthor: Onkar Singh, CoinTelegraph; Compilation: Baishui, Golden Finance

1. Understanding the 10-year Treasury yield: Definition and importance

The 10-year Treasury yield is the interest rate that the U.S. government needs to pay for borrowing 10 years.

When the government needs cash, it issues bonds called Treasury bonds, and 10-year Treasury bonds are one of the most watched bonds. "Rate of Yield" refers to the annual rate of return from purchasing the bond and holding it to maturity. It is expressed as a percentage, for example 4% or 5%.

Imagine the government said, "Lend me $1,000 and I will pay you back the principal and interest 10 years later." This interest rate and yield will fluctuate up and down based on bond demand, inflation expectations and overall economic conditions. Since U.S. Treasury bonds are considered safe (not likely to default by the government), the 10-year Treasury yield is the benchmark for "risk-free" returns in the financial sector.

Why is this so important to cryptocurrencies? Cryptocurrency yields and stablecoins are part of the broader financial world, and 10-year Treasury yields affect investors' behavior and thus affect cryptocurrency markets. Let's take a deeper look.

2. The impact of 10-year U.S. Treasury yield on global financial markets

The 10-year Treasury yield is not unique to the United States - it plays a major role in global financial markets, affecting everything from stock markets to currencies to emerging economies.

Since the US dollar is the world's reserve currency and U.S. Treasury bonds are a global safe haven, changes in the yield on 10-year U.S. Treasury bonds will cause shocks around the world. The details are as follows:

-

Stock Market: Rising U.S. Treasury yields could lead to withdrawal from the stock market, especially growth stocks such as tech companies, as investors can get higher returns from bonds. In 2021, as yields soared, tech stock indexes such as Nasdaq were hit hard as investors turned to safer assets. This shift could lay the foundation for how investors view riskier assets such as cryptocurrencies.

-

Global lending costs: 10-year Treasury yields affect global interest rates. As yields rise, so does borrowing costs for businesses and governments, which may slow economic growth. For example, in 2022, rising yields led to a tightening of the financial environment, affecting everything from European corporate loans to Asian mortgage rates.

-

Money Market: Rising 10-year Treasury yields have led to a stronger dollar as investors flock to assets denominated in USD. A stronger dollar could make cryptocurrencies, which are usually denominated in dollars, more expensive for international investors, potentially curbing demand. This also puts pressure on emerging market currencies, as their debt (usually denominated in US dollars) is more expensive to repay.

-

Emerging markets: Countries with weaker economies rely on cheap lending. When U.S. Treasury yields rise, capital flows from riskier emerging markets to U.S. bonds, causing volatility in its stock and bond markets. This could spread to the cryptocurrency markets, as investors in these regions may sell crypto assets to cover losses in other regions.

-

Inflation and monetary policy: The 10-year Treasury bond yield is a barometer of inflation expectations. If yields rise as investors expect rising inflation, central banks such as the Federal Reserve may raise interest rates, thereby tightening global liquidity. This could reduce speculative investment in assets such as cryptocurrencies, as seen when aggressive rate hikes in 2022 caused market cooling.

For cryptocurrency investors, this global impact lays the backdrop. Rising 10-year Treasury yields may herald a more severe market environment for cryptocurrency prices and yields, especially in the face of global market turmoil. On the contrary, low yields tend to stimulate risk appetite, boosting speculative assets such as cryptocurrencies.

3. Treasury yields rise: Will safer returns take away the yield

attractiveness of cryptocurrencies in 2025?

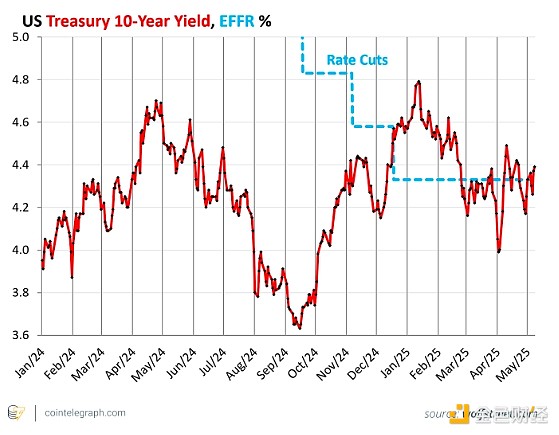

The 10-year U.S. Treasury yield is an important indicator of global financial health, and this yield showed significant fluctuations in 2025. As of May 9, 2025, the yield was approximately 4.37%-4.39%.

The fluctuations in yields are driven by factors such as trade tensions, inflation expectations and Fed policies. Recent interest rate cuts have not lowered yields as expected, which runs contrary to historical trends.

In the cryptocurrency space, yields are obtained through activities such as pledge, lending and liquidity provision, and usually provide returns of 5%-10% or even higher. However, the rise in 10-year Treasury yields present challenges.

Research shows that higher yields for secure assets may reduce demand for riskier cryptocurrencies, as investors may be more inclined toward stability in U.S. Treasury bonds. This kind of capital competition may lead to a decline in participation in cryptocurrency lending platforms, which may push up yields to attract users, but overall market activity may decline.

This is because many cryptocurrency platforms need to borrow money to operate, and their borrowing costs are linked to wider interest rates, and 10-year Treasury yields affect wider interest rates. If interest rates rise, these platforms may pass on higher costs to users, affecting the rate of return you get.

4. How does the yield on treasury affect stablecoins

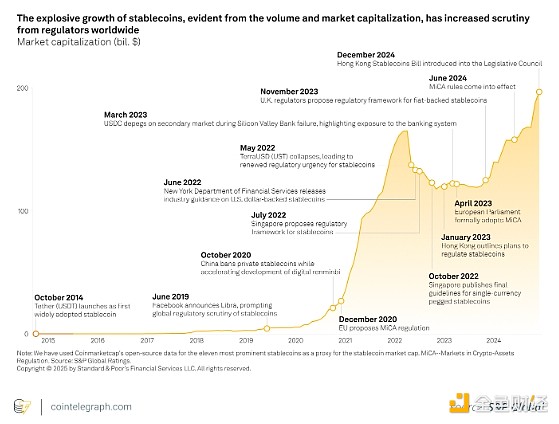

Stable coins like Tether's USDt and USDC are closely linked to traditional finance because their value is often supported by assets such as cash, bonds or - you guessed it - U.S. Treasury bonds.

Here is the impact of 10-year Treasury yields on stablecoins:

-

Supported Assets: Many stablecoins (such as USDC) hold U.S. Treasuries in their reserves to maintain their peg to $1. Rising U.S. Treasury yields (currently 4.39%) means stablecoin reserves can earn more income, which can theoretically be shared to users as income.

-

Regulatory complexity: The regulatory framework in some countries complicates this process. In the EU, the Crypto Asset Market Supervision Ordinance (MiCA) prohibits stablecoin issuers and crypto asset service providers (CASPs) from providing interest to prevent them as a means of store of value, but users can still earn money through the decentralized finance (DeFi) platform.

-

Opportunity Cost: If the 10-year Treasury yield is high, holding stablecoins (which usually have lower yields than riskier cryptocurrencies) may be less attractive than buying U.S. Treasury bonds directly. Investors may withdraw funds from stablecoins, reducing funds available for borrowing and potentially reducing the yield on stablecoins.

-

Market sentiment: Rising U.S. Treasury yields often herald tightening monetary policy (such as the Fed rate hike), which could disrupt the cryptocurrency market. For example, in 2023, when yields reached their peak in years, cryptocurrency prices, including stablecoin-related tokens, felt pressure as investors became more cautious. This may indirectly affect the yield of stablecoins, as the platform will adjust according to market conditions.

-

DeFi Dynamics: In decentralized finance (DeFi), stablecoins are the backbone of borrowing and trading. If Treasury yields rise and traditional finance becomes more attractive, the activity of the DeFi platform may decrease, thereby reducing the yield on the stablecoin pool. On the other hand, some DeFi protocols may increase yields to maintain user engagement.

It is worth noting that more and more people are calling for regulations that allow stablecoins to share their benefits with users, especially in jurisdictions where legislative work is underway, such as the UK and the US. This debate is crucial, as allowing income sharing can enhance the adoption of stablecoins, thereby increasing fiscal revenue, but clear regulatory provisions are required to avoid legal risks.

5. USDC and US Treasury bonds: How should you invest your funds?

USDC pledges provide higher but volatile returns with moderate risks; while US Treasuries provide stable, low-risk returns with government guarantees.

When users pledge USDC (by lending on platforms like Aave or Coinbase), they can earn floating returns, with annual interest rates typically ranging from 4% to 7%, depending on demand and platform risk.

U.S. Treasuries, especially 10-year Treasuries, provide fixed income; yields are about 4.37%-4.39%. These securities are secured by the U.S. government, making them one of the safest investments.

While USDC can provide higher benefits, it also comes with additional risks such as smart contract vulnerabilities, platform failures, and regulatory changes. Although US Treasury bonds are safer, there is limited room for growth.

6. The impact of rising Treasury bond yields on cryptocurrency investors

For cryptocurrency investors, higher Treasury yields may reduce risk appetite, but tokenized Treasury offers a safe alternative.

If you are considering pledging your Ethereum or lending USDC, understanding the trend of Treasury yields can let you know in advance whether yields are rising, falling, or bringing additional risks.

For example:

-

If yields rise, this may indicate that cryptocurrency yields may become more competitive, but it may also mean that global markets are becoming tense. You should probably stick to investing in stablecoins or a safer platform.

-

If the yield is low, investors may invest their money in cryptocurrencies, thereby increasing yields, but also increasing volatility. This may be an opportunity to earn more, but you need to be aware of the risks.

Additionally, if you use a stablecoin to store cash or earn extra income, 10-year Treasury yields can hint whether these yields will remain attractive or whether you are likely to find better returns elsewhere. Thanks to the global influence of stablecoins, yields can herald a wider economic change that could impact your cryptocurrency strategy.

Furthermore, if regulatory regulations develop to allow earnings sharing, especially in the U.S., stablecoin holders may benefit from higher reserve income, although EU restrictions push earnings creation toward DeFi. Alternatively, traditional investors could explore tokenized Treasuries to gain blockchain-based Treasury exposure and potentially integrate them into a broader portfolio when regulation is clearer.

A significant development in 2025 is the rise of tokenized Treasury bonds, that is, the digital manifestation of US Treasury bonds on blockchain. According to RWA.xyz's analysis, as of May 4, 2025, the total value of tokenized Treasury bonds had reached US$6.5 billion, with an average return on maturity of 4.13%. This trend provides cryptocurrency investors with a way to get comparable returns to traditional bonds, potentially mitigating the impact of rising U.S. Treasury yields on cryptocurrency markets.

In addition, the emergence of tokenized U.S. Treasury bonds marks a blurred line between traditional finance and decentralized ecosystems. These blockchain-based government debt tools not only provide returns stability, but also reflect a broader trend: integrating real-world assets (RWAs) into cryptocurrency markets. This development has the potential to reshape risk management practices, attract more conservative capital, and accelerate regulatory participation in digital assets.

chaincatcher

chaincatcher

panewslab

panewslab