Artemis: Where is the supply of 240 billion stablecoins going?

Reprinted from jinse

06/05/2025·11DAuthor: Will Awang; Source: Web3 Xiaolu

Early on, the growth of stablecoins was measured by total supply (Supply), and the key challenge was the trust behind it: which issuers are trustworthy, compliant and capable of scaling. I believe that with the introduction of the Genius Act in the United States, this issue will be resolved immediately.

With the standardization of issuance, the stablecoin market enters the next stage - from issuance to distribution.

There are only a handful of days when the issuer makes amazing profits – the distributor is beginning to realize its leverage and get the share of its due value. This answer is already well given in Circle's prospectus.

Given this shift, it is becoming increasingly important to understand which applications, protocols and platforms are achieving real growth, especially for those on-chain stablecoin scenarios that are already relatively mature in the crypto market.

Last week, we compiled the article Artemis: First-line data used by stablecoin payment. Starting from the stablecoin scenario of off-chain payment, we look at the potential and path of stablecoin linking traditional finance.

Today, we continue to go deeper from Artemis, The Future of Stablecoins, Usage, Revenue, and the Shift from Issuers to Distribution, focusing on stablecoin use cases related to on-chain activities, because each use case has its own unique background and practices, and can also observe value capture trends in dynamic market changes on-chain.

Original text of the report: https://docsend.com/view/vy9ttpq3hpqk2fxj

Core points

Although the market value of stablecoins has reached US$240 billion and the annual trading volume is as high as US$3.1 trillion, there are many misunderstandings about its popularity. On the one hand, in order to expand the market, issuers do not hesitate to pay high fees to distributors. For example, Circle paid US$900 million to distributors such as Coinbase in 2023, accounting for more than half of its revenue, in order to attract users to use USDC.

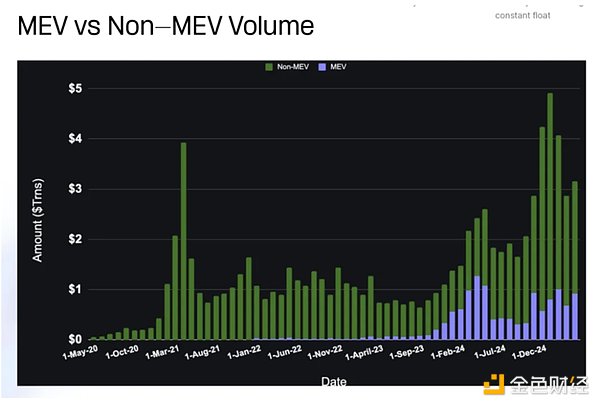

On the other hand, the so-called $3.1 trillion annual transaction volume is extremely misleading, of which 31% is due to the contribution of MEV robots through thousands of cycles per day and repeated use of the same funds. The actual transaction volume of humans is far lower than the scale implied by surface data.

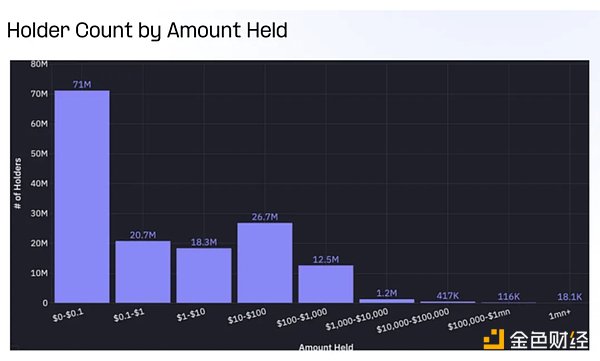

In addition, there is also an over-concentration of wealth in the stablecoin field. Although there are currently 150 million stablecoin wallets, 99% of the wallets have a balance of less than US$10,000, while only 20,000 mysterious wallets control US$76 billion, accounting for 32% of the total supply. These wallets are neither exchanges nor DeFi protocols and are reported to be classified as "gray zones". The meaning behind them is not clear.

It is worth noting that the real explosive growth of stablecoins is in the past six months. Since the summer, DeFi stablecoin trading volume has soared from US$100 billion to US$600 billion. At the same time, meme transactions alone have generated US$500 billion in stablecoin traffic, accounting for 12% of the annual trading volume.

However, our criteria for measuring the success of stablecoins are put before the horse. The decline in total lock-in value (TVL) may not be a decrease in usage, but may be a reflection of technological advances and efficiency improvements. The increase in transaction volume may only mean an increase in robot activity. There are fundamental problems in each indicator we use to track adoption rates.

While people are still arguing about the market share of USDC and USDT, real changes are actually happening quietly at the distribution level. This may lead to the reshaping of the entire stablecoin ecological value chain.

1. The next stage of stablecoins

In just a few years, stablecoins have developed from experimental products to an indispensable financial tool, and their product market compatibility is unquestionable. But now, we have entered a new era, and the issuance and liquidity alone are not enough to bring about sustained growth. The next phase of stablecoin application will involve new factors, including sharing economic benefits with partners, the ease of on-chain and off-chain integration, and the degree of utilization of programmable features.

——Jelena Djuric, Noble Co-founder and CEO

Behind the supply of 11240 billion

Stablecoins have become one of the most widely used products in the crypto field, with supply of more than US$240 billion and annual on-chain transaction volume of more than US$7 trillion, comparable to traditional payment networks, but many figures are worth exploring.

Supply reflects the existence of stablecoins, not the use, flow or purpose. At the same time, volume (Volume) reflects the mix of on-chain human activities and robotic programs, but cannot capture off-chain data.

1.2 Usage is a new signal

Not all stablecoins are in a state of efficient value circulation. Some stablecoins are dormant as node verification or staking, while others are key drivers of cross-platform, cross-user, and cross-regional real economic activities.

As stated in the Status of Stablecoins in 2025, we see significant differences between stablecoins across ecosystems. Stablecoins on Ethereum are often used as DeFi collateral and transaction liquidity, while stablecoins on Tron are more commonly used for remittances and payments in emerging markets. USDC holds a higher share of institutional funding flows, while USDT thrives with its reach and accessibility.

These usage patterns not only reflect the flow of value, but also provide builders with the opportunity to target underserved or high-growth niches.

Understanding the application scenarios and their functional utility of stablecoins is the clearest signal for considering stablecoins at present, indicating where stablecoins are truly adopted and where the next wave of innovation will emerge.

2. From institutional issuance to market distribution

Stablecoins will grow further, and regulatory clarity is opening the door for institutional investors. The next stage of a stablecoin is not only about who owns the scale, but also about the business model of all participants in the stablecoin supply chain, including issuers, distributors and holders. In the next 12-24 months, we will surely see changes and challenges in value chains and value capture.

——Martin Carrica, Vice President of Stablecoin at Anchorage Digital

2.1 Historical Value of the Issuer

In the early days of stablecoins, value acquisition was mainly concentrated on the issuer. Maintaining an anchor rate of 1:1 under huge scale is a difficult problem, and few issuers can solve this problem well.

Tether and Circle are able to dominate not only because they are pioneers, but also because they are one of the few issuers who can continuously manage large-scale issuances and redemptions, manage reserves, integrate with bank partners, and resist market pressures.

Monetize reserve income (mainly short-term US Treasury and cash equivalents), even very ordinary interest rates can be converted into huge income. At the same time, early successes continued to superimpose: exchanges, wallets and DeFi protocols built around USDT and USDC, strengthening the network effect of issuance and liquidity.

2.2 Distribution as an important value layer

Trust, liquidity and redemption are no longer differentiating factors, but expectations. As more and more issuers with similar capabilities enter the market, the importance of the issuer itself gradually decreases.

What matters is what users can do with stablecoins. Therefore, the dominance of stablecoins is being transferred from the issuer to the distributor.

Wallets, exchanges and applications that distributors integrate stablecoins into their actual use cases now have both influence and leverage. They control user relationships, shape user experiences, and increasingly decide which stablecoins can gain attention.

And they are monetizing this status. Circle's recent IPO filing shows that it paid nearly $900 million to partners such as Coinbase to integrate and promote USDC, more than half of its total revenue in 2023.

Note that the current situation is that the issuer pays it to the distributor, not the other way around.

Many distributors are further improving their platform architecture. PayPal launches PYUSD; Telegram partnered with Ethena; Meta is exploring the channels for stablecoins again; Fintech platforms such as Stripe, Robinhood and Revolut are embedding stablecoins directly into payment, savings and transaction capabilities.

The issuer has not stopped. Tether is building wallets and payment channels. Circle is achieving full-stack development through the acquisition of payment application program interfaces (APls), developer tools and infrastructure, and launching the Circle Payment Network in an effort to form a network effect.

But the situation is clear: distribution has now become a strategic commanding height.

We are in the midst of a structural change: a shift from perspective, where stablecoins are no longer seen as "cryptocurrencies", but "global infrastructure"; a shift in utility, where financial institutions are making full use of these new tracks to actively reshape their products; the competitive environment is changing all the time.

——Ran Goldi, Senior Vice President of Payment and Networking, Fireblocks

2.3 Build programmability and accuracy

With the popularity of stablecoins, new infrastructure is emerging—those are aiming at programmability, compliance and value sharing. Issuing alone is no longer the key. To remain competitive, stablecoins must be able to adapt to the needs of platforms that drive usage.

Next-generation stablecoins include programmable features such as cross- checking capabilities, compliance rules and conditional transfers. These features enable stablecoins to act as application-aware assets, automatically routing value to merchants, developers, liquidity providers (LPs) or affiliates without an off-chain protocol.

Each use case has its own unique background. Remittances prioritize speed and conversion, DeFi requires composability and collateral flexibility, while fintech integration requires compliance and auditability. The emerging infrastructure stack is designed to meet these diverse needs, enabling the stablecoin layer to adapt dynamically to its environment rather than providing a one-size-fits-all solution.

Crucially, this transformation of infrastructure can achieve more accurate access to value. Programmable flow means that value can be shared throughout the stack, not just hoarded by the issuer. Stablecoins are becoming a dynamic financial primitive and are influenced by the incentive mechanisms and architecture of the ecosystem in which they live.

3. On-chain stablecoin use cases

As the value acquisition of stablecoins moves downstream, the distributors define their actual use.

Wallets, exchanges, fintech applications, payment platforms and DeFi protocols determine which stablecoins users can see, how they interact with these stablecoins, and where they create utility. These platforms shape the user experience and control the demand side of the stablecoin economy.

Analyzing the actual use of stablecoins in areas such as payments, savings, transactions, DeFi and remittances can reveal who is creating value, where the friction points are, and which distribution channels are effective. This report focuses on stablecoin use cases related to on-chain activity, and by tracking the flow of stablecoins on wallets and platforms, we can gain an in- depth understanding of the infrastructure and incentive mechanisms that affect their adoption.

Among these known (also known as "marks") participants, the current use of stablecoins is mainly concentrated in three main environments:

1. Centralized exchange

2. DeFi protocol

3. MEV

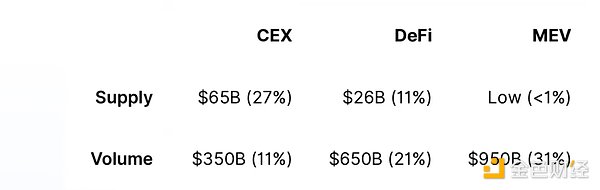

The following table shows the supply and transaction volume share for each category in April 2025:

These three types of addresses account for 38% of the total supply of stablecoins and 63% of the total trading volume of stablecoins.

Unlabeled addresses account for the majority of the remaining supply and transaction volume. These wallets are not directly associated with well-known institutions, exchanges or smart contracts. We will explore trends in unlabeled addresses later in this report.

3.1 Overall stablecoin market overview

Total supply of stablecoins: US$240 billion

Total stablecoin trading volume in the past 30 days: US$3.1 trillion

Reserve revenue: US$10 billion

A. Supply

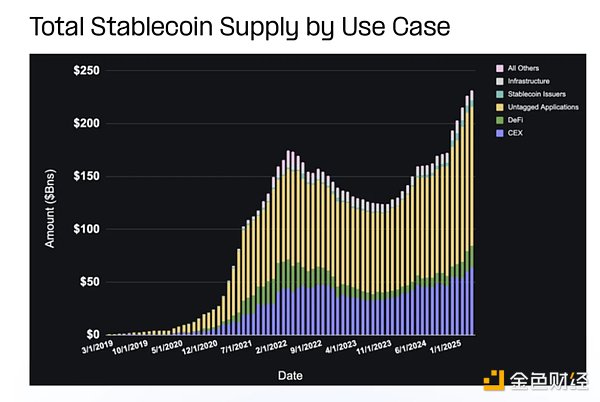

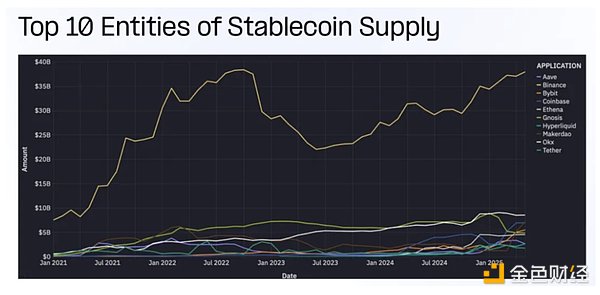

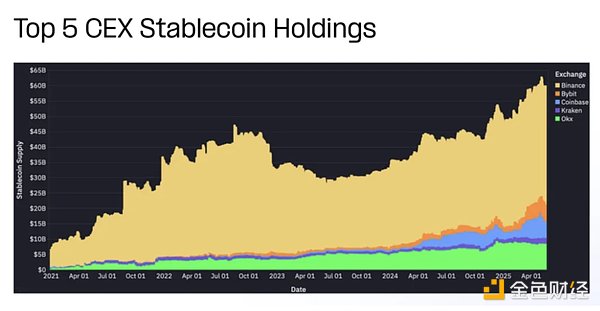

The distribution of stablecoin supply (Supply) reveals which platforms and use cases are attractive enough to attract and retain circulation. The total supply of stablecoins has steadily climbed since the summer of 2023, hitting record highs this year, with supply of centralized exchanges (CEX), DeFi and unmarked wallets all achieving high growth.

Most stablecoin supply is concentrated on centralized exchanges, with Binance taking a considerable lead. DeFi protocols and issuers also hold a considerable share.

B. Volume

B. Volume

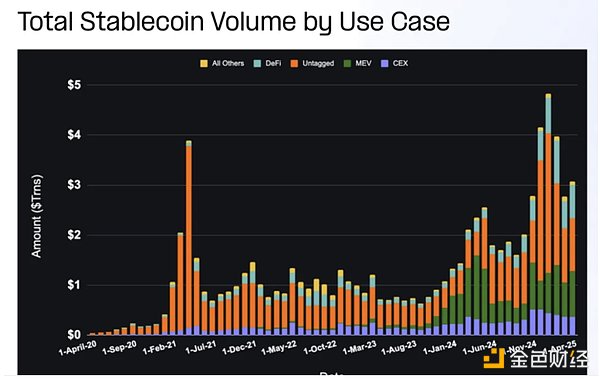

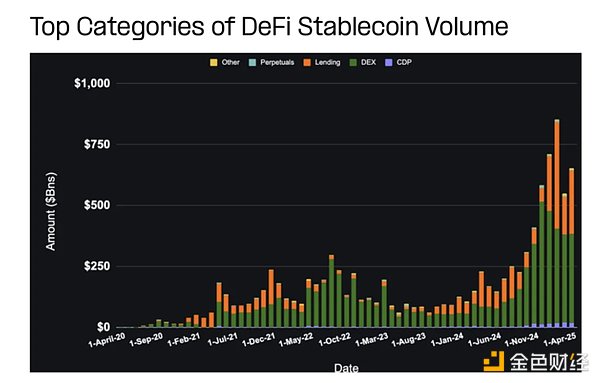

Since the summer of 2023, the total trading volume of stablecoins has steadily increased, with an abnormal surge in market activity. DeFi has the highest volume growth, while MEV and unmarked wallets have higher volume but more volatility.

The entities with the highest volume of stablecoins are often centralized exchanges, followed by DeFi and issuers. CEX trading volume does not reflect transactions on the CEX platform, as most transactions occur off-chain. Instead, it reflects user charges and withdrawals, inter-exchange transfers, and internal operational activities.

3.2 Centralized Exchange (CEX)

The supply of stablecoins anchored by centralized exchanges accounts for a large part of the circulation in the ecosystem. In terms of transaction volume, DeFi protocol and MEV-driven players are currently the most active, highlighting the growing role of on-chain applications and composable infrastructure.

Account for the total supply of stablecoins: 27%

In the past 30 days, total stablecoin transaction volume: 11%

Reserve revenue: $3 billion

The supply of top centralized exchanges (CEXs) has nearly doubled since the local lows in 2023. Supplies from Coinbase, Binance and Bybit tend to fluctuate with the market, while supply from Kraken and OKX grows more stably.

Since most of the activity occurs off-chain (centralized ledger), it is difficult to obtain specific data on how a centralized exchange (CEX) uses stablecoins. Funds are usually concentrated together, and specific uses are rarely disclosed. This opacity makes it difficult to assess the comprehensiveness of stablecoin usage within a centralized exchange (CEX).

The volume of stablecoin transactions attributable to centralized exchanges (CEXs) reflects on-chain activities related to recharge, withdrawal, inter- exchange transfers and liquidity operations, rather than internal transactions, margin collateral or fee settlement. Therefore, it is best to consider it as an indicator of user interaction with exchanges rather than a measure of total trading activity.

3.3 Decentralized Finance (DeFi)

Account for the total supply of stablecoins: 11%

In the past 30 days, total stablecoin transaction volume: 21%

Reserve revenue: US$1.1 billion

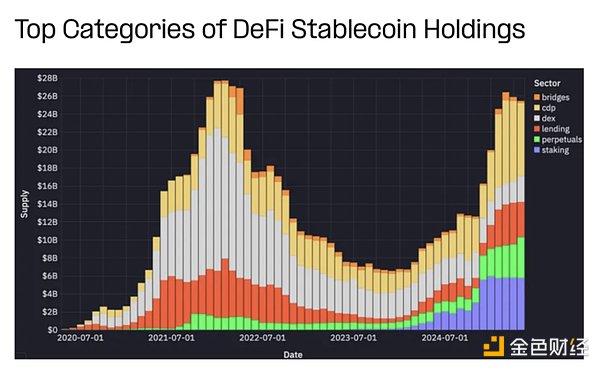

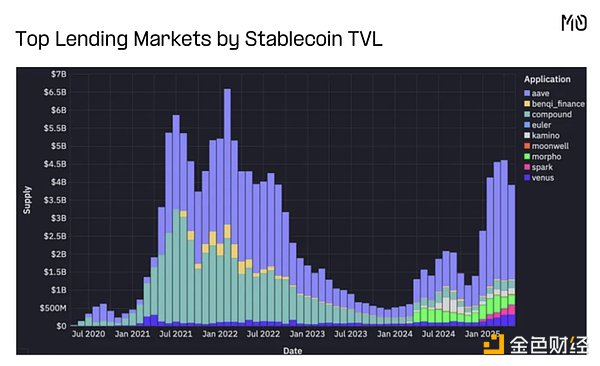

The supply of DeFi stablecoins comes from collateral, liquidity provider (LP) assets, and the settlement layers of lending markets, decentralized exchanges (DEXs) and derivatives agreements. The supply of CDP, lending, perpetual contracts and pledges has nearly doubled in the past six months.

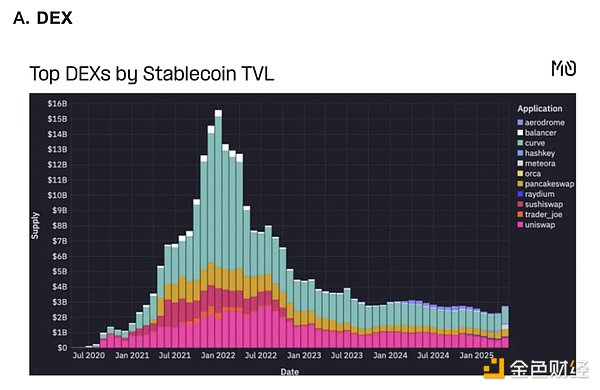

DEX's supply share has dropped significantly, not because of the decline in DEX usage, but because DEX's capital efficiency is higher. With Hyperliquid's popularity, supply locked in perpetual contracts has increased significantly recently.

Monthly trading volumes of DeFi stablecoins have increased from about $100 billion to over $600 billion in the past six months, mainly due to significant growth in decentralized exchanges (DEX), lending markets and collateralized bond stocks (CDP).

In the DeFi field, stablecoins are used in the following key areas:

DEX Fund Pool

Lending Market

Asset mortgage claim

Others (including perpetual contracts, cross-chain and staking)

The way stablecoins are used differently in each field—whether as liquidity, collateral or payment—this can affect user behavior and the economic benefits of the protocol layer.

Centralized liquidity, stablecoin-centric DEX, and cross-protocol

composability reduce the need for DEX to maintain high stablecoin float.

Centralized liquidity, stablecoin-centric DEX, and cross-protocol

composability reduce the need for DEX to maintain high stablecoin float.

Most of the transaction volume of stablecoins in DeFi comes from DEX. DEX's share of total trading volume fluctuates with market sentiment and trading trends, and recently, memecoin's trading volume surged to more than $500 billion, accounting for 12% of the total trading volume.

B. Lending Markets

Although lending business has fallen from its peak, Aave has shown strong recovery momentum, and new agreements such as Morpho, Spark and Euler have also gained attention.

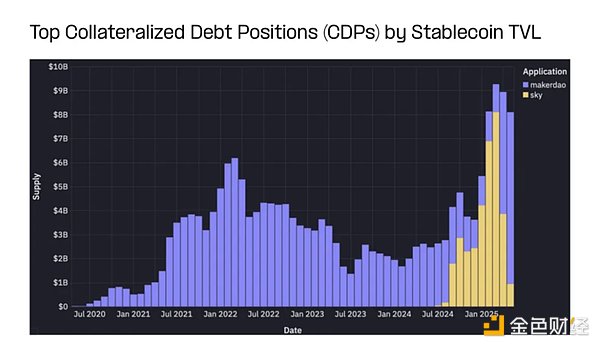

C. Collateralized Debt Positions

MakerDAO continues to manage one of the largest stablecoin libraries in DeFi, and DAI adoption continues to increase due to high savings rates. They hold billions of dollars in stablecoins and play a key role in maintaining the DAI peg to the dollar.

D. Others

Stablecoins also play a key role in supporting DeFi derivatives, synthetic assets, perpetual contracts and trading agreements.

Over time, the supply of stablecoins has rotated between various perpetual contract agreements, currently mainly concentrated on Hyperliquid, Jupiter and Ethereal.

3.4 MEV Miner/Node Verification

Total supply of stablecoins: < 1%

In the past 30 days, total stablecoin transaction volume: 31%

Reserve income:/

MEV robots get value by reordering transactions. Their high-frequency behavior leads to an over-the-raised share of on-chain transaction volume and often reuses the same funds.

The above figure distinguishes MEV-driven activities to distinguish between robot trading volume and manual trading volume. MEV trading volumes will surge with peak trading volumes and fluctuate as blockchains and applications try to combat MEV strategies.

It is not as simple as predicting high transaction volume and low floating- value use cases like MEV. Predicted reserve yields are not very applicable here, but these use cases can adopt various monetization strategies such as transaction fees, spread capture, embedded financial services, and monetization for specific applications.

3.5 Unattributed Wallets

Account for the total supply of stablecoins: 54%

In the past 30 days, total stablecoin transaction volume: 35%

Reserve revenue: US$5.6 billion

Stablecoin activity in unlabeled wallets is harder to explain, because the intent behind the transaction must be inferred or confirmed by private data. Even so, these wallets account for the vast majority of the stablecoin supply and often the vast majority of transaction volume.

The composition of unlabeled wallets includes:

-

Retail users

-

Unidentified institutions

-

Startups and SMEs

-

Dormant or passive holder

-

Smart contracts that are not yet classified

Although the attribution model is not perfect, such “gray zone” wallets are increasingly taking over the real-world payment, savings and operational processes, many of which do not exactly match traditional DeFi or transaction frameworks.

Some of the most promising use cases are emerging, including:

-

P2P remittance

-

Startup Vault Management

-

Individual dollar savings in inflation economies

-

Cross-border B2B payment

-

E-commerce and merchant settlement

-

In-game economy

These emerging use cases are expected to expand rapidly as regulatory transparency increases and payment-centric infrastructure continues to attract capital, especially in areas where traditional banks are underserved.

Related content can be seen: Artemis: First-line data from stablecoin payment

At present, we will focus on the following advanced trends:

Despite the huge number of unattached wallets (more than 150 million), the vast majority of wallets have insignificant balances. More than 60% of the unattached wallets hold less than USD 1 balance, while less than 20,000 wallets hold more than USD 1 million stablecoins.

When we shift the focus to each wallet balance, the situation is completely reversed.

The number of unattached wallets with a balance of more than $1 million is less than 20,000, with a total holding of more than $76 billion, accounting for 32% of the total supply of stablecoins.

Meanwhile, wallets with balances below $10,000 (more than 99% of unattended wallets) hold $9 billion, less than 4% of the total supply of stablecoins.

Most wallets are small in size, but most unattended stablecoins are in the hands of a few high-value groups. This distribution reflects the dual nature of the use of stablecoins: on the one hand, there are a wide range of grassroots users, and on the other hand, there are high concentrations among institutional users or giant whale users.

4. Conclusion

The stablecoin ecosystem has entered a new phase, and value will increasingly flow to those who build applications and infrastructure.

This marks a key maturity in the market, with a shift in focus from the currency itself to the programmable system that makes the currency work. With the improvement of regulatory frameworks and the surge in user-friendly applications, stablecoins will usher in exponential growth. They combine the stability of fiat currency with the programmability of blockchain, making it the cornerstone of global finance in the future.

The future of stablecoins belongs to builders who create applications, infrastructure and experiences and unlock their full potential. As this transformation accelerates, we can expect more innovations in the way value is created, distributed and acquired throughout the ecosystem.

The future financial world will be defined not only by stablecoins, but by the ecosystems formed around them.

chaincatcher

chaincatcher