Where does ETH value come from? Full analysis from asset logic to business strategy

Reprinted from chaincatcher

06/05/2025·11DAuthor: Konstantin Lomashuk, Artem Kotelskiy, XiaMiPP (Odaily)

Editor 's note: Recently, US listed companies have begun to "re-recognize" Ethereum. SharpLink Gaming plans to invest up to $1 billion in ETH as a strategic reserve by selling shares; BTCS has also purchased 3,450 ETH for approximately $8.42 million. These trends may be sending a clear signal: ETH is changing from "on-chain fuel" to "enterprise-level strategic asset."

From the experimental platform of the developer community, to the infrastructure of DeFi, to the long-term configuration in corporate finance, Ethereum’s role is undergoing a profound change. In this wave of value revaluation, how should we understand the technical logic and economic model behind ETH?

Odaily Planet Daily translated and refined the in-depth article "Ethereum Roadmap: Becoming the Root Chain of the "World Computer"" co-authored by Konstantin Lomashuk, an early investor of Ethereum and co-founder of Lido, and Artem Kotelskiy, head of research at Cyber• Fund, and Princeton's Mathematics Ph.D. This article systematically sorts out the development trajectory, protocol evolution, expansion path and its positioning in the Rollup era, and tries to answer a key question: Why is ETH worth "holding for a long time"?

Note: Since the original text is long, in order to improve readability, the translator has deleted and optimized some content without affecting the original meaning.

DeFi: The first time Ethereum found in market fit (PMF)

Ethereum has been committed to building a global shared, trustless computing platform since its inception. After ten years of development, it has grown from early technical experiments to the core foundation of decentralized finance (DeFi), block space market and even on-chain application ecosystem.

But to understand how ETH can get to where it is today step by step, we must start from a key turning point - DeFi 's product market fit (PMF) . It was the bear market from 2018 to 2020. With the emergence of ERC 20, Uniswap, DAI, Aave, Compound and other protocols, Ethereum gradually evolved into a self-hosted, composable, and license-free financial system. The explosion of DeFi is a natural fit between technological innovation and market demand.

The 2020 "DeFi Summer" marks the climax of this point, with the rapid increase in locked positions, the on-chain trading volume surpassing the centralized trading platform for the first time, and the network value of ETH began to appear. But the high transaction fees that followed also exposed the bottleneck of Ethereum in terms of scalability and laid the foreshadowing for the future transformation of technology routes.

The value twist of ETH: From EIP-1559 to The Merge

If DeFi allows Ethereum to show practical value, the two upgrades of EIP-1559 and The Merge give ETH the logic of long-term value.

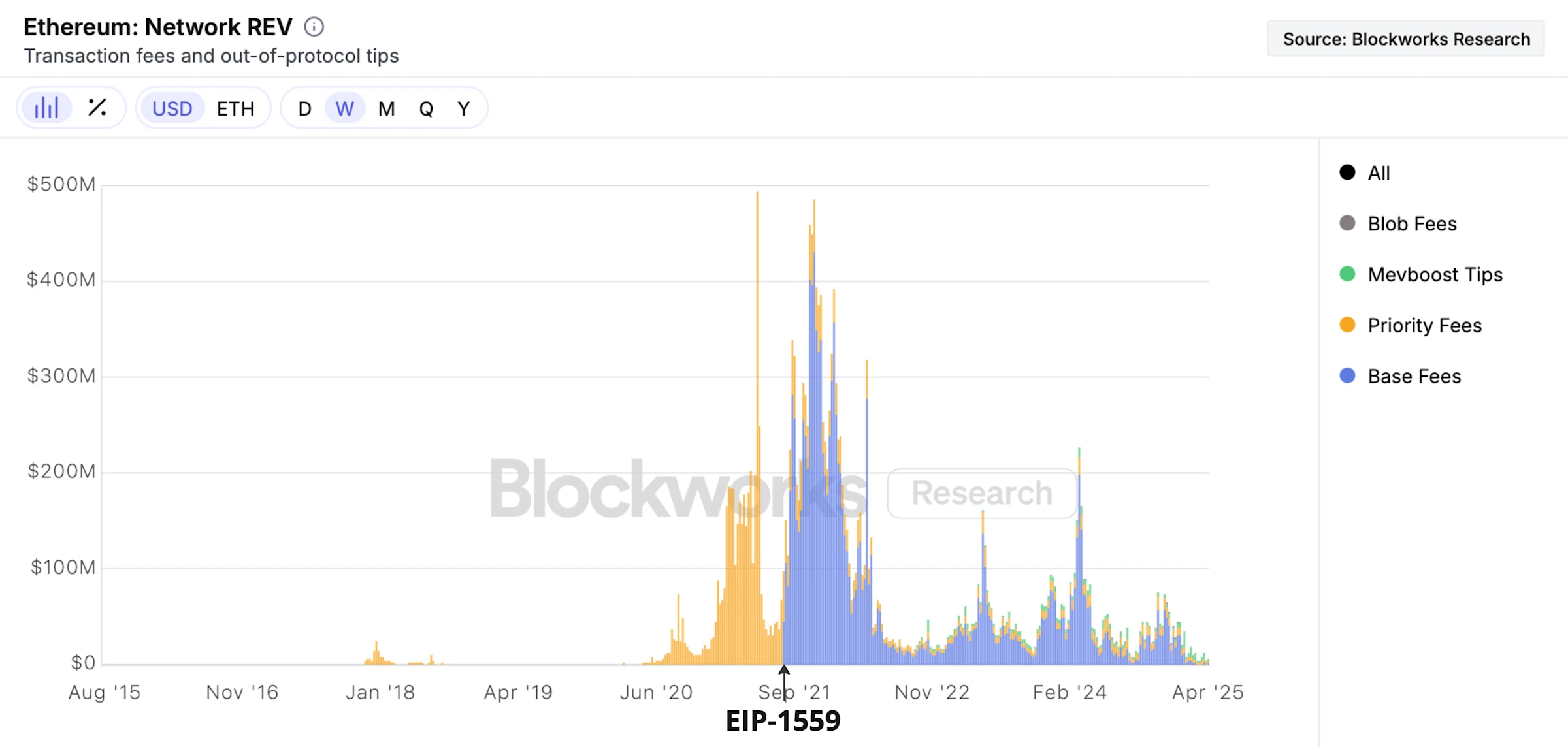

In 2021, EIP-1559 was launched, completely changing the handling fee mechanism of Ethereum. The original "priority bid" model was replaced by the base fee (Base Fee), and all users paid this part of the fee is no longer owned by the miner, but is directly destroyed. This means that the more active the network, the more ETH is destroyed, the less inflation pressure, and the stronger the value support of ETH.

The indigo section shows that ETH begins to achieve "value reflux" through the destruction mechanism

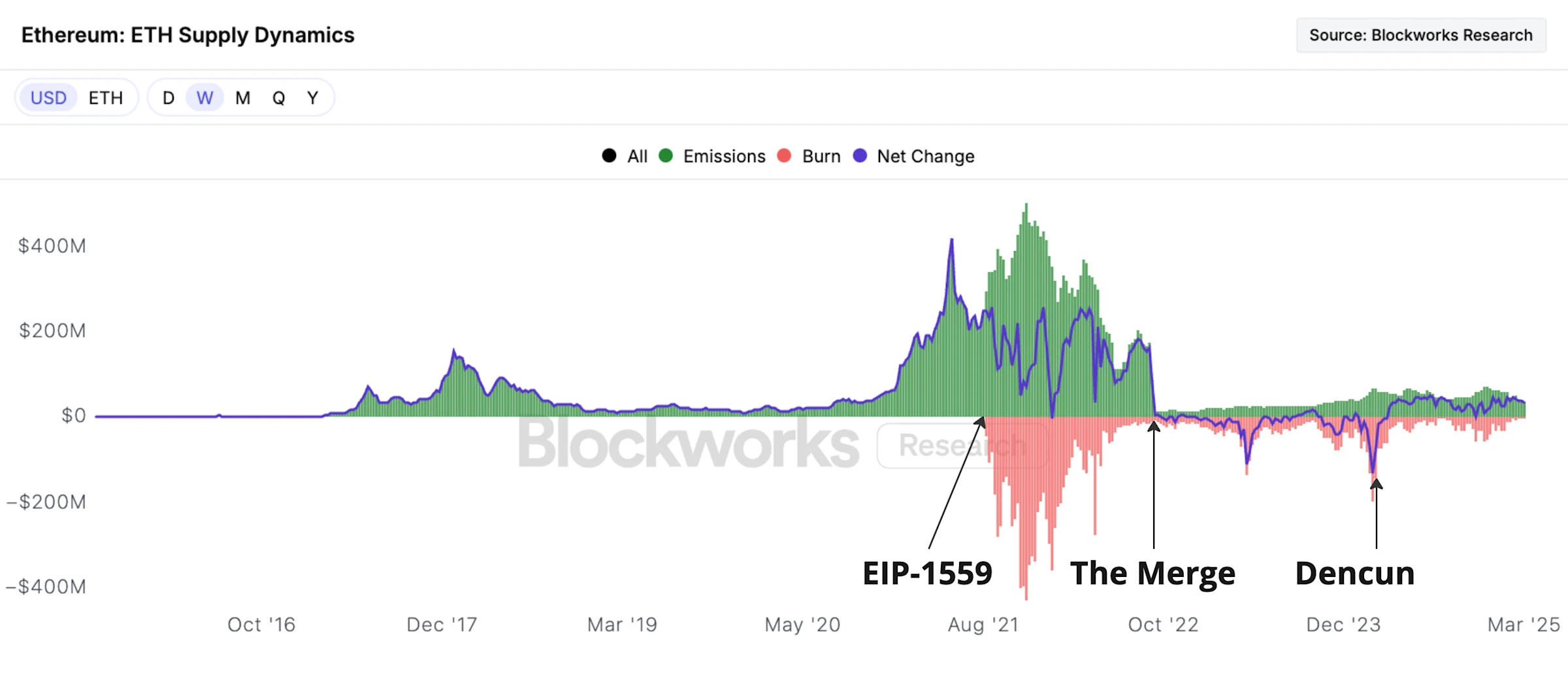

In September 2022, Ethereum completed an important historic upgrade: the consensus mechanism switched from Proof of Work (PoW) to Proof of Stake (PoS) , which marked the official implementation of the "Merge". The technological difficulty of this change is extremely difficult, but it is also extremely critical - it reduces Ethereum's energy consumption by 8,000 times and reduces the annualisation of network security from 4% to less than 1% .

After this, ETH 's "net inflation rate" turned negative for a considerable period of time.

Green represents ETH. New issuances per week, orange represents ETH. Weekly destruction. Blue represents the net difference between the two.

The long-term beliefs of the Rollup era: Cooperation and parasitics?

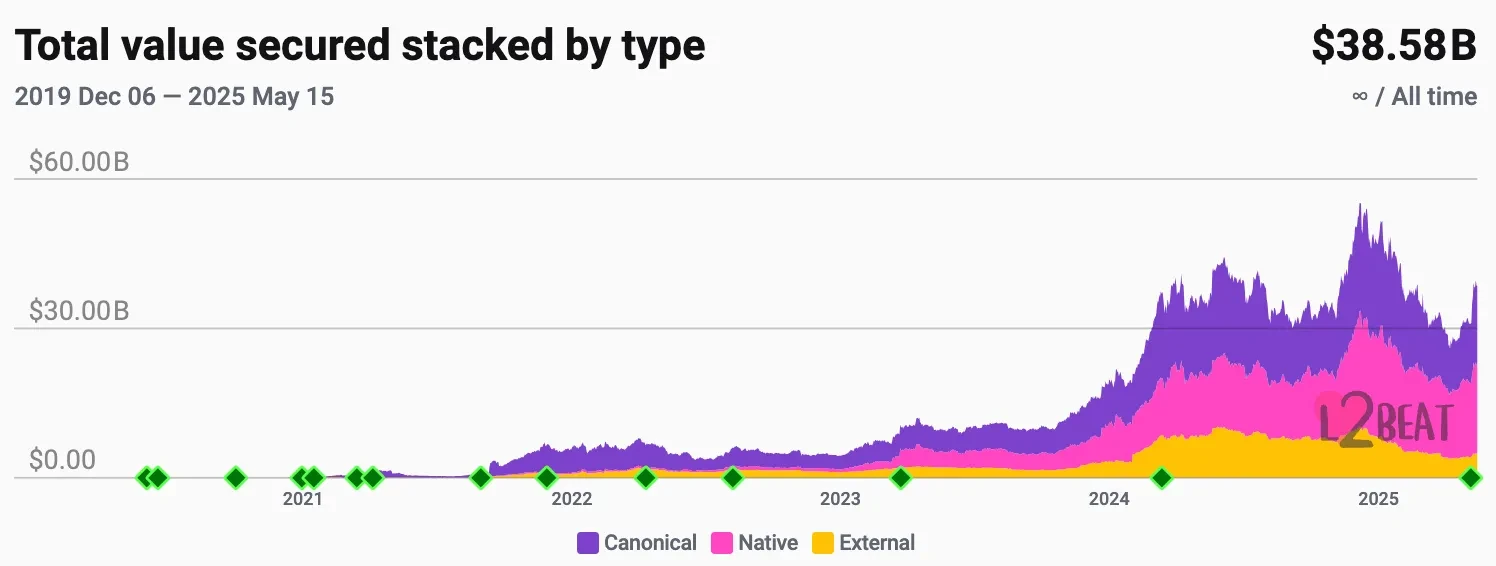

Scaling is the core problem of Ethereum. Faced with the trivial difficulties of decentralization, security and scalability, Ethereum finally chose the Rollup solution. Rollup puts transaction execution off-chain and only writes state changes and data to the main chain, which not only ensures the security of the main chain, but also greatly improves transaction throughput.

This has also transformed Ethereum from a simple "execution platform" to a "security layer + data availability layer", forming a "Rollup-centered" expansion route.

However, Rollup is not just a technological change, but has changed the logic of ETH's value flow. In the past, users paid the handling fee directly to the main chain, but now most transactions are completed through Rollup, and the direct transaction demand for the main chain is reduced . Rollup earns profits by reselling block space, but since Cancun upgraded, its direct expenses on the main chain have been greatly reduced, triggering discussions on "parasiticism". In fact, Rollup is more of a "business expansion" of Ethereum, relying on the main chain's security and data services, bringing more users and transactions.

Although the transaction demand for the main chain has declined, the expansion and upgrading of the main chain are still actively promoting, with the goal of increasing the processing capacity by a hundred or even a thousand times in the next few years, providing stronger security and data support for L2. Rollup and the main chain form a complementary ecosystem, both division of labor and collaboration, laying the foundation for the future sustainable development of Ethereum.

Ethereum Current Situation Indicators: Crisis and In-depth Factor

Analysis

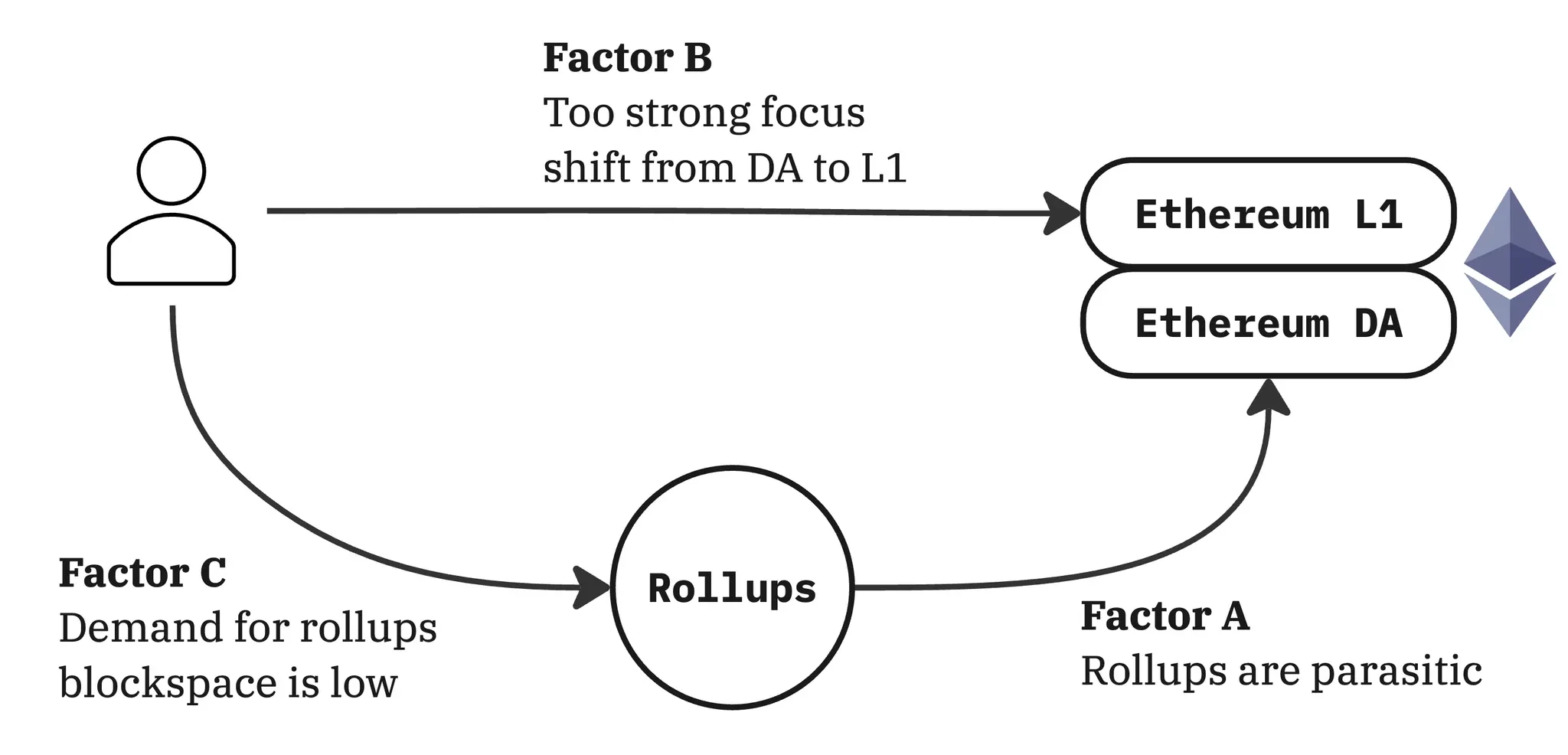

The crypto industry has maintained overall growth since the FTX crash in 2022, but ETH has significantly lagged behind Bitcoin (BTC) and Solana (SOL). ETH price is highly correlated with Ethereum network fees, and the growth of handling fees has been weak since 2022, especially compared with Solana's performance in the 2018-2022 cycle and this cycle, the revenue pressure is obvious. There are three main reasons:

Factor A: Rollup "parasitic"

Although Rollup makes profits through user handling fees, it has not yet given enough value back to the Ethereum main network.

Judging from the data, although this factor exists, it currently has a small impact on overall revenue. Rollup's current weekly revenue is only a few million dollars, and its handling fees are low, partly because rollup's sorters can support far higher gas limits than the mainnet , so they do not need to charge users with high fees like L1 networks.

More importantly, it is too early to question rollup's failure to feed back to the mainnet. In fact, the Ethereum community "surprisingly" adopted a strategy of providing data availability (DA) space for rollups for free to attract as many aggregate layer access as possible. This "concession" is the correct way to build an ecosystem in the early stage.

Factor B: L1 The strategic focus shifts to DA, and main network

construction is marginalized

Since the launch of the Rollup route, Ethereum's strategic and user growth focus has almost all tended to rollup, and the expansion and maintenance of the main network have been relatively neglected.

This bias is indeed true to some extent. When Ethereum solves the problem of high mainnet fees, it chooses to bet on Rollup in the future. This "all in" strategy ignores the potential of L1 itself. Looking back now, as the problem of Rollup fragmentation gradually emerges and we have gradually found a feasible path to L1 expansion (such as access lists and the development of zkEVM), we will find that the strategic low-profile of L1 may be a bit too much.

However, it must be admitted that this judgment is based on a post-event perspective. The Rollup route was a pragmatic move in the face of main network congestion at that time, while plans such as zkEVM were still far away at that time. Therefore, it was difficult to reasonably allocate resources at both ends of L1 and DA at that time.

In addition, even if we now have a clear path to increase the L1 gas limit by 100 times, to achieve performance of more than 10,000 TPS and support a comprehensive public chain computing platform, some form of horizontal sharding is still inevitable. Against this background, choosing the Rollup-first strategy was still a reasonable decision.

Factor C: Rollup's DA demand has not yet broken through the main

network's DA supply

This is the most critical and overlooked deep problem at present: Rollup's demand for data availability space (DA) has not substantially exceeded Ethereum's supply.

Rollup's sorter is very efficient when uploading transactions to the mainnet, with extremely high compression rates, resulting in them consuming much less blob space than the theoretical value. In addition, some user activities in this cycle (such as Meme currency transactions) are also diverted by Tron and Solana.

Before the Pectra upgrade (May 7, 2025), Ethereum's DA supply was approximately 210 TPS based on 3 blobs per block. Until November 2024, this supply exceeded market demand. Even though demand has risen later, the price of blob gas shows that its price has not risen significantly, indicating that demand has not yet exceeded supply. Recently, Pectra doubled the blob target to 6 pieces/block, and the DA supply has increased again, far exceeding the actual demand.

Therefore, factor C is actually the fundamental variable that influencing factors A and B. Once Rollup's demand for blob space truly exceeds the supply, blob fees will enter the market discovery stage and the overall handling fee structure of the Ethereum network will undergo a qualitative change.

How to evaluate the value of ETH? Ethereum's business logic

Is ETH a productive asset or a currency? We firmly believe that ETH should be a productive asset first and a currency second .

The reason is that Ethereum’s most powerful moat comes from its technological advantages : its trust foundation and stability tested over the years, neutrality and censorship resistance brought by decentralization, a leading DeFi ecosystem, a high-quality R&D and developer community, and a strong network activity guarantee mechanism. Ethereum is a truly unstoppable "global computer".

Secondly, as a productive asset that relies on technology adoption, the monetary value of ETH can be consolidated and strengthened. Although ETH is easier to cross the technological iteration cycle as a currency, the safest path is to first build Ethereum as a technology platform to ensure its economic model is sustainable, and then monetary attributes will naturally emerge. On the contrary, "hype ETH as currency" alone cannot establish a solid foundation.

In short, the price of ETH consists of three parts: the discounted value of future fees, the currency premium (as a store of value, a medium of transaction and even an account unit) and the speculative premium (including cultural and meme values). Although the latter two have a great impact, the key to strengthening these three is to maximize the basic network income , which is the foundation of ETH value.

Ethereum’s long-term Rollup strategy: Why is it correct? The truth about

the battle with Solana

The reason why Ethereum firmly chose the "Rollup-centered" expansion route is very clear: it is the only architectural design that can balance security, scalability and neutrality.

From the perspective of technology supply, Ethereum is currently the safest and most decentralized smart contract platform. Through the validating bridge and the data availability layer (DA), Ethereum can "wholesale" the main chain security to Rollup to help them build their own chains without having to rebuild a trust system.

From the perspective of market demand, users ultimately do not care which chain they are using - they only care about "what chain to trade on is cheapest and safest." In the long run, the most rational choice is to be a Rollup, buy security, buy DA, buy consensus, and directly connect with Ethereum. This will naturally form a market convergence phenomenon: Rollup will build its own services around Ethereum, a "neutral ledger", like a company, rather than spreading it to other island chains.

Ethereum vs Solana

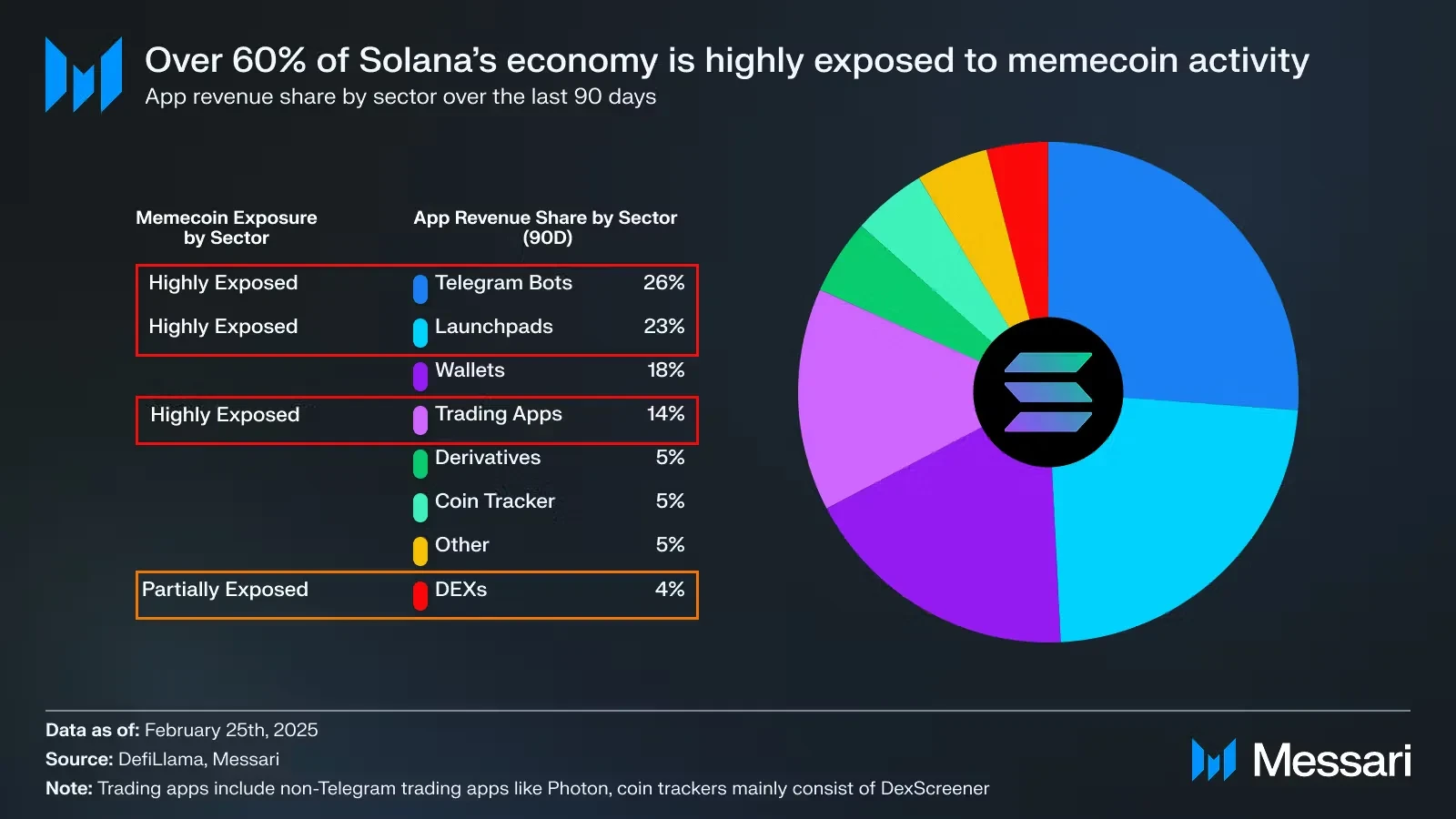

Based on 2024 fee revenue, some believe that Solana has begun to surpass Ethereum in the block space market. However, Solana's strategy with hardware expansion as its core is relatively risky and the network is overloaded periodically. If blockchain wants to realize its full potential, that is, to migrate financial infrastructure to the chain on a large scale, Solana will eventually turn to sharded expansion, and Ethereum is far ahead in security, Rollup infrastructure and ecological adoption.

More importantly, most of Solana's on-chain activity comes from the Memecoin craze. Data shows that such transactions once accounted for more than 50% of their DEX trading volume. But Memecoin is a short-term, zero-sum game-type phenomenon - after the popularity has passed, its "high income" myth is also unsustainable.

In contrast, Ethereum focuses on high-stickiness scenarios such as DeFi. These protocols are not driven by fanatical speculation, but are on-chain migration of real financial behavior.

The most significant and important difference: Solana's validation node concentration, while Ethereum has the most diverse network of stakeholders in the world. This kind of decentralization itself is the strongest moat.

Problems with Rollup Strategy

If the Rollup route is correct, Ethereum’s long-term future is bright, why is ETH price poorly performed?

At the technical level, Rollup's biggest flaw is the lack of default interoperability, which leads to state fragmentation and seriously affects the user and developer experience.

At the business level, the key issue is that Ethereum has not yet clearly communicated Rollup's business strategy:

-

Short-term adoption strategy: How to drive Rollup’s rapid growth?

-

Long-term Moat: Why is Rollup not turning to other data availability platforms?

Rollup's business strategy: expansion, differentiation and moat

1. Ethereum should prioritize expansion and continue to provide

sufficient and low-priced data availability (DA)

The technology network market in which Ethereum is located is fiercely competitive and changes rapidly, and the winner will eventually enjoy a strong network effect. In this environment, the right strategy is to provide quality products and quickly expand the user base at extremely low or even almost free prices, which is also the growth path for most successful technology networks.

Therefore, Ethereum must keep data availability (DA) cheap, minimizing the barrier to access Rollup. After the upgrade of Cancun, Ethereum provided the capacity of 3 blobs, and the supply exceeded demand in the short term, effectively suppressing the price. Although this strategy was not intentional, it achieved good results.

2. Solve Rollup interoperability and improve user and developer

experience

Interoperability is the biggest lack of Ethereum in the Rollup era. Fragmentation seriously affects users and developers, solving the unified experience of interoperability performance, narrowing the gap with the integration chain, and is the key to building a liquidity moat.

The community is actively promoting solutions such as ERC-7683 second-level medium-scale asset cross-chain exchange, 2-of-3 OP+ZK+TEE hour-level large-value asset cross-chain bridge.

3. Differentiated strategies and moat construction

Ethereum needs to achieve differentiation in DA services, attract marginal Rollup customers, and at the same time build a moat to lock in ecological customers.

The key moat comes from three major network effects: trust, liquidity and composition. At present, the combinational needs across Rollup are not clear, and the main values are focused on trust and liquidity. After solving interoperability, the two will naturally expand from Ethereum L1 to the Rollup ecosystem.

In terms of trust , Rollup enjoys the highest security guarantee through Ethereum DA, and the security of independent chains is weak. Rollup, which adopts Ethereum DA, continues to increase its security and the moat continues to consolidate.

In terms of liquidity , the institutional-level liquidity of Ethereum L1 is an important factor in Rollup's choice. After Rollup is connected to Ethereum DA, it can obtain the liquidity of the entire ecosystem, and the capital efficiency is greatly improved, forming a solid moat.

Therefore, the market will drive Rollup to use Ethereum DA for maximum security and liquidity. Ethereum should strengthen these two advantages and attract institutional customers through brand and trust.

The path of value reflux: from "maximizing charges" to "maximizing value

bearing"

When Ethereum expands data availability (DA) to the million-TPS level (such as through 2D PeerDAS, etc.), and the Rollup ecosystem is voluntarily and firmly bound to Ethereum DA, Ethereum will receive significant fee income.

At the main chain level, the widespread adoption and enterprise applications of DeFi will be the main driving force, and the popularity of Rollup will further amplify this effect. At the same time, Rollup will also pay for interoperability and settlement services, further contributing revenue.

At the DA level, the key to achieving a sustainable economy is to increase the minimum blob price. The specific approach is to monitor Rollup's overall revenue and set a reasonable minimum price so that Rollup passes a certain percentage of value to Ethereum.

For example, in the next few years, suppose Rollup occupies the CeDeFi payment market, processes about 10,000 TPS, and earns billions of dollars a year, while Ethereum DA supplies more than 10,000 TPS. At this point, although the blob transaction fee will not fully enter the market price discovery, setting a minimum fee of 0.3 cents per DA transaction can bring about $1 billion in annual revenue to ETH holders.

Further cover high-frequency trading markets, such as social, trading, and AI agent coordination, Rollup's TPS can reach 30,000, bringing DA fee income to more than US$10 billion, and the transaction cost will still be less than one cent.

Such income is affected by ETH prices and other factors, and the minimum price needs to be adjusted dynamically, which is expected to be determined by community consensus, similar to today 's gas restriction mechanism. In the future, we need to conduct in-depth research on the optimal pricing strategies of blobs, such as improving the relationship with the Ethereum L1 fee market. In addition, as Ethereum transitions to zkEVM or RISC-V, new technologies such as SNARK infrastructure will help improve fee capture efficiency.

The key is that the current stage should not be rushing to directly extract value from transactions, but should maximize the support and promotion of high-value activities in Ethereum blocks and blob spaces. This will not only generate and enhance network effects, but will also help Ethereum seize the ever-expanding block space market and consolidate its economic foundation. The path to value reflux is therefore very clear.

jinse

jinse