Golden Web3.0 Daily | Ripple never seeks to acquire Circle

Reprinted from jinse

06/04/2025·11DDeFi data

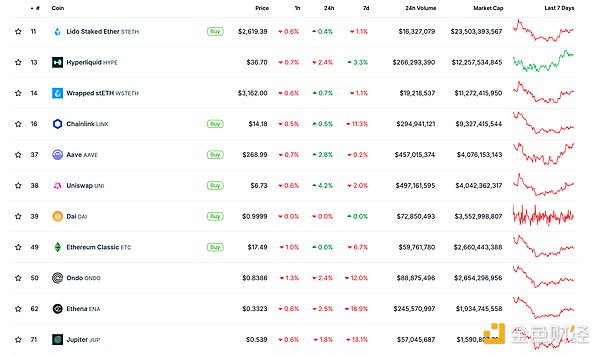

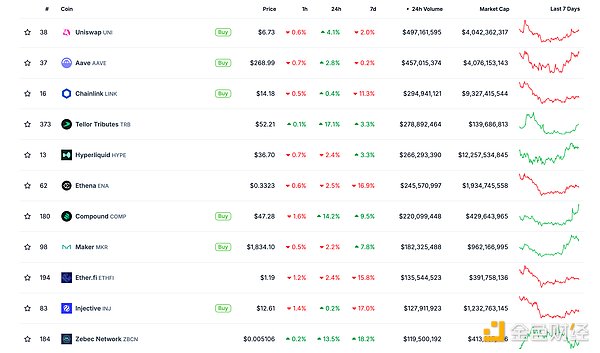

1. Total market value of DeFi tokens: US$117.242 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$6.134 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

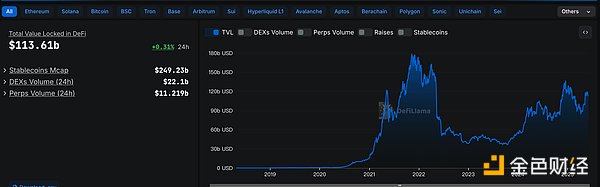

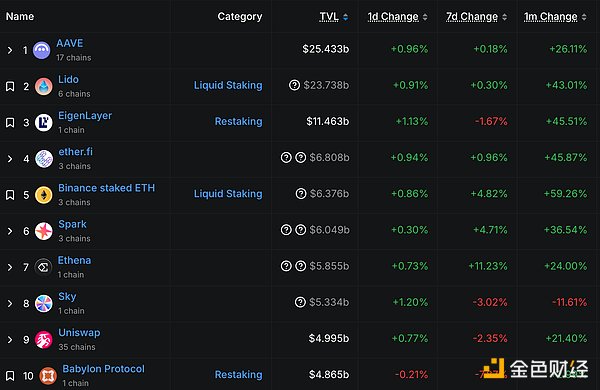

3. Locked assets in DeFi: US$113.61 billion

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

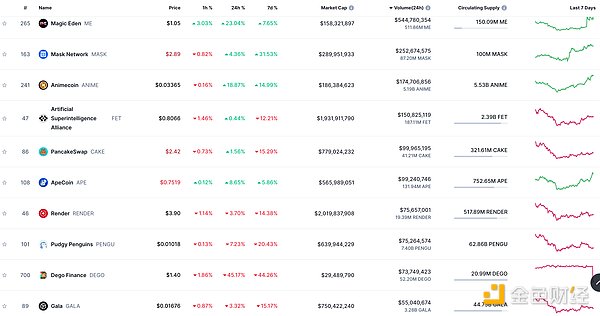

1.NFT total market value: US$19.756 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

2.24-hour NFT trading volume: US$ 2.651 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

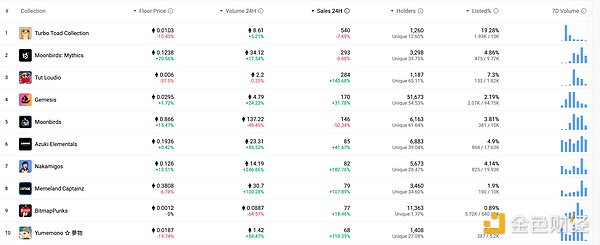

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

Ripple CEO: Ripple never seeks to acquire Circle

According to a conversation between Georgetown law professor Chris Brummer and Ripple CEO Brad Garlinghouse, who has never sought a deal to acquire Circle, which has refuted recent media reports after reports that Ripple had proposed $4 billion to $5 billion in acquisition of Circle. Bloomberg said Ripple had made an offer to Circle but was rejected because of its low price. Coinbase, which has a long-term partnership with the stablecoin issuer, has also proposed an anti-acquisition offer. Chris Brummer said Ripple's recent massive acquisition after a year-long lawsuit with the U.S. Securities and Exchange Commission ended, and if the company was to make more acquisitions, its target would be companies connected to the real world, such as "fiat currency entrance ramps and payment processors." Circle plans to go public as early as this week, with its valuation recently raised to $7.2 billion under the stock code CRCL. The company will sell 32 million Class A common shares at a price of between $27 and $28 per share.

MEME hot spots

1. Trump family project WLFI airdropped 47 USD1 to WLFI subscribers half an hour ago

According to the monitoring of the on-link analyst @ai_9684xtpa, half an hour ago, the Trump family project WLFI airdropped 47 USD1s to WLFI subscribers and directly airdropped to the Ethereum address.

DeFi hotspots

1. Vitalik: L2 cross-chain must have the same censorship resistance, trust and non-intermediation as Ethereum L1

According to Golden Finance, Ethereum founder Vitalik Buterin posted a post on social platform X, proposing the "no return principle", emphasizing that cross-L2 operations must have the same censorship resistance, trust and no intermediary as Ethereum L1 in order to truly solve the cross-chain interoperability problem.

2. Solidity debugger sol-dbg is funded by the Ethereum Foundation

On June 4, the Ethereum Foundation Ecosystem Support Program stated on a social platform that the sol-dbg project was funded and developed by Dimitar Bounov. sol-dbg is a Solidity debugger developed in the form of TypeScript library, using an experimental interpreter method to support any optimized EVM bytecode generated since Solidity compiler version 0.4.13.

3. Alliance DAO Founder: Transparent Order Books May Be More Attractive to Market Makers than Dark Pools

June 4th news, Alliance DAO founder and core contributor Qiao Wang said that the most important information for a market maker is to know who to trade with. If the counterparty is degenping, the market maker will withdraw liquidity. If the counterparty is James Wynn, they actively provide liquidity. That's why transparent order books may be more attractive to market makers than dark pools. At the same time, it said that under other conditions, giant whales with actual alpha information will be more inclined to trade on exchanges/dark pools. But it has no effect on Hyperliquid, because most contract giant whales do not have alpha information. They become whales through reckless risk-taking behaviors, just the product of survivor bias. Previous news, CZ posted that now may be a good time to launch a perpetual contract DEX in the dark pool style on-chain. He pointed out that in existing DEXs, the problems that all orders are visible in real time are particularly serious on perpetual contract platforms, especially when liquidation points are exposed, and are vulnerable to market manipulation and MEV attacks.

4.Farcaster has supported Monad network

On June 4th, Farcaster tweeted that it has supported the Monad network.

5. Market News: Magic Eden and TRUMP Meme officially cooperate to develop TRUMP wallet

According to market news, the official website of TRUMP Wallet shows that Magic Eden and TRUMP Meme officially cooperated to jointly develop TRUMP crypto wallet.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

chaincatcher

chaincatcher