Aptos inflation governance dilemma: AIP-119 proposal causes controversy, ecological prosperity may be a solution

Reprinted from panewslab

04/27/2025·17DAuthor: Frank, PANews

Inflation governance has always been the core proposition of the public chain economic model and ecological development. Recently, the Aptos community has been in heated debate over a proposal to reduce pledge income. Supporters regard it as a necessary measure to curb inflation and activate ecological liquidity, while opponents warn it may weaken the foundation of network decentralization and even trigger capital outflows.

When the game between throttling and open source collides with the redistribution of verifier interests, Aptos' reform not only concerns the future of the APT token economy, but also reflects the deep contradictions in the governance of PoS public chains. PANews analyzes proposal controversies and compares mainstream public chain models to explore how Aptos finds a way to break through between high inflation and low activity.

Inflation "surgery" triggers a debate on whether it is a treatment or

injury

AIP-119 was proposed by community member moonshiesty on April 17, 2025 on GitHub of the Aptos Foundation. The specific proposal for the proposal is to reduce Aptos' underlying staking reward rate by 1% each month over the next three months, with the ultimate goal of reducing the annualized rate of return (APR) from about 7% (or 6.8%) at the time to 3.79%. From the content point of view, this proposal itself is not complicated. It only relieves APT inflation by reducing pledge rewards, which is beneficial to the long-term health of the ecosystem, but will touch the core interests of large pledge nodes accustomed to passive returns, which has caused a lot of controversy in the community.

The mainstream support view believes that in addition to reducing APT inflation more quickly, this proposal can also incentivize coin holders to transfer funds to other DeFi activities on the chain rather than relying solely on passive staking.

However, from the perspective of community discussion, the controversy in this proposal is not limited to the opposition of large players, but many members also raised negative concerns that may arouse by this proposal from the perspective of small validators and the entire community.

If there are opponents spending, and a significant reduction in pledge rewards will have a greater impact on small validators. Many validators' profit margins are thus compressed, possibly failing to cover the cost of operating validators (about $30,000 per year), resulting in them being forced to exit the network. This indirectly weakens the degree of decentralization of the Aptos network, and ultimately concentrates and tilts power and resources towards large validators.

Eric Amnis, co-founder of Amnis Finance, did a specific calculation in the forum. Currently, the server cost for validators holding 1 million APTs is about US$72,000 to US$96,000 per year (but this data is quite different from the US$35,000 proposed by the proposer), but if the yield rate is reduced to 3.9%, the final return may be only US$13,000, so there will be a phenomenon of underpaying money. Only when the holding volume reaches more than 10 million APTs can you barely make a profit, which will directly eliminate small validators.

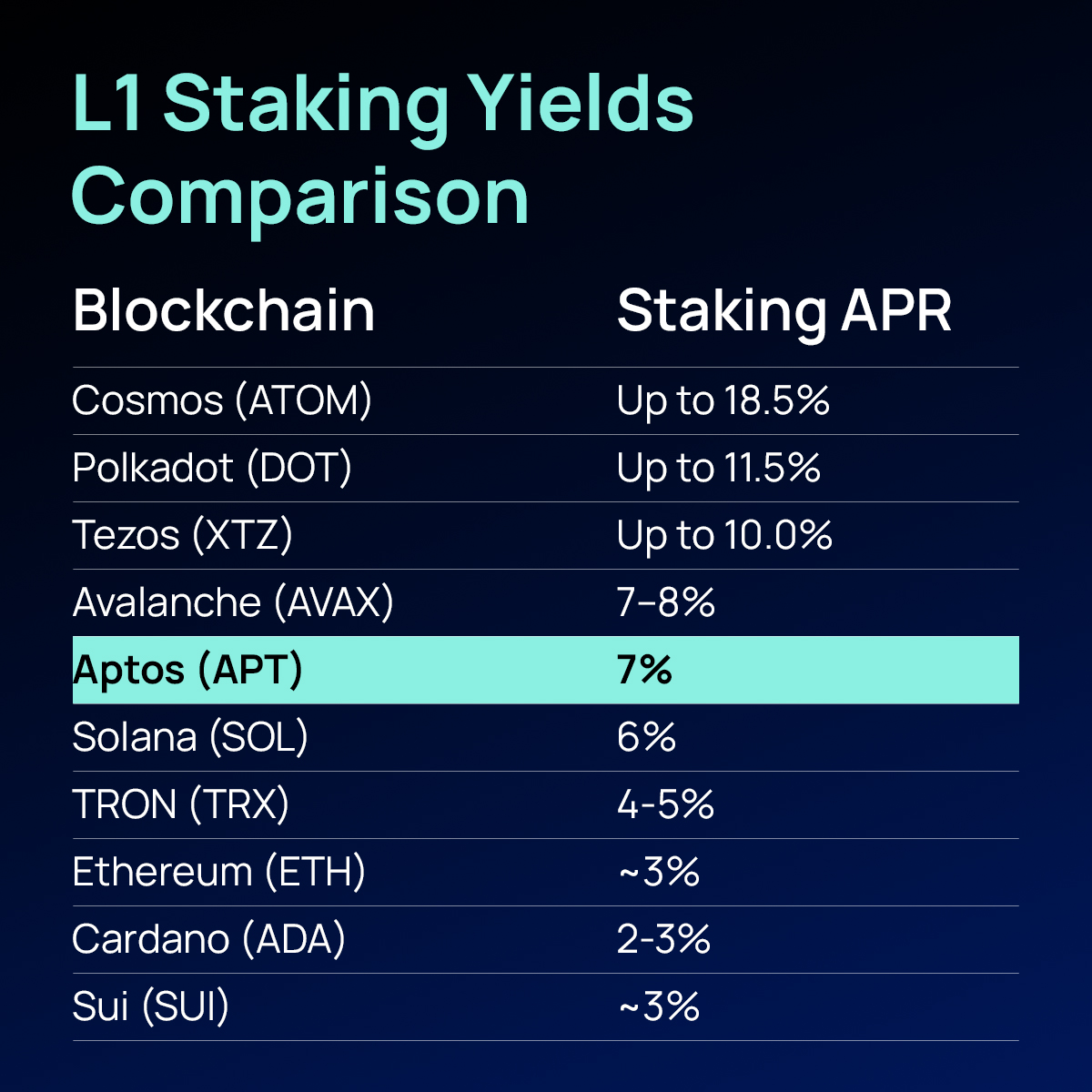

In addition, some comments believe that the reduced pledge yield (3.79%) lacks competitiveness compared with other chains that provide higher returns (such as Cosmos about 15%), which may lead to large players and institutions seeking high returns to transfer funds to other networks, reducing Aptos' TVL and liquidity, and causing the risk of capital outflow. In addition, lower staking yields will also reduce the attractiveness of the AptosDeFi protocol to liquidity providers, affecting the growth of the protocol and user engagement.

PoS governance common problems: the balance between rewards and inflation

In fact, this proposal is exactly the same as the SIMD-0228 proposal that was ultimately rejected on Solana. It is both trying to curb network inflation by reducing the rate of return of validators. What reflects the interest game problem in public chain governance. This kind of governance problem is more prominent when it comes to POS consensus mechanism.

Therefore, the best way to compare whether the Aptos proposal is reasonable is to compare how several public chains with similar mechanisms balance this problem, and what is the effect it produces?

Currently, Aptos' token inflation model issuance of 7% per year. According to the AIP-30 proposal, the highest reward rate plan is reduced by 1.5% per year (relative to the previous year's value) until it reaches the annualized lower limit of 3.25% more than 50 years later. As of April data, the staking rate of APT reached 76%, maintaining a high proportion among public chains. In terms of cost destruction, all Aptos' current transaction fees will be destroyed, but since Aptos' on-chain fees are only thousands of dollars a day, this kind of destruction is a drop in the bucket for resisting inflation.

Judging from the token's trend for more than a year, Solana is a relatively successful public chain in the POS mechanism. Unlike Aptos' current fixed issuance ratio, Solana's inflation model is a decreasing year by year, with an initial value of 8%, then a decrease of 15% per year, and currently about 4.58%. Therefore, this dynamic inflation model seems to be exactly what Aptos expected after the reform of the proposal. However, for Solana, this inflation is still considered too high by the community, so the 0228 proposal emerged. In terms of pledge ratio, Solana's current pledge ratio is about 65%, lower than Aptos' 76%.

In terms of cost destruction, 50% of Solana's transaction fees were previously destroyed, but after the 0096 proposal was approved, the 50% destruction was cancelled and rewarded to the verifier, which also caused Solana's inflation to be even more serious. However, because the Solana network is very active, it does not seem to be affected by much inflation.

In addition, another MOVE-based public chain Sui is often compared with Aptos. In terms of pledge yield, Sui's yield is relatively low, only between 2.3% and 2.5. Moreover, SUI tokens have a hard top limit of 10 billion SUI, which fundamentally controls the possibility of unlimited issuance. In terms of staking rate, SUI's staking rate is about 76.73%, which is close to APT. However, in terms of cost destruction, Sui Network's choice is to use it as a reward, and there is no destruction mechanism. Relatively speaking, Sui's hardtop model seems to have reduced the community's inflation anxiety a lot, so it is also eye-catching in price performance.

In addition, Cosmos' pledge income is relatively typical, up to 14.26%. Judging from the number of tokens circulation, it also shows a continuous climbing effect. Cosmos' current pledge rate is about 59%, and this inflation will continue before it reaches 67%. However, although the pledge returns are very high, the price trend of ATOM tokens continues to decline. From a high of $44, it fell 91%.

Aptos’ choice – throttling or increasing source?

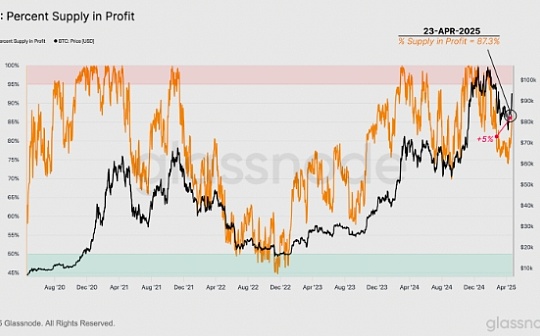

Overall, among the current major POS public chains, no one can perfectly solve the balance between inflation rate and network participation. In the process of solving these games, on the one hand, we must control the inflation rate to maintain the healthy development of the token economic model, and on the other hand, we must attract validators to participate in network governance through more reasonable pledge returns. Ethereum once achieved deflation through POS transformation and basic expense destruction. But ETH also seems to have failed to usher in a rise in token prices by solving the inflation problem. On the contrary, Solana has recently passed proposals on increasing inflation, and the proposals for reducing deflation have been rejected by the community. But this doesn't seem to have much impact on Solana's token price. Ultimately, it is because Solana's network activity has always been among the forefront of major public chains.

Solving inflation is like throttling, and increasing network activity is like opening up. For active networks, the balance between increasing revenue and reducing expenditure is naturally important, but for the not-so-hustle-time network. How to increase activity is the real way to improve online tokens. Judging from the problems Aptos has encountered, Aptos' TVL is only US$1.1 billion, ranking 11th among the public chains. The overall data is not impressive, and the current number of validators on the entire network is 149 and the full nodes is 495, which is not too high. Once many validators withdraw due to lowering the rate of return, there is indeed a possibility of injury.

Therefore, for Aptos, while considering “throwing” through AIP-119, it may be more important to consider its potential impact on validator ecosystems and network decentralization. Compared to radically reducing rewards, the more urgent choice at the current stage may be how to "open source" - that is, to improve the activity of the network and attract more high-quality projects to settle in, thereby building a truly prosperous and sustainable ecosystem. This may be the key to supporting APT's long-term value.

chaincatcher

chaincatcher

jinse

jinse