5 charts predict BTC will rise to $100,000 in May

Reprinted from jinse

04/27/2025·17DAuthor: Yashu Gola, CoinTelegraph; Translated by: Wuzhu, Golden Finance

summary

-

BTC clearing levels, on-chain data and chart settings are all converged at the $100,000 target.

-

The sharp increase in profitability indicates that market confidence has rebounded.

BTC is flashing multiple technologies and on-chain signals that it may rebound to $100,000 by May. The following five charts indicate a breakthrough in the near future.

BTC double bottom suggests target price of $100,600

BTC's daily chart forms a typical double bottom, confirming a breakout of the neckline resistance at $87,643. It is expected to reach USD 100,575 or above.

BTC/USD Daily Price Chart. Source: TradingView

Momentum indicators such as the Relative Strength Index (RSI) support this argument, maintaining the bullish zone and having greater room for expansion. Meanwhile, the 50-day and 200-day exponential moving averages (EMA) have been turned to support, providing additional tailwinds.

Trading volume remained stable after the breakout, indicating that buyers were still under control. This lays a solid foundation for Bitcoin to move towards $100,600.

Bull market targets six-digit BTC

Judging from the hourly chart, BTC consolidated within the bull pennant after a sharp rise. This pattern indicates a temporary hesitation before the next round of gains. The target price is around $100,900.

BTC/USD hourly price chart. Source: TradingView

The pennant shape formed after a sharp rise, indicating that the BTC price may fall first and then resume the upward trend. Despite the low volume, the structure is still intact and supported by a strong EMA permutation.

Breakthroughs through the trend line on the pennant could trigger a new upward momentum, attracting short-term traders and algorithms targeting integer breakthroughs.

Bitcoin’s downward wedge breakout target is $102,000

The three-day chart shows that the decline wedge breakout has been completed, with the price breaking through the key resistance zone near $94,000. The projected target is $102,270.

BTC/USD Three-day Price Chart. Source: TradingView

The downward wedge is usually a bullish reversal pattern, while a clear breakthrough in BTC to the upward trend line increases technical confidence. The price is also above the 50-3D EMA, which is a key trend signal.

Volume surged during the breakout period, indicating strong buyer confidence.

The $94,000-95,000 resistance level currently limits Bitcoin’s upside attempts. Breakthroughs this level means BTC can quickly achieve its full- scale pace towards $100,000.

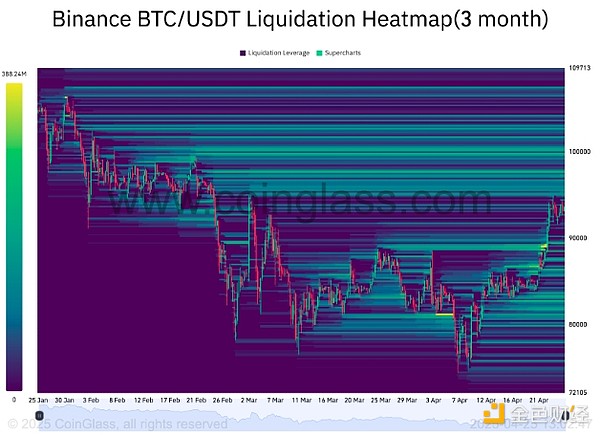

Large amount of short liquidation around $100,000

Clearing data show that there are a large number of short liquidations at the level of around $100,000. These positions are usually like magnets, pulling prices towards them as market makers seek liquidity.

BTC/USDT three-month liquidation heat map. Source: CoinGlass

If BTC continues to climb, it will put pressure on the bears and they may be forced to withdraw, triggering a large amount of payouts.

Liquidity charts are usually pre-priced. With the activity density approaching six digits, the path with the least resistance appears to be upward in the short term.

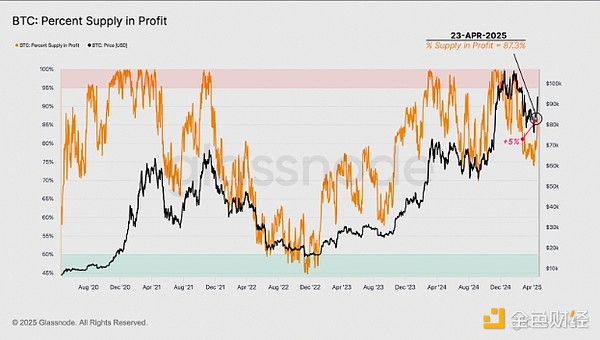

Bitcoin's profitability improves after breakthrough

According to Glassnode, 87.3% of Bitcoin circulating supply was profitable as of April 23, up from 82.7% of the last time BTC traded at $94,000 in early March.

This growth suggests that a large portion of Bitcoin supply changed hands at lower levels during the adjustment period in March, reflecting a new wave of accumulation.

BTC supply volume profit percentage. Source: Glassnode

Historically, when the percentage of profit supply remains above 90% for a long time, the market often enters an euphoric stage. As profitability is now approaching this threshold, bullish sentiment continues to increase.

Combining the bullish chart structure and concentrated short-term liquidity, BTC is still likely to reach $100,000 in May.

panewslab

panewslab

chaincatcher

chaincatcher