AO airdrop weakness and ecological stagnation: Has Arweave's newly launched "decentralized computing" narrative failed?

Reprinted from panewslab

02/12/2025·2MAuthor: Frank, PANews

On February 11, the old decentralized storage protocol Arweave launched the decentralized computing platform AO and released an official announcement, stating that the first main network token minting has been completed and new token minting will be carried out at 18:20 Eastern Time every day. Unlike Story and Solayer, which were airdropped during the same period, AO's release seems to have failed to cause much turmoil on social media. From a vision perspective, AO is closely related to the hottest AI topics at present, and Arweave, as a mature decentralized storage infrastructure, can provide many assistance on the underlying network.

For the former stars who should have triggered discussion, is the "lost voice" between Arweave and AO caused by the decline of the ecosystem or another gem that has been ignored by the market.

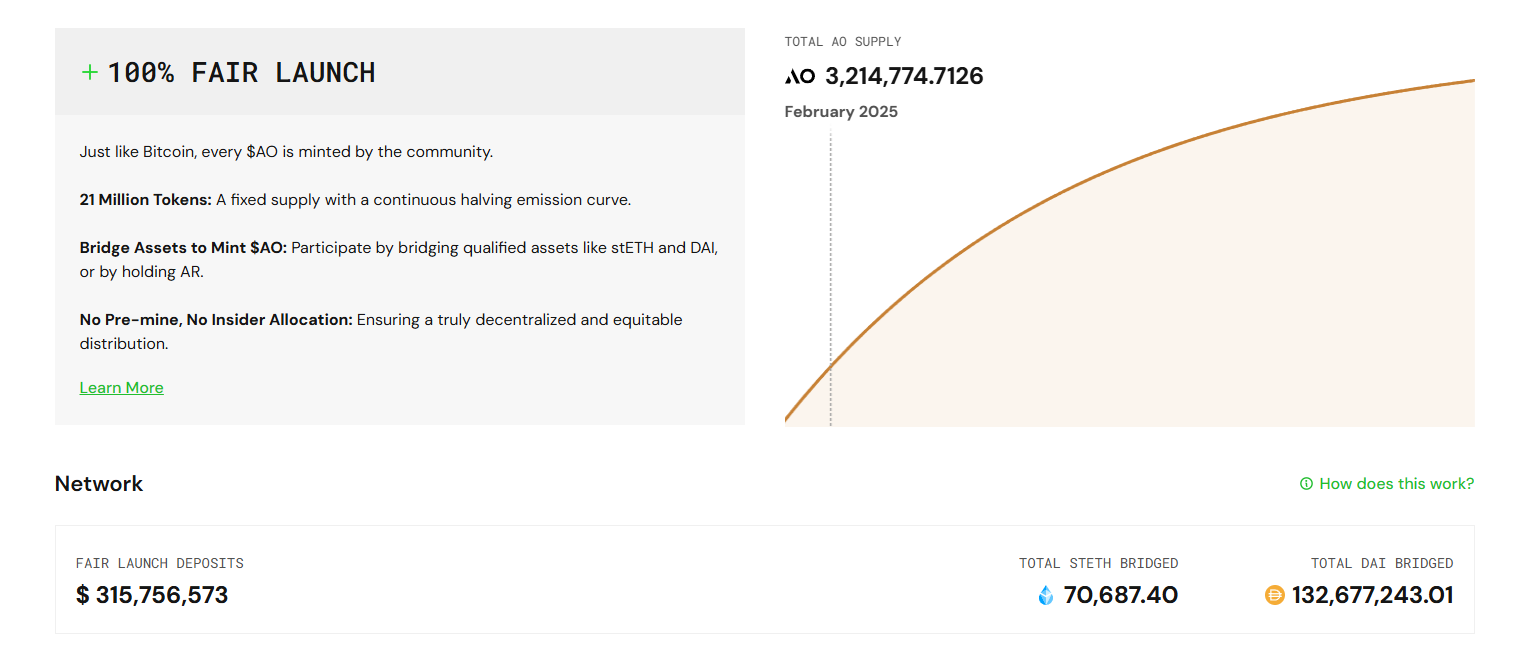

Low airdrop expectations lead to a downturn in market enthusiasm

The first reason why AO is ignored may be that this token issuance did not bring too many expectations to the market. According to official reports, the total issuance of AO tokens is 21 million, and a halving mechanism similar to Bitcoin is adopted. Among the early reward distribution, 36% were allocated to AR holders, and 64% were incentivized to cross-chain asset bridging (such as DAI, stETH). Data on February 12 showed that 3.214 million AO tokens have been minted.

As of February 11, 2025, the issuance of AR was 65.65 million. Based on this ratio, the current issuance ratio of AR to AO is 20.78:1. LBank and MEXC, which have been listed on pre-market trading, have a huge gap in pre-market prices of the two exchanges. The pre-market price of LBANK is about $92, while the price of MEXC is only about $35, a difference of more than 1 times. However, in terms of trading volume, LBANK's 24-hour pre-market trading volume was US$1.97 million, higher than MEXC's trading volume. Therefore, the price of LBANK may be more in line with market expectations. Based on the current high pre-market price of $92, AO's circulating market value is approximately $290 million.

According to previous official information, on average, each AR token holder may receive 0.016 AO tokens. Based on the pre-market price of US$92, AR holders can get about the value of each in these few months. $14.72 AO. This share has exceeded the value when a single AR. However, if we consider the decline of AR in the past six months, it has fallen from its highest point in May 2024 at US$49.55 to US$9.52 on February 11, a drop of more than 80%. Users holding coins during this period need to expect the AO opening price to rise to around $500 to make up for the decline losses.

As of February 11, the total number of coin addresses held by AR was 211,000. Based on this calculation, each address can get about 4.44 AO, worth 409 US dollars (but this data is just a calculation, and the specific value must comply with the airdrop rules). According to the current official data, the top 100 addresses of AO's coin holding addresses hold a total of 2.21 million tokens, accounting for about 70%, and the chips of large investors are relatively concentrated. From the overall airdrop scale, if the pre-market price of $92 is maintained, the scale can reach $290 million. If the price is only about $35, the airdrop size will be as small as $110 million. Considering the rapid decline of AR tokens, it is indeed difficult to arouse market enthusiasm.

Network activity has indeed improved, and it remains low overall

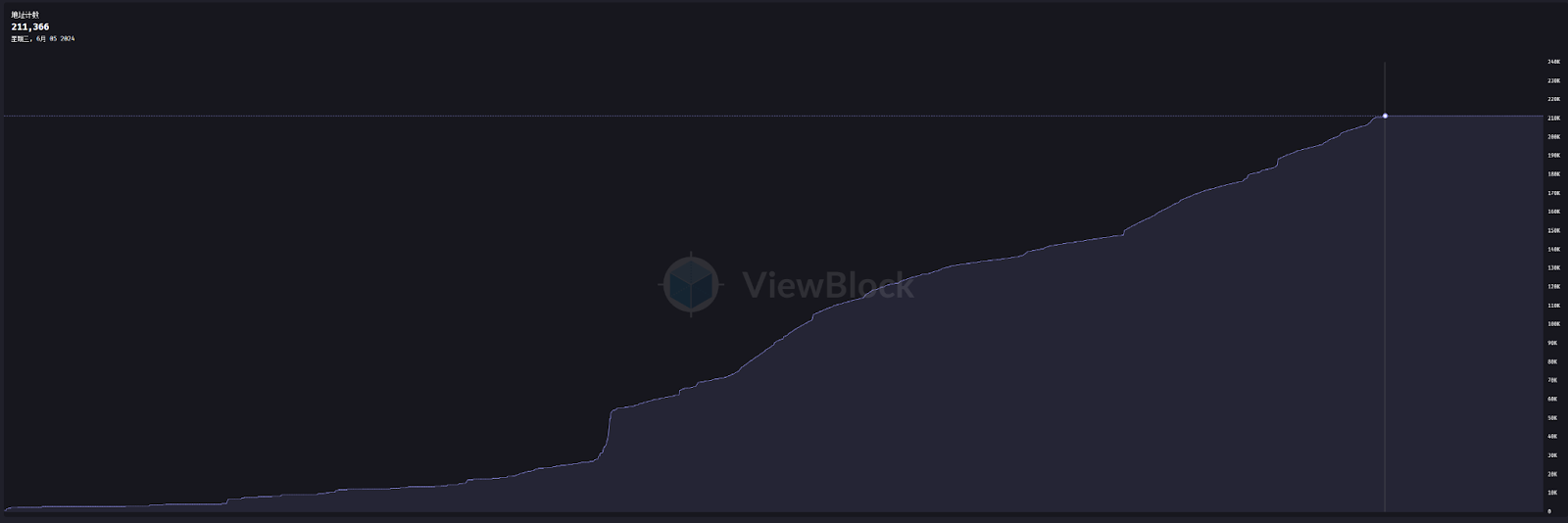

In fact, the overall activity of the Arweave network has never been high. Taking February 11 as an example, Arweave's daily active addresses on that day were 3,366, but this data level is actually a stage with a high degree of activity compared with historical data. Before 2023, its online daily active users will basically remain around 1,000, and the daily active users will be increased to 2,000 level in 2024. After entering 2025, perhaps because of AO's airdrop expectations, the daily active data generally reached more than 3,000, and the highest reached more than 5,000 per day.

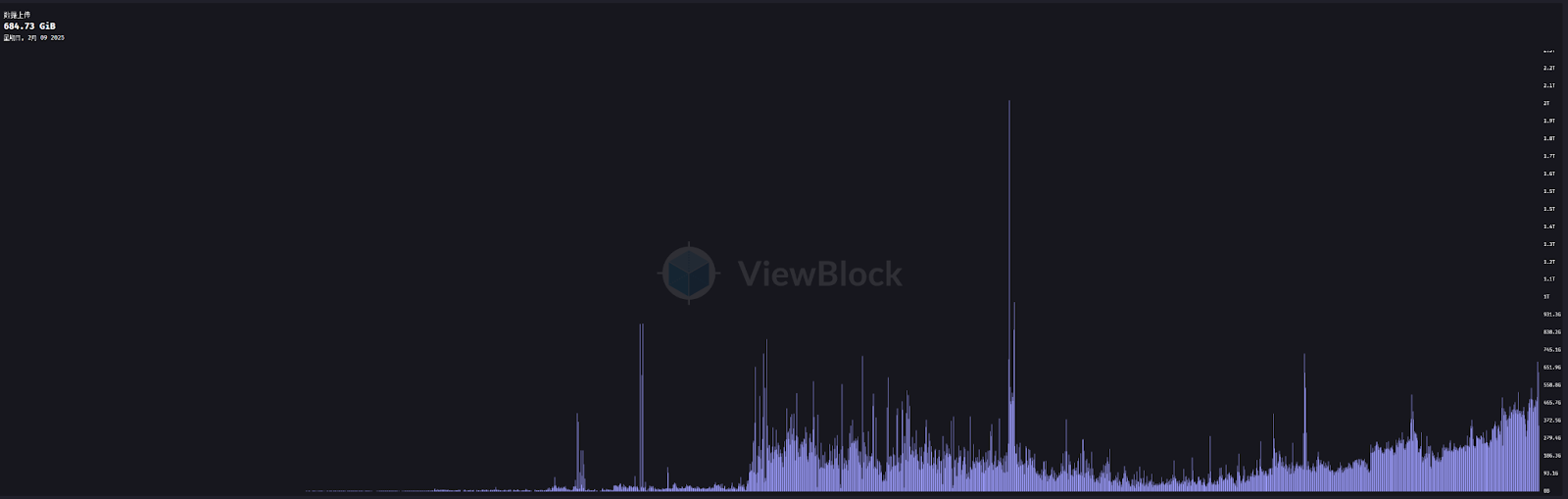

In addition, as a decentralized storage network, the amount of data uploads may be one of the most important indicators to measure activity. On-chain data shows that since the end of 2023, Arweave's daily data upload volume has continued to grow. The average amount of data of more than 100 GB per day has increased to more than 400. Although the highest point is still less than the single-day 2.02TB peak created in 2022, the overall upload volume does show a stable climbing trend.

In terms of network activity, ArDrive is the most active application in the Arweave network. About 90% of the daily data uploads are uploaded by ArDrive. ArDrive is a permanent storage application in the Arweave network that allows users to permanently save their files and is completely uncensored. In 2022, ArDrive completed a seed round of $17.2 million. In addition to ArDrive, another ecological project, Irys, contributed about 10% of the upload volume.

In addition, there is a strange data phenomenon in the Arweave ecosystem. Since June 1, 2024, the total number of Arweave addresses has not increased, and has been frozen on the number 211366. I don’t know if the user growth of the ecosystem has completely stagnated or if there is a problem with the data maintenance of the browser. However, just like AO's lukewarm, these details and bugs are not discussed.

The AO ecosystem is still in its very early stage

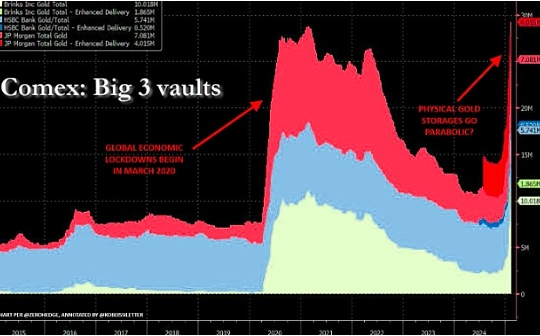

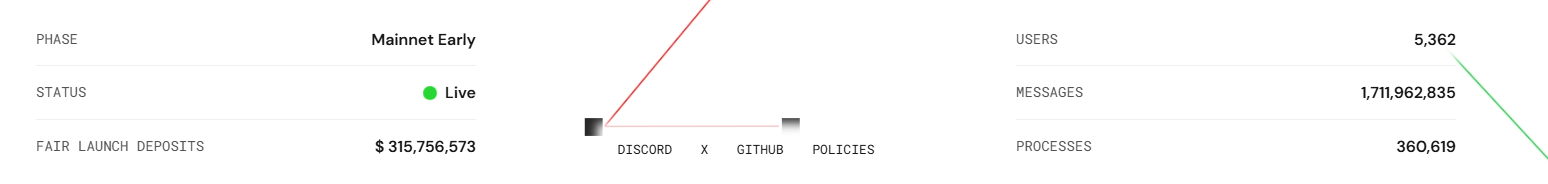

According to official data, AO Network's current TVL is about US$315 million. Compared with the $700 million in the test network stage, there has been a lot of decline. From this point of view, it seems that users are not very enthusiastic about the subsequent staking tokens for AO network.

From the perspective of ecological projects, several related ecological projects are still developing in the early stages, such as AOX, the most important cross-chain bridge in the AO network. On February 11, it announced that its transaction volume exceeded US$8 million and TVL exceeded US$3 million. . Another ecological project, FusionFi, announced that its settlement amount exceeded US$10 million.

Judging from the social media interaction, the following projects in the AO ecosystem are already running.

Marketverse AI: AI Agent Project

StarGrid Battle Tactics: On-chain Games

Decent.land: EVM virtual machine

AOX: Cross-chain bridge

FusionFi Protocol: AgentFi

Permaswap: DEX

Astro Labs: Liquidity Provider and Stablecoin USDA Issuance

RedStone Oracles: Oracle Project

Overall, AO Network is still a new generation of products. There is currently no exclusive browser, no official ecological map, and the publicity has not yet been clearly announced when AO will start the official transaction. Even after a year of test network stage, judging from the current ecological state, it seems that it is still in a rough state. Therefore, the public may not be able to start with the expectations of AO.

From another perspective, perhaps AO's innovative concept at the technical level is the main reason for the previous market investment expectations. But with the answers submitted by the main website online, it is more like handing over a test paper that has done the first half, and only partially interpreted the token mechanism problem. The core narrative of its claimed AI potential and performance upgrade through permanent storage has not yet delivered actual results. For AO, the key to success or failure lies in whether it can transform technological narrative into practical applications, rather than relying solely on token incentives.

chaincatcher

chaincatcher

jinse

jinse