Analysts: Altcoins are about to usher in the "strongest rebound" since 2017

Reprinted from jinse

05/19/2025·21DAuthor: Biraajmaan Tamuly, CoinTelegraph; Translated by: Tao Zhu, Golden Finance

summary

- The total altcoin market value (excluding ETH) rose by $126 billion in the second quarter, sparking speculation about the peak altcoin season.

The market value of altcoins, including Ethereum, increased by $126 billion in the second quarter, sparking enthusiasm among analysts who have been looking forward to the peak altcoin season. Cryptocurrency analyst Javon Marks noted that the breakthrough may be comparable to the explosive bull market in 2017.

Marks highlights a chart in X's latest article that compares the TOTAL3 index (excluding the total altcoins market capitalization of Bitcoin and Ethereum) with the U.S. money supply, indicating that altcoins may be about to experience a significant uptrend.

The rise in the TOTAL3 index relative to the U.S. money supply indicates that the total liquidity of altcoins relative to the U.S. economy is increasing, reflecting an increase in investor interest and an increase in capital inflows into altcoins.

Marks stressed that the altcoin has recently rebounded from a critical retest level after its breakthrough, saying: "The altcoin has rebounded from a breakthrough retest to the U.S. money supply and may hit one of the strongest gains since 2017!"

Similarly, anonymous cryptocurrency trader Moustache shared an analysis about X, highlighting the inverted head and shoulders pattern that appears every week in the TOTAL3 chart. The chart compares 2021 and 2025 and reflects the trend of altcoins in 2021, when top altcoins soared 174% in the final stage, while Bitcoin rose only 20%. The pattern is a bullish reversal indicator that indicates a rebound in the market, and analysts predict that altcoins will "raise."

"Altcoin Season" triggers emotional fluctuations among analysts

While some analysts are optimistic about the rise in altcoins, some are cautious. Technical analyst Crypto Scient explained that the recent rise in altcoin market value has not yet reflected a bullish trend shift in the higher time frame (HTF). The analyst noted that TOTAL2 remained bearish after hitting the $1.25 trillion resistance level and said:

“Since both BTC and TOTAL are close to resistance and there is still some room for TOTAL2, I tend to think we are doing distribution.”

Similarly, cryptocurrency commentator DonaXBT believes that a sharp breakthrough in Bitcoin’s dominant trend line is crucial to the massive fluctuations in altcoins. The figure shows that Bitcoin’s dominance has exceeded 60%, and the weekly upward trend is still intact.

Bitcoin dominance. Source: Cointelegraph/TradingView

According to analysts, a break below 60% level and subsequent retesting the support area between 56% and 58% could be the initial catalyst for the emergence of a full altcoin season.

Spot trading volume of altcoins remains below $10 billion

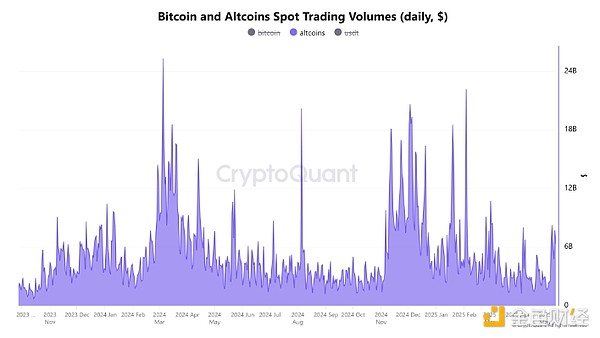

CryptoQuant data shows that spot trading volumes of altcoins remain sluggish, with an average daily trading volume of $3 billion to $5 billion, compared with $8 billion to $12 billion in the fourth quarter of 2024, indicating that altcoins are in the early stages of a rebound. Despite the low volume, market observers see this as a harbinger of altcoins’ significant growth, indicating that the altcoins have not yet reached their peak momentum.

Spot trading volume of Bitcoin and altcoins. Source: CryptoQuant

As Blockchaincenter.net points out, the altcoin season index is currently at 24, further confirming that the market is in the Bitcoin season, which further supports this view. Historically, an index below 25 indicates that Bitcoin is dominant, but this may be a good thing for altcoins. When the index climbs above 30-40, altcoins usually experience a significant increase, mainly due to Bitcoin’s capital rotation.

Investor optimism about the altcoin rebound is growing as trading volumes show early signs of recovery and the altcoin seasonal index predicts a shift in the market.

chaincatcher

chaincatcher