Can Ethereum return to $3,000 in May?

Reprinted from jinse

05/19/2025·21DAuthor: Nancy Lubale, CoinTelegraph; Translated by: Deng Tong, Golden Finance

summary

-

On May 18, Ethereum price rose 3% to $2,550, triggering a $22 million short liquidation of ETH.

-

The bullish flag on the chart predicts a target price of $3,700, with analysts predicting Bitcoin price to rise to $5,000 in May.

On May 18, ETH prices rose, up more than 2.5% in the past 24 hours, trading at $2,536. The rebound has strengthened optimism among traders, who believe ETH prices could hit $3,000 in May, citing strong technical aspects.

Ethereum erases short positions of $7.5 million in one hour

On May 18, Ethereum price rose more than 4.5% from its previous day's low of $2,440 to an intraday high of $2,551, according to Cointelegraph Markets Pro and Bitsamp.

ETH/USD daily chart. Source: Cointelegraph/TradingView

Today, in addition to the plunge in Ethereum, large-scale liquidation has also occurred in the cryptocurrency market. According to CoinGlass, over $158 million of leveraged cryptocurrency positions have been liquidated in the past 24 hours, of which $95 million is long.

The total liquidation of short positions on Ethereum reached US$22.25 million, with US$7.5 million evaporating in the past hour alone.

Total clearing status of the cryptocurrency market. Source: CoinGlass

This means that Ethereum's return to $2,500 caught the bears off guard.

Additional data from CoinGlass shows that seller interest has appeared several bands above the spot price, with sell orders worth more than $384 million, climbing all the way to $3,000. This suggests that the sustained rebound may be limited by this level.

ETH clearing chart. Source: CoinGlass

Market analysts believe that Ethereum’s recent decline is a technical pullback, aiming to retest key support levels before continuing to rise, with a target of $3,000 and above.

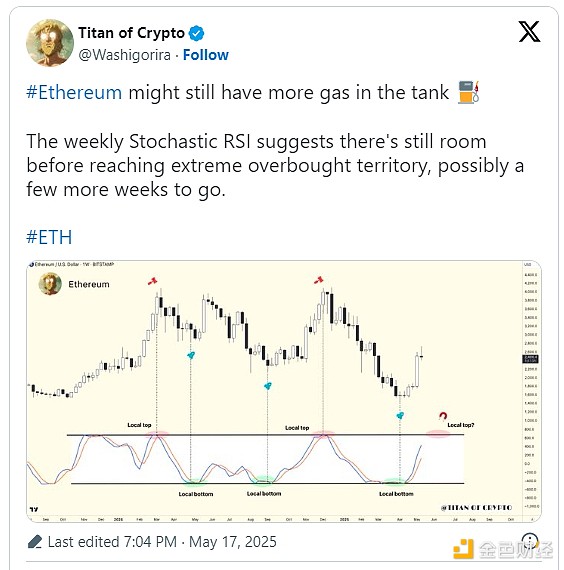

"Crypto Titan" said the weekly random RSI indicator is 79, indicating that ETH "still has upward potential."

According to anonymous analyst Chimp of the North, the downside of Ethereum may be limited to $2,400.

The analyst shared a chart showing that the altcoin could continue to pull back, retesting the $2,400 support level before launching another rebound with a target price of $3,000-3,300.

Another analyst, Crypto Patel, predicted a deeper pullback in Ethereum and said that the price of ETH could fall to $1,800 before starting the upward trend.

"If the price is supported, the region will be a high probability area for bullish reentering," the analyst wrote in a May 17 X post, adding: "If demand continues, the next round of ups could move towards $4,000-5,000."

Driven by the adoption of artificial intelligence, inflows of spot ETFs and the latest improvements brought by Pectra upgrades, ETH could hit an all-time high of around $5,000.

Ethereum price bull market flag still plays a role

From a technical point of view, the ETH price is still above the bull market flag pattern within the four-hour time frame. This is a bullish signal, which is formed after the price rises sharply and is consolidated in the downward range.

On May 13, the bull market flag was confirmed when the price broke through the upward trend line of $2,550. Currently, Ethereum is retesting the upper boundary of the flag, currently at $2,470, which constitutes a direct support level.

If the daily chart closes above that level, the asset may resume upward trend towards a bull-shaped technical target of $3,720, up 50% from the current price.

ETH/USD four-hour chart. Source: Cointelegraph/TradingView

Instead, RSI has dropped from 60 to 42 in the past 24 hours, indicating that the current pullback may continue if profit-taking takes place intensifies.

If the daily chart closes below the support level of $2,470, the probability of a price dropping to $2,400 and then falling to the lower limit of $2,300 will increase.

chaincatcher

chaincatcher