An excellent DEX will not allow retail investors to become the source of liquidity for institutional investors directly

Reprinted from panewslab

02/17/2025·2MIntroduction: The underlying logic of liquidity game

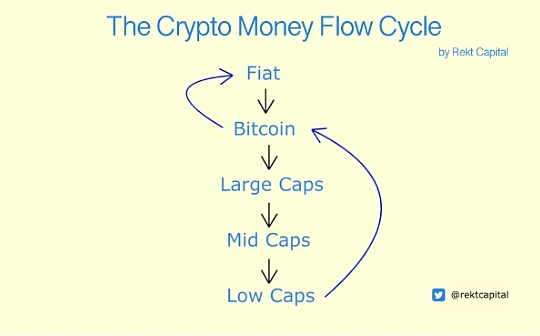

In the financial market, retail investors are often regarded as the "taker" of institutional investors when they exit liquidity - when institutions need to sell in large quantities, retail investors often passively take over assets with falling prices. This asymmetry is further amplified in the cryptocurrency field, and the market maker mechanism and dark pool trading of centralized exchanges (CEXs) exacerbates this information gap. However, with the evolution of decentralized exchanges (DEX), new order book DEX represented by dYdX and Antarctic are reconstructing the distribution of liquidity power through mechanism innovation. This article will use the technical structure, incentive mechanism and governance model as the entry point to analyze how excellent DEX can achieve physical isolation between retail investors and institutional liquidity.

Liquidity stratification: from passive assumption to power reconstruction

The liquidity dilemma of traditional DEX

In the early AMM (automatic market makers) model, there is a significant risk of reverse selection of liquidity provision (LP) behavior of retail investors. Taking Uniswap V3 as an example, although its centralized liquidity design improves capital efficiency, data shows that the average retail LP position is only US$29,000, and is mainly distributed in small pools with daily trading volumes below US$100,000; while professional institutions The large-value trading pool is dominated by an average holding of US$3.7 million, and institutions account for as much as 70-80% of the pool with daily trading volume exceeding US$10 million. Under this structure, when institutions execute large-scale sell-offs, the liquidity pool of retail investors is the first to become a buffer zone for price decline, forming a typical "exit liquidity trap."

The necessity of liquidity stratification

Research by the Bank for International Settlements (BIS) revealed that the DEX market has shown significant specialized stratification: Although retail investors account for 93% of the total liquidity providers, 65-85% of the actual liquidity is provided by a few institutions. This stratification is not accidental, but an inevitable result of market efficiency optimization. Excellent DEXs need to separate the "long-tail liquidity" of retail investors from the "core liquidity" of institutions through mechanism design. For example, the MegaVault mechanism launched by dYdX Unlimited will allocate the USDC deposited by retail investors to the institutional-led sub-organized by algorithms. The capital pool not only ensures the depth of liquidity, but also prevents retail investors from being directly exposed to the impact of large-scale trading.

Technical mechanism: Building a liquidity firewall

Innovation of order book model

DEX using order books can build a multi-level liquidity protection mechanism through technological innovation. The core goal is to physically isolate the liquidity needs of retail investors from the large-scale trading behavior of institutions, and prevent retail investors from becoming passively "sacrifices" of violent market fluctuations. . Liquid firewall design requires the ability to take into account efficiency, transparency and risk isolation. Its core lies in the hybrid architecture that cooperates on-chain and off-chain, while protecting user asset autonomy, it resists the impact of market fluctuations and malicious operations on the liquidity pool.

The hybrid model places high-frequency operations such as order matching off-chain processing, and takes advantage of the low latency and high throughput characteristics of off-chain servers to greatly improve transaction execution speed and avoid slippage problems caused by blocked blockchain networks. At the same time, on-chain settlement ensures the security and transparency of asset self-custody. For example, dYdX v3, Aevo, Antarctic and other DEXs match transactions through the order book on the chain and complete final settlement on the chain, which not only retains the core advantages of decentralization, but also achieves transaction efficiency close to CEX

At the same time, the privacy of the off-chain order book reduces the pre-exposed transaction information, effectively curbing MEV behaviors such as snatch-up and sandwich attacks. For example, projects such as Paradex reduce the risk of market manipulation caused by on-chain transparent order books through a hybrid model. The hybrid model allows access to the professional algorithms of traditional market makers, providing closer bid-ask spreads and depth through flexible management of off-chain liquidity pools. Perpetual Protocol adopts a virtual automatic market maker (vAMM) model, combined with off-chain liquidity supplement mechanism, to alleviate the high slippage problem of pure on-chain AMMs.

Complex calculations off-chain processing (such as dynamic capital rate adjustment, high-frequency transaction matching) reduce on-chain Gas consumption, while on-chain only needs to handle key settlement steps. Uniswap V4's singleton contract architecture (Singleton) merges multi-pool operations into a single contract, further reducing Gas costs by 99%, providing a technical basis for the scalability of the hybrid model. The hybrid model supports deep integration with DeFi components such as oracles, lending protocols, etc. GMX obtains off-chain price data through Chainlink oracle, and combines the on-chain clearing mechanism to realize the complex functions of derivative transactions.

Build a liquidity firewall strategy that meets market needs

The liquidity firewall is designed to maintain the stability of the liquidity pool through technical means and prevent systemic risks caused by malicious operations and market fluctuations. General practices include introducing time locks when LP exits (such as a 24-hour delay, up to 7 days) to prevent liquidity instantaneous depletion caused by high-frequency divestment. When the market fluctuates violently, time locks can buffer panic divestment, protect the returns of long-term LPs, and ensure fairness through transparent records of smart contracts.

Based on the real-time monitoring of the asset ratio of the liquidity pool by the oracle, the exchange can also set a dynamic threshold triggering risk control mechanism. When the proportion of an asset in the pool exceeds the preset upper limit, the relevant transactions are suspended or the rebalancing algorithm is automatically called to avoid the expansion of impermanent losses. Grading rewards can also be designed based on the LP's locking time and contribution. LPs that lock in assets for a long time can enjoy higher fee sharing or governance token incentives, thereby encouraging stability. Uniswap V4's Hooks function allows developers to customize LP incentive rules (such as automatic re-investment of fees) to enhance stickiness.

Deploy a real-time monitoring system off-chain to identify abnormal trading patterns (such as large-scale arbitrage attacks), and trigger the on-chain circuit breaker mechanism. Suspend transactions in specific trading pairs or restrict large-scale orders, similar to the traditional "circuit breaking" mechanism of finance. Ensure the security of liquidity pool contracts through formal verification and third-party audits, while using a modular design to support emergency upgrades. The proxy contract model was introduced to allow the fixing of vulnerabilities without migrating liquidity and avoiding recurrences similar to The DAO events.

Case study

dYdX v4——A complete decentralized practice of order book model

dYdX v4 maintains the order book off-chain, forming a hybrid architecture between the order book on-chain and the settlement on-chain. The decentralized network consisting of 60 verification nodes matches transactions in real time, and the final settlement is only completed after the transaction is completed through the application chain built through the Cosmos SDK. This design isolated the impact of high-frequency trading on retail liquidity off-chain, and only the results were processed on the chain to avoid direct exposure of retail LPs to price fluctuations caused by large order withdrawals. Adopting the Gas-free trading model only charges a proportional fee after the transaction is successful, avoiding retail investors from bearing high Gas costs due to high frequency withdrawals and reducing the risk of passive becoming "exit liquidity".

When retail investors pledge DYDX tokens, they can get 15% APR of USDC stablecoin income (from transaction fee sharing), while institutions need to pledge tokens to become verification nodes, participate in the maintenance of the chain order book and obtain higher returns. This stratified design separates retail investors' income from institutional node functions and reduces conflicts of interest. Unlicensed listing is isolated from liquidity, and the USDC provided by retail investors is allocated to different subpools through algorithms to avoid the single asset pool being penetrated by large-scale transactions. Token holders decide on the fee allocation ratio and new transaction reciprocity parameters through on-chain voting. Institutions cannot unilaterally modify the rules and harm the interests of retail investors.

Ethena—Stablecoin Liquidity Moat

When the user stakes ETH to generate the Delta neutral stablecoin USDe, the Ethena protocol automatically opens short positions in CEX equal ETH perpetual contracts to achieve hedging. Retail investors hold USDe only bears the spread of ETH pledge income and capital rate to avoid direct exposure to spot price fluctuations. When the USDe price deviates from 1 USD, arbitrageurs need to redeem collateral through on-chain contracts to trigger a dynamic adjustment mechanism to prevent institutions from manipulating prices through centralized selling.

Retail investors pledge USDe to obtain sUSDe (yield token), and the income comes from ETH pledge rewards and capital rates; institutions obtain additional incentives through market making to provide on-chain liquidity, and the income sources of the two types of roles are physically isolated. Inject reward tokens into the USDe pool of DEX such as Curve to ensure that retail investors can exchange it with low slippage and avoid being forced to bear institutional selling pressure due to insufficient liquidity. In the future, it is planned to control the type and hedging ratio of USDe collateral through governance token ETA, and the community can vote to limit the excessive leverage of institutions.

ApeX Protocol—Flexible Market Making and Protocol Control Value

ApeX Protocol migrated from StarkEx to zkLink X to build an efficient order book contract trading model with off-chain matching and on-chain settlement. User assets adopt a self-custodial mechanism, and all assets are stored in on-chain smart contracts to ensure that the platform cannot misappropriate funds. Even if the platform stops operating, users can still force withdraw cash to ensure security. The ApeX Omni contract supports seamless deposits and withdrawals for multi-chain assets, and adopts a KYC-free design. Users only need to connect to their wallet or social accounts to trade, while exempting Gas fees greatly reduce transaction costs. In addition, ApeX spot transactions innovatively support USDT to buy and sell multi-chain assets with one click, eliminating the cumbersome processes and additional costs of cross-chain bridging, and are especially suitable for efficient transactions of multi-chain Meme coins.

ApeX's core competitiveness stems from the breakthrough design of its underlying infrastructure, zkLink X. zkLink X solves the liquidity fragmentation, high transaction costs and cross-chain complexity faced by traditional DEX through zero-knowledge proof (ZKP) and aggregation Rollup architecture. Its multi-chain liquidity aggregation capabilities will be integrated into assets scattered in L1/L2 networks such as Ethereum and Arbitrum to form a deep liquidity pool, and users can obtain the best transaction price without cross-chain. At the same time, zk-Rollup technology realizes off-chain batch processing transactions, combined with recursive proof optimization verification efficiency, making ApeX Omni's throughput close to CEX level, and the transaction cost is only a small part of similar platforms. Compared with single-chain optimized DEXs such as Hyperliquid, ApeX provides users with a more flexible and low-threshold trading experience with cross-chain interoperability and unified asset listing mechanism.

Antarctic Exchange – **Privacy and Efficiency Revolution Based on ZK

Rollup**

Antarctic Exchange uses Zero Knowledge technology to deeply combine the privacy attributes of Zk-SNARKs with order book liquidity. Users can anonymously verify transaction validity (such as margin adequacy) without exposing the details of positions to prevent MEV attacks and information leakage, and successfully solve the industry problem of "transparency and privacy cannot be obtained at the same time". Merkle Tree aggregates thousands of transaction hashs into a single hash and puts it on the chain, greatly compressing the on-chain storage cost and on-chain Gas consumption. Through the coupling between Merkle Tree and on-chain verification, retail investors provide a "no compromise solution" between CEX-level experience and DEX-level security.

In the design of the LP pool, Antarctic adopts a hybrid LP model, seamlessly connecting user stablecoins with LP Token (AMLP/AHLP) exchange operations through smart contracts, which also takes into account the advantages of on-chain transparency and off-chain efficiency. Introduce delays when users try to exit the liquidity pool to prevent unstable market liquidity supply due to frequent inflows and outflows. This mechanism can reduce the risk of price slippage, enhance the stability of liquidity pools, and protect the interests of long-term liquidity providers, preventing market manipulators and opportunist traders from profiting from market volatility.

In traditional CEX, if large-scale funds customers want to withdraw from liquidity, they need to rely on the liquidity of all order book users, which can easily lead to trampling and smashing the market. However, Antarctic's hedging market making mechanism can effectively balance the supply of liquidity, so that institutional investors' exits will not rely too much on retail investors' funds, so that retail investors do not need to bear excessive risks. More suitable for professional traders who are highly leveraged, low slippage and aversion to market manipulation.

Future direction: Possibility of liquidity democratization

In the future, DEX liquidity design may have two different development branches: whole-domain liquidity network : cross-chain interoperability technology breaks the island and maximizes capital efficiency. Retail investors can obtain the optimal trading experience through "invisible cross-chain"; Co-governance ecology : Through mechanism design innovation, DAO governance has shifted from "capital power" to "contribution rights confirmation", and retail investors and institutions have formed a dynamic balance in the game.

Cross-chain liquidity aggregation: from fragmentation to the whole-domain liquidity network

This path uses cross-chain communication protocols (such as IBC, LayerZero, Wormhole) to build the underlying infrastructure, realize real-time data synchronization and asset transfer between multiple chains, and eliminate dependence on centralized bridges. Ensure the security and immediacy of cross-chain transactions through zero-knowledge proof (ZKP) or light node verification technology.

Combining AI prediction model and on-chain data analysis, intelligent routing will automatically select the liquidity pool of the optimal chain. For example, when the ETH sell-off on the main network ETH causes the slippage to rise, the system can instantly dismantle liquidity from the low slippage pool of Polygon or Solana, and complete cross-chain hedging through atomic exchange, reducing the impact cost of retail investors' pools.

Or unify the liquidity layer design and develop cross-chain liquidity aggregation protocol (such as Thorchain model) to allow users to access multi-chain liquidity pools with a single point. The capital pool adopts the "liquidity as a service" (LaaS) model, which is distributed to different chains on demand, and automatically balances the price difference between each chain through arbitrage robots to maximize capital efficiency. And introduce cross-chain insurance pools and dynamic rate models to adjust premiums for the liquidity usage frequency and security levels of different chains.

**Game balance of DAO governance: From whale monopoly to multiple checks

and balances**

Unlike the previous route, DAO governance dynamically adjusts voting weights. The voting weight of governance tokens increases with the holding time (such as the veToken model), and DAO incentivizes organizational members to participate in community governance for a long time and curbs short-term manipulation. Dynamically adjust the weights in combination with on-chain behaviors (such as liquidity providing time and transaction volume) to avoid the concentration of power caused by large-scale hoarding of coins.

Combined with the existing dual-track system, the core decisions involving liquidity allocation must meet both "over half of the total votes" and "over half of the retail address" to prevent whales from being unilaterally controlled. Retail investors can entrust their voting rights to reputation-certified "government nodes". The nodes need to pledge tokens and undergo transparent audits. If they abuse their power, they will be fined and confiscated. Additional benefits are given to liquidity providers (LPs) participating in governance, but if voting behavior deviates from community consensus, the benefits are reduced proportionally.

NFTs can play an important role in the governance of DAOs as a medium for labor relations transfer and transactions. For example, the rebate relationships that all exchanges have can be directly bound to NFTs. When the NFT is traded, the rebate relationship and the corresponding customer resources will be transferred together, and the value of this NFT can also be directly controlled by the number of resources. Quantification. At present, DEX has made corresponding attempts, allowing NFTs to flow quickly to users who are truly willing to promote DEX through transactions on opensea. More than 90% of the performance of the entire operational department comes from NFT rebates. The anonymity of NFTs can also help DAO better manage BD departments and will not cause user churn due to the departure of a certain BD.

Conclusion: Paradigm transfer of liquidity power

Excellent DEX is essentially a reconstruction of the distribution of financial power through technical architecture. The practices of dYdX, Antarctic and other practices show that when the liquidity provision mechanism shifts from "passive acceptance" to "active management", and when transaction matching is upgraded from "price priority" to "risk isolation", retail investors will no longer be victims of institutional exits , but an equal participant in ecological co-construction. This change is not only about technical efficiency, but also the core embodiment of the DeFi spirit - allowing finance to return to the essence of service, rather than a battlefield of zero-sum game.

chaincatcher

chaincatcher

jinse

jinse