What is causing liquidity concerns in the crypto market?

Reprinted from jinse

02/17/2025·2MAuthor: Zoltan Vardai, CoinTelegraph; Translated by: Wuzhu, Golden Finance

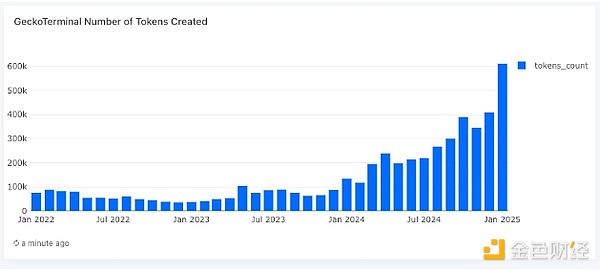

In January, new cryptocurrency issuance hit an all-time high, raising concerns among analysts about the lack of investor liquidity in the market.

More than 600,000 new cryptocurrencies were issued in January, a 12-fold increase compared to the same period in 2024, according to GeckoTerminal data shared by CoinGecko Co-founder and COO Bobby Ong.

“As early as 2022-2023, about 50,000 new tokens were minted every month,” Ong wrote in a February 14 post,

“Fast forward to the fourth quarter of 2024, we see 400,000 new tokens per month – January 2025 set a record of 600,000 new tokens per month!” he added.

The number of tokens created by GeckoTerminal. Source: Bobby Ong

Ong said platforms like Pump.Fun simplified token creation and promoted this token surge.

Gabriel Halm, a research analyst at crypto intelligence platform IntoTheBlock, said the increase in token issuance also reflects the "natural boom in the bullish crypto market."

“So, today’s wide variety of tokens distract liquidity and investors, causing price movements to be even more disconnected,” he noted.

Due to insufficient liquidity in the crypto market, more mature altcoins also lack the motivation to return to their 2021 highs. However, analysts predict that the altcoin season will be delayed due to the increasing number of cryptocurrencies, resulting in token dispersion.

TradFi institutions are changing the rotation of cryptocurrency liquidity

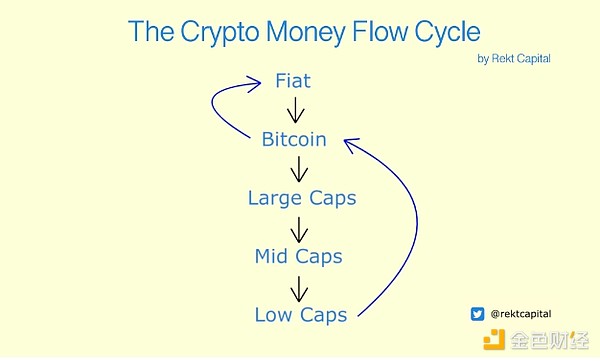

In the previous cryptocurrency bull market, profits from Bitcoin’s rise would flow into Ethereum and then into altcoins and more speculative Meme coins.

Cryptocurrency market flows. Source: Rekt Capital

However, Halm said that increased institutional participation is changing the market liquidity liquidity dynamics:

“With the near-exponential growth of new crypto assets, the emergence of traditional financial institutions as participants in the field will inevitably change the liquidity rotation that has occurred in the previous cycles, reforming the way capital flows in the crypto space.”

CoinGecko 's Ong also pointed out that liquidity dispersion is a problem that leads to a lack of motivation in the cryptocurrency market.

" There are too many tokens, and each one distracts the trader's limited attention and liquidity. That's why we haven't seen the great alt surge in the previous few cycles," Ong said in a subsequent X post.

He added that at the current rate, the cryptocurrency industry could exceed 1 billion tokens in the next five years.

chaincatcher

chaincatcher

panewslab

panewslab