Altcoins are "bloodless". Is VC in the exit period the culprit?

Reprinted from panewslab

03/21/2025·2MAuthor: 0xLouisT , L1D Investment Partner

Compiled by: Felix, PANews

Altcoins are "bleeding" in a lot - why? FDV high? CEX Coin Listing Strategy? Should Binance and Coinbase invest their treasury funds in the form of TWAP (time-weighted average price) into new altcoins?

The real culprit is not new. It all goes back to the crypto VC bubble in 2021.

ICO boom ( 2017-2018 )

The crypto market is essentially a highly liquid industry—a project can launch tokens representing anything at any stage. Most of the events were on the open market until 2017 and anyone can buy them directly through CEX.

Then there is the ICO bubble: an era of crazy speculation, entangled by fraud (litigation, deception and regulatory crackdown). The SEC intervened and ICO became almost illegal. Founders who want to avoid the U.S. justice had to find another way to raise funds.

VC boom ( 2021-2022 )

As retail investors exited, the founder turned his attention to institutional investors. From 2018 to 2020, crypto VCs continue to grow: some companies are pure venture capital, others are hedge funds, allocating a small portion of AUM (asset management scale). At that time, investing in alternative assets was a reverse operation: many people thought that these assets would be zeroed.

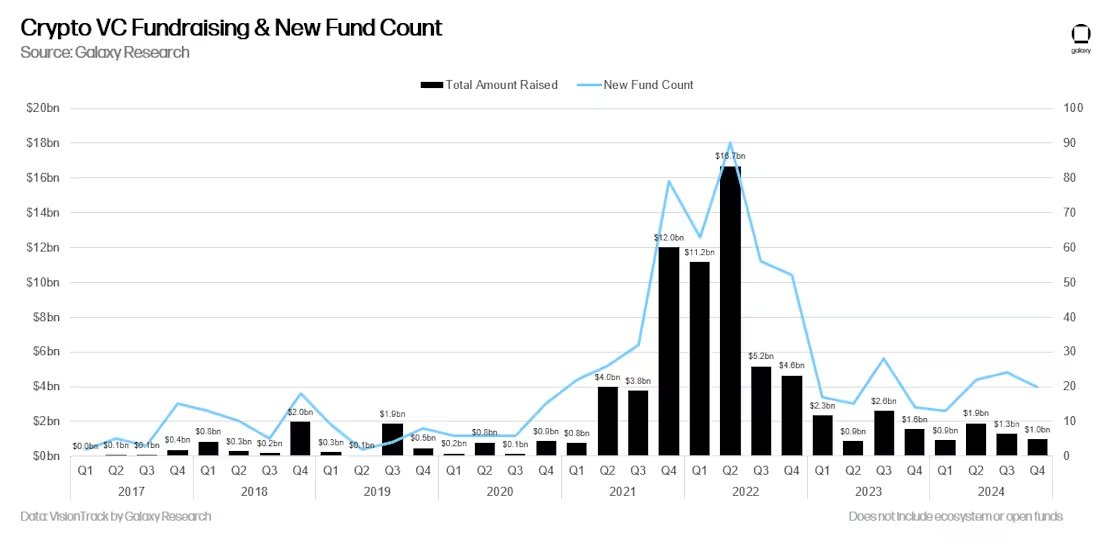

Then there is 2021. The bull market caused VC's portfolio to soar (on books). By April, the fund had risen 20 to 100 times. Encrypted VC suddenly looks like a money printing machine. LPs flocked to catch up with the next wave. The scale of the new fund is 10 times or even 100 times that of the previous fund, and they believe they can reproduce these excess returns.

Source: Galaxy Research

Hangover Period ( 2022-2024 )

2022: Luna, 3AC, FTX, billions of dollars in book returns evaporated overnight. (PANews Note: Like the headache and nausea hangover reaction the next day after excessive drinking, encrypted VC also experienced labor pains)

Contrary to mainstream perception, most venture capital firms are not selling at highs. They went through a crash crisis with others. Now they face two serious problems:

- Frustrated LP: The LP, who once cheered for a hundred times return, is now demanding an exit, forcing the fund to reduce risks and settle profits in advance.

- Too much money: VC's Dry Powder (Note: Unused cash reserves waiting to be invested) are too much, but there are fewer quality projects. Instead of returning capital to LPs, many funds invest their funds in projects that have no economic significance, just to deploy surplus capital to meet investment thresholds and pave the way for possible next round of financing.

Most crypto VCs are now in trouble - unable to raise new funds, holding a bunch of inferior projects in their hands that are destined to perform a script of "high FDV zero". Under pressure from LP, VC has moved from a long-term vision supporter to a short-term exit seeker. Under the push of VCs, a large number of VC-backed tokens (copy L1, L2, infrastructure tokens) are constantly being sold at unreasonable valuations.

In other words, there have been significant changes in the incentives and timetables for encrypting VCs:

- In 2020, venture capitalists are against the trend and lack funds, and are long-term thinkers.

- By 2024, there will be too much venture capital and overcapacity, which will be oriented towards short-term benefits.

Most VCs in 2021-2023 will perform poorly. VC returns follow a power law distribution, with a few winners making up for the majority of losers. But being forced to sell early will distort the results and lead to overall weak performance.

It’s no surprise that entrepreneurs and communities are increasingly skeptical of venture capital. Their incentives and schedules are inconsistent with the founder’s goals, leading to a turn to:

- Community-led financing

- Liquid capital supports tokens for a long time, not venture capital

Assessing liquidity / VC cycles

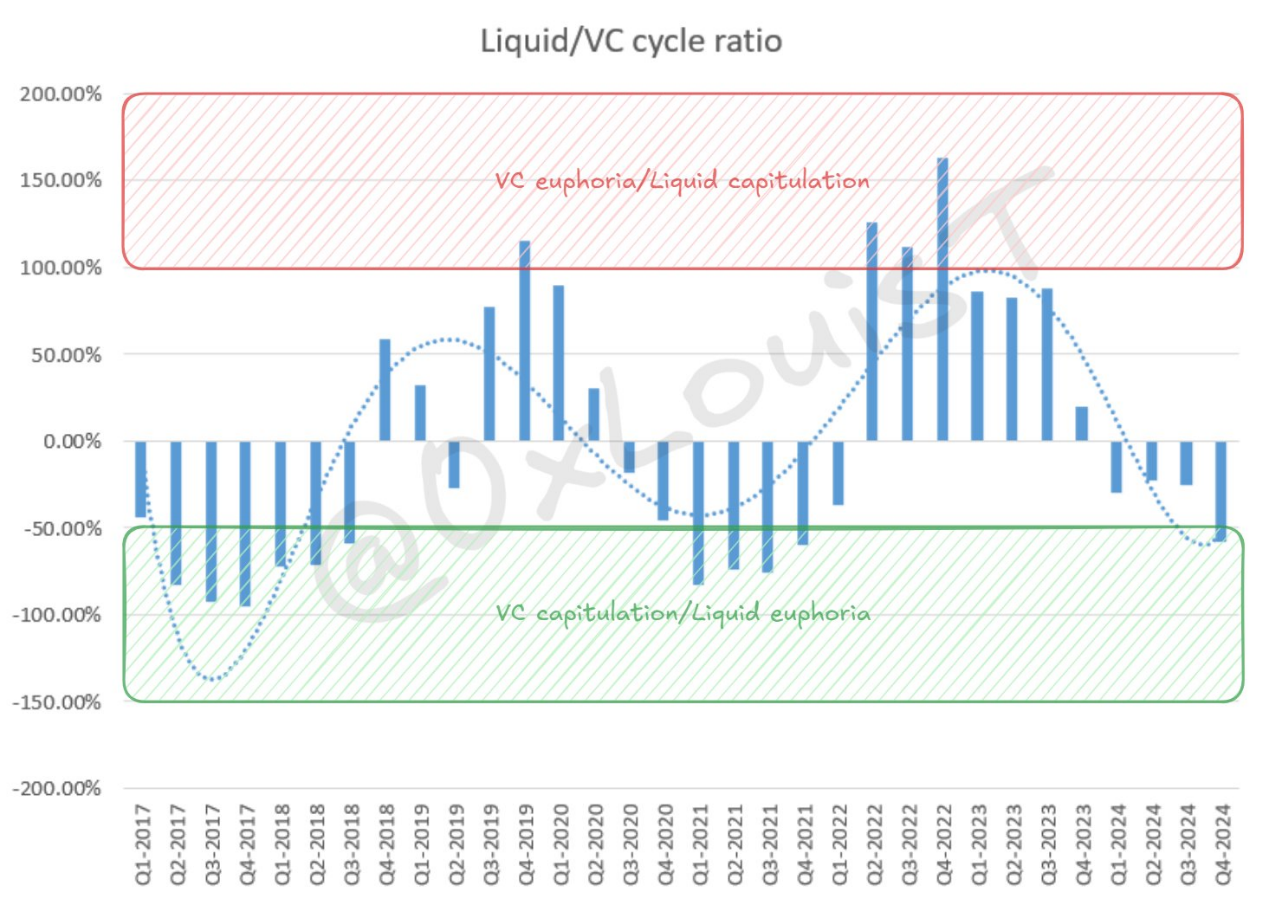

Tracking capital flows between VC and liquidity markets is crucial. An indicator is used here to evaluate the status of the VC market. The metric is not perfect, but it is useful.

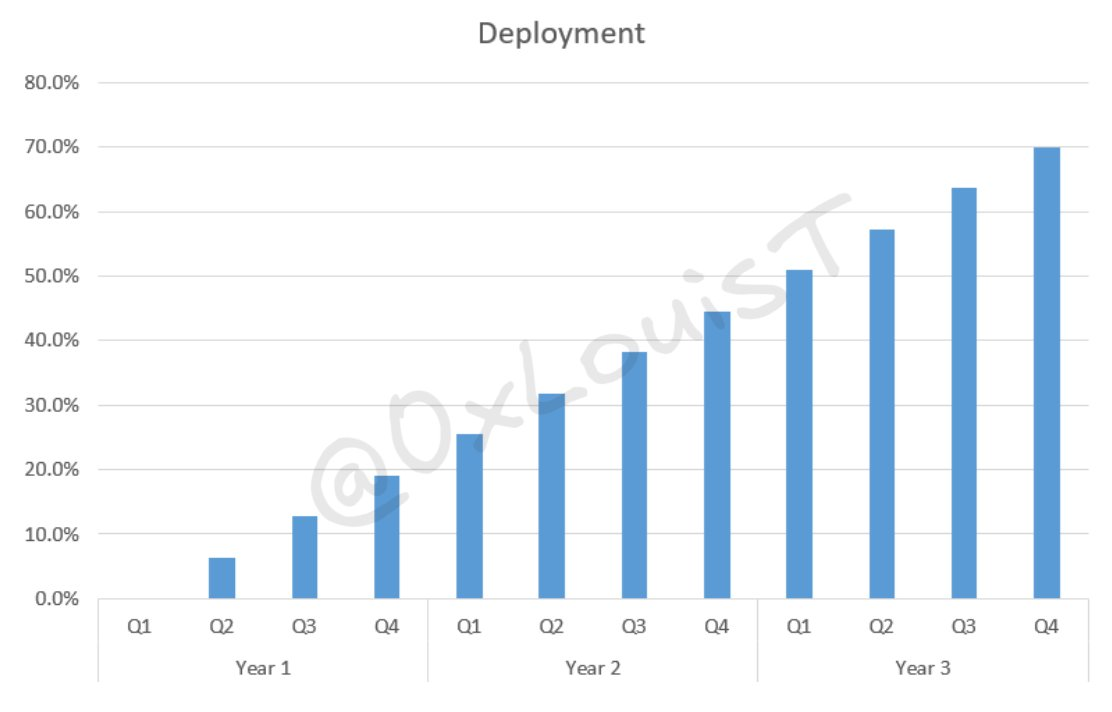

Assuming VCs deploy 70% of their funds linearly over three years – this seems to be a trend for most venture capital firms.

3-year VC linear deployment visualization chart

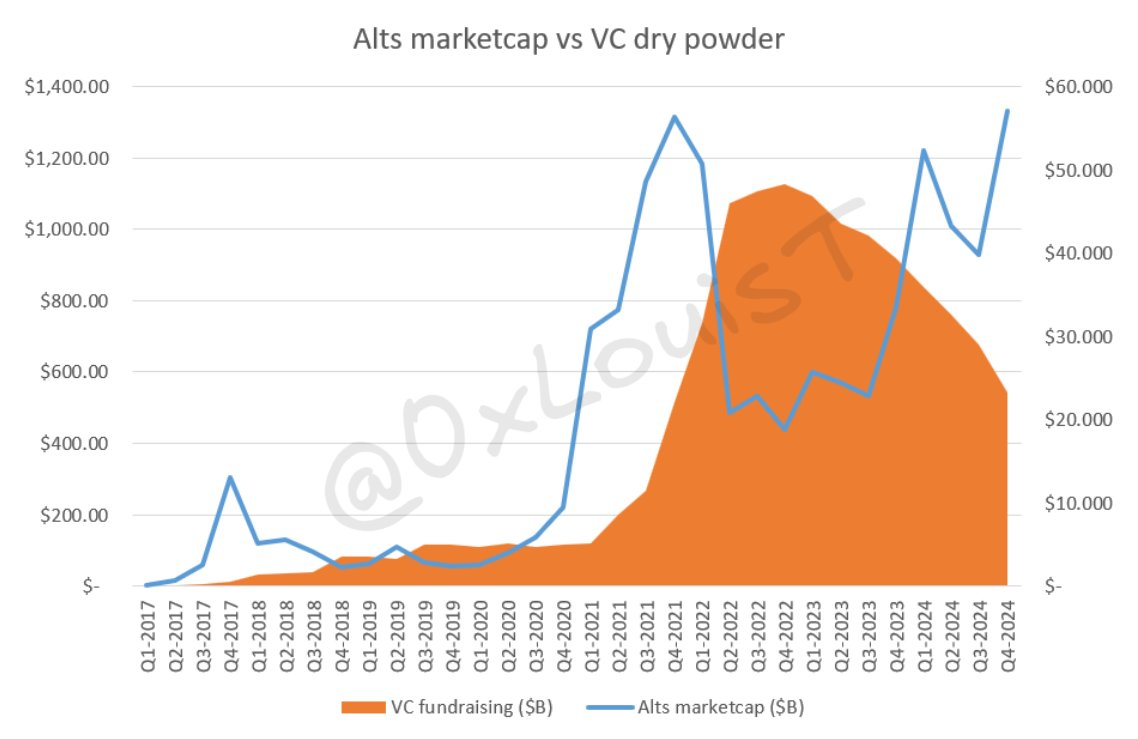

According to Galaxy Research's VC financing data, the deployment rate for 16 quarters was weighted to estimate unused cash reserves. In the fourth quarter of 2022, VC's unused cash reserves were approximately $48 billion. As new financing stagnates, this number has dropped at least half and continues to decline.

VC Unused Cash Reserve Visual Chart

Next, compare the unused cash reserves of VCs for each quarter with TOTAL2 (excluding Bitcoin’s cryptocurrency market capitalization) (this is the best indicator since VCs are typically invested in altcoins). If VC has too much unused cash reserves relative to TOTAL2, the market will not be able to absorb future token generation events (TGEs). Standardizing these data can reveal the periodicity of the liquidity/VC ratio.

Generally speaking, being in the “VC fanatic” area means that the risk-adjusted returns in the liquidity market are better than venture capital. The “VC surrender” area is even more tricky: it may indicate that VC is surrendering or liquidity markets are overheating.

Like all markets, crypto VC and liquidity markets follow cycles. The surplus funds in 2021/2022 are rapidly exhausted, making it more difficult for founders to raise funds. Underfunded venture capital firms are becoming increasingly picky about deals and terms.

TLDR

- Venture capital has performed poorly in recent years and is turning to short-term sell-offs, with funds returning to LPs. Many popular crypto VC organizations may not survive in the next few years

- Misalignment between venture capital and founders is forcing founders to turn to other financing channels

- Oversupply of VC capital leads to uneven distribution (which will be analyzed in detail in the next article)

In the following articles, the impact on projects, liquidity markets, future development trends, and provide advice to founders who start businesses under current conditions.

Related Reading: Crypto Market from the First-Level Perspective of Eastern and Western VCs: Narrative for Narrative, boring

jinse

jinse