The Turkish lira has depreciated for many years. When the fiat currency in the crisis is lost, can crypto assets become a safe haven?

Reprinted from panewslab

03/21/2025·2M

Author: Weilin, PANews

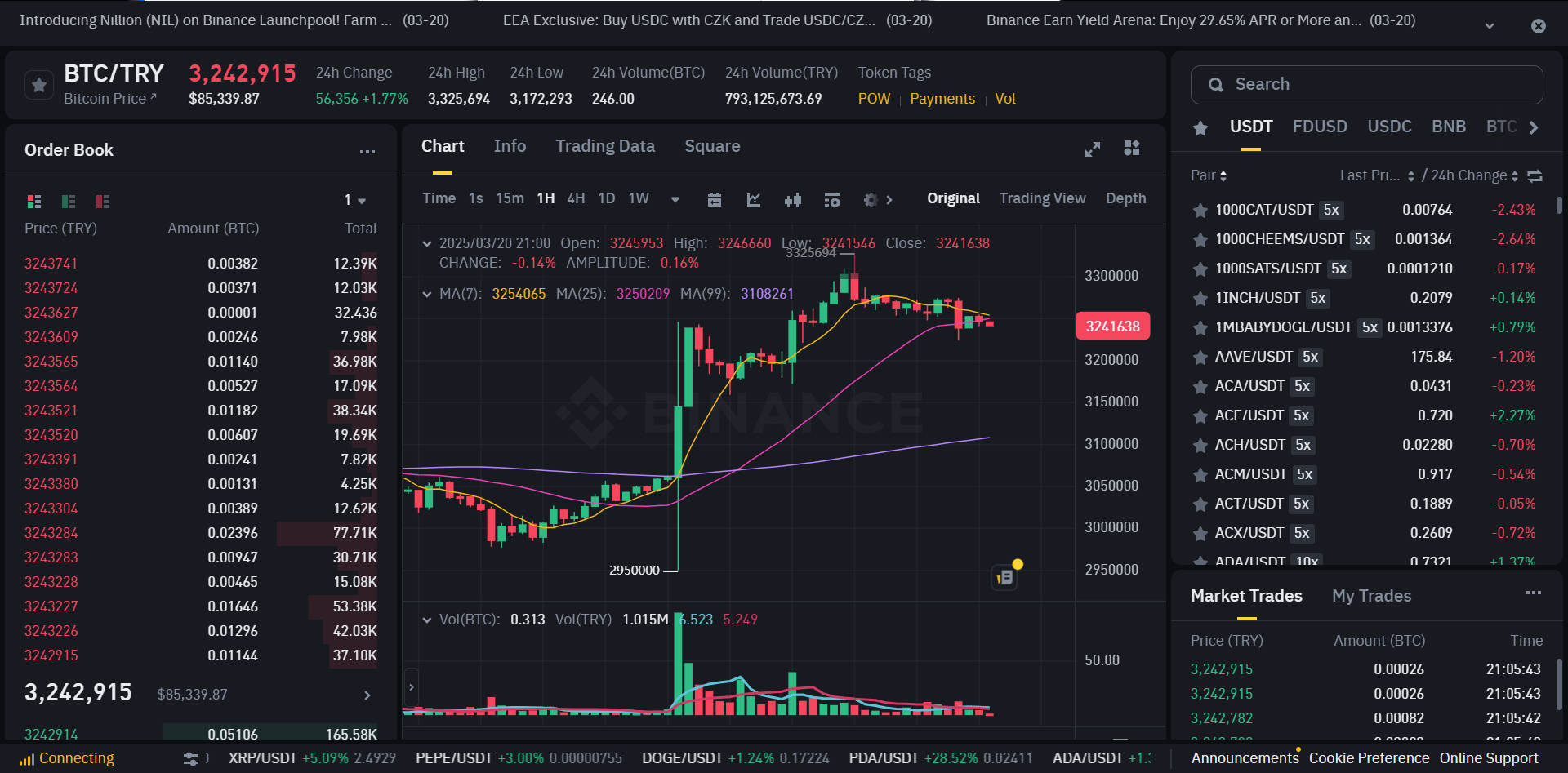

On March 19, Turkey's mayor and president Erdogan's rival Ekrem Imamoglu was arrested, causing panic among local investors. The Turkish fiat lira plummeted around 4:00 p.m., reaching a new all-time low of 41:1 (TRY:USD). About an hour later, the crypto market experienced a risk aversion wave, and BTC/TRY trading volume on Binance soared sharply.

Looking back on the past five years, Türkiye has experienced a major depreciation crisis in fiat currency, and most of the Bitcoin transaction volume has increased significantly. At a time when global economic volatility is intensifying, will cryptocurrencies become a financial hedging tool for more people in currency unstable countries?

Turkish lira plummeted to historic lows amid turbulence, and Bitcoin

trading volume surged

On March 19, affected by the turbulence of domestic situation, the exchange rate of the Turkish lira (TRY) against the US dollar (USD) fell to its historical low, reaching 41 lira to 1 US dollar, depreciating by nearly 10% in a single day. The direct consequence of the exchange rate plunge is that there is a wave of capital hedging in the crypto market, and the trading volume of Bitcoin-lira (BTC/TRY) on the Binance platform soared sharply. From 15 to 16 on March 19, the trading pair's trading volume reached 93 BTC, the highest level in at least a year. At the same time, partly due to the influence of US macro policies, Bitcoin prices also ushered in a significant increase during this period. As of 8:00 a.m. on March 20, BTC broke through $87,000, with an intraday increase of 2.78%. Some market analysts also believe that Türkiye's trading demand has stimulated the rise of BTC/USD.

After that, Strategy founder Michael Saylor even posted a depreciation chart of lira on the social media X platform, calling for "trying Bitcoin" to further promote the market's attention to BTC as a store of value tool.

Against the backdrop of a sharp depreciation of the Turkish lira, investors are quickly turning to Bitcoin and stablecoins in search of a more stable store of value. This is not an isolated case. Looking back over the past five years, whenever Turkey experiences a currency crisis, local trading volumes of Bitcoin and stablecoins have mostly shown a surge, which highlights the risk-haven role of cryptocurrencies in "safe haven" among currency unstable countries.

How does BTC/TRY trading volume and Bitcoin perform after the Turkish

lira decline in the past five years?

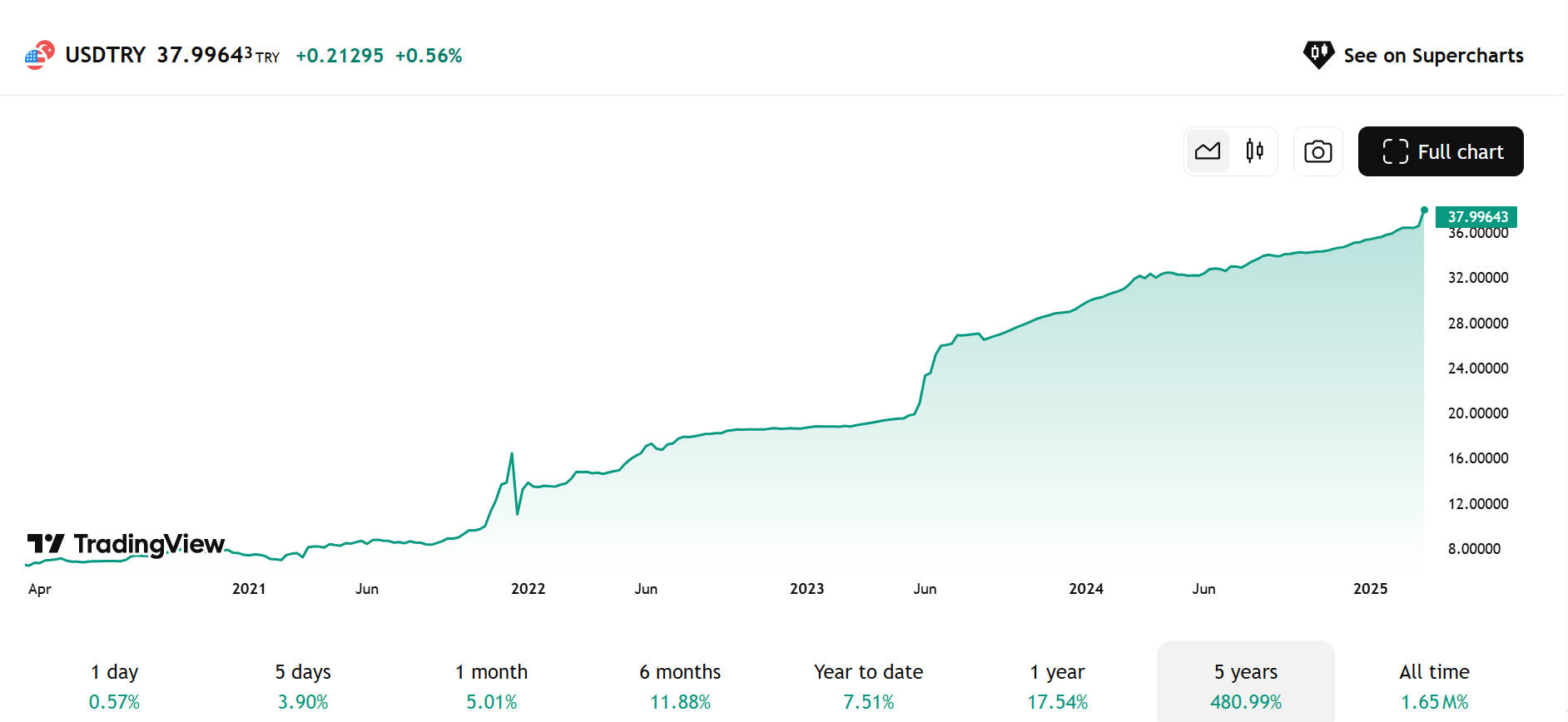

From 2020 to 2025, the trend of the US dollar against the lira shows that the

lira is continuing to depreciate .

From 2020 to 2025, the trend of the US dollar against the lira shows that the

lira is continuing to depreciate .

In recent years, the Turkish lira has experienced several significant declines against the US dollar.

2020: Global epidemic shock and policy mistakes, lira fell below 7 to 1

USD

In 2020, the outbreak of the global COVID-19 pandemic had a serious impact on the emerging market economy, Turkey's foreign exchange reserves fell rapidly, while the Erdogan government insisted on a low interest rate policy, exacerbating capital outflows. At the end of July, the lira fell below the 7:1 mark against the US dollar. Binance data shows that BTC/TRY has increased from 43.79BTC to 60.33BTC on August 21, starting from July 21. By November 7, the lira fell further to 8.43:1 against the US dollar. This year, the cumulative depreciation of the lira throughout the year was close to 26%.

Bitcoin performed well in 2020, rising from $7,194 at the beginning of the year to $28,990 at the end of the year, an increase of up to 303% for the whole year. Although the "3.12 sharp drop" on March 12 caused BTC to fall to a low of $4,106, the subsequent strong rebound once again proved the potential of Bitcoin as an anti-inflation asset.

2021: Central action turmoil intensifies, lira plummeted by 17% in a

single day

In 2021, Türkiye's financial market fell into a crisis of trust. On March 20, central bank governor Naci Agbal was suddenly dismissed, causing market panic. On March 22, the lira plummeted against the US dollar by nearly 17% in a single day, falling to 8.4:1. From then until April 13, Binance BTC/TRY daily trading volume was on the rise. During the same period, Google search data showed that the number of Bitcoin searches in Turkey soared by 566%, indicating that the market's demand for BTC has surged. In terms of Bitcoin, the global price of Bitcoin did not rise significantly in March.

On November 23, 2021, Erdogan defended the interest rate cut policy and refused to raise the interest rate to deal with inflation, and Türkiye's inflation rate was close to 20%. On November 23, the lira fell by more than 15% in a single day, and fell below 12 to 1 USD at the end of November. On November 24, the daily trading volume of BTC/TRY soared to 873.52BTC.

However, after this lira plunge, Bitcoin has not risen significantly in the global market (BTC/USD) in the short term, and even declined from the end of November to the beginning of December.

In 2021, the lira fell by about 82% throughout the year, from the exchange rate at the beginning of the year to about 7.43 to about 13.50 at the end of the year.

2022: Cryptocurrency trading is active under hyperinflation

In 2022, Türkiye's inflation rate soared to its 20-year high, exceeding 85%. Although the government has launched the "Lira Deposit Protection" plan to stabilize the market, investor confidence has not yet recovered. In mid-December, the lira fell below 18:1 against the US dollar, depreciating by 39% throughout the year. In January of the following year, a new peak period for trading BTC appeared on Binance.

Bitcoin fell into a bear market in 2022. BTC fell 64% throughout the year due to factors such as the Fed's interest rate hike and the FTX crash. Despite this, Turkish investors remain active in the crypto market, with DOGE becoming one of the most popular trading assets, with trading volume even exceeding BTC and ETH combined to $380 million between October and November 2022. Although the Erdogan government has warned the public to stay away from cryptocurrencies, local residents still use it as a tool to combat inflation.

2023: Policy adjustments after the election are difficult to reverse the

decline, and BTC/TRY trading volume rises

In May 2023, Erdogan was successfully re-elected, the government's economic team began to adjust its monetary policy, and the central bank raised interest rates significantly to stabilize the market. However, due to the excessive economic damage before, inflation is still high. By June, the lira fell to 23:1 against the US dollar, and further fell to 29.5:1 at the end of the year, depreciating by 58% throughout the year. On June 27, BTC/TRY reached a daily trading volume of 502.9BTC.

During this year, the global Bitcoin market experienced a strong rebound from June to December 2023, with prices rising from $26,800 to $42,300, an increase of 58%. The rise in Bitcoin’s global price is more driven by factors such as institutional capital inflows and ETF approval expectations. However, in Turkey, due to the depreciation of the lira, the increase in BTC prices has become more significant, from 700,000 lira to 1.25 million lira, an increase of 78%.

2024: Türkiye frequently displays account deficits, BTC exceeds

US$100,000

In October 2024, the global dollar strengthened, and the Russian-Ukrainian conflict pushed up energy prices, exacerbating Türkiye's current account deficit. In mid-October, the lira fell below 35:1 against the US dollar, depreciating by 19% throughout the year.

During the same period, the price of Bitcoin fell to $58,000 due to the strong US dollar, but in December, due to the clear policy after the US election and the positive effects of the crypto market (such as the surge in ETF trading volume). This trend has also driven the trading volume of BTC/TRY trading pairs to rise. For example, Binance data shows that after the US election, people's enthusiasm for crypto has increased. On December 17, BTC/TRY reached 123.23 BTC daily trading volume.

BTC and stablecoins: Safe haven for people in currency unstable countries

In economies experiencing hyperinflation and depreciation of their local currency, BTC and stablecoins are becoming important hedge tools for residents.

In Venezuela, inflation in the country remained as high as 60% in 2024, and the economic difficulties remained severe, according to a report by coingecko. The government-launched Petro cryptocurrency went bankrupt in 2024, but Bitcoin and stablecoin transactions surged. In 2024, cryptocurrencies used as remittances surged, and 9% of Venezuela's annual remittances have been transferred through cryptocurrencies.

In Argentina, inflation rate is as high as 276% in 2024, and Bitcoin has become an important tool to hedge against the depreciation of the peso. The country's cryptocurrency trading volume reached US$91.1 billion between 2023 and 2024, surpassing Brazil and becoming one of the most active crypto markets in Latin America.

Bitcoin is regarded as "digital gold" due to its decentralized, fixed supply (21 million) and anti-censorship characteristics, and is suitable for long-term store of value. Stable coins (such as USDT and USDC) are pegged to the US dollar, providing price stability and are more suitable for short-term trading and safe-haven.

In currency-instable countries, BTC and stablecoins form a complementary system: Bitcoin is used to fight inflation in the long term, while stablecoins provide short-term liquidity demand. Although cryptocurrencies cannot solve the fundamental problems of the economy, they undoubtedly provide individuals with realistic solutions to preserve value and trade in amidst hyperinflation and exchange rate crisis.

Overall, from the example of this lira plunge, it can be seen that in an economy experiencing hyperinflation, cryptocurrencies highlight the importance of individuals in dealing with the financial crisis. Cryptocurrencies like Bitcoin and stablecoins provide timely and practical solutions to protect wealth and facilitate transactions, especially when traditional currencies fail. In the future, cryptocurrencies may become an important part of the global financial ecosystem.

jinse

jinse

chaincatcher

chaincatcher